Logistics Warehousing Service Market

Logistics Warehousing Service Market Size, Share & Trends Analysis Report by Type (General Warehousing and Storage, Refrigerated Warehousing and Storage, Farm Product Warehousing and Storage), by Ownership (Private Warehouses, Public Warehouses, and Bonded Warehouses), and by End-User Industry (Manufacturing, Consumer Goods, Food and Beverage, Construction, Healthcare and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Logistics warehousing service market is anticipated to grow at a CAGR of 8.2% during the forecast period. The logistics warehousing service market has witnessed significant growth due to the result of heightened global trade, the rise of the e-commerce sector, increased demand for processed and frozen food items, the expansion of the industrial sector, and the demand for manufactured goods. The logistics and warehousing sector has seen a significant transformation, mainly driven by the post-pandemic surge in online purchases, and a shift in consumer buying behavior. According to World Trade Organization (WTO), global exports of digitally delivered services reached $3.82 trillion in 2022 representing a 54% share of total global services exports and the value of worldwide goods trade increased by 12% to $25.3 trillion.

Segmental Outlook

The global logistics warehousing service market is segmented based on the type, ownership, and end-user industry. Based on the type, the market is sub-segmented into general warehousing and storage, refrigerated warehousing and storage, and farm product warehousing and storage. Based on ownership, the market is sub-segmented into private warehouses, public warehouses, and bonded warehouses. Based on the end-user industry, the market is sub-segmented into manufacturing, consumer goods, food and beverage, construction, healthcare, and others. Among the end-user industry, the food and beverage sub-segment is anticipated to hold a considerable share of the market. In recent years, the food logistics system has expanded rapidly, and consumers increasingly want exotic delights on their plates year-round, fresh year-round.

Refrigerated Warehousing and Storage Sub-Segment Is Anticipated To Hold a Prominent Share in the Global Logistics warehousing service Market

Among the types, the refrigerated warehousing and storage sub-segment is anticipated to hold a prominent share of the market. The demand for cold storage facilities has increased over the past few years due to the expansion of the global pharma and meat industry. Seafood, meat, and other perishable foods must be stored under specific conditions to preserve their freshness and safety. At the retail level, meat, fish, and seafood are typically kept in temperature-controlled spaces such as cold stores or chilled cabinets. The majority of these cold storage rooms or refrigerated warehouses are built with qualities that allow the item to be kept in optimal conditions. Tempering, blast freezing, and modified environment storage services are provided by establishments in the refrigerated warehousing and storage business.

Refrigerated warehousing and storage has witnessed positive market expansion, primarily in the pharmaceutical and food & beverage sectors. To ensure the effectiveness of medicines, the Care Quality Commission recommends that insulins, antibiotic liquids, injections, eye drops, and certain creams be refrigerated between 2ºC and 8ºC. According to the US Census Bureau, 117.45 million Americans used eye drops and eyewash in 2021. In 2023, this figure is expected to rise to 118.49 million. The rising need for liquid medicinal goods, particularly in the aftermath of the pandemic, is likely to boost market growth.

Regional Outlook

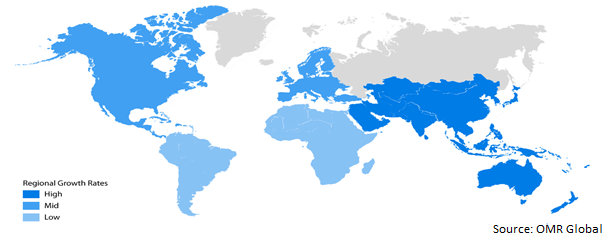

The global logistics warehousing service market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific regional market is expected to grow considerably over the forecast period. Asia-Pacific is a large consumer of perishable foods, which increases the need for refrigerated warehousing methods. Additionally, several projects undertaken by governments in the area in aspects of technological advances, infrastructural facilities, and taxation regulations to improve warehousing resources.

