Liquid Dietary Supplements Market

Liquid Dietary Supplements Market Size, Share & Trends Analysis Report by Ingredient (Vitamins, Botanicals, Minerals, Proteins & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, and Prebiotics & Postbiotics), by Application (Energy & Weight Management, Bone & Joint Health, Cardiac Health, Diabetes, Anti-cancer, Skin/Hair/Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, and Prenatal Health), by End-Users (Adults, Geriatric, Pregnant Women, Children, and Infants), by Type (OTC and Prescribed), and by Distribution Channel (Offline and Online), Forecast Period (2024-2031)

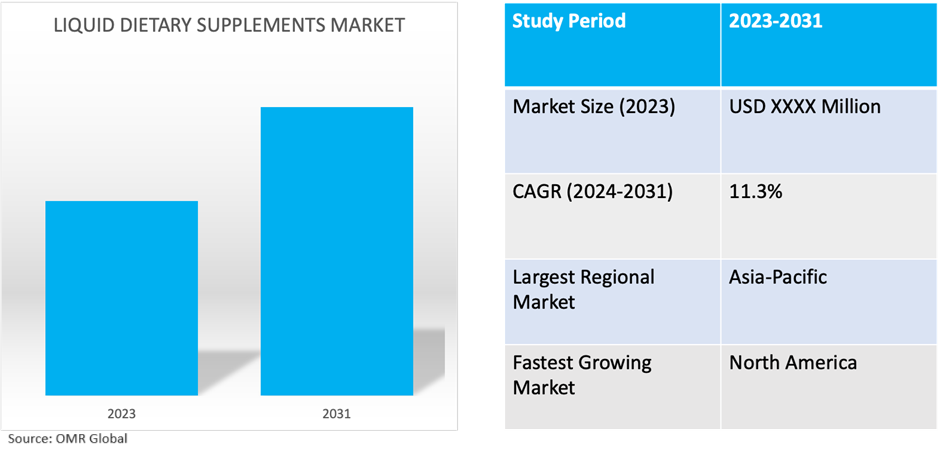

Liquid dietary supplements market is anticipated to grow at a CAGR of 11.3% during the forecast period (2024-2031). The rising awareness related to liquid dietary supplements, growing incidence and prevalence rates of lifestyle-oriented diseases, and cohesive government support, among others, are driving the market growth. Liquid dietary supplements are nutritional products that come in liquid form and are consumed orally to supplement the diet with essential vitamins, minerals, herbs, amino acids, or other nutrients. These supplements are typically designed to provide a convenient and easily absorbable alternative to traditional pill or tablet forms of supplements. Liquid dietary supplements may come in various forms, such as juices, syrups, drops, or concentrates, and they often contain a combination of nutrients tailored to support specific health goals or address nutritional deficiencies.

Market Dynamics

Rising Health Consciousness To Foster Demand

As awareness about the importance of nutrition and preventive healthcare continues to rise, there's a notable trend toward increasing health consciousness among consumers. Globally, individuals are becoming more proactive in managing their health and well-being, seeking out products that support their nutritional needs and overall wellness. The inclination of youths towards healthy supplements is driving the demand for dietary supplements, including liquid dietary supplements that contain essential vitamins, minerals, and nutrients, among others. Manufacturers are responding to this trend by developing innovative formulations and marketing strategies that emphasize the health benefits of their products, further fueling the growth of the market. For instance, in May 2023, ChildLife Essentials introduced a novel organic liquid elderberry supplement tailored to enhance children's immune health. This potent formulation is meticulously crafted to bolster immune function in children and foster holistic well-being.

Liquid Dietary Supplements are Elevating Convenience

Liquid dietary supplements offer a convenient and easy-to-use alternative to traditional pill or tablet forms, particularly for individuals who have difficulty swallowing or prefer liquid formulations. The accessibility of these supplements through various retail channels, including pharmacies, supermarkets, health food stores, and online platforms, further enhances their appeal to consumers. With liquid supplements readily available for purchase and consumption, people can easily incorporate them into their daily routines, whether at home, work, or on the go, contributing to the overall growth and popularity of the market. For instance, in May 2022, AquaCap, situated in Philadelphia, was bought by Vantage Nutrition from Nestlé Health Science. The company specializes in contract manufacture of liquid-filled nutritional supplement capsules, and its innovative liquid delivery technique enables the liquid filling of hard gelatin and vegetarian capsules making it convenient for consumers.

