Low Noise Amplifier Market

Low Noise Amplifier Market Size, Share & Trends Analysis Report by Material Type (Silicon, Silicon Germanium, and Others), by Frequency (Up to 6 GHz, 6 GHz to 60 GHz, and More Than 60 GHz), and by Industry Vertical (Consumer Electronics, Telecom & Broadcasting, Automotive, Military & Defense, Medical and Other) Forecast Period (2024-2031)

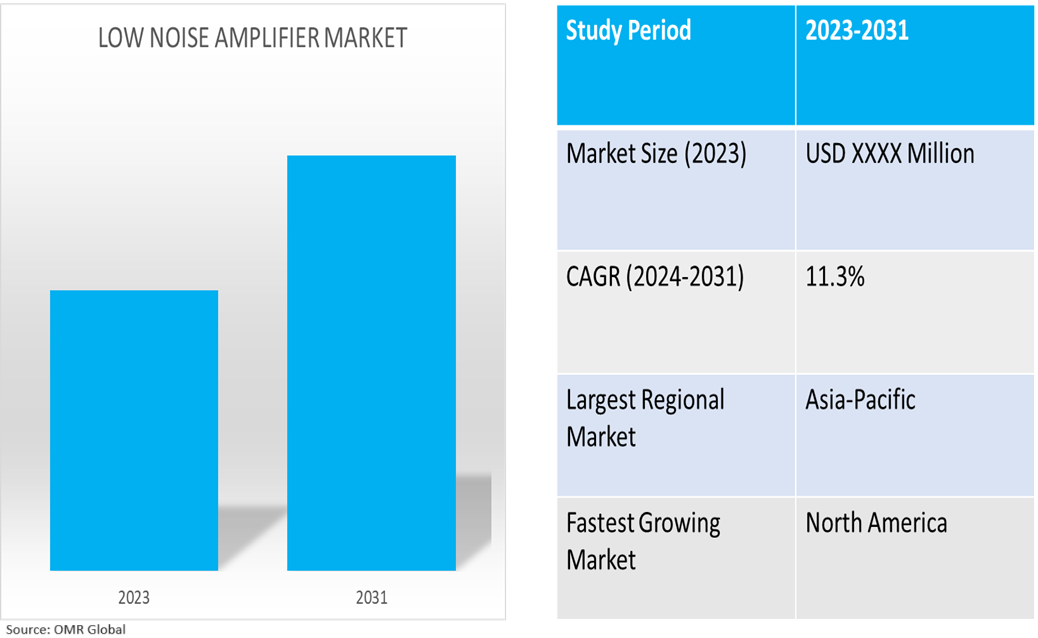

Low noise amplifier market is anticipated to grow at a CAGR of 11.3% during the forecast period (2024-2031). The low noise amplifier (LNA) market is driven by increasing demand for wireless connectivity, technological advancements, 5G network expansion, IoT expansion, consumer electronics, satellite communications, and the automotive industry. LNAs are essential components in wireless devices, satellite communication systems, and automotive radar systems, enhancing signal reception and minimizing noise. The market is influenced by technological advancements, 5G network deployment, IoT expansion, consumer electronics, satellite communications, and automotive industry integration.

Market Dynamics

Automotive Industry Growth

A low noise amplifier in automotive applications amplifies weak signals from sensors or communication systems while minimizing added noise for improved performance and reliability. The automotive industry is experiencing growth due to the integration of advanced driver-assistance systems (ADAS) and the development of vehicle-to-everything (V2X) communication systems creating demand for low noise amplifiers. According to the ACEA (Association des Constructeurs Européens d’Automobiles), in 2023, in terms of global car production, the EU secured its position as the second-largest producer with a total of 12.1 million units, reflecting a growth rate of over 11%. China, on the other hand, witnessed a 9% increase in production, manufacturing over 25.3 million cars, which now represents more than a third of the global car manufacturing market. The US observed a growth of 8.5%, producing over 7.6 million cars, while Japan experienced a significant increase of 17.4%, building over 7.7 million cars.

