Liquefied Petroleum Gas Market

Liquefied Petroleum Gas Market Size, Share & Trends Analysis Report by Source (Natural Gas Liquid and Crude Oil) and by Application (Residential, Commercial, Chemical, Industrial, Autogas and Refinery) Forecast Period (2024-2031)

Liquefied petroleum gas market is anticipated to grow at a CAGR of 3.2% during the forecast period (2024-2031). Liquefied Petroleum Gas is a versatile hydrocarbon fuel that is commonly used for heating, cooking, and powering appliances in residential, commercial, industrial, and agricultural settings. It is composed primarily of propane and butane, which are extracted from natural gas processing and petroleum refining.

Market Dynamics

Infrastructure Development Drives Economic Expansion and Social Progress

Effective infrastructure development supports sustainable development goals and enhances overall societal well-being. For instance, in September 2022, Enterprise Products Partners unveiled its strategy to expand its Natural Gas Liquid (NGL) pipeline infrastructure within the Permian Basin. This expansion initiative includes the construction of two processing plants alongside the extension of the Shin Oak NGL pipeline system. The proposed enhancements involve the addition of new pipelines and the modification of existing pump stations. Upon completion, the capacity of the infrastructure is projected to reach 275,000 barrels per day (bpd), with the anticipated timeline for finalization set for the early stages of 2024.

Market Segmentation

Our in-depth analysis of the global LPG market includes the following segments by source and application:

- Based on the source, the market is segmented into natural gas liquid and crude oil.

- Based on application, the market is segmented into residential, commercial, chemical, industrial, autogas, and refinery.

Natural Gas Liquid is Projected to Emerge as the Largest Segment

Based on the source, the natural gas liquid sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the versatility and wide range of applications across various industries. NGLs, which include ethane, propane, butane, and pentane, are by-products of natural gas production and crude oil refining. They serve as essential feedstocks to produce LPG, which is used for heating, cooking, transportation, and industrial processes. The increasing demand for LPG as a cleaner alternative to traditional fuels, particularly in emerging economies, drives the need for NGLs as feedstock for LPG production. Additionally, the petrochemical industry relies on NGLs as raw materials to produce plastics, synthetic rubber, and other chemical products, further boosting their demand in the market.

Residential to Hold a Considerable Market Share

Residential usage maintains a substantial market share in the global LPG market due to its convenience and versatility. LPG serves as a primary energy source for cooking and heating in households worldwide, offering reliability and energy efficiency. Its cleaner-burning nature makes it an environmentally preferable option, contributing to its popularity among environmentally conscious consumers. Additionally, LPG's suitability for areas with limited access to natural gas or electricity further drives its adoption in residential settings. Government incentives and subsidies also play a role in promoting LPG usage for residential purposes, consolidating its position as a leading energy choice for households globally.

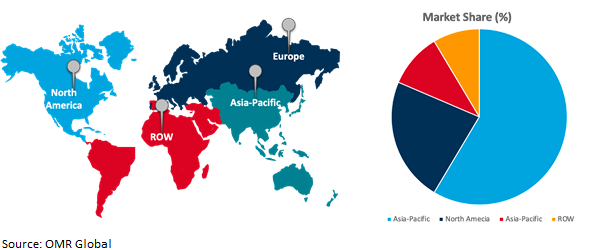

Regional Outlook

The global LPG market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Fueling Growth: The Rise of North America's LPG Market

North America is emerging as the fastest-growing market due to the shale gas revolution in the United States that has led to increased domestic production of LPG, reducing import reliance, and driving export growth to international markets. Additionally, the expanding industrial sector, along with growing residential and commercial demand for LPG in heating, cooking, and appliances, contributes to the region's market growth. Environmental policies promoting cleaner energy sources further bolster the adoption of LPG, which is considered a cleaner-burning fuel. Infrastructure investments ensure reliable supply and distribution channels, supporting the rapid expansion of the North American LPG market. For instance, in June 2021, Astomos Energy Corp. inked a deal with Shell to procure the world's first carbon-neutral liquefied petroleum gas (LPG) cargo for shipment to Japan. This agreement entails offsetting the lifecycle carbon dioxide equivalent (CO2e) emissions of the cargo using verified nature-based carbon credits from Shell's global portfolio. These credits will counterbalance emissions generated from production to consumption, including transportation, through nature-based projects that protect, transform, or restore land, facilitating the absorption of CO2 emissions from the atmosphere.

