Liquefied Natural Gas (LNG) Market

Liquefied Natural Gas (LNG) Market Size, Share & Trends Analysis Report by Application (Transportation, Power and Gas Generation, and Industrial) Forecast Period (2025-2035)

Industry Overview

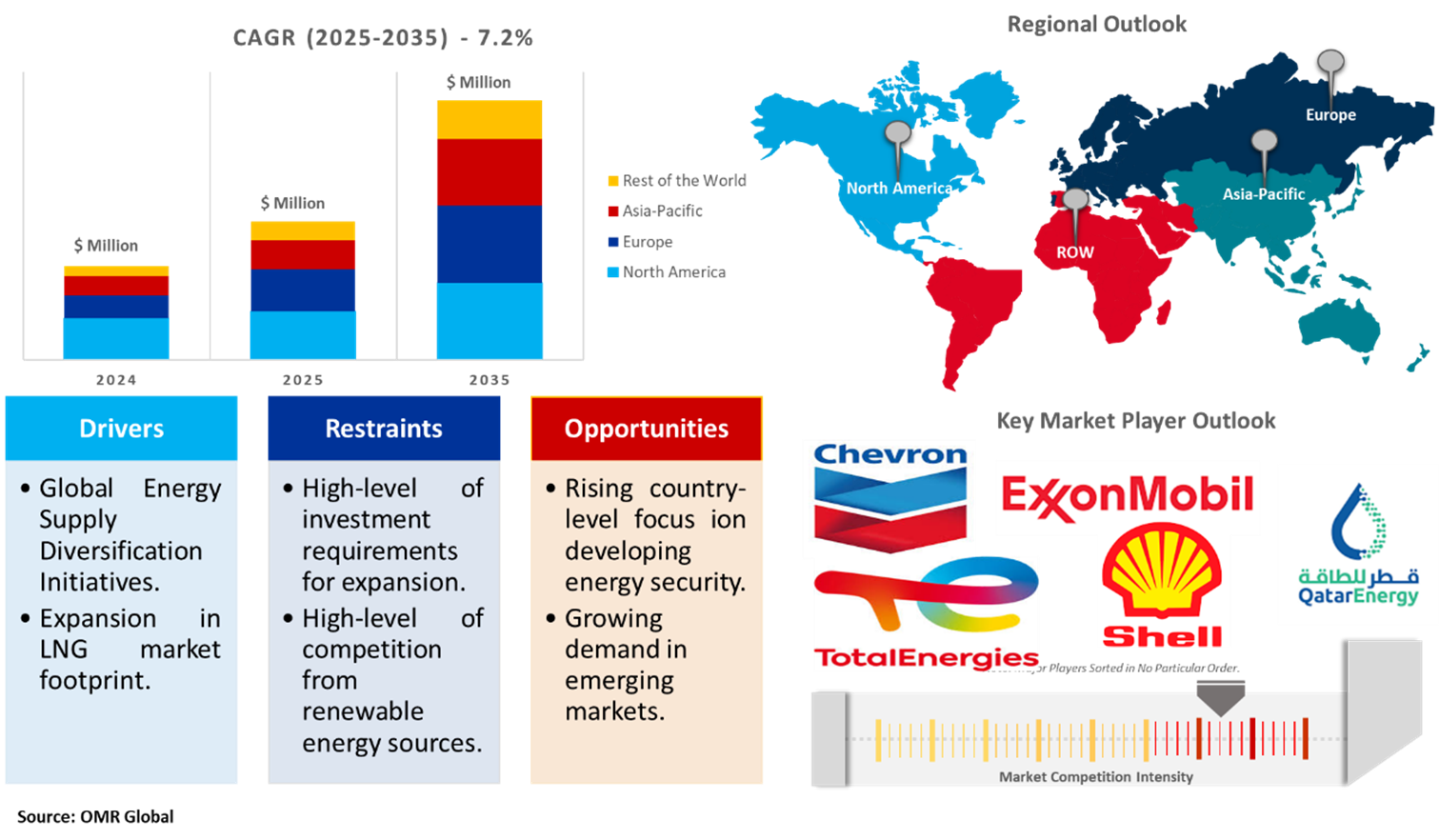

Liquefied natural gas (LNG) market size was valued at $135.7 billion in 2024 and is projected to reach $290.0 billion in 2035, growing at a CAGR of 7.2% during the forecast period (2025-2035). LNG market growth is majorly supported by global efforts to diversify energy sources in the power generation sector, geopolitical disruptions, investments by countries into LNG infrastructure, and shifts towards cleaner energy sources. According to the IEA's worldwide Energy Outlook 2024-2028, worldwide LNG production capacity would rise by nearly 193 MTPA between 2024 and 2028, rising from approximately 474 MTPA of nameplate capacity at the beginning of this year to 666.5 MTPA by the end of 2028. Based on its stated policy scenario, the IEA also anticipates that global LNG trade will reach 482 MTPA by 2050.

Market Dynamics

Energy Supply Diversification Initiatives

The global emphasis on diversifying energy supplies paves the way for LNG market growth. The emphasis is largely driven by the replacement of conventional fuels with LNG in sectors such as power generation and industrial manufacturing, as the fuel type results in reduced GHG emissions and assists in compliance with environmental regulations. Further, the changing dynamics for reducing emissions through stricter policies paired with the implication of carbon neutrality targets are projected to support extensive growth in the LNG market. For instance, the European Commission approved a $4.2 billion German aid measure under EU State aid rules to support four Floating Storage Regasification Units (FSRUs) for LNG import by Deutsche Energy Terminal (DET). This initiative aids the REPowerEU Plan by diversifying energy supplies and enhancing gas security, addressing disruptions from Russia's invasion of Ukraine and pipeline gas supply cuts.

Expansion in LNG Market Footprint

In recent years, the infrastructure and demand for LNG have exponentially increased based on the change in global energy supply dynamics owing to geopolitical tensions and country-level focus on energy diversifications. These shifts have developed novel import markets, infrastructure, and production capabilities across geographies that have assisted economies in fulfilling their energy requirements alongside transitioning into cleaner pathways. Collectively, the emergence & development of these new markets & supportive infrastructure is projected to act