Liquid Applied Membranes Market

Liquid Applied Membranes Market Size, Share & Trends Analysis Report by Type (Polyurethane, Cementitious, Bituminous, and Other) by Application (Roofing, Walls, Underground and Tunnels, and Other) Forecast Period (2024-2031)

Liquid applied membranes market is anticipated to grow at a CAGR of 8.2% during the forecast period (2024-2031). Liquid applied membranes (LAMs) are a popular waterproofing material in the construction industry due to their greater flexibility, conformability, seamless application, faster application times, easier repairs, and lower life-cycle costs. They conform to irregular shapes and surfaces, eliminating leaks at seams, saving time and labor costs, and offering lower life-cycle costs compared to traditional methods.

Market Dynamics

Technological Advancements

The ongoing developments in material science are leading to new and improved liquid applied membranes with enhanced performance. These advancements include better UV resistance, improved chemical resistance, and even fire resistance. The growing adoption of these membranes in end-user industries owing to its offered technological advancements is a key factor driving the growth of the global liquid applied membranes market.

Increasing Sustainability Focus

Liquid applied membranes are often viewed as a more sustainable solution than traditional methods. They can be VOC-free and solvent-free, and they can contribute to energy efficiency by improving building thermal performance. Therefore, the growing focus of builders on using eco-friendly materials in buildings is anticipated to drive the growth of the global LAM market.

Market Segmentation

- Based on type, the market is segmented into polyurethane, cementitious, bituminous, and other types including acrylic and EPDM rubber.

- Based on application, the market is segmented into roofing, walls, underground and tunnels, and other applications including waterproofing.

Polyurethane is Projected to Hold the Largest Segment

The polyurethane segment is expected to hold the largest share of the market. The primary factors supporting the growth include elongation, high flexibility, and durability with UV resistance, which are highly suitable for rooftops, balconies, and exposed areas. ISOMAT S.A. offers a polyurethane liquid membrane that creates a continuous, elastic membrane with excellent mechanical strength, without joints or seams, and is used for both total sealing of flat roof surfaces and for local waterproofing of cracks. It may be applied to all common flat roof substrates, such as concrete, cement mortar, terrazzo, and others. The availability of such products is further aiding high growth in this market segment.

Roofing Segment to Hold a Considerable Market Share

The roofing segment is expected to hold a considerable share of the market. The factors supporting segment growth include increasing adoption of liquid-applied membranes, or LAMs, which provide an impermeable, seamless barrier that successfully prevents water from penetrating through the roof and causing damage to the interior of the building. If moisture seeps through the roof, it may build up inside the building and create an environment that is favorable to rot, decay, and the development of mold and mildew. By reducing the possibility of moisture-related issues and preserving the structural integrity of the roof and the building, LAMS provides a solid waterproofing defense. Tropical climes and areas with restricted land areas benefit most from green roofs. Furthermore, rooftop greenery promotes soil-less agriculture and helps achieve sustainable development goals, both of which advance environmental sustainability.

