Lithium-air Battery Market

Lithium-air Battery Market Size, Share & Trends Analysis Report by Type (Aprotic, Aqueous, Solid-state and Mixed aqueous-aprotic), by End User (Automotive, Consumer Electronics, Energy Storage and Other (Aerospace and Defense, Medical Devices)), Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Lithium-air battery market is anticipated to grow at a CAGR of 7.2% during the forecast period. Considering recent developments, Lithium-air batteries represent a significant advancement in energy storage technology, in various sectors such as electric vehicles (EV), aircraft, and grid power. Unlike traditional lithium-ion batteries, which rely on internal metal oxides, lithium-air batteries utilize atmospheric oxygen, theoretically providing 5 to 10 times higher energy density. This growth in capacity addresses the growing demand for energy in a variety of applications, including renewable energy integration, grid modernization, and sustainable transportation. Additionally, the environmental advantages of lithium-air batteries, such as the use of non-toxic materials and the potential for closed-loop operation, are contributing to its further market growth.

Globally, multiple factors are driving interest in lithium-air batteries including growing energy needs, rising environmental concerns, and geopolitical factors. However, despite their potential, these batteries encounter multiple technical challenges such as durability, efficiency, and safety concerns pose significant obstacles hindering general adoption by end-user industries. To address these challenges, ongoing R&D efforts are focused on material research, such as solid-state electrolytes and nanostructured catalysts, to enhance stability and efficiency. Despite these hurdles, considering its advantages, the lithium-air battery presents significant market opportunities in multiple end-user industries.

Segmental Outlook

The global lithium air battery market is segmented by type and end user. By type, the market is sub-segmented into aprotic, aqueous, solid-state and mixed aqueous-aprotic type. By end user, the market is sub-segmented into automotive, consumer electronics, energy storage and other (aerospace and defence, medical devices) end users. Among end-users, the energy storage sector presents significant opportunities for the global lithium air battery market owing to significant growth in sustainable energy generation, investments in smart grid infrastructure, importance of energy security primarily due to rising geopolitical tensions among others. As per the data from the International Energy Agency (IEA), in 2022, China took the lead in adding grid-scale battery storage, installing nearly 5 GW annually, followed by the US, commissioning 4 GW throughout the year. Also, the Inflation Reduction Act passed in August 2022, incorporates an investment tax credit specifically for stand-alone storage, indicating a potential for increased deployments in the coming years.

Automotive Industry Contribute the Highest to the Global Lithium Air Battery Industry

Among the techniques, the automotive industry contributes the highest share in the global lithium-air battery market. Lithium-air batteries present the potential for higher energy densities compared to current lithium-ion batteries, with theoretical capacities that could potentially double or triple the driving range of electric vehicles which is a major problem among EV automakers and consumers. The global EV market is growing significantly, leading to an increased demand for improved batteries, eventually driving the progression of lithium-air technology. Major automotive manufacturers and research institutions are heavily investing in battery technology, with initiatives such as IBM's Battery 500, which targets a 500-mile electric vehicle range, focusing on the improvements of energy density, an area where lithium-air displays considerable promise.

Although the technology presents significant potential in the automotive industry, technical concerns such as stability and durability issues with lithium-air batteries, along with the need for effective air management systems, higher reactivity and flammability of lithium-air batteries compared to lithium-ion, necessitating stringent safety measures before commercialization are hindering overall market growth.

Regional Outlook

The global lithium air battery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among regions, the European lithium-air battery market is expected to grow significantly during the forecasting period primarily due to the growing focus on sustainable solutions by regional economies, eventually driving growth in end-user industries mainly in energy storage and EVs. Growing investments in sustainable energy production in the region are also driving demand for strong energy storage infrastructure. As per the data from the European Association for Storage of Energy, to achieve a target of approximately 200 GW by 2030, the deployment of storage must increase to a minimum of 14 GW per year. Looking ahead to 2050, the energy system will require a storage capacity of at least 600 GW, with more than two-thirds of this demand being fulfilled by energy-shifting technologies, specifically power-to-power applications. Also, Europe was the second largest market in EVs with annual sales increasing by over 15% in 2022. With the growth of end-user industries in the region, both public and private organizations in the region are increasingly focusing on R&D of lithium-air battery technology, eventually driving overall market growth. For instance, in May 2023, the €1.1 million ($1.19 million) AMaLiS 2.0 project, led by Iolitec Ionic Liquids Technologies in Heilbronn along with partners University of Oldenburg, MEET Battery Research Centre, and Fraunhofer IFAM, is working to enhance the stability of lithium-air batteries. As per the company, the project focuses on designing a membrane to separate positive and negative electrodes, allowing for the use of different electrolytes on each side. The development of this separating layer, in collaboration with the MEET Battery Research Centre at the University of Münster, is expected to broaden electrolyte options.

