Marine Battery Market

Marine Battery Market Size, Share & Trends Analysis Report by Battery Type (Lithium, Nickel Cadmium, Fuel Cell, and Lead-acid), by Ship Type (Commercial and Defense), by Battery Design (Solid-State Batteries, and Flow Batteries), and by Nominal Capacity (<100 Ah, 100–250 Ah, >250 Ah) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Marine battery market is anticipated to grow at a CAGR of 18.5% during the forecast period. The growing establishment of start-ups across the globe is the major factor driving the growth of the market. Start-up companies are increasingly inclined towards the development of marine battery in the market. For instance, in June 2022, Alsym Energy Inc, the US start-up company announced the development of energy storage solutions for electric vehicles (EVs), stationary storage, and marine applications. The battery will provide the performance of lithium-ion batteries at a low cost with reduced risk of fire, which is extremely high in lithium-ion batteries. The company uses low-cost materials in manufacturing batteries, which makes it less sensitive to raw material shortages. Furthermore, to accelerate the development of affordable battery systems, the company partnership with an India-based automaker in a joint effort to develop Alsym’s batteries, in order to expand the business and its footprints across the globe.

Segmental Outlook

The global marine battery market is segmented based on battery type, ship type, battery design, and nominal capacity. Based on the battery type, the market is sub-segmented into lithium, nickel cadmium, fuel cell, and lead-acid. Based on the ship type, the market is divided into commercial and defense. Based on the battery design, the market is further sub-segmented into solid-state batteries, and flow batteries. Based on the nominal capacity, the market is sub-segmented into <100 Ah, 100–250 Ah, and>250 Ah. Among these, the solid-state batteries sub-segment is expected to hold a considerable share in the market due to its higher energy density feature than other battery that uses liquid electrolyte solution.

Among these, the lithium sub-segment is expected to hold a considerable share in the market due to the growing demand for commercial vessels with electric propulsion across the globe. Key players are also launching high-energy batteries to meet the demand. For instance, in October 2021, Electric Fuel Ltd., a manufacturer of professional high-performance batteries launched a 48V high energy density lithium-ion marine battery at the METSTRADE. The battery offers four times more energy than traditional lead acid batteries of a similar size. Additionally, it has thousands of charging cycles with 7-10 years of operational life. It is mainly designed to use in naval and commercial marine battery designs and supports rigid-hulled inflatable boats, racing sailboats, and yachts. The battery is integrated with internal heaters, which enable them to operate in cold weather conditions required in professional and operational marine activity.

Regional Outlooks

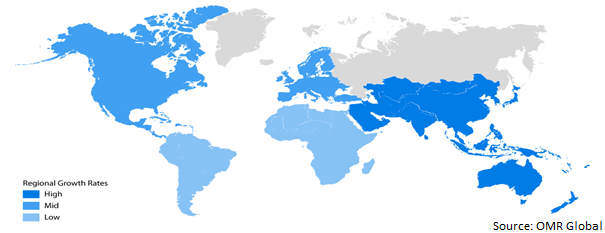

The global marine battery market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The European region is expected to hold a considerable share in the marine battery market during the forecast period, owing to the increase in demand for electric ships for fully electric passenger vessels, tugs, and yachts, among others in the region.

Global Marine Battery Market Growth, by Region 2022-2028

The European Region is Expected to Hold a Significant Share in the Global Marine Battery Market

Among all regions, the Europe region is expected to hold a significant market share during the forecast period. The presence of marine battery market players such as Akasol AG, Siemens AG, Leclanché SA, and others is accelerating the growth of the regional market by launching various battery solutions to meet the requirements of ship manufacturers. For instance, in June 2022, Leclanché SA, energy storage solutions company launched Navius MRS-3 (Marine Rack System), a third-generation marine battery system. The product is designed to support the requirements of ship manufacturers in producing 100% electric and hybrid marine vessels. The product offers several features including battery string voltages of up to 1200 VDC with up to 720 A string continuous discharge current. Additionally, its liquid-cooled design increases the lifespan of the system. Reduced carbon footprint with cells, modules, battery management systems, and racks are some other by-products which are majorly manufactured in European countries.

