Mammography Market

Global Mammography Market Size, Share & Trends Analysis Report by Product Type (Digital Systems, Analog Systems, Biopsy Systems, Film Screen System, and Others), By End-User (Hospital & Clinics and Diagnostics Centers) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global market for mammography is estimated to grow at CAGR of around 12.9% during the forecast period. The market is mainly due to growing prevalence of breast cancer coupled with increasing diagnosis rates across the globe. As per the American Institute for Cancer Research, breast cancer is the most common cancer in women and the second most common cancer overall across the globe. There were more than 2 million new cases of breast cancer diagnosed in 2018 across the globe. Mammography is a specific medical imaging technique that uses a low-dose x-ray system to see inside the breasts. A mammography exam, called a mammogram, aids in the early detection and diagnosis of breast diseases in women. The x-ray (radiograph) is a non-invasive medical test that provides physicians diagnosis and treat medical situations. Imaging with x-rays involves exposing a part of the body to a small dose of ionizing radiation to produce pictures of the inside of the body. Therefore the mammography has significant application in breast cancer diagnosis thus rising breast cancer cases propels the market growth.

Segmental Outlook

The global mammography market is segmented based on product type and end-user. Based on the product type, the market is further classified into digital systems, analog systems, biopsy systems, film screen system, and others. The digital systems segment is projected to have considerable growth owing to the growing demand of digital mammography in breast cancer diagnostics. Digital mammography also called full-field digital mammography (FFDM), it is a mammography system in which the x-ray film is replaced by electronics that convert x-rays into mammographic pictures of the breast. These technologies are parallel to those technologies found in digital cameras and their proficiency enables better pictures with a lower radiation dose. On the basis of end-user the market is further segregated into hospitals & clinics and diagnostic centers.

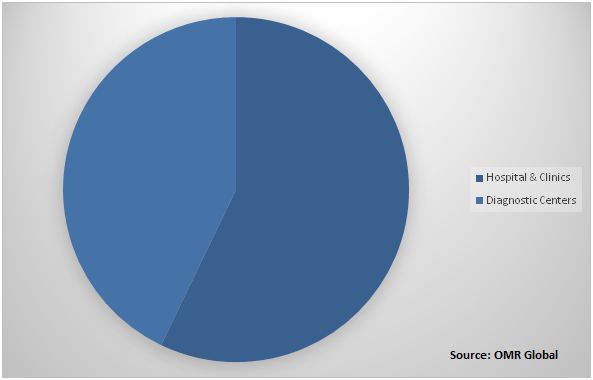

Global mammography Market Share by End-User, 2018(%)

Global mammography market to be driven by Hospitals & Clinics

Among end-user, the hospitals & clinics segment held a considerable share in the market. In the hospitals, the different facilities need to offer to the patients in the hospital to meet the demand; the organization offers different customized products for the hospitals.The factor is driving the growth of the mammography market due to the increasing number of breast screening; the demand for hospitals is flourishing across the globe. The hospitals are using the various mammography devices for the diagnosis pf breast cancer that includes a digital mammography and others. Moreover, Diagnostic centers segment is projected to have significant growth during the forecast period owing increasing government breast cancer screening programs in emerging economies.

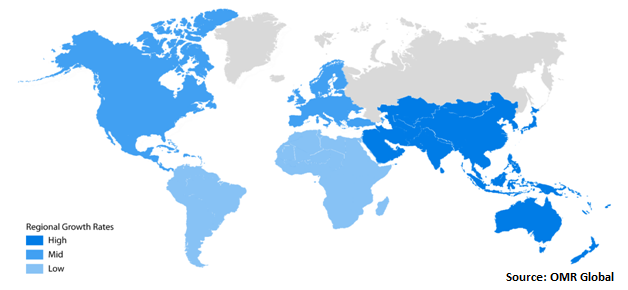

Regional Outlook

Geographically, the global mammography market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth in the region is increasing owing to the high prevalence of breast cancer coupled with growing awareness program towards breast cancer screening in emerging economies. The major countries which will have a significant market share during the forecast period are India, China, and Japan. Government agencies, NGOs and charity organizations have put great emphasis on improved breast cancer awareness among masses for promotion of early detection, providing comprehensive treatment module, providing support for breast cancer management and for screening and rehabilitation.

Global mammography Market Growth, by Region 2019-2025

North America to hold a considerable share in the global mammography market

Geographically, North America is projected to hold a significant market share in the global mammography market. Major economies which are anticipated to contribute to the North America mammography market are the US and Canada. The market is mainly driven due to the high prevalence of breast cancer among women in the region. According to Breastcancer.org, around 1 in 8 women in the US, contributing around 12% of the population, will develop invasive breast cancer over the course of their lifetime. Moreover, the aforementioned society further estimated that around 268,600 new cases of invasive breast cancer are expected to be diagnosed in women in the US, along with 62,930 new cases of non-invasive (in-situ) breast cancer. High prevalence of breast cancer is the US augments the demand for mammography tests for the diagnosis of breast cancer across the region. Additionally, well-developed healthcare infrastructure and adoption of new technologies for mammography such as 3D mammography are also driving the market growth of the region.

Market Players Outlook

The key players in the mammography market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Fujifilm Holdings Corp., Koninklijke Philips N.V., General Electric Co., Hologic Inc., Siemens AG and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mammography market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Fujifilm Holdings Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Koninklijke Philips N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. General Electric Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Hologic Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Mammography Market by Product Type

5.1.1. Digital Systems

5.1.2. Analog Systems

5.1.3. Biopsy Systems

5.1.4. Film Screen System

5.1.5. Others( 3D Systems)

5.2. Global Mammography Market by End-User

5.2.1. Hospital & Clinics

5.2.2. Diagnostic Centers

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Analogic Corp.

7.2. Carestream Health, Inc.

7.3. CMR Naviscan Corp.

7.4. CureMetrix, Inc.

7.5. Benetec Medical Systems

7.6. Barco NV

7.7. Esaote SPA

7.8. EIZO Corp.

7.9. Fujifilm Holdings Corp.

7.10. General Electric Co.

7.11. General Medical Merate S.p.A

7.12. Hologic Inc.

7.13. IMS GIOTTO S.P.A.

7.14. Koninklijke Philips NV.

7.15. Konica Minolta, Inc.

7.16. Metaltronica S.p.A.

7.17. Planmed Oy

7.18. Siemens AG

7.19. Sectra AB

7.20. Varex Imaging Corp

1. GLOBAL MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL DIGITAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ANALOG SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL BIOPSY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL FILM SCREEN SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL MAMMOGRAPHY IN HOSPITAL & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL MAMMOGRAPHY IN DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

14. EUROPEAN MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. REST OF THE WORLD MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL MAMMOGRAPHY MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL MAMMOGRAPHY MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL MAMMOGRAPHY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD MAMMOGRAPHY MARKET SIZE, 2018-2025 ($ MILLION)