Regional Outlook

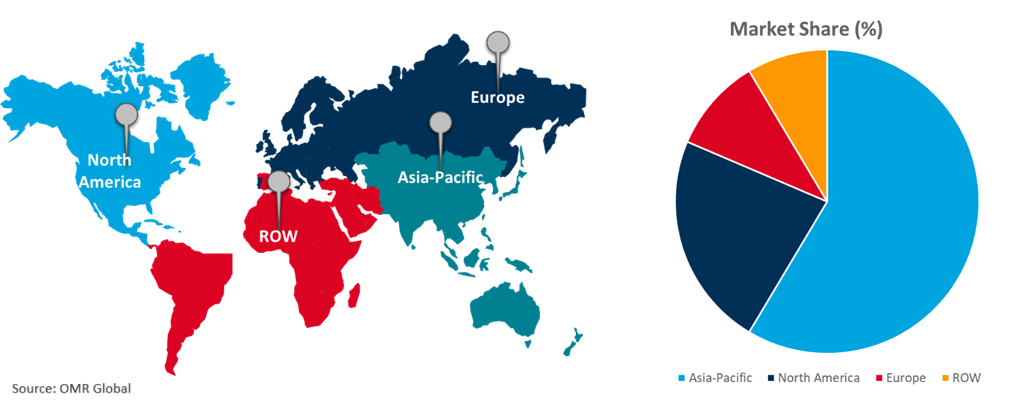

The global liquid applied membrane market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Liquid Applied Membrane Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to numerous prominent liquid applied membrane companies and providers such as GAF Materials Corp., MAPEI Corp., and Pidilite Industries Ltd. in the region. The expansion of the market in the region is driven by increasing demand for liquid applied membranes owing to the growing investments made in infrastructure projects, including public infrastructure, residential complexes, and commercial structures. For instance, Bronco Buildsmart LLP offers Bronco Cemcoat P Membrane for a primer on steel or concrete substrates. Protective coating of concrete structures and protection of galvanized iron in a corrosive environment.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global liquid applied membranes market include H.B. Fuller Company, Sika AG, Bostik Ltd., Dow, Inc., and Henry Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions among others to stay competitive.

Recent Development

- In April 2022, Pidilite Industries Ltd., a manufacturer of adhesives, sealants, and construction chemicals, partnered with GCP Applied Technologies Inc., in construction products, to offer high-performance waterproofing solutions for challenging sites that have exposure to high-temperature variation and water under its brand Dr Fixit.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the liquid applied membranes market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bostik global

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. H.B. Fuller Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sika AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Liquid Applied Membranes Market by Type

4.1.1. Polyurethane

4.1.2. Cementitious

4.1.3. Bituminous

4.1.4. Other Types (Acrylic and EPDM Rubber)

4.2. Global Liquid Applied Membranes Market by Application

4.2.1. Roofing

4.2.2. Walls

4.2.3. Underground and Tunnels

4.2.4. Other Applications (Waterproofing)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Alphateq Waterproofing

6.2. Ardex Group

6.3. Bronco Buildsmart LLP

6.4. Carlisle Companies Inc.

6.5. Dow Inc.

6.6. Fosroc Inc.

6.7. GAF, Inc.

6.8. GCP Applied Technologies Inc.

6.9. Henry Company

6.10. Johns Manville

6.11. Kemper System Ltd

6.12. MAPEI SpA

6.13. Saint-Gobain Weber

6.14. SOPREMA INC.

6.15. Wacker Chemie AG

1. GLOBAL LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL POLYURETHANE LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CEMENTITIOUS LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BITUMINOUS LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHERS LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION 2023-2031 ($ MILLION)

7. GLOBAL LIQUID APPLIED MEMBRANES FOR ROOFING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LIQUID APPLIED MEMBRANES FOR WALLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LIQUID APPLIED MEMBRANES FOR UNDERGROUND AND TUNNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LIQUID APPLIED MEMBRANES FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION

17. EUROPEAN LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD LIQUID APPLIED MEMBRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL LIQUID APPLIED MEMBRANES MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL LIQUID APPLIED MEMBRANES FOR ROOFING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LIQUID APPLIED MEMBRANES FOR WALLS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL LIQUID APPLIED MEMBRANES FOR UNDERGROUND AND TUNNELS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL LIQUID APPLIED MEMBRANES FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LIQUID APPLIED MEMBRANES MARKET SHARE BY TYPE, 2023 VS 2031 (%)

7. GLOBAL POLYURETHANE LIQUID APPLIED MEMBRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CEMENTATIONS LIQUID APPLIED MEMBRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BITUMINOUS LIQUID APPLIED MEMBRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OTHER LIQUID APPLIED MEMBRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LIQUID APPLIED MEMBRANES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

14. UK LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA LIQUID APPLIED MEMBRANES MARKET SIZE, 2023-2031 ($ MILLION)