as a key enabler for market players to expand their business footprint. For instance, the World Energy Outlook (WEO)-2023 highlights that the natural gas market, hit hard by the energy crisis and Russia’s supply cuts, will ease by 2025. Over 250 billion cubic meters of new LNG capacity will come online by 2030, adding around 45% to global LNG supply, helping stabilize market pressures, and addressing security and price concerns.

Market Segmentation

- Based on the application, the market is segmented into transportation, power and gas generation, and industrial.

Power & Gas to Lead the Market with the Largest Share

Power & gas generation remained the primary application of LNG across the global market owing to the preference for LNG over fossil fuels in power generation plants, GHG emission reduction initiatives, and expansion in accessibility of LNG in emerging markets. For instance, the US is the world’s leading producer of natural gas, which utilizes roughly one-third of the country’s natural gas for primary energy consumption, including heating and electricity generation.

Regional Outlook

The global LNG market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

North America is the Biggest Market for LNG

North America dominates the global LNG market owing to the availability of substantial natural resources for LNG production in countries such as the US and Canada, growing ties of regional countries for exporting energy in other markets, strong geopolitical connections of regional countries, and the establishment of supportive policies for LNG production, trade, and export. Further, the recent changes in policy structure by the US for LNG exports are projected to aid in the growth of LNG market players in the region. For instance, the U.S. Department of Energy (DOE) has lifted the LNG export pause, resuming consideration of applications for exporting LNG to non-FTA countries, following President Trump’s directive for American energy dominance.

Asia-Pacific Region Dominates the Market with Major Share

The Asia-Pacific LNG market is projected to grow extensively in the forecast period owing to growing demand for energy in Asian countries, increasing share of imports of LNG by Asian countries such as China, and regional goals for diversifying energy sources & reducing GHG emissions from the power generation sector. For instance, in November 2024, TotalEnergies signed a sales agreement with Sinopec to deliver 2 million tons of LNG per year for 15 years, starting in 2028. This deal strengthens TotalEnergies' position in China, the world's largest LNG market, and follows a strategic cooperation agreement between the two companies.

