Liquid Biopsy Market

Global Liquid Biopsy Market Size, Share & Trends Analysis Report, by Biomarker Type (Circulating Tumor Cells, Circulating Tumor DNA, and Others), by Cancer Type (Lung Cancer, Breast Cancer, Prostate Cancer, Colorectal Cancer, and Other Cancers), and by End-User (Hospitals and Laboratories, and Academic and Research Centres) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global liquid biopsy market is anticipated to grow at a significant CAGR of 17.3% during the forecast period. One of the core factors that is fueling the market is the rising prevalence of cancer diseases. There are several kinds of cancers such as lung cancer, breast cancer, prostate cancer, colorectal cancer, and other cancers which have been examined over the decade, and cases are growing every year. Along with various methods, this has pushed the demand for liquid biopsy to find the tumor cells in the blood. The treatment has been helping to find the tumor precisely in real-time which helped to recognize the symptoms of cancer at the initial stage to treat cancer successfully. As per theWorld Health Organization (WHO) report in 2020, cancer was the leading cause of death worldwide, with an estimated 10 million fatalities.

Impact of COVID-19 Pandemic on Global Liquid Biopsy Market

COVID-19 pandemic impacted the healthcare sector across the globe. The sector was struggling to treat the COVID-19 patients while saving their own lives. The spread of the virus and lockdowns restricted a lot of the patients to visit hospitals and clinics for other issues rather than COVID-19 to save themselves from bigger risks. It had crippled the liquid biopsy as well during the pandemic. The study entitled 'Impact of the COVID-19 Pandemic on Cancer Care: A Global Collaborative Study' in 2020, reported that 356 Centers from 54 countries across the six continents participated between April 21 and May 8, 2020. These institutions provide 716,979 new cancer patients a year. The majority of them (88.2%) reported that they were facing challenges in delivering care during the violence. Although 55.34% reduced resources as part of a strategic plan, other common reasons include the full program (19.94%), lack of defense equipment (19.10%), staff shortages (17.98%), and limited access to medicines (9.83%). However, as the situation normalized, the liquid biopsy backed on track with a great jump.

Segmental Outlook

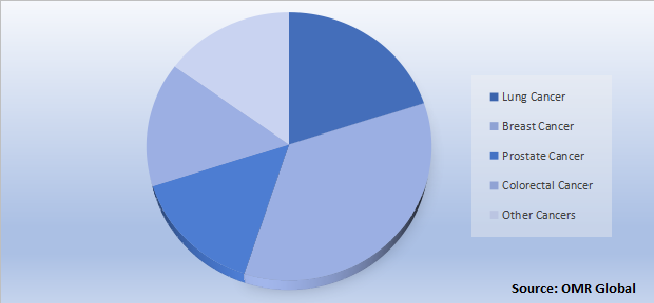

The global liquid biopsy market is segmented based on the biomarker type, cancer type, and end-user. Based on the biomarker type, the market is segmented into circulating tumor cells, circulating tumor DNA, and others. The other biomarker type includes extracellular vesicles. Based on the cancer type, the market is segmented into lung cancer, breast cancer, prostate cancer, colorectal cancer, and other cancers. Based on the end-user, the market is sub-segmented into the hospitals and laboratories, and academic and research centers. The above-mentioned segments can be customized as per the requirements. Based on cancer type, breast cancer is estimated to hold a prominent share in the market while based on end-user, the hospitals and laboratories segment is anticipated to hold a prominent share during the forecast period.

Global Liquid Biopsy Market Share by Cancer Type, 2021 (%)

The Breast Cancer Segment Estimated to Hold the Prominent Share in the Global Liquid Biopsy Market

Based on cancer, the breast cancer segment is anticipated to hold a prominent share in the market during the forecast period. Breast cancer is considered the most common cancer in women and has become the fifth leading cause of mortality in the past few years. As per the report ofWHO, in 2020, there were 2.3 million women diagnosed with breast cancer, and 685 000 fatalities registered globally. By the end of 2020, 7.8 million women were living who was diagnosed with breast cancer in the last past 5 years, making it the world’s most prevalent cancer.Early detection and treatment can reduce the mortality rate. A biopsy is a process that can find if the suspicious area is cancerous. A breast biopsy test can remove sometimes fluid or tissue from the suspicious part, and the removed cells are inspected under a microscope and further tested, to check for the presence of breast cancer.

