Liver Health Supplements Market

Global Liver Health Supplements Market Size, Share & Trends Analysis Report, By Product (Vitamins and Minerals, Herbal Supplements, and Others), By Dosage Form (Capsule, Tablet, Powder, Liquid, and Others), By Distribution Channel (Online and Offline) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global liver health supplements market is estimated to grow at a CAGR of nearly 4.5% during the forecast period. Some key factors encouraging the market growth include the growing incidences of liver diseases and increasing demand for dietary supplements. Increasing shift towards a healthy lifestyle is the major cause for accelerating adoption of dietary supplements. As per the Council for Responsible Nutrition (CRN) 2019 survey, 77% of the US adults take dietary supplements. Vitamins & minerals are among the most commonly adopted dietary supplement, as nearly 76% of the US population consumed these supplements over several years.

Specialty supplements (40%) is the second most commonly consumed supplement, which is followed by herbals and botanicals (39%), sports nutrition supplements (28%), and weight management supplements (17%). There is an increasing focus on promoting awareness regarding liver health among people. On 19th April of every year, World Liver Day is observed to spread awareness regarding the liver-related disease. The liver is the most complex organ in the body that performs several essential functions including supporting digestion, cleaning the blood, producing hormones, and synthesizing proteins.

Increasing prevalence of non-alcoholic fatty liver disease (NAFLD), liver cancer, and other liver disorders have led the demand for liver supplements to detoxify and rejuvenate the liver. Many liver supplements consist of a combination of herbal ingredients, minerals, and vitamins. These supplements enable to protect liver cells from damage, improve blood flow from the liver, encourage the growth of new liver cells, detoxify the liver, and promote healthy functioning of the liver. These supplements can support liver regeneration and restore it to its peak function. As a result, liver supplements can provide more energy, support lose weight, and strengthen the immune system.

EuroPharma Inc. product Clinical Strength Liver Formula (Terry Naturally) combines the traditional liver herb, milk thistle, with the most effective bioflavonoid of milk thistle, silybin, and sesamin from sesame seed oil. Sesamin acts as a potential and unique antioxidant to support liver health. Therefore, it promotes healthy liver enzyme levels as well as detoxification activity of the liver, according to the company. Manufacturers of liver supplements are focusing on adding ingredients that can contribute to better functioning of the liver and reduce the risk of adverse reactions such as nausea, abdominal pain, and increased blood pressure. This, in turn, is expected to offer an opportunity for market growth.

Market Segmentation

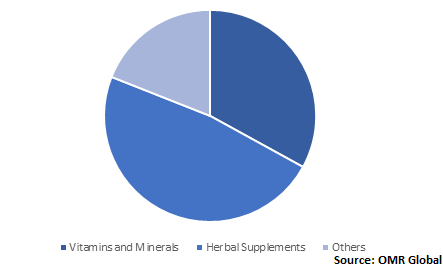

The global liver health supplements market is classified into product, dosage form, and distribution channel. Based on the product, the market is classified into vitamins and minerals, herbal supplements, and others. Based on dosage form, the market is classified into capsule, tablet, powder, liquid, and others. Based on the distribution channel, the market is classified into online and offline. Offline is further sub-segmented into specialty stores, supermarkets and hypermarkets, and others.

Herbal Supplements Find Significant Applications in Liver Health

In 2019, herbal supplements held the largest share in the market owing to its significant adoption for the treatment of liver disorders. Several liver supplements available on the market contain a combination of three herbal ingredients, which include milk thistle, dandelion root, and artichoke leaf. Milk thistle has been utilized for the treatment of liver diseases over the decades. It is the most often used and trusted source for liver complaints in the US. In milk thistle, the present active substance is silymarin, which contains many natural plant chemicals.

Another herbal ingredient, the artichoke leaf extract is used by various manufacturers in their liver health supplements. Animal research reveals that artichoke contains several medicinal qualities, which seems beneficial effect on the liver. These studies suggest that liquid extracts of the leaves and roots of artichoke have shown the capability of liver protection, with the possibility of supporting liver cells to regenerate. This, in turn, is contributing to a significant share of herbal supplements.

