Logistics Automation Market

Logistics Automation Market Size, Share, and Trends Analysis Report by Offerings (Automated Systems and Automated Software), by Deployment (Cloud-Based, and On-Premise), by Logistic Type (Inbound Logistics (Production Logistics, and Procurement Logistics), Outbound Logistics, and Reverse Logistics), by Technology (RPA, AI and Analytics, IoT Platform, Big Data, and Blockchain), by Organization Type (SMEs, and Large Enterprises), and by End-User Industry (Manufacturing, Healthcare and Pharmaceuticals, Automotive, Third-Party Logistics, Metal and Machinery, Food and Beverage, E-Commerce and Retail, and Others), Forecast Period (2025-2035)

Industry Overview

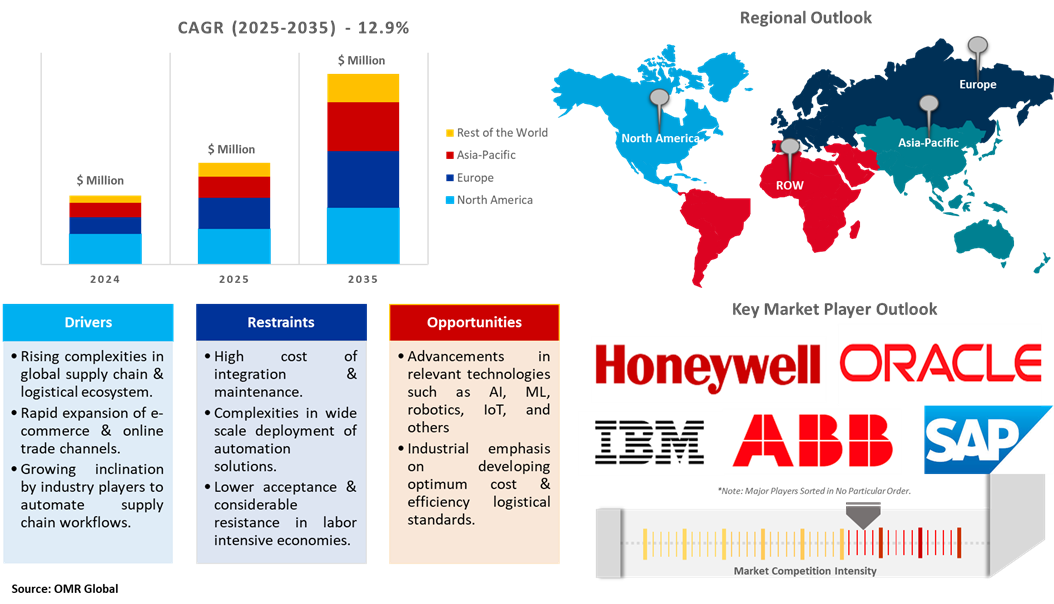

Logistics automation market is anticipated to grow at a CAGR of 12.9% during the forecast period (2025-2035) with total revenue projected to increase from $32.9 billion in 2024 to $124.33 billion in 2035. In recent years, automation has been a key enabler across diverse industries, including logistics, which is majorly owing to rapidly expanding e-commerce and retail quick commerce sectors, increasing global obstacles relating to labor availability and maintenance, and a growing industrial shift towards adopting automation technologies in complex and unsafe logistical activities. Relatively, the overall logistics industry is additionally experiencing several developments, such as the incorporation of autonomous robots and drone-based solutions and investments in advanced and smart manufacturing hubs, showcasing the growing prominence of the deployment and development of logistical infrastructure with automated solutions.

Market Dynamics

Increasing Complexity in Supply Chain

The global supply chain dynamics is experiencing difficulties owing to expanding logistic business across geographies, cross-border regulations, involvement of several stakeholders, transportation issues, and increasing supply chain disruptions. The growing impediments to smooth logistical operation are gradually stimulating companies and logistic providers to integrate automated logistical solutions into the business workflow, to deliver seamless cross-border trade, optimize inventory management, better respond to transportation challenges, mitigate logistical risks, and enhance customer experience. Furthermore, the introduction and expansion of specialized solution providers for logistics are helping in the inclusion of automation technologies to raise productivity and profits and enhance the basis of decision-making. For instance, in July 2024, Rapyuta Robotics Inc. introduced its Automated Storage and Retrieval Systems (ASRS) in the US market. The system has been proven in Japan and features multi-agent coordination, a modular design, and flexible scalability, which improved the productivity of operations for picking and efficient storage of inventories.