Global Liquefied Petroleum Gas Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share due to its burgeoning population, rapid economic growth, and extensive urbanization. With millions migrating to cities in search of better opportunities, energy consumption for residential and commercial needs skyrockets, with LPG being a popular choice for cooking and heating. Moreover, the region's robust industrial sector relies heavily on LPG for various manufacturing processes. Government policies promoting cleaner energy sources, coupled with significant infrastructure investments, further fuel the demand for LPG. Cultural preferences also play a role, with LPG being a staple for cooking in many Asian households.

In February 2024, Nagpur-based LPG leader Confidence Petroleum India, in partnership with Norway's BW LPG, aims to build an onshore LPG import terminal at Jawaharlal Nehru Port Trust (JNPT). With an investment of Rs 650 crore, the terminal, expected to be operational by 2026, will boast a capacity of 62,000 metric tonnes. The venture, announced on February 19, also includes investments totalling Rs 2,000 crore ($267 million) for upstream and downstream expansions over the next three years. Confidence Petroleum plans to finance the capital expenditure through internal accruals, according to Nithin Khara, Chairman of Confidence Group.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global liquefied petroleum gas market include BP p.l.c., Sinopec Corp., Indian Oil Corporation Ltd., PetroChina Company Limited, Exxon Mobil, Reliance Industries Ltd., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2022, Indian Oil Corp. (IOC) unveiled its intentions to erect three new plants in Northeast India, aiming to augment its LPG bottling capacity by nearly 53%, reaching an annual production capacity of 8 crore cylinders by 2030. This expansion initiative is a response to the escalating demand for LPG in the region. The projected investment outlay for this plant expansion endeavor is estimated to fall within the range of USD 43-46 million.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liquefied petroleum gas market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BP p.l.c.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Sinopec Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Indian Oil Corporation Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. PetroChina Company Limited

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Liquefied Petroleum Gas Market by Source

4.1.1. Natural gas liquid

4.1.2. Crude oil

4.2. Global Liquefied Petroleum Gas Market by Application

4.2.1. Residential

4.2.2. Commercial

4.2.3. Chemical

4.2.4. Industrial

4.2.5. Autogas

4.2.6. Refinery

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Abu Dhabi National Oil Co.

6.2. Bharat Petroleum Corporation Limited

6.3. Chevron Corp.

6.4. China Gas Holdings Ltd.

6.5. ConocoPhillips

6.6. Exxon Mobil Corp.

6.7. Gazprom PJSC

6.8. Hindustan Petroleum Corp. Ltd.

6.9. Kleenheat Gas Pty Limited

6.10. Kuwait Petroleum Corp.

6.11. PAO Novatek

6.12. Petroliam Nasional Berhad (PETRONAS)

6.13. Phillips Petroleum Company

6.14. Qatar Petroleum

6.15. QatarEnergy LNG

6.16. Reliance Industries Ltd.

6.17. Repsol SA

6.18. Saudi Arabian Oil Co. (Saudi Aramco)

6.19. Shell plc

6.20. TotalEnergies SE

6.21. UGI Corp.

1. GLOBAL LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

2. GLOBAL NATURAL GAS-BASED LIQUID LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CRUDE OIL-BASED LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL LIQUEFIED PETROLEUM GAS FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LIQUEFIED PETROLEUM GAS FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LIQUEFIED PETROLEUM GAS FOR CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LIQUEFIED PETROLEUM GAS FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LIQUEFIED PETROLEUM GAS FOR AUTOGAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LIQUEFIED PETROLEUM GAS FOR REFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

17. EUROPEAN LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD LIQUEFIED PETROLEUM GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL LIQUEFIED PETROLEUM GAS MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

2. GLOBAL NATURAL GAS-BASED LIQUID LIQUEFIED PETROLEUM GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CRUDE OIL-BASED LIQUEFIED PETROLEUM GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL LIQUEFIED PETROLEUM GAS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL LIQUEFIED PETROLEUM GAS FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LIQUEFIED PETROLEUM GAS FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LIQUEFIED PETROLEUM GAS FOR CHEMICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL LIQUEFIED PETROLEUM GAS FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL LIQUEFIED PETROLEUM GAS FOR AUTOGAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL LIQUEFIED PETROLEUM GAS FOR REFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LIQUEFIED PETROLEUM GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

14. UK LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA LIQUEFIED PETROLEUM GAS MARKET SIZE, 2023-2031 ($ MILLION)