Lung Cancer Screening Software Market

Lung Cancer Screening Software Market Size, Share & Trends Analysis Report by Cancer Type (Non-small Cell Lung Cancer (NSCLC), and Small Cell Lung Cancer) by Diagnosis Type (Dose Spiral, CT Scan, and Chest X-ray) and by End-User (Hospitals & Clinics, and Diagnostic Centres) Forecast Period (2024-2031)

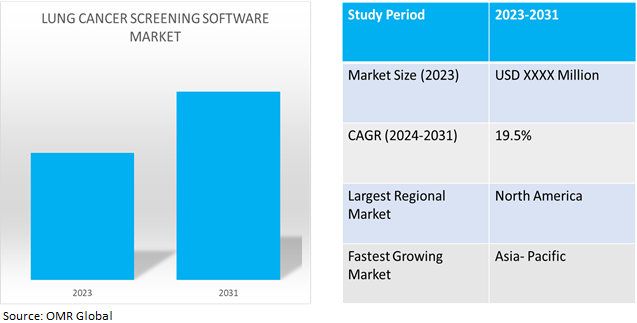

Lung cancer screening software market is anticipated to grow at a significant CAGR of 19.5% during the forecast period (2024-2031). Lung cancer is a leading cause of cancer-related deaths globally, driving the demand for advanced screening tools. Advancements in imaging technology, such as CT scanners, enable more accurate visualization of lung anatomy. Early detection is crucial for better treatment outcomes and increased survival rates. AI integration in screening software enhances image analysis, pattern recognition, and risk prediction. Personalized medicine approaches emphasize risk stratification based on patient-specific factors. Regulatory agencies like the FDA and EMA play an essential role in approving screening software. Industry collaborations between healthcare providers, academic institutions, and technology companies accelerate the development and commercialization of screening software. Global health initiatives and public awareness campaigns additionally contribute to increased demand for screening software.

Market Dynamics

Increasing disease Burden

The global lung cancer screening software market is enhancing healthcare providers' ability to detect and manage the increasing disease burden through advanced tools and technologies. According to the American Cancer Society, in 2023, approximately 238,340 individuals will receive a diagnosis of lung cancer, with 117,550 cases among men and 120,790 cases among women. Tragically, the disease is expected to claim the lives of 127,070 individuals.

Rising incidence of lung cancer

The rising prevalence of lung cancer, influencing both smokers and non-smokers alike, highlights the importance of early detection and screening measures. For instance, in May 2024, Lucem Health introduced Reveal for lung cancer, an AI-driven solution that helps healthcare organizations identify and engage patients at higher risk for respiratory illnesses, facilitating earlier diagnosis and treatment. The solution uses EHR data and an AI model to flag individuals more likely to be diagnosed after low-dose CT screening.

Market Segmentation

Our in-depth analysis of the global lung cancer screening software market includes the following segments by cancer type, diagnosis type, and end-user:

- Based on cancer type, the market is sub-segmented into Non-Small Cell Lung Cancer (NSCLC), and small cell lung cancer.

- Based on diagnosis type, the market is bifurcated into low-dose spiral CT scans and chest X-rays.

- Based on end-user, the market is sub-segmented into hospitals & clinics, and diagnostic centres.

Non-small Cell Lung Cancer (NSCLC) is Projected to Emerge as the Largest Segment

Based on the device platform, the global Lung cancer screening software market is sub-segmented into Non-Small Cell Lung Cancer (NSCLC), and small cell lung cancer. Among these, the NSCLC sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes NSCLC subtype classification. This aids in personalized medicine in lung cancer treatment, incorporating imaging characteristics, genetic markers, and patient demographics into screening software solutions. According to the American Cancer Society, in January 2024, approximately 80.0% - 85.0% of lung cancers fall under the category of NSCLC, with adenocarcinoma, squamous cell carcinoma, and large cell carcinoma being the primary subtypes. These subtypes are classified together as NSCLC owing to similar treatment approaches and prognoses.

Chest X-ray Sub-segment to Hold a Considerable Market Share

The healthcare sector is experiencing a growing demand for effective reporting solutions owing to the need to provide timely communication, optimize workflow, and minimize reporting backlogs, specifically in the area of lung cancer screening. According to NHS England, in May 2023, during the period from February 2022 to January 2023, a total of 43.4 million imaging tests were conducted in England, with 3.4 million of these tests being reported.