Expansion of E-Commerce Industry

In recent years, the e-commerce industry has become a prominent contributor to the growth of the overall logistics market. Its contribution is anticipated to extend in the future owing to the rapid expansion of e-commerce companies across geographies, shifting consumer buying patterns towards online channels, and increasing adoption of omnichannel distribution approaches by market players. The growth trajectory is augmented by the acceptance of different types of automation technologies in e-commerce, which include automated sorting systems, transport management software enabled by artificial intelligence, and robotic solutions for goods management. Additionally, the dominance of quick commerce for providing same-day or 10-minute deliveries and flexibility in the return feature are together facilitating the incorporation of advanced and automated mechanisms to cater to the enormous demands and enhanced productivity. For instance, according to the International Trade Administration, the global B2B e-commerce market is anticipated to reach $36 trillion in 2026, when APAC will be about 80% of the portion. Growth is additionally visible in Latin America and the Middle East. Since 2020, over 90% of B2B companies have transitioned to virtual sales, although South Korean and Japanese consumers still favor traditional commerce. Further, the B2C e-commerce segment will reach $5.5 trillion by 2027, with fashion and consumer electronics as leaders, and BioHealth pharmaceuticals being the growth leader. India will be the biggest contributor to e-commerce growth, with a CAGR of 14.1% from 2023 to 2027.

Market Segmentation

- Based on the offerings, the market is segmented into automated systems (robotic systems, storage solutions, AIDC, conveyors and sorters, and drones) automated software (transport management systems, WMS, order management software, and deployment (cloud-based, and on-premise).

- Based on the logistics type, the market is segmented into inbound logistics (production logistics, and procurement logistics), outbound logistics, and reverse logistics.

- Based on the organization type, the market is segmented into SMEs and large enterprises.

- Based on the technology, the market is segmented into Robotic Process Automation (RPA), Artificial Intelligence (AI) and analytics, Internet of Things (IoT) platform, big data, and blockchain.

- Based on the end-user industry, the market is segmented into manufacturing, healthcare and pharmaceuticals, food and beverage, automotive, third-party logistics provider (3PL), metal and machinery, e-commerce and retail, and others.

The Automation Software Segment is Projected to Hold a Considerable Market Share

The automation software segment dominates the market owing to the development of smarter and autonomous systems, the integration of advanced technologies such as AI, ML, and robotics, and the growing emphasis by market players on digitizing logistical workflow. Further, the software market has been a key enabler, for small organizations in integrating and deploying automation solutions at low cost, resulting in rapid innovations across the automation software space. For instance, EliteX unveiled its transportation ERP software. It is an all-in-one solution that integrates fleet management, telematics, maintenance, inventory, and more.

Outbound Logistics Segment is Projected to Exponentially Gain Market Share

Outbound logistics is projected to lead the market owing to the expanding e-commerce market, increase in innovative offerings by logistical providers, and extension in the geographical footprint of businesses. Further, advancement in outbound delivery techniques such as autonomous drones and the growing popularity of quick commerce is expected to drive segmental growth during the forecast period.

Regional Outlook

The global logistic automation market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America)

North America Holds the Highest Share in the Global Logistics Automation Market

North America is leading the logistics automation market, attributed to various factors, such as growing investment in automation technologies, including robotics and AI-based software, a matured market for utilization of automated technologies in logistical workflow, the presence of major automated software and hardware providers, including IBM, SAP, and others, and developed infrastructure for seamless transformation of logistical automation. Further, the region is additionally recording increased collaboration among market players for a better transition into logistical automation. For instance, in April 2024, MODE Global, a multi-brand 3PL platform, entered into a partnership with Transporeon, a Trimble Company. The collaboration will utilize autonomous procurement by Transporeon to automate the tendering of both spot and dedicated freight. Under the collaboration, Transporeon's Transportation Management Platform will be white-labeled and customized for MODE, creating the MODE Global Marketplace.