Market Segmentation

- Based on ingredients, the market is segmented into vitamins, botanicals, minerals, proteins & amino acids, fibers & specialty carbohydrates, omega fatty acids, probiotics, and prebiotics & postbiotics.

- Based on application, the market is segmented into energy & weight management, general health, bone & joint health, gastrointestinal health, immunity, cardiac health, diabetes, anti-cancer, lung detox/cleanse, skin/hair/nails, sexual health, brain/mental health, insomnia, menopause, anti-aging and prenatal health.

- Based on end-users, the market is segmented into adults, geriatric, pregnant women, children, and infants.

- Based on type, the market is segmented into OTC and prescribed.

- Based on the distribution channel, the market is segmented into offline and online.

Energy & Weight Management is Projected to Emerge as the Largest Segment

The energy & weight management segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing prevalence of lifestyle-related health issues, such as obesity and fatigue, coupled with rising health consciousness among consumers. As people become more aware of the importance of maintaining a healthy weight and energy levels, there is a growing demand for dietary supplements designed to support these goals. Liquid dietary supplements formulated specifically for energy enhancement and weight management offer convenient and effective solutions for individuals looking to improve their overall well-being. These supplements often contain ingredients such as vitamins, minerals, amino acids, and herbal extracts known for their potential to boost energy levels, support metabolism, and aid in weight management.

Protein & Amino Acids Segment to Hold a Considerable Market Share

The protein & amino acids segment is poised to hold a considerable market share in the global liquid dietary supplements market owing to rising awareness, growing obesity, and inclination towards weight management. These nutrients are vital for muscle repair, growth, and metabolic health, driving increased consumer awareness of their importance. Liquid supplements offer a convenient and easily digestible way to consume protein and amino acids, appealing to busy lifestyles and those with swallowing difficulties. For instance, as per the World Health Organization (WHO), individuals in North America ingest protein at a rate exceedingly twice the Dietary Recommended Intake (DRI). A study named 'Protein Fever' discovered that more than a quarter of North American residents express a willingness to invest additional funds in diets abundant in protein.

Regional Outlook

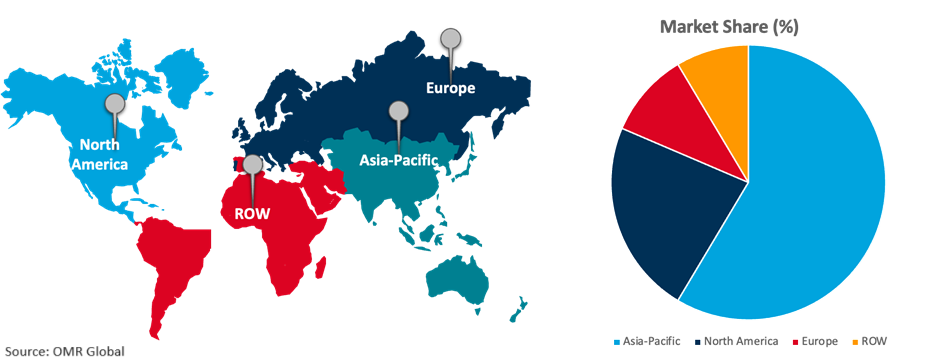

The global liquid dietary supplements market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Grow at the Highest CAGR

