Macular Degeneration Treatment Market

Global Macular Degeneration Treatment Market Size, Share & Trends Analysis Report, By Type (Dry Age-Related Macular Degeneration and Wet Age-Related Macular Degeneration), By Route of Administration (Intravitreal and Intravenous), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global macular degeneration treatment market is estimated to grow at a CAGR of nearly 7.0% during the forecast period. The major factors contributing to the market growth include a significant rise in the prevalence of age-related macular degeneration (AMD) and rising geriatric population base. As per the International Agency for the Prevention of Blindness (IAPB), AMD is the third most common cause of blindness across the globe. It is the major cause of blindness in higher-income countries with geriatric populations. AMD accounts for nearly 5% of blindness across the globe. The major risk factors that lead to the rising incidences of AMD include genetic factors, age, and tobacco smoking.

AMD is the major cause of permanent central vision loss among people aged 65 and over in developed countries. The incidence of macular degeneration is expected to rise continuously coupled with the significant rise in ageing population. This, in turn, will drive the demand for reliable and effective macular degeneration treatment. The treatment efforts for AMD is aimed to keep the central vision as long as possible. The treatment alternatives available for wet AMD include Bevacizumab (Avastin), Ranibizumab (Lucentis), and Aflibercept (Eylea) drugs. These medications are injected into the vitreous cavity of the eye, which decreases the leakage from the retinal blood vessels. A large number of patients receiving these treatments will need lifelong therapy at the intervals of 1-3 months.

The strong pipeline for novel macular degeneration medications is offering an opportunity for the growth of the market. Some products have granted fast track from the US FDA for the treatment of geographic atrophy (GA) secondary to dry AMD. For instance, in April 2020, IVERIC bio, Inc. declared that the US FDA has granted Fast Track designation to Zimura (avacincaptad pegol), which is in development to treat GA secondary to dry AMD. Currently, there are no treatment options available for patients with GA secondary to dry AMD and allowing Fast Track designation by the US FDA will enable to address the unmet needs.

Market Segmentation

The global macular degeneration treatment market is segmented based on the type, route of administration, and distribution channel. Based on type, the market is classified into dry AMD and wet AMD. Based on the route of administration, the market is classified into intravitreal and intravenous. Based on the distribution channel, the market is classified into retail pharmacies, hospital pharmacies, and online pharmacies.

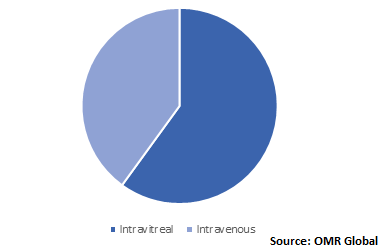

Intravitreal route of administration finds its significant application in AMD treatment

Intravitreal medications are estimated to hold potential share during the forecast period owing to the emerging demand for anti-VEGF therapy and a strong pipeline for intravitreally administered drugs. Currently, anti-VEGF therapy is the most common and potential treatment for wet AMD, which is the periodic eye (intravitreal) injection of a chemical referred to as anti-VEGF. VEGF is a healthy molecule which enables the growth of new blood vessels. However, VEGF is unhealthy in the case of macular health as it supports the growth of new, fragile blood vessels behind the retina.

These vessels leak serum, lipids, and blood into the layers of the retina. The leakage resulting in retinal scarring and kills macular cells, such as photoreceptor rods and cones. Anti-VEGF drug restricts the formation of new blood vessels in the choroid layer and may keep the retina free of leakage. Anti-VEGF treatments have decreased the incidence of legal blindness by 50% in some parts of the world. As a result, the demand for intravitreal therapy is expected to emerge for macular degeneration treatment.