Asia-Pacific is the Fastest Growing Region in the Global Logistics Automation Market

Asia-Pacific is the fastest-growing region in the global market for logistics automation, supported by regional shifts towards adopting automation technology in the logistics sector, increasing labor acquisition costs, rapid expansion in the quick commerce industry, and substantial investment and support by state-owned organizations for developing domestic manufacturing industries with automation technologies. Further, the regional countries including Singapore, India, Thailand, and Malaysia account for major logistical hubs in global commerce and trade, necessitating regional players to automate logistical workflow to meet future demand. For instance, OMRON opened the first automation center for logistics in Singapore, serving Southeast Asia and Oceania. The center is OMRON's second in Singapore, sixth in APAC, and thirty-eighth globally. The center will focus on developing solutions for the Robotics Middleware Framework (RMF) to enable multi-robot systems to collaborate with human workers in warehouses, autonomously handling and storing goods.

Market Players Outlook

The major companies operating in the global logistic automation market include ABB Group, IBM Corp., Honeywell International Inc., Oracle Corp., and SAP SE, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain the market positioning.

Recent Developments

- In October 2024, Vanderlande partnered with Hai Robotics to integrate Hai’s Automated Case-Handling Mobile Robot (ACR) systems into its Tote AV portfolio in North America. The collaboration enhances Vanderlande’s ADAPTO Automated Storage and Retrieval System (AS/RS), providing warehouses with advanced, fully automated solutions for case and tote handling, improving storage density and throughput for high-performance fulfillment operations.

- In December 2023, Yusen Logistics (Americas) Inc. collaborated with Pickle Robot Company to deploy Pickle Unload systems at its trans-loading operation in Long Beach, California. The partnership will reduce labor for employees, improve service reliability, and introduce the latest robotic automation to warehouse operations to enhance warehouse efficiency and serve customers better.

- In November 2023, Emtec Digital, a subsidiary of Emtec Inc., introduced OptimateIQ, a cloud-based platform for boosting supply chain and logistics efficiency. The platform provides services such as Automation-as-a-Service, Copilot, and Conversation-as-a-Service to enhance appointment scheduling and carrier onboarding, offering unique, fully managed support to T&L leaders.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global logistic automation market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Logistics Automation Market Sales Analysis – Offerings| Logistic Type | Organization Type| Technology | End-User Industry ($ Million)

• Logistics Automation Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Logistics Automation Industry Trends

2.2.2. Market Recommendations

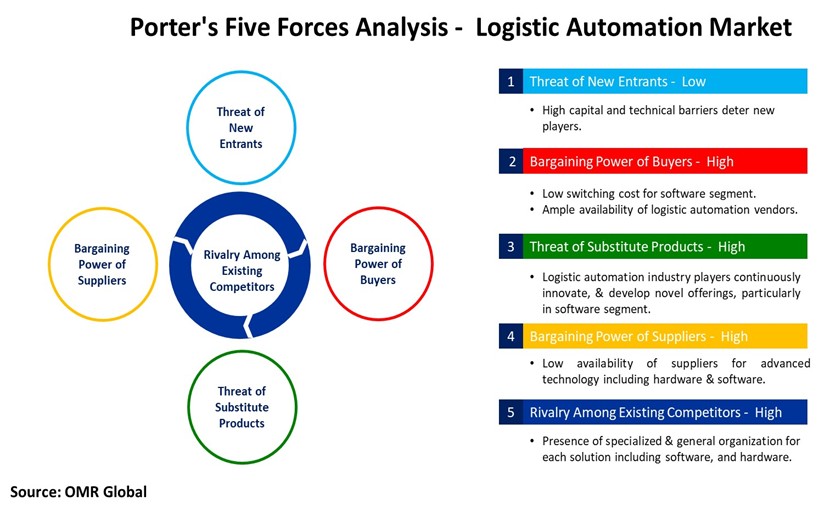

2.3. Porter's Five Forces Analysis for the Logistics Automation Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Logistics Automation Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Logistics Automation Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Logistics Automation Market Revenue and Share by Manufacturers

• Logistics Automation Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. ABB Group

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Honeywell International Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. IBM Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.4. Business StrategyOracle Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. SAP SE

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Logistics Automation Market Sales Analysis by Offering ($ Million)