North America is swiftly emerging as the fastest-growing market in the global liquid dietary supplements sector owing to its heightened health awareness among consumers, coupled with sedentary lifestyles, which has sparked a surge in demand for convenient dietary solutions, with liquid supplements proving particularly popular. The region benefits from a well-established healthcare infrastructure and widespread distribution networks, ensuring easy accessibility of liquid supplements through various retail channels. For instance, in April 2022, Abbott Laboratories unveiled an inventive automated insulin delivery system in partnership with CamDiab and Ypsomed, aiming to revolutionize the management of diabetes. This pioneering solution merges Abbott's proficiency in continuous glucose monitoring, CamDiab's cutting-edge algorithms, and Ypsomed's innovative insulin pump technology. The system facilitates real-time monitoring of glucose levels and administers precise insulin doses automatically, minimizing the necessity for manual adjustments. It empowers individuals with diabetes by offering enhanced glycemic control, reduced occurrences of hypoglycemia, and an elevated overall quality of life.

Global Liquid Dietary Supplements Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to its rapidly expanding population and increasing disposable incomes, there's a growing demand for dietary supplements, particularly in liquid form, driven by heightened health awareness. Lifestyle changes, urbanization, and shifts toward Western dietary patterns have also contributed to the rise in demand for supplements to support overall health and well-being. Additionally, the region benefits from a diverse market landscape, with innovative product offerings tailored to local preferences and government initiatives promoting health and wellness.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global liquid dietary supplements market include BASF SE, Bayer AG, DSM, Nu Skin, and Nature's Sunshine Products, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in May 2022, GlaxoSmithKline plc finalized the acquisition of Affinivax, Inc., bolstering its portfolio with clinical-stage biopharmaceutical developments. This strategic maneuver underscores GSK's dedication to broadening its footprint within the biopharmaceutical domain, particularly in innovative vaccine research. The acquisition enriches GSK's R&D capabilities by harnessing Affinivax's proficiency in pioneering vaccine technologies. This strategic alignment positions GSK to propel groundbreaking healthcare solutions, addressing unmet medical necessities and potentially revolutionizing disease prevention and treatment modalities.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liquid dietary supplements market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bayer AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. dsm-firmenich

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Liquid Dietary Supplements Market by Ingredients

4.1.1. Vitamins

4.1.2. Botanicals

4.1.3. Minerals

4.1.4. Proteins & Amino Acids

4.1.5. Fibers & Specialty Carbohydrates

4.1.6. Omega Fatty Acids

4.1.7. Probiotics

4.1.8. Prebiotics & Postbiotics

4.2. Global Liquid Dietary Supplements Market by Application

4.2.1. Energy & Weight Management

4.2.2. Bone & Joint Health

4.2.3. Gastrointestinal Health

4.2.4. Immunity

4.2.5. Cardiac Health

4.2.6. Diabetes

4.2.7. Anti-cancer

4.2.8. Lungs Detox/Cleanse

4.2.9. Skin/Hair/Nails

4.2.10. Sexual Health

4.2.11. Brain/Mental Health

4.2.12. Insomnia

4.2.13. Menopause

4.2.14. Anti-aging

4.2.15. Prenatal Health

4.3. Global Liquid Dietary Supplements Market by End-users

4.3.1. Adults

4.3.2. Geriatric

4.3.3. Pregnant Women

4.3.4. Children

4.3.5. Infants

4.4. Global Liquid Dietary Supplements Market by Type

4.4.1. OTC

4.4.2. Prescribed

4.5. Global Liquid Dietary Supplements Market by Distribution Channel

4.5.1. Offline

4.5.2. Online

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. American Health

6.2. Amway Corporation.

6.3. Arkopharma

6.4. DuoLife S.A.

6.5. DuPont

6.6. Glanbia Plc.

6.7. GlaxoSmithKline Plc (GSK Plc.)

6.8. GNC Holdings Inc.

6.9. Goodhealth Products Ltd.

6.10. Herbalife International of America, Inc.

6.11. Nature's Bounty

6.12. Nature's Sunshine Products, Inc.

6.13. Nestlé

6.14. Nu Skin

6.15. Pfizer Inc.

6.16. Pharmavite LLC

6.17. Suntory Holdings Ltd.

6.18. The Himalaya Drug Co.

6.19. The Nature's Way Co.

6.20. USANA Health Sciences, Inc.

1. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2023-2031 ($ MILLION)

