Malted Wheat Flour Market

Malted Wheat Flour Market Size, Share & Trends Analysis Report by Application (Bakery & Confectionery, Food & Beverages, Others) Forecast Period (2020-2026) Update Available - Forecast 2025-2035

Malted wheat flour market is projected to grow at a considerable CAGR of around 5% during the forecast period (2020-2026). Malt is made from the enzymatic process for germinate the grains and allow them to sprout. Malted wheat flour is available in the market with diastatic and non-diastatic malts. Bread, coated cereals, premixes, bakery products, crunchy cereals, biscuits, functional flours, and flour correctors confectionery among others are the major items that make use of the malted wheat flour in their production. The rising adoption of the malted wheat flour in the bakery industry is a key factor driving the malted wheat flour market across the globe.

The malting process provides a significant level of enzyme activity and a wide variety of sugars can be carried into the dough if using malted wheat flour. Therefore, the rising consumption of confectionery items owing to the increasing urbanization, rising disposable income and changing consumer preferences towards confectionery items in the developing economies is a key factor driving the growth of the global malted wheat flour market. Dough softening and side-wall collapse in the baked food can appear if formulating bread with excessive amounts of malted grains. This factor may restrain the growth of the market across the globe.

Segmental Outlook

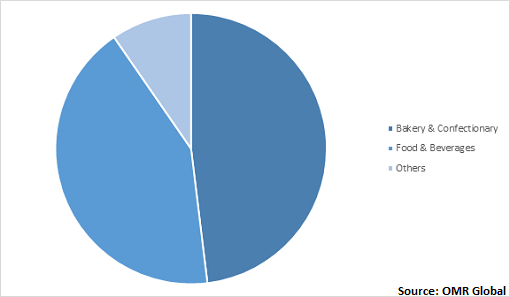

The malted wheat flour market is segmented on the basis of application into bakery & confectionery, food & beverages, and others. The bakery and confectionery is anticipated to hold major market share based on the application segment. The malted wheat flour is used as a controlling agent to control the enzymatic behavior of dough during the fermentation process of the bread production in the bakery. The increasing global demand for bread is a major aspect driving the growth of the bakery and confectionary segment across the globe. The food & beverage segment is anticipated to exhibit considerable growth based on the application segment. The rising adoption of the malted wheat flour in the brewing industry is expected to be a key factor contributing to the growth of the market segment.

Global Malted Wheat Flour Market Share by Application, 2019 (%)

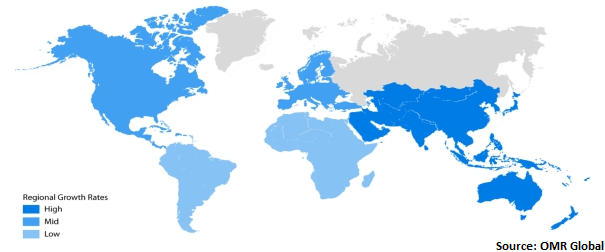

Regional Outlook

The global malted wheat flour market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and Rest of the World. North America and Europe are anticipated to hold a major market share in the global malted wheat flour market during the forecast period. Europe is a major consumer of alcoholic beverages the growing consumption of beverages in the region is creating the demand for the malted wheat flour market. The considerable presence of malted wheat flour storage warehouses along with the presence of end-user industries such as confectionery, food & beverage industry is a key factor contributing towards the high share of the market in the region.

Global Malted Wheat Flour Market Growth, by Region 2020-2026

Asia-Pacific will augment with the significant growth rate in the malted wheat flour market

Cohesive government regulation related to the use of malted wheat flour in bakery food is anticipated to make a positive influence on the growth of the malted wheat flour market in the region. The rising demand for bakery and confectionery products in China, India, Japan, and Thailand is further propelling the growth of the malted wheat flour market in the region. Moreover, the presence of major wheat-producing countries in the region such as India and China is further anticipated to drive the market growth in the Asia-Pacific region.

Market Players Outlook

The key players of the malted wheat flour market include Archer Daniels Midland Co., Simpsons Malt Ltd., Boortmalt N.V. (Axéréal), Malteurop Group, Bairds Malt Ltd., Crisp Malting Group Ltd., Imperial Malts, Muntons Malt plc, and King Arthur Flour Company, among others. The players of the market are making major emphasis on the expansion of their production capacity and distribution efficiency. For this purpose, they are adopting different growth strategies such as horizontal integration and vertical integration along with mergers and acquisitions in order to stay competitive in the marketplace.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global malted wheat flour market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Malted Wheat Flour Market by Application

Bakery & Confectionary

Food & Beverages

Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Archer Daniels Midland Co.

7.2. Bairds Malt, Ltd.

7.3. Boortmalt N.V. (Axéréal)

7.4. Crisp Malting Group, Ltd.

7.5. GrainCorp, Ltd.

7.6. Great Western Malting Co.

7.7. Imperial Malts, Ltd.

7.8. IREKS GmbH

7.9. King Arthur Flour Co.

7.10. Malteurop Group

7.11. Mungoswells Malt & Milling

7.12. Muntons Malt PLC

7.13. Simpsons Malt, Ltd.

7.14. Viking Malt

1. GLOBAL MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL BAKERY & CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. NORTH AMERICAN MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

6. NORTH AMERICAN MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

7. EUROPEAN MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. EUROPEAN MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. ASIA-PACIFIC MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. ASIA-PACIFIC MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. REST OF THE WORLD MALTED WHEAT FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MALTED WHEAT FLOUR MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL MALTED WHEAT FLOUR MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. THE US MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

5. UK MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD MALTED WHEAT FLOUR MARKET SIZE, 2019-2026 ($ MILLION)