Advancements in Telecommunications

Advancements in telecommunications, including 5G deployment and improved signal reception, necessitate high-performance LNAs to enhance signal quality and reduce noise in high-frequency bands. For instance, in June 2024, Teledyne e2v HiRel introduced the TDLNA0840SEP, a space-enhanced plastic UHF to S-band low noise amplifier, ideal for high-reliability applications. The amplifier, developed on a 150 nm process, offers ultra-low power consumption, low noise figure, and a small package footprint. It consumes 27 mW of power, delivers 29 dB gain, and is internally self-biased, requiring no external bias resistor.

Market Segmentation

- Based on material type, the market is segmented into silicon, silicon germanium, and others (gallium arsenide).

- Based on frequency, the market is segmented into up to 6 GHz, 6 GHz to 60 GHz, and More Than 60 GHz.

- Based on the industry vertical, the market is segmented into consumer electronics, telecom & broadcasting, automotive, military & defense, medical, and others.

Consumer Electronics Sub-segment to Hold a Considerable Market Share

The increasing number of IoT devices requires the use of low-power LNAs for efficient communication across various applications, ensuring battery life and high performance. Wi-Fi devices use low noise amplifiers to enhance the reception of weak signals by amplifying them with minimal additional noise, thereby improving signal quality and overall performance. According to wi-fi.org, in May 2023, the global shipment of Wi-Fi devices is predicted to reach 3.8 billion in 2023, contributing to a cumulative total of 42 billion Wi-Fi shipments over the technology's lifespan. This year, there will be approximately 19.5 billion Wi-Fi devices in use, including smartphones, laptops, security cameras, and smart plugs. The report also highlights the increasing support for the latest Wi-Fi generations, which enables users, service providers, and network administrators to meet the demands of complex use cases. Additionally, with the release of a 6 GHz unlicensed spectrum for Wi-Fi, the 6 GHz band offers high gigabit speeds, low latency, and increased capacity, supporting emerging applications and driving innovation in service provider networks. IDC predicts that Wi-Fi 6E devices will continue to gain momentum, with an expected shipment of 473 million devices in 2023.

More Than 60 GHz Sub-Segment To Grow Considerably

The rise in the use of long-term evolution (LTE) technology and the increase in penetration of smartphone devices across the globe are contributing to market growth. The growing demand for wide-band intensive applications is further expected to drive the market of low-noise amplifiers across the globe. Along with this, the low noise amplifiers having more than 60 GHz frequency are anticipated to grow with the considerable growth rate in the market. Due to the increasing scarcity of other microwave bands, the E band has gained a lot of popularity in recent times. The increase in demand for E bands will drive the market for low-noise amplifiers in the near future.

