Low Speed Vehicle Market

Low Speed Vehicle Market Size, Share, and Trends Analysis Report by Vehicle Type (Commercial Turf and Industrial Utility Vehicle, Golf Cart, Personal Utility Vehicle, and Public Transport), Propulsion (Diesel, Electric, and Gasoline), and Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Low-speed vehicle market is anticipated to grow at a considerable CAGR of 5.3% during the forecast period. The versatility of low-speed vehicles is a crucial feature for sustaining the market. Meter maids, hunting, yard maintenance, industrial utilities, grounds-keeping, and campus security are all common uses for them. They are also utilized in corporate offices, museums, and other public areas. These vehicles are light and can carry up to six passengers. Another factor that is increasing the demand for these vehicles is the growth of golf courses across the globe.

Segmental Outlook

The global low-speed vehicle market is segmented by vehicle type and propulsion. Based on vehicle type, the market is sub-segmented into commercial turf and industrial utility vehicle, golf cart, personal utility vehicle, and public transport. Based on propulsion, the market is sub-segmented into diesel, electric, and gasoline. Among vehicle types, the commercial turf and industrial utility vehicle segment is expected to hold a significant share of the market owing to the growth of manufacturing and warehouse facilities as well as commercial turfs.

The Electric Sub-Segment Holds a Prominent Share in the Global Low Speed Vehicle Market

Based on propulsion, the market is sub-segmented into diesel, electric, and gasoline. Among these, the electric segment holds a significant share of the market. The adoption of rigorous rules and regulations on vehicle emissions by governments is the primary market driver for electric low-speed vehicles globally. Electric low-speed vehicles employ an electric motor that is powered by a steady supply of energy; as a consequence, EVs emit no pollution. Germany, the US, France, and China, among others, have implemented stringent rules and regulations limiting vehicle emissions, requiring automakers to use cutting-edge technologies to lower excessive levels of pollutants in vehicles. For instance, the CARB (California Air Resources Board) program specifies rules for zero-emission vehicle manufacturers and suppliers (ZEVs).

Regional Outlook

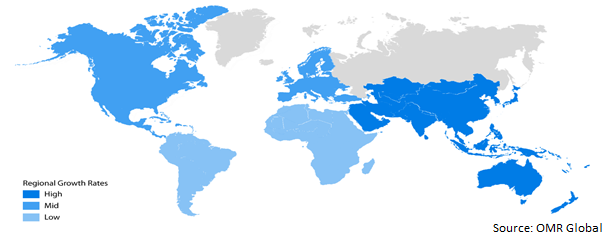

The global low speed vehicle market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the North American region is expected to generate the highest market share. However, the Asia-Pacific markets are also expected to hold a significant market share in the forecast period owing to low speed vehicle manufacturing activities in the region.

Global Low Speed Vehicle Market Growth, by Region (2023-2030)

The North American Region is Expected to Dominate the Global Low Speed Vehicle Market

With a stronger demand for low-speed cars on golf courses and for personal mobility, the North American region has the world's largest market for these vehicles. Additionally, increased demand for these vehicles from other application sectors such as hotels and resorts, airports, and industrial facilities is anticipated to boost market expansion even further. Meanwhile, continual product improvements by prominent regional low speed vehicle manufacturers such as The Toro Company (US), Textron (US), Deere & Company (US), and Club Car (US) are boosting the region's market growth.

Market Players Outlook

The major companies serving the global low-speed vehicle market include HDK Co., Ltd., Intimidator Inc., Kubota Corporation, Moto Electric Vehicles, Taylor-Dunn Manufacturing Company, and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new vehicle launches to stay competitive in the market. For instance, in September 2022, GT Force, an electric two-wheeler company, unveiled two new models in the low-speed category with a top speed of 25 km/h- the GT Soul Vegas and GT Drive Pro. Both scooters have a range of 50–60 km on lead-acid batteries and 60–65 km on lithium-ion batteries per charge.

The Report Covers-

- Market value data analysis for 2023 and forecast to 2030.Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global low speed vehicle market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Low Speed Vehicle Market by Vehicle Type

4.1.1. Commercial Turf and Industrial Utility Vehicle

4.1.2. Golf Cart

4.1.3. Personal Utility Vehicle

4.1.4. Public Transport

4.2. Global Low Speed Vehicle Market by Propulsion

4.2.1. Diesel

4.2.2. Electric

4.2.3. Gasoline

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1 American Landmaster

6.2 Bintelli Electric Vehicle

6.3 Club Car LLC

6.4 Cruise Car, Inc.

6.5 Deere & Company

6.6 HDK Co., Ltd.

6.7 Intimidator Inc.

6.8 Kubota Corporation

6.9 Moto Electric Vehicles

6.10 Polaris Industries Inc.

6.11 Taylor-Dunn Manufacturing Company

6.12 Textron

6.13 The Toro Company

6.14 Tomberlin Automotive Grp.

6.15 Yamaha Golf-Car Company

1. GLOBAL LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

2. GLOBAL LOW SPEED COMMERCIAL TURF AND INDUSTRIAL UTILITY VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL LOW SPEED GOLF CART MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL LOW SPEED PERSONAL UTILITY VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL LOW SPEED PUBLIC TRANSPORT VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2022-2030 ($ MILLION)

7. GLOBAL LOW SPEED DIESEL VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL LOW SPEED ELECTRIC VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL LOW SPEED GASOLINE VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

13. NORTH AMERICAN LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2022-2030 ($ MILLION)

14. EUROPEAN LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

16. EUROPEAN LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2022-2030 ($ MILLION)

20. REST OF THE WORLD LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD LOW SPEED VEHICLE MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2022-2030 ($ MILLION)

1. GLOBAL LOW SPEED VEHICLE MARKET SHARE BY VEHICLE TYPE, 2022 VS 2030 (%)

2. GLOBAL LOW SPEED COMMERCIAL TURF AND INDUSTRIAL UTILITY VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL LOW SPEED GOLF CART MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL LOW SPEED PERSONAL UTILITY VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL LOW SPEED PUBLIC TRANSPORT MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL LOW SPEED VEHICLE MARKET SHARE BY PROPULSION, 2022 VS 2030 (%)

7. GLOBAL LOW SPEED DIESEL VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL LOW SPEED ELECTRIC VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL LOW SPEED GASOLINE VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL LOW SPEED VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. US LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

13. UK LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD LOW SPEED VEHICLE MARKET SIZE, 2022-2030 ($ MILLION)