2. GLOBAL VITAMINS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BOTANICALS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MINERALS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PROTEINS & AMINO ACIDS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FIBERS & SPECIALTY CARBOHYDRATES LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OMEGA FATTY ACIDS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PROBIOTICS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PREBIOTICS & POSTBIOTICS LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ENERGY & WEIGHT MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR BONE & JOINT HEALTH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR GASTROINTESTINAL HEALTH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR IMMUNITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR CARDIAC HEALTH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ANTI-CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR LUNGS DETOX/CLEANSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR SKIN/HAIR/NAILS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR SEXUAL HEALTH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR BRAIN/MENTAL HEALTH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR INSOMNIA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR MENOPAUSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ANTI-AGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR PRENATAL HEALTH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

27. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ADULTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR GERIATRIC MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR PREGNANT WOMEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR CHILDREN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR INFANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

33. GLOBAL OTC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

34. GLOBAL PRESCRIBED LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

35. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

36. GLOBAL LIQUID DIETARY SUPPLEMENTS VIA OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

37. GLOBAL LIQUID DIETARY SUPPLEMENTS VIA ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

38. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

39. NORTH AMERICAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

40. NORTH AMERICAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2023-2031 ($ MILLION)

41. NORTH AMERICAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

42. NORTH AMERICAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

43. NORTH AMERICAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

44. NORTH AMERICAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

45. EUROPEAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

46. EUROPEAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2023-2031 ($ MILLION)

47. EUROPEAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

48. EUROPEAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

49. EUROPEAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

50. EUROPEAN LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

51. ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

52. ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2023-2031 ($ MILLION)

53. ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

54. ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

55. ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

56. ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

57. REST OF THE WORLD LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

58. REST OF THE WORLD LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2023-2031 ($ MILLION)

59. REST OF THE WORLD LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

60. REST OF THE WORLD LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

61. REST OF THE WORLD LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

62. REST OF THE WORLD LIQUID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY INGREDIENTS, 2023 VS 2031 (%)

2. GLOBAL VITAMINS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BOTANICALS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MINERALS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PROTEINS & AMINO ACIDS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FIBERS & SPECIALTY CARBOHYDRATES LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OMEGA FATTY ACIDS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL PROBIOTICS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PREBIOTICS & POSTBIOTICS LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ENERGY & WEIGHT MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR BONE & JOINT HEALTH MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR GASTROINTESTINAL HEALTH MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR IMMUNITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR CARDIAC HEALTH MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR DIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ANTI-CANCER MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR LUNGS DETOX/CLEANSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR SKIN/HAIR/NAILS MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR SEXUAL HEALTH MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR BRAIN/MENTAL HEALTH MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR INSOMNIA MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR MENOPAUSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ANTI-AGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR PRENATAL HEALTH MARKET SHARE BY REGION, 2023 VS 2031 (%)

26. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

27. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR ADULTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

28. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR GERIATRIC MARKET SHARE BY REGION, 2023 VS 2031 (%)

29. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR PREGNANT WOMEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

30. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR CHILDREN MARKET SHARE BY REGION, 2023 VS 2031 (%)

31. GLOBAL LIQUID DIETARY SUPPLEMENTS FOR INFANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

32. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

33. GLOBAL OTC LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

34. GLOBAL PRESCRIBED LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

35. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

36. GLOBAL OFFLINE LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

37. GLOBAL ONLINE LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

38. GLOBAL LIQUID DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

39. US LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

40. CANADA LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

41. UK LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

42. FRANCE LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

43. GERMANY LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

44. ITALY LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

45. SPAIN LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

46. REST OF EUROPE LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

47. INDIA LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

48. CHINA LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

49. JAPAN LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

50. SOUTH KOREA LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

51. REST OF ASIA-PACIFIC LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

52. LATIN AMERICA LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)

53. MIDDLE EAST AND AFRICA LIQUID DIETARY SUPPLEMENTS MARKET SIZE, 2023-2031 ($ MILLION)