Regional Outlook

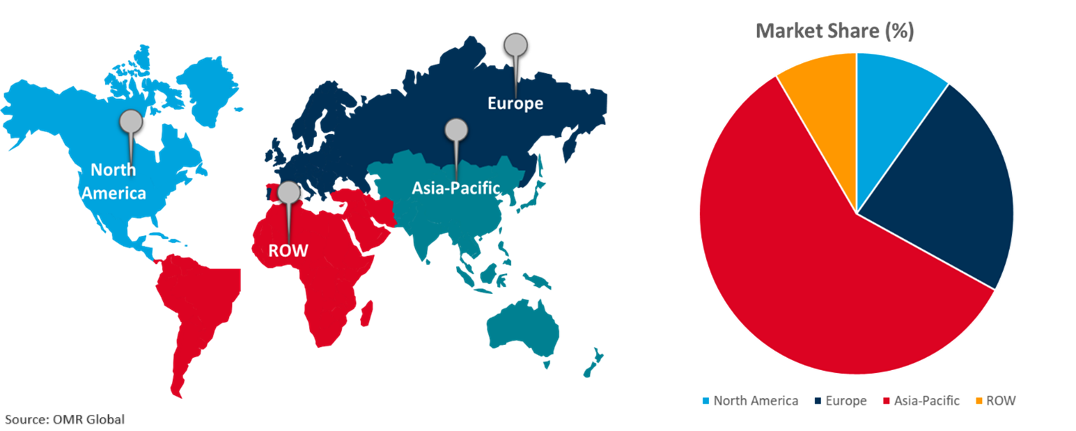

The low noise amplifier market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Mobile Penetration and Subscriber Growth In North America Region

North America's mobile penetration and subscriber growth are expected to increase, with the US and Canada leading in widespread adoption and usage of mobile services. According to the GSMA Association, in 2023, in North America, the number of unique mobile customers has been consistently rising and is expected to reach 377 million by 2030. The US is expected to be responsible for more across the same year, more than 85% of all mobile subscribers in the area. By 2030, which is significantly more than the 73% global average. The US and Canada had the highest penetration rates, at 93% for each country.

Global Low Noise Amplifier Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

The implementation of 5G is most advanced in the Asia-Pacific, where LNAs are essential for enhanced signal quality and fast data transfer. LNAs improve network performance by optimizing noise reduction and signal reception. According to the GSM Association, in 2023, the mobile ecosystem in the Asia-Pacific, which has 1.73 billion members, is a major force behind digital innovation and is expected to generate $810 billion in additional economic value by 2022. Fintech, circularity, generative AI, 5G monetization, and consolidation are important developments.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the low noise amplifier market include Analog Devices, Inc., Scientific Components Corporation (Mini-Circuits), Qorvo, Inc., Infineon Technologies AG, and Skyworks Solutions, Inc., among others. Market expansion and applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2023, Pasternack launched a new series of AC-powered low-noise amplifiers, covering a wide frequency range from 10 MHz to 50 GHz. These amplifiers use GaAs semiconductor technology for optimal performance and efficiency, covering popular market brands. Operating at 110 VACS to 220 VACS, they are RoHS and REACH compliant, suitable for both laboratory and outdoor applications.

The Report Covers-

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global low noise amplifier market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Analog Devices, Inc.

1.1.1. Overview

1.1.2. Financial Analysis

1.1.3. SWOT Analysis

1.1.4. Recent Developments

3.3. Qorvo, Inc.

1.1.5. Overview

1.1.6. Financial Analysis

1.1.7. SWOT Analysis

1.1.8. Recent Developments

3.4. Scientific Components Corporation (Mini-Circuits)

1.1.9. Overview

1.1.10. Financial Analysis

1.1.11. SWOT Analysis

1.1.12. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Low Noise Amplifier Market by Material Type

4.1.1. Silicon

4.1.2. Silicon Germanium

4.1.3. Others (Gallium Arsenide)

4.2. Global Low Noise Amplifier Market by Frequency

4.2.1. Up to 6 GHz

4.2.2. 6 GHz to 60 GHz

4.2.3. More Than 60 GHz

4.3. Global Low Noise Amplifier Market by Industry Vertical

4.3.1. Consumer Electronics

4.3.2. Telecom & Broadcasting

4.3.3. Automotive

4.3.4. Military & Defense

4.3.5. Medical

4.3.6. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. BeRex Corp.

6.2. DBwave Technologies LLC

6.3. Diodes Inc.

6.4. Eravant

6.5. Guerrilla RF

6.6. Infineon Technologies AG

6.7. L3Harris Technologies, Inc.

6.8. MACOM Technology Solutions Inc.

6.9. Microchip Technology Inc.

6.10. NuWaves RF Solutions.

6.11. NXP Semiconductors N.V.

6.12. Panasonic Corp.

6.13. Skyworks Solutions, Inc.

6.14. Teledyne Technologies Inc.

6.15. Texas Instruments Inc.