Market Players Outlook

The major companies operating in the global liquefied natural gas market include Chevron Corp., Exxon Mobil Corp., QatarEnergy LNG, Shell Group, and TotalEnergies SE, among others. Market players are leveraging partnerships, collaborations, and mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In December 2024, Energy Transfer LP announced a 20-year LNG Sale and Purchase Agreement (SPA) with Chevron U.S.A. Inc. for its Lake Charles LNG project. Under the agreement, Energy Transfer LNG will supply Chevron with 2 million tonnes of LNG per year on a free-on-board (FOB) basis. The price will include a fixed liquefaction charge and a gas supply component tied to the Henry Hub benchmark.

- In September 2024, Shell and Turkey's BOTA? signed a ten-year agreement for Shell to supply up to 4 billion cubic meters of LNG per year from its US and global portfolio, starting in 2027. The deal will help BOTA? expand LNG access, utilizing its terminal and pipeline infrastructure to diversify Turkey’s gas resources and support its role as a regional gas hub.

- In July 2023, BP and OMV signed a long-term sale and purchase agreement to supply up to 1 million tonnes of LNG per year for 10 years starting in 2026. Under the agreement, BP will deliver LNG from its global portfolio to OMV, which will receive and re-gasify it at the Gate LNG terminal in Rotterdam or other European terminals where OMV holds regasification capacity.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liquefied natural gas (LNG) market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Liquefied Natural Gas Market Sales Analysis – Application ($ Million)

• Liquefied Natural Gas Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Liquefied Natural Gas Industry Trends