Global Macular Degeneration Treatment Market Share by Type, 2019 (%)

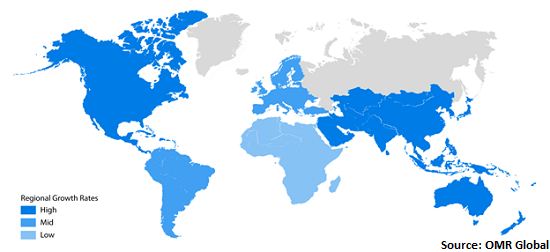

Regional Outlook

The global macular degeneration treatment market is segmented into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). North America is anticipated to hold a significant share in the market owing to the significant prevalence of AMD in the region. As per the BrightFocus Foundation, over 11 million people in the US have some form of AMD, which is expected to double to approximately 22 million by 2050. Age is a major risk factor for AMD. The risk of getting advanced AMD increases from 2% for those aged 50-59, to approximately 30% for those more than the age of 75. Therefore, a significant rise in the ageing population will accelerate the demand for AMD treatment in the region.

Global Macular Degeneration Treatment Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include F. Hoffman L-Roche AG, Novartis International AG, Regeneron Pharmaceuticals, Inc., Pfizer Inc., and Bausch Health Companies Inc. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. For instance, in October 2019, Novartis declared the US FDA approval for Beovu (brolucizumab) injection, which is also referred to as RTH258 to treat wet AMD.

It is the first FDA approved anti-VEGF medication that delivers both greater fluid resolution versus aflibercept and the ability to maintain eligible wet AMD patients on a three-month dosing interval immediately after a three-month loading phase without affecting efficacy. With greater fluid reduction through a considerable decrease in the thickness of the retina and a larger share of patients with drier retinas, Beovu holds the potential to treat patients with quarterly injections and may change the approach to treat wet AMD. This, in turn, will enable Novartis to accelerate its share in the AMD treatment.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global macular degeneration treatment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Pipeline Analysis

2.4. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. F. Hoffman La-Roche AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Novartis International AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Regeneron Pharmaceuticals, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Pfizer Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Bausch Health Companies Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Macular Degeneration Treatment Market by Type

5.1.1. Dry Age-Related Macular Degeneration

5.1.2. Wet Age-Related Macular Degeneration

5.2. Global Macular Degeneration Treatment Market by Route of Administration

5.2.1. Intravitreal

5.2.2. Intravenous

5.3. Global Macular Degeneration Treatment Market by Distribution Channel

5.3.1. Retail Pharmacies

5.3.2. Hospital Pharmacies

5.3.3. Online Pharmacies

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alkahest, Inc.

7.2. Allergan plc

7.3. Amgen Inc.

7.4. Bausch Health Companies Inc.

7.5. Boehringer Ingelheim GmbH

7.6. Clearside Biomedical, Inc.

7.7. Exonate Ltd.

7.8. F. Hoffman La-Roche AG

7.9. Gemini Therapeutics, Inc.

7.10. IVERIC bio, Inc.

7.11. Mylan N.V.

7.12. Neurotech Pharmaceuticals, Inc.

7.13. Novartis International AG

7.14. Ocular Therapeutix, Inc.

7.15. Pfizer Inc.

7.16. Regeneron Pharmaceuticals, Inc.

7.17. REGENXBIO Inc.

7.18. Xcovery

1. GLOBAL MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL DRY AGE-RELATED MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL WET AGE-RELATED MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

5. GLOBAL INTRAVITREAL ADMINISTRATION FOR MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL INTRAVENOUS ADMINISTRATION FOR MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

8. GLOBAL RETAIL PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL HOSPITAL PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ONLINE PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

15. NORTH AMERICAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

16. EUROPEAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. EUROPEAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

19. EUROPEAN MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

24. REST OF THE WORLD MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

26. REST OF THE WORLD MACULAR DEGENERATION TREATMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL MACULAR DEGENERATION TREATMENT MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL MACULAR DEGENERATION TREATMENT MARKET SHARE BY ROUTE OF ADMINISTRATION, 2019 VS 2026 (%)

3. GLOBAL MACULAR DEGENERATION TREATMENT MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

4. GLOBAL MACULAR DEGENERATION TREATMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

7. UK MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD MACULAR DEGENERATION TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)