Market Players Outlook

The major companies serving the global marine battery market include Akasol AG, Corvus Energy, Echandia Marine AB, EnerSys, EverExceed Industrial Co, Leclanché SA, Lifeline Batteries Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2021, Brunswick Corp. acquired RELiON Battery, LLC, a provider of lithium batteries and related products. Through this acquisition, the company aims to expand its offering in electrical systems innovation by adopting lithium-ion battery and power management systems in both marine and mobile markets. Additionally, Brunswick Corp. also plans for a new Electrification Technology Center to be located in Michigan.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global marine battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Marine Battery Market by Battery Type

4.1.1. Lithium

4.1.2. Nickel Cadmium

4.1.3. Fuel Cell

4.1.4. Lead-acid

4.2. Global Marine Battery Market by Ship Type

4.2.1. Commercial

4.2.2. Defense

4.3. Global Marine Battery Market by Battery Design

4.3.1. Solid-State Batteries

4.3.2. Flow Batteries

4.4. Global Marine Battery Market by Nominal Capacity

4.4.1. <100 AH

4.4.2. 100–250 Ah

4.4.3. >250 Ah

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Akasol AG

6.2. Corvus Energy

6.3. Echandia Marine AB

6.4. EnerSys

6.5. EverExceed Industrial Co.

6.6. Leclanché SA

6.7. Lifeline Batteries Inc.

6.8. Saft Groupe SAS

6.9. Siemens AG

6.10. Spear Power Systems.

6.11. Toshiba Corp.

6.12. Wärtsilä

6.13. SUNLIGHT GROUP

1. GLOBAL MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL LITHIUM-BASED MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL NICKEL CADMIUM-BASED MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL FUEL CELL-BASED MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL LEAD-ACID-BASED MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY SHIP TYPE, 2021-2028 ($ MILLION)

7. GLOBAL COMMERCIAL MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL DEFENSE MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY DESIGN, 2021-2028 ($ MILLION)

10. GLOBAL SOLID-STATE MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL FLOW MARINE BATTERY FOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION

12. GLOBAL MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY NOMINAL CAPACITY, 2021-2028 ($ MILLION)

13. GLOBAL MARINE BATTERY OF <100 AH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL MARINE BATTERY OF 100–250 AH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL MARINE BATTERY OF >250 AH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2021-2028 ($ MILLION)

19. NORTH AMERICAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY SHIP TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY DESIGN, 2021-2028 ($ MILLION)

21. NORTH AMERICAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY NOMINAL CAPACITY, 2021-2028 ($ MILLION)

22. EUROPEAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. EUROPEAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2021-2028 ($ MILLION)

24. EUROPEAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY SHIP TYPE, 2021-2028 ($ MILLION)

25. EUROPEAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY DESIGN, 2021-2028 ($ MILLION)

26. EUROPEAN MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY NOMINAL CAPACITY, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY SHIP TYPE, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY DESIGN, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY NOMINAL CAPACITY, 2021-2028 ($ MILLION)

32. REST OF THE WORLD MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY SHIP TYPE, 2021-2028 ($ MILLION)

35. REST OF THE WORLD MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY DESIGN, 2021-2028 ($ MILLION)

36. REST OF THE WORLD MARINE BATTERY MARKET RESEARCH AND ANALYSIS BY NOMINAL CAPACITY, 2021-2028 ($ MILLION)

1. GLOBAL MARINE BATTERY MARKET SHARE BY BATTERY TYPE, 2021 VS 2028 (%)

2. GLOBAL LITHIUM -BASED MARINE BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL NICKEL CADMIUM-BASED MARINE BATTERY BY MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL FUEL CELL-BASED MARINE BATTERY BY MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL LEAD-ACID-BASED MARINE BATTERY BY MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL MARINE BATTERY MARKET SHARE BY SHIP TYPE, 2021 VS 2028 (%)

7. GLOBAL COMMERCIAL MARINE BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL DEFENSE MARINE BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL MARINE BATTERY MARKET SHARE BY BATTERY DESIGN, 2021 VS 2028 (%)

10. GLOBAL SOLID-STATE MARINE BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL FLOW MARINE BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL MARINE BATTERY MARKET SHARE BY NOMINAL CAPACITY, 2021 VS 2028 (%)

13. GLOBAL MARINE BATTERY OF <100 AH MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL MARINE BATTERY OF 100–250 AH MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL MARINE BATTERY OF >250 AH MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL MARINE BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. US MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

19. UK MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD MARINE BATTERY MARKET SIZE, 2021-2028 ($ MILLION)