Global Lithium-air battery Market Growth, by region 2024-2031

Asia Pacific is Expected to Grow at the Highest Rate in Global Lithium-Air Batteries Market

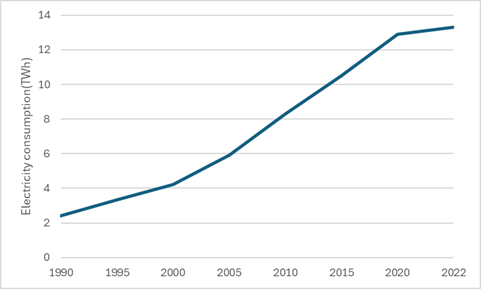

Among the regions, the Asia Pacific region is growing at the highest CAGR in the forecasting period owing to several pivotal factors. One of the key factors is growing electrification, demand for efficient power storage, and growing investments in the development of regional energy infrastructure from both private and public organizations. As per the data from the Asian Development Bank, from 2016 to 2021, approximately 380 million individuals in Asia-Pacific obtained electricity access. Despite a population growth of 180 million during this timeframe, the electrification rate surged from 94.0% to 98.6%. By 2021, urban areas achieved nearly universal access at 99.8%, and rural regions are steadily narrowing the gap, reaching 97.7%. Additionally, the region has a significant share in global EV sales and production. As per the same source, in 2022, China was the largest EV market globally, accounting for 60.0% of global EV sales. Outside major markets, EV sales have generally been low, but there was significant growth in 2022 in India, Thailand, and Indonesia. Combined, the sales of electric cars in these countries more than triple compared to 2021, reaching a total of 80,000 units. In Thailand, electric cars constituted slightly over 3% of total sales in 2022, while both India and Indonesia maintained an average of around 1.5% throughout the year. India is experiencing growth in EV and component manufacturing, driven by the government's $ 3.2 billion incentive program, which has attracted investments totalling $8.3 billion. Apart from this, the growing focus on the development of battery ecosystems such as manufacturing, and R&D by major regional economies such as China, and India is expected to contribute significantly to overall market growth.

Asia Pacific energy consumption, in TWh

Source: International Energy Agency (IEA)

Market Players Outlook

The major companies serving the global Lithium-air battery market are PolyPlus Battery Company (PPBC), Lithium Air Industries Inc., and Sion Power Corporation among others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the lithium air battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Tesla Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.3. Mullen Technologies Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lithium Air Battery Market by Type

4.1.1. Aprotic

4.1.2. Aqueous

4.1.3. Solid-state

4.1.4. Mixed aqueous-aprotic

4.2. Global Lithium Air Battery Market by End-user

4.2.1. Automotive

4.2.2. Consumer Electronics

4.2.3. Energy Storage

4.2.4. Other(Aerospace and Defense, Medical Devices)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Baker Hughes Company

6.2. Contemporary Amperex Technology

6.3. EV Express, Inc.

6.4. Fuji Pigment Co. Ltd.

6.5. Lithium Air Industries Inc.

6.6. MTI Corporation

6.7. PolyPlus Battery Company (PPBC)

6.8. Robert Bosch GmbH

6.9. Samsung Advanced Institute of Technology (SAIT)

6.10. Shenzhen Beide New Energy Technology Co., LTD

6.11. Sion Power Corporation

1. GLOBAL LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL APROTIC LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AQUEOUS LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SOLID-STATE LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MIXED AQUEOUS-APROTIC LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

7. GLOBAL LITHIUM AIR BATTERY IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LITHIUM AIR BATTERY IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LITHIUM AIR BATTERY IN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LITHIUM AIR BATTERY IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

14. EUROPEAN LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

20. REST OF THE WORLD LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD LITHIUM AIR BATTERY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL LITHIUM AIR BATTERY MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL APROTIC LITHIUM AIR BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AQUEOUS LITHIUM AIR BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SOLID-STATE LITHIUM AIR BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MIXED AQUEOUS-APROTIC LITHIUM AIR BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LITHIUM AIR BATTERY MARKET SHARE BY END USER, 2023 VS 2031 (%)

7. GLOBAL LITHIUM AIR BATTERY IN AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL LITHIUM AIR BATTERY IN CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL LITHIUM AIR BATTERY IN ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL LITHIUM AIR BATTERY IN OTHER MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LITHIUM AIR BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

14. UK LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD LITHIUM AIR BATTERY MARKET SIZE, 2023-2031 ($ MILLION)