Regional Outlooks

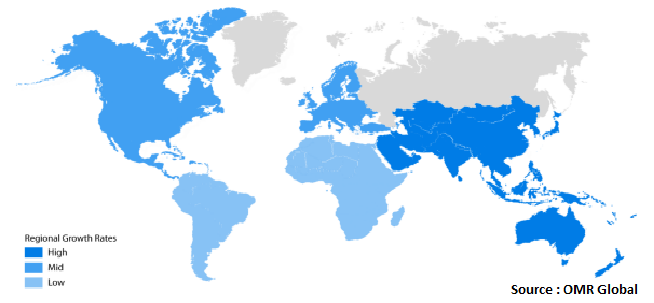

The global liquid biopsy market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is projected to dominate the market while the Asia-Pacific is projected to witness the highest growth rate during the forecasted period.

Global Liquid Biopsy Market Growth, by Region 2022-2028

North America Region Anticipated to Dominate the Market in the Global Liquid Biopsy Market

North American region is estimated to dominate the market during the forecast period owing to the fact that cancer is the 2nd most common cause of death in the US which has increased the demand for cancer diagnosis and treatment in the country including liquid biopsy. As perthe American Cancer Society, Inc. in 2021, 1.9 million new cancer cases are estimated to be diagnosed and 608,570 cancer deaths in the US, which is projected to drive the market during the forecast period. Furthermore, as per John Hopkins Medicine, the elderly population is at high risk of getting affected with cancer, and the geriatric population is expected to increase from 53.340 million in 2019 to 83.813 million in 2050, as per the World Ageing Report 2019. Thus, the growing geriatric population is expected to result in a high incidence of cancer, which will raise the demand for liquid biopsies for countering the issue.

Market Players Outlook

The major companies serving the global liquid biopsy market include Bio-Rad Laboratories Inc., CellMax Life, Guardant Health Inc., MDxHealth SA, QIAGEN NV, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2021, Epic Sciences, Inc. introduced DefineMBC, a novel metastatic breast cancer (MBC) test that included both cell-free and cell-based analysis from a single blood draw.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liquid biopsy market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Liquid Biopsy Market

- Recovery Scenario of Global Liquid Biopsy Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Bio-Rad Laboratories Inc.

3.1.1.1.Overview

3.1.1.2.Financial Analysis

3.1.1.3.SWOT Analysis

3.1.1.4.Recent Developments

3.1.2.CellMax Life

3.1.2.1.Overview

3.1.2.2.Financial Analysis

3.1.2.3.SWOT Analysis

3.1.2.4.Recent Developments

3.1.3.Guardant Health Inc.

3.1.3.1.Overview

3.1.3.2.Financial Analysis

3.1.3.3.SWOT Analysis

3.1.3.4.Recent Developments

3.1.4.MDxHealth SA

3.1.4.1.Overview

3.1.4.2.Financial Analysis

3.1.4.3.SWOT Analysis

3.1.4.4.Recent Developments

3.1.5.Qiagen NV

3.1.5.1.Overview

3.1.5.2.Financial Analysis

3.1.5.3.SWOT Analysis

3.1.5.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Liquid Biopsy Market by Biomarker Type

4.1.1.Circulating Tumor Cells

4.1.2.Circulating Tumor DNA (ctDNA)

4.1.3.Others (Extracellular Vesicles)

4.2.Global Liquid Biopsy Market by Cancer Type

4.2.1.Lung Cancer

4.2.2.Breast Cancer

4.2.3.Prostate Cancer

4.2.4.Colorectal Cancer

4.2.5.Other Cancers

4.3.Global Liquid Biopsy Market by End-User

4.3.1.Hospitals and Laboratories

4.3.2.Academic and Research Centres

5.Regional Analysis

5.1.North America

5.1.1.US

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Biocept Inc.

6.2.Biodesix, Inc.

6.3.Circulogene

6.4.Clearbridge Biomedics Pte Ltd.

6.5.Cynvenio Biosystems, Inc.

