Machinery Leasing Market

Global Machinery Leasing Market Size, Share & Trends Analysis Report By Type (Heavy Construction Machinery Rental, Commercial Air, Rail, and Water Transportation Equipment Rental, Mining, Oil and Gas, Forestry Machinery, and Equipment Rental) By Mode (Online, and Offline) Forecast 2022-2028 Update Available - Forecast 2025-2031

The global machinery leasing market is anticipated to grow at a considerable CAGR of 5.6% during the forecast period. The machinery leasing market consists of sales of machinery rental services by the entities that rent out or lease commercial type and industrial type machinery and equipment to farmers, construction workers, and other end-users. The main types of machinery leasing are heavy construction machinery, commercial air, rail, and water transportation equipment machines, among others. The factor that drives the market growth is the need to replace outdated equipment, increasing number of drilling activities, improved logistics infrastructure, growing capital expenditure for the development of infrastructure, and rising number of agriculture practices majorly in the emerging economies countries such as India, and Japan. Moreover, the application of machinery leasing in agriculture, construction activities, and the mining and gas extraction practices leads to support significant growth in the coming years. For farmers, machinery leasing offers a variety of advantages that allow the crops to be harvested on time. Over time, the outdated equipment becomes obsolete such as tillers, harvesters, tractors which are needed to be replaced with new and advance machines and offers a chance to farmers to improve the operations conveniently.

Impact of COVID-19 Pandemic on Global Machinery Leasing Market

The COVID-19 pandemic had impacted the global machinery leasing market to a great extent. During COVID-19, as of May 2020, 212 countries had been impacted by the pandemic, and the governments of these countries had ordered nationwide lockdowns due to which people were forced to stay in their homes which impacted the travel, transportation industry which in turn impacted the machinery leasing market. Additionally, the operations of several industries were put to a halt such as infrastructure development, construction, commercial rail, and water transportation which also negatively impacted the market growth. Furthermore, the mining and drilling activities were also severely impacted by the COVID-19 pandemic which in turn hampered market growth. However, as the COVID-19 situation normalizes, the global machinery leasing market started recovery as many industries construction and infrastructure industries were normalized after the recovery.

Segmental Outlook

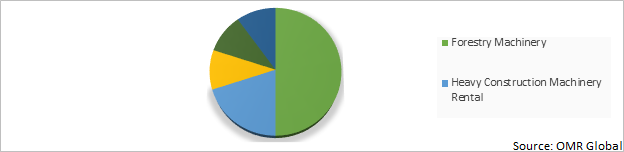

The global machinery leasing market is segmented based on type, and mode. Based on type, the market is segmented into heavy construction machinery rental, commercial air, rail, and water transportation equipment rental, mining, oil and gas, forestry machinery, and equipment rental. Based on mode, the market is bifurcated into online, and offline. Based on type, heavy construction machinery rental is expected to witness the highest growth during the forecast period, owing to an increase in construction and mining activities in developing nations of Latin America and Africa. In addition, excessive operational costs, and additional expenses charged for the maintenance of the equipment can be saved to some extent by renting heavy construction machinery for the required time, which significantly contributes toward the growth of the heavy construction machinery rental market.

Global Machinery Leasing Market Share by Type, 2022 (%)

The Forestry Machinery Holds the Major Share in the Global Machinery Leasing Market

The forestry machinery market is expected to remain the leading as well as the fastest-growing market, owing to an increase in the agriculture activities and replacing the obsolete machines and equipment for cultivating, harvesting, and plouging of crops results in higher demand for forestry machinery. Moreover, leasing machines also helps in managing the cash flow, guards against obsolescence, and increase the efficiency of the farmers. Moreover, the market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2021, New Holland Agriculture announced a partnership with the Alamo Group, the partnership will provide the customers of new Holland with the opportunity to finance their tractor in the same transaction, as their bush hog, rhino, or Schulte-branded attachment. Moreover, this partnership offers solutions for a variety of applications along with complimentary new Holland tractors in one packaged deal.

Regional Outlooks

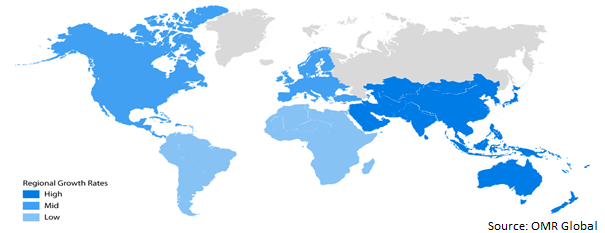

The global machinery leasing market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). North America accounted for the largest share of revenue in 2022 and is expected to maintain its presence over the forecast period. The growth is mainly driven due to climate change and changing precipitation patterns, and the high cost of machinery equipment has increased the demand for the machinery leasing market in the North-America region.

