Mammography Workstations Market

Mammography Workstations Market Size, Share & Trends Analysis Report, By Modality (Multimodal and Standalone), By Application (Advanced Imaging, Clinical Review and Diagnostics Screening), By End-User (Hospitals, Diagnostic Centers, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global mammography workstations market is expected to exhibit a CAGR of 5.8% during the forecast period. Mammography workstation has a significant role in breast cancer screening and diagnosis as digital mammograms is displayed on mammographic workstations that allow monitoring, managing, and storing images. There are several factors encouraging the market growth, which include the rising prevalence of breast cancer coupled with the increasing demand for multimodality workstations. Healthcare facilities are moving towards multi-modality breast imaging workstations for improving breast imaging reading workflow.

There are several companies offering multimodality workstations, which include Carestream Health, Inc., Merge Healthcare Solutions, Inc., and Hologic, Inc. Kodak Carestream mammography workstation allows the diagnostic review of breast imaging exams, such as ultrasound, full-field digital mammography (FFDM), magnetic resonance (MR), and computed radiography (CR). It is easy to use and offers several specific functional features that can improve the diagnostic reading workflow. This allows radiologists to read ultrasound and digital mammograms on a single workstation and supports a more precise diagnosis. As a result, it enables early detection of breast cancer and thereby allows healthcare providers to offer better patient care. Therefore, multi-modality workstations are being significantly preferred in breast cancer screening and diagnosis.

Segment Outlook

The global mammography workstations market is segmented on the basis of modality, application, and end-user. Based on modality, the market is further segmented into multimodal mammography workstations and standalone mammography workstations. Based on application, the market is further classified into advanced imaging, clinical review, and diagnostics screening. Based on the end-user, the market is further segmented into hospitals, diagnostic centers, and others. Hospitals are anticipated to gain significant share in 2018 due to increasing demand for advanced cancer diagnostics technology coupled with the availability of skilled radiologists in the hospitals.

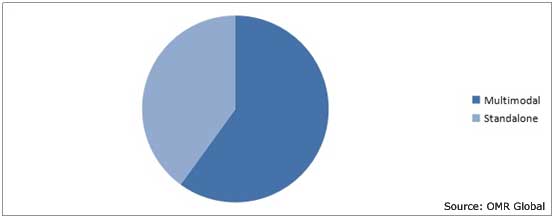

Global Mammography Workstations Market: By Modality

Multimodal mammography workstations are anticipated to hold the largest share in 2018. This is resulting due to rising advances in multimodality workstations and significant availability of multimodal workstations to streamline the workflow involved in radiology practices. Several new launches of multimodality workstations were reported over the years. For instance, in March 2018, Fujifilm unveiled ASPIRE Bellus II multi-modality mammography diagnostic workstation. This platform offers a multimodality view that can be utilized to analyze 2D and tomosynthesis scans against each other. Several DICOM standards are led by the system and contain beneficial features, including historical scan comparisons, image inversion, and quadrant view. As a result, it allows radiologists to diagnose breast cancer more accurately. In addition, rising focus on offering better patient care are encouraging healthcare providers to adopt advanced medical imaging workstations and thereby driving the demand for multimodal mammography workstations.

Global Mammography Workstations Market Share by Modality, 2018 (%)

Regional Outlook

Geographically, the global mammography workstations market is further segmented into four major regions, such as North America, Europe, Asia-Pacific, and RoW. Asia-Pacific is expected to grow at a significant rate during the forecast period. Government initiatives to promote breast cancer awareness and growing incidences of breast cancer is encouraging market growth. In addition, improving healthcare infrastructure is also boosting the growth of the market.

Global Mammography Workstations Market Growth by Region, 2019-2025

Asia-Pacific is Expected to Witness Lucrative Growth in the Market During the Forecast Period

Asia-Pacific is expected to witness potential growth in the market due to the significant prevalence of breast cancer, rising awareness programs for breast cancer and rising adoption of medical imaging workstations in the region. For instance, in March 2019, China has decided to promote a package of prevention and treatment of breast cancer across the country. This is aimed at further increasing the survival period of the patients and lowering the diagnosis and treatment gap between rural and urban areas. Furthermore, in November 2017, the National Cancer Center of China (NCC) and the International Agency for Research on Cancer (IARC) signed a new agreement to expand and renew their collaboration on prevention and control of cancer. They have also collaborated on the setting up of the National Central Cancer Registry of China that allows enhanced availability, quality, and the use of cancer registry data to better inform cancer control planning in China. As breast cancer incidence has been rising in China, these initiatives may encourage the adoption of advanced medical imaging technologies, which in turn, will contribute to the adoption of mammography workstations that can increase the efficiency and reliability of breast cancer screening and diagnosis.