6.6.Epigenomics AG

6.7.Exosome Diagnostics Inc.

6.8.F. Hoffmann-La Roche AG

6.9.Genomic Health Inc.

6.10.Inivata Ltd.

6.11.Lariat Biosciences, Inc.

6.12.Menarini-Silicon Biosystems

6.13.Personal Genome Diagnostics Inc.

6.14.Raindance Technologies, Inc.

6.15.Thermo Fisher Scientific Inc.

6.16.Trovagene, Inc.

1.GLOBAL LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY BIOMARKER TYPE, 2021-2028 ($ MILLION)

2.GLOBAL LIQUID BIOPSY FOR CIRCULATING TUMOR CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL LIQUID BIOPSY FOR CIRCULATING TUMOR DNA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL LIQUID BIOPSY FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2021-2028 ($ MILLION)

6.GLOBAL LIQUID BIOPSY FOR LUNG CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL LIQUID BIOPSY FOR BREAST CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL LIQUID BIOPSY FOR PROSTATE CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9.GLOBAL LIQUID BIOPSY FOR COLORECTAL CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.GLOBAL LIQUID BIOPSY FOR OTHER CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.GLOBAL LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12.GLOBAL LIQUID BIOPSY IN HOSPITALS AND LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13.GLOBAL LIQUID BIOPSY IN ACADEMIC AND RESEARCH CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14.GLOBAL LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15.NORTH AMERICAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16.NORTH AMERICAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY BIOMAKER TYPE, 2021-2028 ($ MILLION)

17.NORTH AMERICAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2021-2028 ($ MILLION)

18.NORTH AMERICAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19.EUROPEAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20.EUROPEAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY BIOMAKER TYPE, 2021-2028 ($ MILLION)

21.EUROPEAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2021-2028 ($ MILLION)

22.EUROPEAN LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

23.ASIA-PACIFIC LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24.ASIA-PACIFIC LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY BIOMAKER TYPE, 2021-2028 ($ MILLION)

25.ASIA-PACIFIC LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2021-2028 ($ MILLION)

26.ASIA-PACIFIC LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

27.REST OF THE WORLD LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28.REST OF THE WORLD LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY BIOMAKER TYPE, 2021-2028 ($ MILLION)

29.REST OF THE WORLD LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2021-2028 ($ MILLION)

30.REST OF THE WORLD LIQUID BIOPSY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL LIQUID BIOPSY MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL LIQUID BIOPSY MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL LIQUID BIOPSY MARKET, 2022-2028 (%)

4.GLOBAL LIQUID BIOPSY MARKET SHARE BY BIOMARKER TYPE, 2021 VS 2028 (%)

5.GLOBAL LIQUID BIOPSY FOR CIRCULATING TUMOR CELLSMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL LIQUID BIOPSY FOR CIRCULATING TUMOR DNA (CTDNA) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL LIQUID BIOPSY FOR OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL LIQUID BIOPSY MARKET SHARE BY CANCER TYPE, 2021 VS 2028 (%)

9.GLOBAL LIQUID BIOPSY FOR LUNG CANCER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL LIQUID BIOPSY FOR BREAST CANCER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL LIQUID BIOPSY FOR PROSTATE CANCER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL LIQUID BIOPSY FOR COLORECTAL CANCER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.GLOBAL LIQUID BIOPSY FOR OTHER CANCERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14.GLOBAL LIQUID BIOPSY MARKET SHARE BY END-USER, 2021 VS 2028 (%)

15.GLOBAL LIQUID BIOPSY IN HOSPITALS AND LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.GLOBAL LIQUID BIOPSY IN ACADEMIC AND RESEARCH CENTRES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17.GLOBAL LIQUID BIOPSY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18.US LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

19.CANADA LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

20.UK LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

21.FRANCE LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

22.GERMANY LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

23.ITALY LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

24.SPAIN LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

25.REST OF EUROPE LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

26.INDIA LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

27.CHINA LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

28.JAPAN LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

29.SOUTH KOREA LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

30.REST OF ASIA-PACIFIC LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)

31.REST OF THE WORLD LIQUID BIOPSY MARKET SIZE, 2021-2028 ($ MILLION)