Global Machinery Leasing Market Growth, by Region 2022-2028

The North-America Region Holds the Major Share in the Global Machinery Leasing Market

North America dominated the market by accounting highest share in the machinery leasing market in 2022. The robust growth of the construction sector is stimulating the global machinery leasing market in the North-America region. Further, with the compliance of strict regulations, rental firms are increasingly inclined towards expanding their fleet with low emissions loaders, excavators, and other equipment which is necessary for road building, infrastructure development, and other construction and drilling activities. Moreover, the growing global population has led to an increase in the demand for food to fulfill the needs of the people, which increase food production activities and improvements across the agriculture sector, thereby positively impacting the market growth for global machinery leasing market in the North-America region.

Market Players Outlook

The major companies serving the global machinery leasing market are AerCap, Aggreko Ltd., Ahern Rentals, Air Lease Corp., Ashtead Group Plc., Fuyo General Lease Co. Ltd., Tokyo Century Corp., United Rentals Inc., Herc Rentals Inc., Maxim Crane Works L.P., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021, Herc Holding Inc. has completed its acquisition of Rapid equipment, and also acquired SkyKing Lift Rentals. With this partnership, the company has significantly improved the coverage in the dynamic Toronto and Chicago equipment rental markets by serving a diverse mix of construction, industrial machine equipment.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global machinery leasing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Machinery Leasing Market

• Recovery Scenario of Global Machinery Leasing Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. AerCap

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Ashtead Group Plc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Fuyo General Lease Co. Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Tokyo Century Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. United Rentals Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Machinery Leasing Market, by Type

5.1.1. Heavy Construction Machinery Rental

5.1.2. Commercial Air, Rail, and Water Transportation Equipment Rental

5.1.3. Mining, Oil And Gas

5.1.4. Forestry Machinery

5.1.5. Equipment Rental

5.2. Global Machinery Leasing Market, by Mode

5.2.1. Online

5.2.2. Offline

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aggreko Ltd

7.2. Ahern Rentals

7.3. Air Lease Corp.

7.4. Aktio Corp.

7.5. General Electric Co.

7.6. H & E equipment Services Inc.

7.7. Herc Rentals Inc.

7.8. Konamoto Co. Ltd.

7.9. Loxam

7.10. Maxim Crane Works L.P.

7.11. Net Jets Aviation Inc.

7.12. Nishio Rent All Co. Ltd.

7.13. Nissan Motor Co., Ltd

7.14. Sandhills Global Inc.

7.15. Sarens Bestuur NV

7.16. TDR Capital LLP

1. GLOBAL MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL HEAVY CONSTRCUTION MACHINERY RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COMMERCIAL AIR, RAIL, AND WATER TRANSPORTATION EQUIPMENT RENTAL MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MINING,OIL AND GAS MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FORESTY MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL EQUIPMENT RENTAL MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY MODE, 2021-2028 ($ MILLION)

8. GLOBAL ONLINE MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL OFFLINE MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. NORTH AMERICAN MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

13. NORTH AMERICAN MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY MODE, 2021-2028 ($ MILLION)

14. EUROPEAN MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. EUROPEAN MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY MODE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY MODE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD MACHINERY LEASING MARKET RESEARCH AND ANALYSIS BY MODE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MACHINERY LEASING MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MACHINERY LEASING MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL MACHINERY LEASING MARKET, 2021-2028 (%)

4. GLOBAL MACHINERY LEASING MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL HEAVY CONSTRCUTION MACHINERY RENTAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL COMMERCIAL AIR,RAIL,AND WATER TRANSPORTATION EQUIPMENT RENTAL MACHINERY LEASING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL MINING,OIL AND GAS MACHINERY LEASING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL FORESTRY MACHINERY LEASING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL EQUIPMENT RENTAL MACHINERY LEASING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL MACHINERY LEASING MARKET SHARE BY MODE, 2021 VS 2028 (%)

11. GLOBAL ONLINE MACHINERY LEASING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL OFFLINE MACHINERY LEASING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

15. UK MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD MACHINERY LEASING MARKET SIZE, 2021-2028 ($ MILLION)