Global Logistics Warehousing Service Market Growth, by Region 2023-2030

North America is Expected to Hold a Prominent Share in the Global Logistics Warehousing Service

North America is dominating the logistics warehousing service market, due to government steps to build cutting-edge warehouses with sophisticated features like Web Map Service (WMS) functionality for expiration date monitoring, barcode scanning, order fulfillment, and enhanced inventory management. The presence of retail and e-commerce giants like Amazon and Walmart considerably contributes to the region's need for warehouse and storage services. With strong expansion in the manufacturing, retail, and pharmaceutical units, the market in the US offers potential growth. According to the US Department of Commerce, the revenue of the warehousing and storage industry in the US increased to $50.49 million in 2021. These patterns are only expected to rise further as vendors continue to focus on expanding their facilities.

Market Players Outlook

The major companies serving the global logistics warehousing service market include FedEx Corp, DHL International GmbH, Ryder System, Inc., Lineage Logistics Holding LLC, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2022, Vertical Cold Storage, a developer and operator of temperature-controlled distribution centers sponsored by Platform Ventures, acquired three public refrigerated warehouses in Florida, Nebraska, and North Carolina from US Cold Storage. The company made these acquisitions to support its expanding protein business, including poultry, meat, poultry, and seafood.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global logistics warehousing service market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Logistics Warehousing Service Market by Type

4.1.1. General Warehousing and Storage

4.1.2. Refrigerated Warehousing and Storage

4.1.3. Farm Product Warehousing and Storage

4.2. Global Logistics Warehousing Service Market by Ownership

4.2.1. Private Warehouses

4.2.2. Public Warehouses

4.2.3. Bonded Warehouses

4.3. Global Logistics Warehousing Service Market by End-User Industry

4.3.1. Manufacturing

4.3.2. Consumer Goods

4.3.3. Food and Beverage

4.3.4. Construction

4.3.5. Healthcare

4.3.6. Other (Chemicals and Electronics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. DHL International GmbH

6.2. AmeriCold Logistics LLC

6.3. FedEx Corp

6.4. Lineage Logistics Holding LLC

6.5. APM Terminals BV

6.6. DSV Panalpina AS

6.7. Kane Is Able Inc.

6.8. MSC - Mediterranean Shipping Agency AG

6.9. C.H. Robinson Worldwide, Inc.

6.10. Schneider National, Inc.

6.11. A.P. Moller – Maersk

6.12. DSV A/S

6.13. Mitsubishi Logistics America Corp.

6.14. Moduslink Corp.

6.15. Kuehne + Nagel International AG

6.16. Rakuten Super Logistics

6.17. XPO Logistics, Inc.

6.18. NFI Industries, Inc.

6.19. Ryder System, Inc.

6.20. UPS Supply Chain Solutions (SCS)

1. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL GENERAL WAREHOUSING AND STORAGE LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL REFRIGERATED WAREHOUSING AND STORAGE LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL FARM PRODUCT WAREHOUSING AND STORAGE LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2022-2030 ($ MILLION)

6. GLOBAL PRIVATE LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL PUBLIC LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BONDED LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

10. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2022-2030 ($ MILLION)

20. NORTH AMERICAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

21. EUROPEAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. EUROPEAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

23. EUROPEAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2022-2030 ($ MILLION)

24. EUROPEAN LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

29. REST OF THE WORLD LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. REST OF THE WORLD LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2022-2030 ($ MILLION)

32. REST OF THE WORLD LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022 VS 2030 (%)

2. GLOBAL GENERAL WAREHOUSING AND STORAGE LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

3. GLOBAL REFRIGERATED WAREHOUSING LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

4. GLOBAL FARM PRODUCT WAREHOUSING AND STORAGE LOGISTICS SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

5. GLOBAL PRIVATE LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2022 VS 2030 (%)

6. GLOBAL PUBLIC LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

7. GLOBAL BONDED LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

8. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022 VS 2030 (%)

9. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

10. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

11. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

12. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

13. GLOBAL LOGISTICS WAREHOUSING SERVICE FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

14. GLOBAL LOGISTICS WAREHOUSING SERVICE IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

15. GLOBAL LOGISTICS WAREHOUSING SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

16. US LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

17. CANADA LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

18. UK LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

21. ITALY LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

22. SPAIN LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF EUROPE LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

24. INDIA LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

25. CHINA LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

26. JAPAN LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

27. SOUTH KOREA LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF ASIA-PACIFIC LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

29. LATIN AMERICA LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)

30. MIDDLE EAST AND AFRICA LOGISTICS WAREHOUSING SERVICE MARKET SIZE, 2022-2030 ($ MILLION)