5.1. Automated Systems

5.1.1. Robotic Systems

5.1.2. Storage Solutions

5.1.3. Automatic Identification & Data Collection (AIDC)

5.1.4. Conveyors & Sorters

5.1.5. Drones

5.2. Automated Software

5.2.1. Transport Management Systems

5.2.2. Warehouse Management Systems (WMS)

5.2.3. Order Management Software

5.2.4. Deployment

5.2.4.1. Cloud-Based

5.2.4.2. On-Premise

6. Global Logistics Automation Market Sales Analysis by Logistics Type ($ Million)

6.1. Inbound Logistics

6.1.1. Production Logistics

6.1.2. Procurement Logistics

6.2. Outbound Logistics

6.3. Reverse Logistics

7. Global Logistics Automation Market Sales Analysis by Organization Type ($ Million)

7.1. Small & Medium Enterprise (SMEs)

7.2. Large Enterprises

8. Global Logistics Automation Market Sales Analysis by Technology ($ Million)

8.1. Robotic Process Automation (RPA)

8.2. Artificial Intelligence (AI) & Analytics

8.3. Internet of Things (IoT) Platform

8.4. Big Data

8.5. Blockchain

9. Global Logistics Automation Market Sales Analysis by End-User Industry ($ Million)

9.1. Manufacturing

9.2. Healthcare & Pharmaceuticals

9.3. Food & Beverage

9.4. Automotive

9.5. Third-Party Logistics (3PL)

9.6. Metal & Machinery

9.7. E-commerce & Retail

9.8. Others

10. Regional Analysis

10.1. North American Logistics Automation Market Sales Analysis – Offerings| Logistic Type | Organization Type| Technology | End-User Industry| Country ($ Million)

• Macroeconomic Factors for North America

10.1.1. United States

10.1.2. Canada

10.2. European Logistics Automation Market Sales Analysis Offerings| Logistic Type | Organization Type| Technology | End-User Industry | Country ($ Million)

• Macroeconomic Factors for North America

10.2.1. UK

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. France

10.2.6. Russia

10.2.7. Rest of Europe

10.3. Asia-Pacific Logistics Automation Market Sales Analysis – Offerings| Logistic Type | Organization Type| Technology | End-User Industry | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

10.3.1. China

10.3.2. Japan

10.3.3. South Korea

10.3.4. India

10.3.5. Australia & New Zealand

10.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

10.3.7. Rest of Asia-Pacific

10.4. Rest of the World Logistics Automation Market Sales Analysis – Offerings| Logistic Type | Organization Type| Technology | End-User Industry | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