2.2.2. Market Recommendations

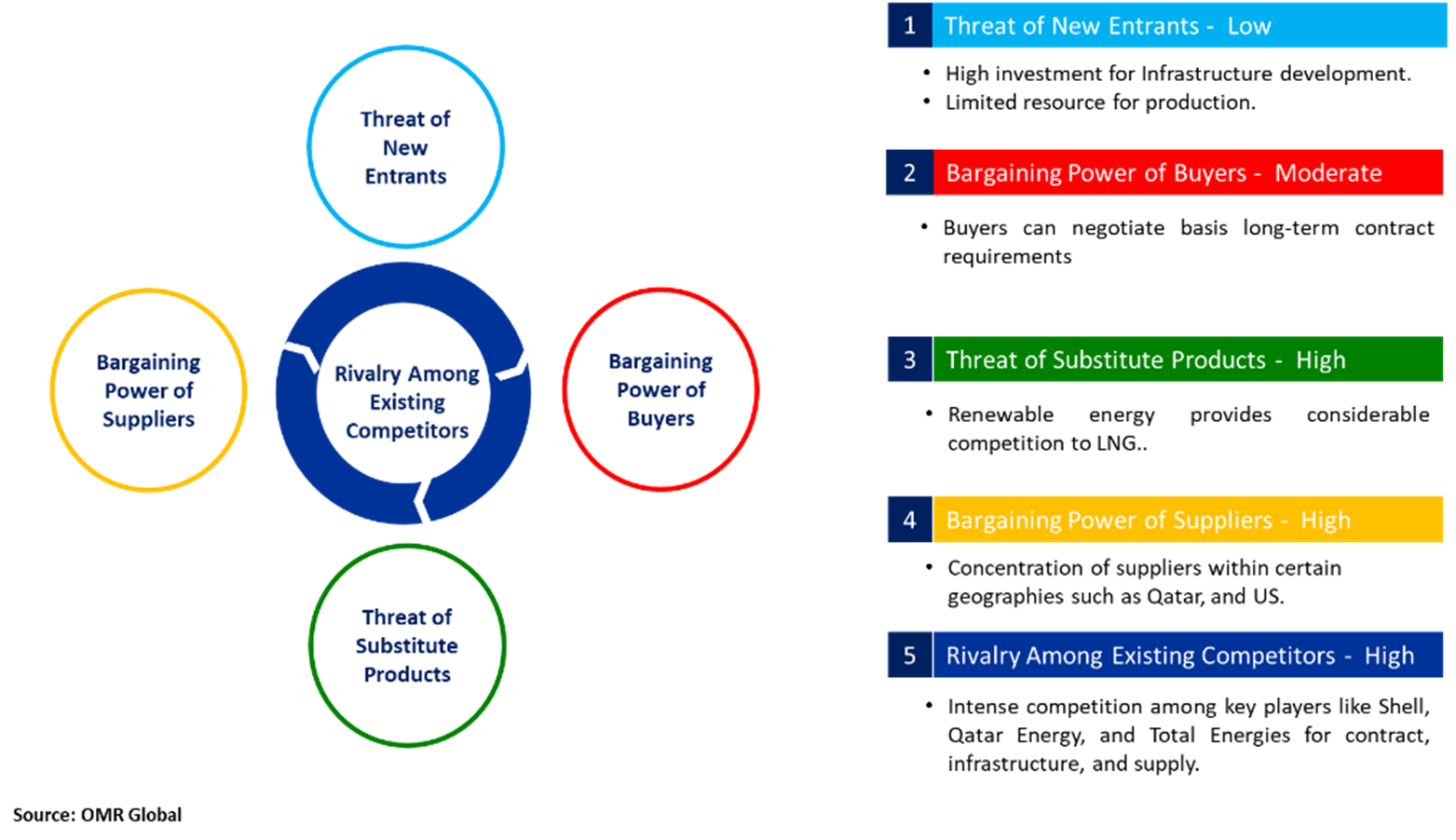

2.3. Porter's Five Forces Analysis for the Liquefied Natural Gas Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Liquefied Natural Gas Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Liquefied Natural Gas Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Liquefied Natural Gas Market Revenue and Share by Manufacturers

• Liquefied Natural Gas Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Chevron Corp.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Exxon Mobil Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. QatarEnergy LNG

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Shell Group

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. TotalEnergies SE

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Liquefied Natural Gas Market Sales Analysis by Application ($ Million)

5.1. Transportation

5.2. Power and Gas Generation

5.3. Industrial

6. Regional Analysis

6.1. North American Liquefied Natural Gas Market Sales Analysis – Application | Country ($ Million)

• Macroeconomic Factors for North America

6.1.1. United States

6.1.2. Canada

6.2. European Liquefied Natural Gas Market Sales Analysis Application| Country ($ Million)

• Macroeconomic Factors for North America

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific Liquefied Natural Gas Market Sales Analysis – Application | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. South Korea

6.3.4. India

6.3.5. Australia & New Zealand

6.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

6.3.7. Rest of Asia-Pacific

6.4. Rest of the World Liquefied Natural Gas Market Sales Analysis – Application | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

6.4.1. Latin America

6.4.2. Middle East and Africa

7. Company Profiles

7.1. bp Oil International Ltd.