Global Liver Health Supplements Market Share by Product, 2019 (%)

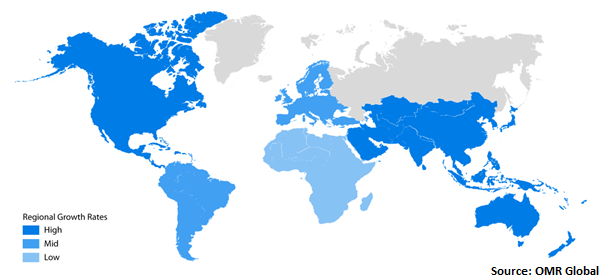

Regional Outlook

Geographically, in 2019, North America is anticipated to hold a considerable share in the market owing to the increasing prevalence of liver disorders in the region. As per the Centers for Disease Control and Prevention (CDC), in 2018, there were 4.5 million adults diagnosed with liver disease in the US, which is 1.8% of the total adult population. This is leading to an emerging demand for liver supplements to optimize liver functioning, promote the production of bile, detoxification of the liver, and promote overall liver health. Significant awareness regarding the health benefits of dietary supplements is primarily driving the adoption of liver supplements in the region.

Global Liver Health Supplements Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Amway Corp., The Himalaya Drug Co., BASF SE, General Nutrition Corp., and Vitaco Health Ltd. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in November 2019, BASF Nutrition & Health declared to launch omega 3 fatty acid solution, Hepacor in Switzerland. It is manufactured with proprietary technology which aims to support patients manage NAFLD. With this launch in Switzerland, BASF is bringing Hepacor to the first market in continental Europe.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liver health supplements market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amway Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The Himalaya Drug Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. BASF SE

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. General Nutrition Corp. (GNC)

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Vitaco Health Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Liver Health Supplements Market by Product

5.1.1. Vitamins and Minerals

5.1.2. Herbal Supplements

5.1.3. Others

5.2. Global Liver Health Supplements Market by Dosage Form

5.2.1. Capsule

5.2.2. Tablet

5.2.3. Powder

5.2.4. Liquid

5.2.5. Others

5.3. Global Liver Health Supplements Market by Distribution Channel

5.3.1. Online

5.3.2. Offline

5.3.2.1. Specialty Stores

5.3.2.2. Supermarkets and Hypermarkets

5.3.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amway Corp.

7.2. Amy Myers MD PA

7.3. BASF SE

7.4. Enzymedica

7.5. EuroPharma, Inc.

7.6. Gaia Herbs, Inc.

7.7. General Nutrition Corp. (GNC)

7.8. Integria Healthcare (Australia) Pty Ltd.

7.9. Irwin Naturals

7.10. Jarrow Formulas, Inc.

7.11. Natures Craft

7.12. Nature's Way Products, LLC

7.13. NOW Health Group, Inc.

7.14. Procter & Gamble Co.

7.15. Swanson Health Products, Inc.

7.16. Swisse Wellness Pty Ltd.

7.17. The Himalaya Drug Co.

7.18. The Nature's Bounty Co.

7.19. Vitaco Health Ltd.

1. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL LIVER HEALTH VITAMINS AND MINERALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL LIVER HEALTH HERBAL SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL OTHER LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2019-2026 ($ MILLION)

6. GLOBAL LIVER HEALTH SUPPLEMENT IN CAPSULE FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL LIVER HEALTH SUPPLEMENT IN TABLET FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL LIVER HEALTH SUPPLEMENT IN POWDER FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL LIVER HEALTH SUPPLEMENT LIQUID FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL LIVER HEALTH SUPPLEMENT IN OTHER DOSAGE FORMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL LIVER HEALTH SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

12. GLOBAL LIVER HEALTH SUPPLEMENT FROM ONLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL LIVER HEALTH SUPPLEMENT FROM OFFLINE DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

17. NORTH AMERICAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2019-2026 ($ MILLION)

18. NORTH AMERICAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

19. EUROPEAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPEAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

21. EUROPEAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2019-2026 ($ MILLION)

22. EUROPEAN LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

27. REST OF THE WORLD LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

28. REST OF THE WORLD LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2019-2026 ($ MILLION)

29. REST OF THE WORLD LIVER HEALTH SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET SHARE BY DOSAGE FORM, 2019 VS 2026 (%)

3. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

4. GLOBAL LIVER HEALTH SUPPLEMENTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD LIVER HEALTH SUPPLEMENTS MARKET SIZE, 2019-2026 ($ MILLION)