10.4.1. Latin America

10.4.2. Middle East and Africa

11. Company Profiles

11.1. ABB Group

11.1.1. Quick Facts

11.1.2. Company Overview

11.1.3. Product Portfolio

11.1.4. Business Strategies

11.2. BEUMER Group

11.2.1. Quick Facts

11.2.2. Company Overview

11.2.3. Product Portfolio

11.2.4. Business Strategies

11.3. Dematic Group

11.3.1. Quick Facts

11.3.2. Company Overview

11.3.3. Product Portfolio

11.3.4. Business Strategies

11.4. Falcon Autotech Pvt Ltd.

11.4.1. Quick Facts

11.4.2. Company Overview

11.4.3. Product Portfolio

11.4.4. Business Strategies

11.5. Honeywell International Inc.

11.5.1. Quick Facts

11.5.2. Company Overview

11.5.3. Product Portfolio

11.5.4. Business Strategies

11.6. IBM Corp.

11.6.1. Quick Facts

11.6.2. Company Overview

11.6.3. Product Portfolio

11.6.4. Business Strategies

11.7. JR Automation (Hitachi)

11.7.1. Quick Facts

11.7.2. Company Overview

11.7.3. Product Portfolio

11.7.4. Business Strategies

11.8. Jungheinrich AG

11.8.1. Quick Facts

11.8.2. Company Overview

11.8.3. Product Portfolio

11.8.4. Business Strategies

11.9. Kardex Holding AG

11.9.1. Quick Facts

11.9.2. Company Overview

11.9.3. Product Portfolio

11.9.4. Business Strategies

11.10. KNAPP AG

11.10.1. Quick Facts

11.10.2. Company Overview

11.10.3. Product Portfolio

11.10.4. Business Strategies

11.11. Körber AG

11.11.1. Quick Facts

11.11.2. Company Overview

11.11.3. Product Portfolio

11.11.4. Business Strategies

11.12. KUKA AG

11.12.1. Quick Facts

11.12.2. Company Overview

11.12.3. Product Portfolio

11.12.4. Business Strategies

11.13. Manhattan Associates, Inc.

11.13.1. Quick Facts

11.13.2. Company Overview

11.13.3. Product Portfolio

11.13.4. Business Strategies

11.14. Murata Machinery, Ltd.

11.14.1. Quick Facts

11.14.2. Company Overview

11.14.3. Product Portfolio

11.14.4. Business Strategies

11.15. Mecalux, S.A.

11.15.1. Quick Facts

11.15.2. Company Overview

11.15.3. Product Portfolio

11.15.4. Business Strategies

11.16. Omron Corp

11.16.1. Quick Facts

11.16.2. Company Overview

11.16.3. Product Portfolio

11.16.4. Business Strategies

11.17. Oracle Corp

11.17.1. Quick Facts

11.17.2. Company Overview

11.17.3. Product Portfolio

11.17.4. Business Strategies

11.18. Samsung SDS Co., Ltd.

11.18.1. Quick Facts

11.18.2. Company Overview

11.18.3. Product Portfolio

11.18.4. Business Strategies

11.19. SAP SE

11.19.1. Quick Facts

11.19.2. Company Overview

11.19.3. Product Portfolio

11.19.4. Business Strategies

11.20. SEER Robotics Europe GmbH

11.20.1. Quick Facts

11.20.2. Company Overview

11.20.3. Product Portfolio

11.20.4. Business Strategies

11.21. SSI SCHÄFER GmbH & Co KG

11.21.1. Quick Facts

11.21.2. Company Overview

11.21.3. Product Portfolio

11.21.4. Business Strategies

11.22. Toshiba Infrastructure Systems & Solutions Corp.

11.22.1. Quick Facts

11.22.2. Company Overview

11.22.3. Product Portfolio

11.22.4. Business Strategies

11.23. Toyota Material Handling International AB

11.23.1. Quick Facts

11.23.2. Company Overview

11.23.3. Product Portfolio

11.23.4. Business Strategies

11.24. Zebra Technologies Corp.

11.24.1. Quick Facts

11.24.2. Company Overview

11.24.3. Product Portfolio

11.24.4. Business Strategies

1. Global Logistics Automation Market Research And Analysis By Offering, 2024-2035 ($ Million)

2. Global Automated Logistics Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Robotic Systems Market Research And Analysis By Region, 2024 Vs 2035 (%)

4. Global Storage Solutions Market Research And Analysis By Region, 2024 Vs 2035 (%)

5. Global Automatic Identification & Data Collection (AIDC) Market Research And Analysis By Region, 2024 Vs 2035 (%)

6. Global Conveyors & Sorters Market Research And Analysis By Region, 2024 Vs 2035 (%)

7. Global Drones Market Research And Analysis By Region, 2024 Vs 2035 (%)

8. Global Automated Logistics Software Market Research And Analysis By Region, 2024 Vs 2035 (%)

9. Global Transport Management Systems Market Research And Analysis By Region, 2024 Vs 2035 (%)

10. Global Warehouse Management Systems (WMS) Market Research And Analysis By Region, 2024 Vs 2035 (%)

11. Global Order Management Software Market Research And Analysis By Region, 2024 Vs 2035 (%)

12. Global Logistics Automation Software Market Research And Analysis By Deployment, 2024 Vs 2035 (%)

13. Global Cloud-Based Logistic Automation Software Market Research And Analysis By Region, 2024 Vs 2035 (%)

14. Global On-Premise Logistic Automation Software Market Research And Analysis By Region, 2024 Vs 2035 (%)

15. Global Logistics Automation Market Research And Analysis By Logistics Type, 2024-2035 ($ Million)

16. Global Inbound Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Production Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Procurement Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Outbound Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Reverse Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Logistics Automation Market Research And Analysis By Organization Type, 2024-2035 ($ Million)

22. Global Logistics Automation For Small & Medium Enterprise (SMEs) Market Research And Analysis By Region, 2024-2035 ($ Million)