7.1.1. Quick Facts

7.1.2. Company Overview

7.1.3. Product Portfolio

7.1.4. Business Strategies

7.2. Cheniere Energy, Inc.

7.2.1. Quick Facts

7.2.2. Company Overview

7.2.3. Product Portfolio

7.2.4. Business Strategies

7.3. ConocoPhillips Holding Co.

7.3.1. Quick Facts

7.3.2. Company Overview

7.3.3. Product Portfolio

7.3.4. Business Strategies

7.4. Chevron Corp.

7.4.1. Quick Facts

7.4.2. Company Overview

7.4.3. Product Portfolio

7.4.4. Business Strategies

7.5. China National Petroleum Corp. (CNPC)

7.5.1. Quick Facts

7.5.2. Company Overview

7.5.3. Product Portfolio

7.5.4. Business Strategies

7.6. E.ON SE

7.6.1. Quick Facts

7.6.2. Company Overview

7.6.3. Product Portfolio

7.6.4. Business Strategies

7.7. Eni SpA

7.7.1. Quick Facts

7.7.2. Company Overview

7.7.3. Product Portfolio

7.7.4. Business Strategies

7.8. Equinor ASA

7.8.1. Quick Facts

7.8.2. Company Overview

7.8.3. Product Portfolio

7.8.4. Business Strategies

7.9. Exxon Mobil Corp.

7.9.1. Quick Facts

7.9.2. Company Overview

7.9.3. Product Portfolio

7.9.4. Business Strategies

7.10. Galp Energia, SGPS, S.A

7.10.1. Quick Facts

7.10.2. Company Overview

7.10.3. Product Portfolio

7.10.4. Business Strategies

7.11. India Oil Corp.

7.11.1. Quick Facts

7.11.2. Company Overview

7.11.3. Product Portfolio

7.11.4. Business Strategies

7.12. JERA Co., Inc.

7.12.1. Quick Facts

7.12.2. Company Overview

7.12.3. Product Portfolio

7.12.4. Business Strategies

7.13. KOGAS (Korea Gas Corp.)

7.13.1. Quick Facts

7.13.2. Company Overview

7.13.3. Product Portfolio

7.13.4. Business Strategies

7.14. PAO NOVATEK

7.14.1. Quick Facts

7.14.2. Company Overview

7.14.3. Product Portfolio

7.14.4. Business Strategies

7.15. Petroliam Nasional Berhad

7.15.1. Quick Facts

7.15.2. Company Overview

7.15.3. Product Portfolio

7.15.4. Business Strategies

7.16. PT PERTAMINA (PERSERO)

7.16.1. Quick Facts

7.16.2. Company Overview

7.16.3. Product Portfolio

7.16.4. Business Strategies

7.17. QatarEnergy LNG

7.17.1. Quick Facts

7.17.2. Company Overview

7.17.3. Product Portfolio

7.17.4. Business Strategies

7.18. Reliance Industries Ltd.

7.18.1. Quick Facts

7.18.2. Company Overview

7.18.3. Product Portfolio

7.18.4. Business Strategies

7.19. Saudi Arabian Oil Co.

7.19.1. Quick Facts

7.19.2. Company Overview

7.19.3. Product Portfolio

7.19.4. Business Strategies

7.20. Sempra Energy

7.20.1. Quick Facts

7.20.2. Company Overview

7.20.3. Product Portfolio

7.20.4. Business Strategies

7.21. Shell Group

7.21.1. Quick Facts

7.21.2. Company Overview

7.21.3. Product Portfolio

7.21.4. Business Strategies

7.22. Sonatrach Petroleum Corp

7.22.1. Quick Facts

7.22.2. Company Overview

7.22.3. Product Portfolio

7.22.4. Business Strategies

7.23. Tokyo Gas

7.23.1. Quick Facts

7.23.2. Company Overview

7.23.3. Product Portfolio

7.23.4. Business Strategies

7.24. TotalEnergies SE

7.24.1. Quick Facts

7.24.2. Company Overview

7.24.3. Product Portfolio

7.24.4. Business Strategies

7.25. Woodside Energy Group Ltd

7.25.1. Quick Facts

7.25.2. Company Overview

7.25.3. Product Portfolio

7.25.4. Business Strategies

1. Global Liquefied Natural Gas Market Research And Analysis By Application, 2024-2035 ($ Million)

2. Global Liquefied Natural Gas For Transportation Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Liquefied Natural Gas For Power and Gas Generation Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Liquefied Natural Gas For Industrial Market Research And Analysis By Region, 2024-2035 ($ Million)

5. North American Liquefied Natural Gas Market Research And Analysis By Country, 2024-2035 ($ Million)

6. North American Liquefied Natural Gas Market Research And Analysis By Application, 2024-2035 ($ Million)

7. European Liquefied Natural Gas Market Research And Analysis By Country, 2024-2035 ($ Million)

8. European Liquefied Natural Gas Market Research And Analysis By Application, 2024-2035 ($ Million)

9. Asia-Pacific Liquefied Natural Gas Market Research And Analysis By Country, 2024-2035 ($ Million)

10. Asia-Pacific Liquefied Natural Gas Market Research And Analysis By Application, 2024-2035 ($ Million)

11. Rest Of The World Liquefied Natural Gas Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Rest Of The World Liquefied Natural Gas Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Liquefied Natural Gas Market Share By Application, 2024 Vs 2035 (%)

2. Global Liquefied Natural Gas For Transportation Market Share By Region, 2024 Vs 2035 (%)

3. Global Liquefied Natural Gas For Power and Gas Generation Market Share By Region, 2024 Vs 2035 (%)

4. Global Liquefied Natural Gas For Industrial Market Share By Region, 2024 Vs 2035 (%)

5. Global Liquefied Natural Gas Market Share By Region, 2024 Vs 2035 (%)

6. US Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

7. Canada Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

8. UK Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

9. France Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

10. Germany Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

11. Italy Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

12. Spain Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

13. Russia Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

14. Rest Of Europe Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

15. India Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

16. China Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

17. Japan Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

18. South Korea Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

19. Australia & New Zealand Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

20. ASEAN Countries Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

21. Rest Of Asia-Pacific Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

22. Latin America Liquefied Natural Gas Market Size, 2024-2035 ($ Million)

23. Middle East And Africa Liquefied Natural Gas Market Size, 2024-2035 ($ Million)