Competitive Landscape

The major players operating in the market include Fujifilm Holdings Corp., Siemens AG, Carestream Health, Inc., Koninklijke Philips NV, General Electric Co., and Hologic, Inc. These companies are offering mammography workflow solutions that can augment the performance through intuitive viewing and reporting, seamless connectivity, and easy collaboration. For instance, GE’s IDI mammography workflow solution can increase the performance by seamless RIS/MIS/PACS connectivity, easy collaboration, and review innovations, such as custom hanging protocols, automatic pre-fetching of prior exams, and automatic scaling and aligning. In addition, it offers DICOM connectivity for easy interface with virtually any picture archiving and communication system (PACS). Furthermore, some new product launches were reported over the years. For instance, in November 2018, Novarad Corp. introduced NovaMG-Pro, a new mammography software, primarily intended for multi-modality radiologists. The platform offers one-click workflow and is completely integrated with dictation/voice recognition. In addition, this eliminates the need for transcription and keep tracks and reports complete breast-related procedures, such as ultrasound, MRI, and mammography. As a result, it streamlines workflow to significantly increase productivity and efficiency and reduce processing time.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mammography workstation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Fujifilm Holdings Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Siemens AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Koninklijke Philips NV

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. General Electric Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Hologic, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Mammography Workstations Market by Modality

5.1.1. Multimodal

5.1.2. Standalone

5.2. Global Mammography Workstations Market by Application

5.2.1. Advanced Imaging

5.2.2. Clinical Review

5.2.3. Diagnostics Screening

5.3. Global Mammography Workstations Market by End-User

5.3.1. Hospitals

5.3.2. Diagnostic Centers

5.3.3. Others (Breast Care Centers and Research Institutes and Academics)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agfa-Gevaert N.V.

7.2. Aycan Medical Systems, LLC

7.3. Barco NV

7.4. Benetec Medical Systems

7.5. Carestream Health, Inc.

7.6. EIZO Inc.

7.7. Esaote SPA

7.8. Fujifilm Holdings Corp.

7.9. General Electric Co.

7.10. Hologic, Inc.

7.11. JPI Healthcare Solutions

7.12. Konica Minolta Healthcare Americas, Inc.

7.13. Koninklijke Philips NV

7.14. Medical Scientific Ltd.

7.15. Merge Healthcare Solutions, Inc. (a part of IBM Watson)

7.16. Neusoft Corp.

7.17. Novarad Corp.

7.18. PerkinElmer, Inc.

7.19. PLANMED OY

7.20. Sectra AB

7.21. Siemens AG

1. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

2. GLOBAL MULTIMODAL MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL STANDALONE MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL MAMMOGRAPHY WORKSTATIONS FOR ADVANCED IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL MAMMOGRAPHY WORKSTATIONS FOR CLINICAL REVIEW MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL MAMMOGRAPHY WORKSTATIONS FOR DIAGNOSTICS SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

9. GLOBAL MAMMOGRAPHY WORKSTATIONS IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL MAMMOGRAPHY WORKSTATIONS IN DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL MAMMOGRAPHY WORKSTATIONS IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. NORTH AMERICAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

17. EUROPEAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

19. EUROPEAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. EUROPEAN MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

25. REST OF THE WORLD MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

26. REST OF THE WORLD MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. REST OF THE WORLD MAMMOGRAPHY WORKSTATIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET SHARE BY MODALITY, 2018 VS 2025 (%)

2. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL MAMMOGRAPHY WORKSTATIONS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US MAMMOGRAPHY WORKSTATIONS SIZE, 2018-2025 ($ MILLION)

6. CANADA MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD MAMMOGRAPHY WORKSTATIONS MARKET SIZE, 2018-2025 ($ MILLION)