23. Global Logistics Automation For Large Enterprises Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Global Logistics Automation Market Research And Analysis By Technology, 2024-2035 ($ Million)

25. Global Robotic Process Automation (RPA) In Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

26. Global Artificial Intelligence (AI) & Analytics In Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

27. Global Internet of Things (IoT) Platform In Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

28. Global Big Data In Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

29. Global Blockchain In Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

30. Global Logistics Automation Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

31. Global Logistics Automation For Manufacturing Market Research And Analysis By Region, 2024-2035 ($ Million)

32. Global Logistics Automation For Healthcare & Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

33. Global Logistics Automation For Food & Beverage Market Research And Analysis By Region, 2024-2035 ($ Million)

34. Global Logistics Automation For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

35. Global Logistics Automation For Third Party Logistics (3PL) Market Research And Analysis By Region, 2024-2035 ($ Million)

36. Global Logistics Automation For Metal & Machinery Market Research And Analysis By Region, 2024-2035 ($ Million)

37. Global Logistics Automation For E-commerce & Retail Market Research And Analysis By Region, 2024-2035 ($ Million)

38. Global Logistics Automation For Other End-User Industry Market Research And Analysis By Region, 2024-2035 ($ Million)

39. Global Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

40. North American Logistics Automation Market Research And Analysis By Country, 2024-2035 ($ Million)

41. North American Logistics Automation Market Research And Analysis By Offering, 2024-2035 ($ Million)

42. North American Logistics Automation Market Research And Analysis By Logistics Type, 2024-2035 ($ Million)

43. North American Logistics Automation Market Research And Analysis By Organization Type, 2024-2035 ($ Million)

44. North American Logistics Automation Market Research And Analysis By Technology, 2024-2035 ($ Million)

45. North American Logistics Automation Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

46. European Logistics Automation Market Research And Analysis By Country, 2024-2035 ($ Million)

47. European Logistics Automation Market Research And Analysis By Offering, 2024-2035 ($ Million)

48. European Logistics Automation Market Research And Analysis By Logistics Type, 2024-2035 ($ Million)

49. European Logistics Automation Market Research And Analysis By Organization Type, 2024-2035 ($ Million)

50. European Logistics Automation Market Research And Analysis By Technology, 2024-2035 ($ Million)

51. European Logistics Automation Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

52. Asia-Pacific Logistics Automation Market Research And Analysis By Country, 2024-2035 ($ Million)

53. Asia-Pacific Logistics Automation Market Research And Analysis By Offering, 2024-2035 ($ Million)

54. Asia-Pacific Logistics Automation Market Research And Analysis By Logistics Type, 2024-2035 ($ Million)

55. Asia-Pacific Logistics Automation Market Research And Analysis By Organization Type, 2024-2035 ($ Million)

56. Asia-Pacific Logistics Automation Market Research And Analysis By Technology, 2024-2035 ($ Million)

57. Asia-Pacific Logistics Automation Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

58. Rest Of The World Logistics Automation Market Research And Analysis By Region, 2024-2035 ($ Million)

59. Rest Of The World Logistics Automation Market Research And Analysis By Offering, 2024-2035 ($ Million)

60. Rest Of The World Logistics Automation Market Research And Analysis By Logistics Type, 2024-2035 ($ Million)

61. Rest Of The World Logistics Automation Market Research And Analysis By Organization Type, 2024-2035 ($ Million)

62. Rest Of The World Logistics Automation Market Research And Analysis By Technology, 2024-2035 ($ Million)

63. Rest Of The World Logistics Automation Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

1. Global Logistics Automation Market Share By Offering, 2024 Vs 2035 (%)

2. Global Automated Logistics Systems Market Share By Region, 2024 Vs 2035 (%)

