Live Cell Imaging Market

Global Live Cell Imaging Market Size, Share & Trends Analysis Report by Product (Instruments, Consumables, and Software & Services), By Application (Stem Cells, Drug Discovery, Cell Biology, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Research Institutes, and Contract Research Organizations) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global market for live cell imaging is estimated to have a CAGR of around 8.7% during the forecast period. The market is mainly driven due to growing prevalence of cancer, increasing application of high content screening and cell culture in drug discovery. Cancer is one of the fatal diseases increasing rapidly across the globe. Cancer involves the development of abnormal cells which spread on mammoth scale and have potential to destroy other normal cells. Therefore, early diagnosis and on time replacement of affected cells plays a significant role in the treatment of cancer. Live cell imaging technology is being used widely in the form of models to investigate disease mechanism and to develop therapies. The models based on live cell imaging technology generates biological information in order to facilitate medical solutions promising preclinical drugs. Across the globe, there is a rise in the cancer patient’s each year. According to the WHO, cancer was considered to be the second leading cause of mortalities in the year 2018. It is also estimated that 1 out of 6 deaths was due to cancer, therefore growing cancer across the globe further propels the market growth.

Segmental Outlook

The global live cell imaging market is segmented based on product, application and end-user. Based on the product, the market is further classified into instruments, consumables, and software & services. The instruments segment is projected to have considerable share owing to the high application of microscopes in various live cell imaging and technological advancements in the live cell imaging instruments. Based on the application, the global live cell imaging market is further segmented into stem cells, drug discovery, cell biology, and others. The stem cells application segment is projected to hold considerable growth during the forecast period owing to growing investment in the stem cell research activities. On the basis of end-user the market is further segregated into pharmaceutical & biotechnology companies, research institutes, and contract research organizations (CRO).

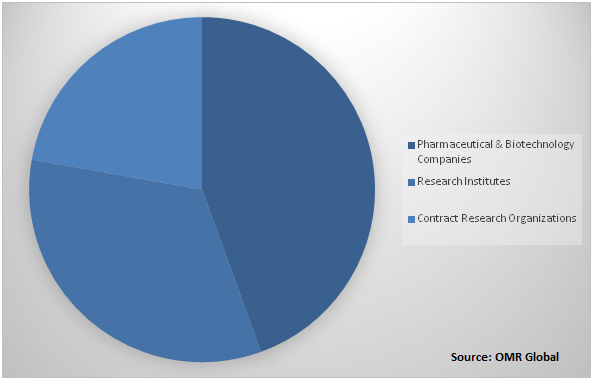

Global Live Cell Imaging Market Share by End-User, 2018(%)

Global live cell imaging Market to be driven by pharmaceutical & biotechnology companies

Among end-user, the pharmaceutical & biotechnology companies segment held a considerable share in the market. Pharmaceutical and biotechnology companies have an increasingly important role in the field of science and technology industry. It contributes to the design, development, and delivery of novel therapeutic drugs, including the development of diagnostic agents for purposeful medical tests, and the implementation of gene therapy for treating hereditary diseases. Pharmaceuticals and biotechnology companies undergo robust clinical trial during the development of novel drugs in order to ensure their safety of the consumers. Live cell imaging techniques are being extensively used in the production of biosimilars such as monoclonal antibodies, regenerative medicine, vaccine production, drug development and others.

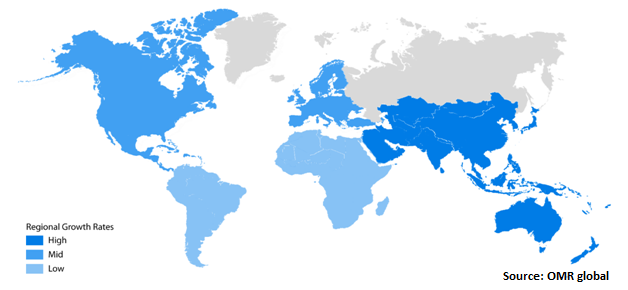

Regional Outlook

Geographically, the global live cell imaging market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth in the region is increasing owing to the high prevalence of different types of cancer coupled with growing research activities in emerging economies. The major countries which will have a significant market share during the forecast period are India, China, and Japan. China is expected to be the major contributor at the global level and is expected to be the biggest contributor in the region. While, India will share a considerable market growth due to the rising prevalence of cancer, and growing R&D funding for the cancer drug discovery and personalized medicine.

Global Live Cell Imaging MarketGrowth, by Region 2019-2025

North America to hold a considerable share in the global live cell imaging market

Geographically, North America is projected to hold a significant market share in the global live cell imaging market. Major economies which are anticipated to contribute to the North America live cell imaging market are the US and Canada. The factors that are contributing significantly to market growth include R&D, and high healthcare expenditure. Moreover, a rising number of cancer patients are considered to be one of the major factors that are driving the growth in the North American market. There are several research segments in the US that tend to invest in the research of healthcare and medical drugs, medical devices and others. The sectors that invest in the healthcare and medical researchers are the pharmaceutical industry, the federal government, academic and research institutes, non-research conducting grant-giving entities, state and local government. The government sector and the private sector of the US are investing in the R&D of the healthcare sector which is driving the market in the region.

Market Players Outlook

The key players in the live cell imaging market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Olympus Corp., Danaher Corp., PerkinElmer Inc., Nikon Corp., Thermo Fisher Scientific, Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global live cell imaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Olympus Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Danaher Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. PerkinElmer Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Nikon Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Thermo Fisher Scientific, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Live Cell Imaging Market by Product

5.1.1. Instruments

5.1.2. Consumables

5.1.3. Software & Services

5.2. Global Live Cell Imaging Market by Application

5.2.1. Stem Cells

5.2.2. Drug Discovery

5.2.3. Cell Biology

5.2.4. Others( Developmental Biology)

5.3. Global Live Cell Imaging Market by End-User

5.3.1. Pharmaceutical & Biotechnology Companies

5.3.2. Research Institutes

5.3.3. Contract Research Organizations

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agilent Technologies Inc.

7.2. Bruker Corp.

7.3. Becton, Dickinson and Co.

7.4. Blue-Ray Biotech Corp.

7.5. Carl Zeiss AG

7.6. CytoSMART Technologies BV

7.7. Danaher Corp.

7.8. Etaluma, Inc.

7.9. Lonza Group Ltd.

7.10. Merck KGaA

7.11. Marker Gene Technologes, Inc

7.12. Molecular Devices, LLC

7.13. Nikon Corp.

7.14. Nanoentek

7.15. Olympus Corp.

7.16. PerkinElmer Inc.

7.17. Sartorius AG

7.18. Thermo Fisher Scientific Inc.

7.19. Yokogawa Electric Corp

1. GLOBAL LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CONSUMABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SOFTWARE & SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

6. GLOBAL LIVE CELL IMAGING IN STEM CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL LIVE CELL IMAGING IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL LIVE CELL IMAGING IN CELL BIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL LIVE CELL IMAGING IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

11. GLOBAL LIVE CELL IMAGING IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL LIVE CELL IMAGING IN RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL LIVE CELL IMAGING IN CONTRACT RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. NORTH AMERICAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. NORTH AMERICAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. EUROPEAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

21. EUROPEAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

22. EUROPEAN LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

27. REST OF THE WORLD LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

28. REST OF THE WORLD LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

29. REST OF THE WORLD LIVE CELL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL LIVE CELL IMAGING MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL LIVE CELL IMAGING MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL LIVE CELL IMAGING MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL LIVE CELL IMAGING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

7. UK LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD LIVE CELL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)