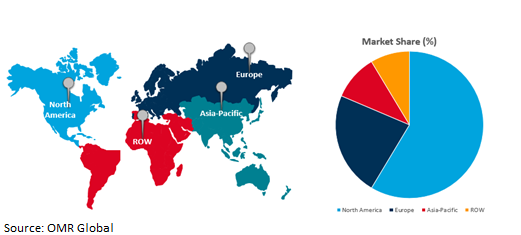

Regional Outlook

The global lung cancer screening software market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

High Cancer Incidence In Asia-Pacific Region

The high cancer incidence rate in India indicates the need for lung cancer screening software in addition to individuals' complete screening and diagnostic solutions to enhance patient outcomes and minimize the burden of disease. According to World Cancer Day, in February 2024, India's cancer incidence reached 1,461,427 in 2022, with lung cancer being the most prevalent among males and breast cancer among females. Lymphoid leukemia is the predominant childhood cancer, with an estimated 12.8% increase in incidence by 2025.

Global Lung Cancer Screening Software Market Growth by Region 2024-2031

North America Holds Major Market Share

The rising incidence and mortality rates of lung cancer in the US necessitate the development of advanced screening software solutions to improve early detection and intervention. According to the National Cancer Institute, in 2024, it estimated number of new lung cancer cases in the US to reach 234,580, accounting for approximately 11.7% of all new cancer cases. Additionally, it is projected that there will be 125,070 fatalities from cancer in the same year, representing 20.4% of all cancer mortalities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global lung cancer screening software market include FUJIFILM Holdings Corp., McKesson Corp., Siemens Healthineers Co., Nuance Communications, Inc., and VIDA Diagnostics Inc. among others., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in November 2022, RadNet and Google Health partnered to improve lung cancer screening using artificial intelligence. Audience, RadNet's lung AI subsidiary, will license a Google Health AI research model for lung nodule malignancy prediction. This helps reduce the time and cost of early detection of benign lung nodules, potentially saving lives.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global lung cancer screening software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. FUJIFILM Holdings Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. McKesson Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Siemens Healthineers Pvt. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lung Cancer Screening Software Market by Cancer Type

4.1.1. Non-small Cell Lung Cancer (NSCLC)

4.1.2. Small Cell Lung Cancer

4.2. Global Lung Cancer Screening Software Market by Diagnosis

4.2.1. Low Dose Spiral CT Scan

4.2.2. Chest X-ray

4.3. Global Lung Cancer Screening Software Market byEnd-user

4.3.1. Hospitals & Clinics

4.3.2. Diagnostic Centres

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Canon Medical Systems Corp.

6.2. CureMetrix, Inc.

6.3. GE HealthCare Technologies Inc.

6.4. iCAD, Inc.

6.5. Intelerad Medical Systems Inc.

6.6. Koninklijke Philips N.V.,

6.7. Matrix Analytics, Inc. (Eon)

6.8. Medtronic

6.9. MeVis Medical Solutions AG

6.10. Mirada Medical Ltd.

6.11. MRS Systems, Inc.

6.12. Nuance Communications, Inc.

6.13. Riverain Technologies

6.14. Subtle Medical, Inc.

6.15. Thirona

6.16. VIDA Diagnostics Inc.

6.17. Volpara Health Technologies Ltd.

6.18. Zebra Technologies Corp.

1. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2023-2031 ($ MILLION)

2. GLOBAL NON-SMALL CELL LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SMALL CELL LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS TYPE, 2023-2031 ($ MILLION)

5. GLOBAL LOW DOSE SPIRAL CT SCAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CHEST X-RAY LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

8. GLOBAL LUNG CANCER SCREENING SOFTWARE IN HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LUNG CANCER SCREENING SOFTWARE IN DIAGNOSTIC CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

15. EUROPEAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

23. REST OF THE WORLD LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY CANCER TYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD LUNG CANCER SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKETSHARE BY CANCER TYPE, 2023 VS 2031 (%)

2. GLOBAL NON-SMALL CELL LUNG CANCER LUNG CANCER SCREENING SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SMALL CELL LUNG CANCER SCREENING SOFTWARE IN TELEMEDICINE PLATFORMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKET SHARE BY DIAGNOSIS TYPE, 2023 VS 2031 (%)

5. GLOBAL LOW DOSE SPIRAL CT SCAN LUNG CANCER SCREENING SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CHEST X-RAY LUNG CANCER SCREENING SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKET SHARE BY END USER, 2023 VS 2031 (%)

8. GLOBAL LUNG CANCER SCREENING SOFTWARE IN HOSPITALS & CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL LUNG CANCER SCREENING SOFTWARE IN DIAGNOSTIC CENTRES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL LUNG CANCER SCREENING SOFTWARE MARKETSHARE BY REGION, 2023 VS 2031 (%)

11. US LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

13. UK LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA LUNG CANCER SCREENING SOFTWARE MARKET SIZE, 2023-2031 ($ MILLION)