3. Global Robotic Systems Market Share By Region, 2024 Vs 2035 (%)

4. Global Storage Solutions Market Share By Region, 2024 Vs 2035 (%)

5. Global Automatic Identification & Data Collection (AIDC) Market Share By Region, 2024 Vs 2035 (%)

6. Global Conveyors & Sorters Market Share By Region, 2024 Vs 2035 (%)

7. Global Drones Market Share By Region, 2024 Vs 2035 (%)

8. Global Automated Logistics Software Market Share By Region, 2024 Vs 2035 (%)

9. Global Transport Management Systems Market Share By Region, 2024 Vs 2035 (%)

10. Global Warehouse Management Systems (WMS) Market Share By Region, 2024 Vs 2035 (%)

11. Global Order Management Software Market Share By Region, 2024 Vs 2035 (%)

12. Global Logistics Automation Market Share By Deployment, 2024 Vs 2035 (%)

13. Global Cloud-Based Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

14. Global On-Premise Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

15. Global Logistics Automation Market Share By Logistics Type, 2024 Vs 2035 (%)

16. Global Inbound Logistics Market Share By Region, 2024 Vs 2035 (%)

17. Global Production Logistics Market Share By Region, 2024 Vs 2035 (%)

18. Global Procurement Logistics Market Share By Region, 2024 Vs 2035 (%)

19. Global Outbound Logistics Market Share By Region, 2024 Vs 2035 (%)

20. Global Reverse Logistics Market Share By Region, 2024 Vs 2035 (%)

21. Global Logistics Automation Market Share By Organization Type, 2024 Vs 2035 (%)

22. Global Logistics Automation For Small & Medium Enterprise (SMEs) Market Share By Region, 2024 Vs 2035 (%)

23. Global Logistics Automation For Large Enterprise Market Share By Region, 2024 Vs 2035 (%)

24. Global Logistics Automation Market Share By Technology, 2024 Vs 2035 (%)

25. Global Robotic Process Automation (RPA) In Logistic Automation Market Share By Region, 2024 Vs 2035 (%)

26. Global Artificial Intelligence (AI) & Analytics in Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

27. Global Internet of Things (IoT) Platform in Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

28. Global Big Data in Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

29. Global Blockchain in Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

30. Global Logistics Automation Market Share By End-User Industry, 2024 Vs 2035 (%)

31. Global Logistics Automation For Manufacturing Market Share By Region, 2024 Vs 2035 (%)

32. Global Logistics Automation For Healthcare & Pharmaceuticals Market Share By Region, 2024 Vs 2035 (%)

33. Global Logistics Automation For Food & Beverage Market Share By Region, 2024 Vs 2035 (%)

34. Global Logistics Automation For Automotive Market Share By Region, 2024 Vs 2035 (%)

35. Global Logistics Automation For Third Party Logistics (3PL) Market Share By Region, 2024 Vs 2035 (%)

36. Global Logistics Automation For Metal & Machinery Market Share By Region, 2024 Vs 2035 (%)

37. Global Logistics Automation For E-commerce & Retail Market Share By Region, 2024 Vs 2035 (%)

38. Global Logistics Automation For Other End-User Industry Market Share By Region, 2024 Vs 2035 (%)

39. Global Logistics Automation Market Share By Region, 2024 Vs 2035 (%)

40. US Logistics Automation Market Size, 2024-2035 ($ Million)

41. Canada Logistics Automation Market Size, 2024-2035 ($ Million)

42. UK Logistics Automation Market Size, 2024-2035 ($ Million)

43. France Logistics Automation Market Size, 2024-2035 ($ Million)

44. Germany Logistics Automation Market Size, 2024-2035 ($ Million)

45. Italy Logistics Automation Market Size, 2024-2035 ($ Million)

46. Spain Logistics Automation Market Size, 2024-2035 ($ Million)

47. Russia Logistics Automation Market Size, 2024-2035 ($ Million)

48. Rest Of Europe Logistics Automation Market Size, 2024-2035 ($ Million)

49. India Logistics Automation Market Size, 2024-2035 ($ Million)

50. China Logistics Automation Market Size, 2024-2035 ($ Million)

51. Japan Logistics Automation Market Size, 2024-2035 ($ Million)

52. South Korea Logistics Automation Market Size, 2024-2035 ($ Million)

53. Australia & New Zealand Logistics Automation Market Size, 2024-2035 ($ Million)

54. ASEAN Countries Logistics Automation Market Size, 2024-2035 ($ Million)

55. Rest Of Asia-Pacific Logistics Automation Market Size, 2024-2035 ($ Million)

56. Latin America Logistics Automation Market Size, 2024-2035 ($ Million)

57. Middle East And Africa Logistics Automation Market Size, 2024-2035 ($ Million)