Marine Electronics Market

Marine Electronics Market Size, Share & Trends Analysis Report by Component Type (Hardware, and Software), and by Application (Merchant Marine Electronics, Fishing Vessel Electronics, Yacht/Recreation Boat Electronics, Military Naval Electronics, Autonomous Shipping Electronics, Smart Boat Electronics, and Underwater Drone Electronics) Forecast Period (2024-2031)

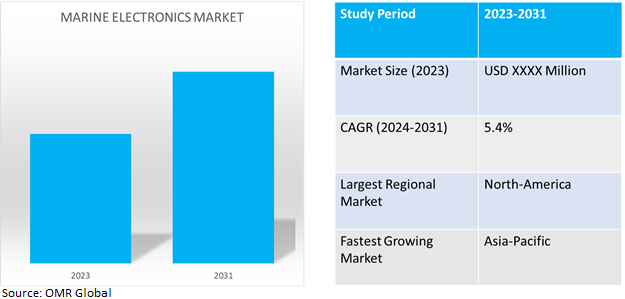

Marine electronics market is anticipated to grow at a considerable CAGR of 5.4% during the forecast period (2024-2031). The market growth is attributed to growing seaborne trade, development of novel marine vessels, growing demand for marine electronics in recreational boating industry, andincreasing emphasis on marine vessel safety. Further, the market trends are moving towards development of autonomous and unmanned marine vessels, growing adoption of electric and hybrid propulsion systems, and rising development of naval vessels, such as submarines, ships, and aircraft carrier.

Market Dynamics

Growth in the Recreational Boating and Fishing Industry,

The recreational boating industry has seen a surge in demand, post-pandemic especially in developed countries. For instance, according to the National Marine Manufacturer Association (NMMA), retail unit sales of new powerboats in the US reached a 13-year high in 2020 with nearly 320,000 units sold, up 13.0% compared to 2019, comprising Personal Watercraft (PWC), including Jet Ski, Sea-Doo and Wave Runner, were up 8.0% to 82,500 units in 2020.Theannual sales of boats, marine products, and services totaled $49.3 billion in 2020, up 14.0% from 2019.

Simultaneously, a large chunk of the population in several countries indulged in fishing creating a derived demand for the boating industry. For instance, according to the American Sportfishing Association, 42 million Americans ages 6 and over freshwater fished in 2022, representing 7 in 10 total fishing participants. Freshwater's national participation rate rose to 14.0%, up from 13.0% in 2021. Average outings per freshwater angler held steady at 15.0%, while total outings increased 2.0% to 634 million

Development in Offshore Renewable Energy

Offshore renewable energy is getting traction globally due to its advocacy by governments to promote clean electricity and its high feasibility including higher speed of winds, greater consistency, and lack of physical interference from land or human-made objects. Marine electronics are used for remote control and monitoring, power management, maintenance and repair, and data transmission in offshore renewable energy plants. For instance, according to the European Union Blue Economy Observatory, by 2030, the EU Offshore Renewable Energy Strategy aims to have at least 60 GW of offshore wind and 1 GW of ocean energy built. In addition, as part of the European Green Deal, plans are underway to deploy 300 GW of offshore wind energy by 2050, accounting for around 30.0% of future EU electricity, with an intermediate objective of reaching 60 GW by 2030.

Market Segmentation

Our in-depth analysis of the global marine electronics market includes the following segments by component type and application:

- Based on component type, the market is segmented into hardware and software.

- Based on application, the market is segmented into merchant marine electronics, fishing vessel electronics, yacht/recreation boat electronics, military naval electronics, autonomous shipping electronics, smart boat electronics, and underwater drone electronics.

Hardware to remain the Largest Segment

The marine hardware segment is expected to hold the largest share of the market. The primary factor supporting the segmental growth is the harsh condition of working in the marine industry. The vessels are used for commercial purposes and require reliable components to withstand adverse weather conditions in the deep sea. The demand for high-quality hardware is leading to segmental growth.

Autonomous shipping electronics to emerge as the largest sub-segment

Demand for autonomous features and vehicles is growing in the transport industry, and several developments in the marine vessels have been introduced with the integration of semi-autonomous, and autonomous features such as autonomous navigation systems, autonomous survey vessels, autonomous marine robotic systems, and others. For instance, in September 2020, Ocean Research and IBM announced the completion and launch of the Mayflower Autonomous Ship (MAS), an AI and solar-powered marine research vessel that will traverse oceans gathering vital environmental data. The same vessel has crossed many countries pioneering autonomous ships. Also, advancements in electronic components and technology will contribute to the growth of this sub-segment. For instance, in November 2023, Japan Radio Company (JRC) participated in the Joint Technological Development Program for the demonstration test of fully autonomous ships under the MEGURI 2040 Fully Autonomous Ship Project*1 (MEGURI2040), which is administered by the Nippon Foundation and is accompanied by JRC's autonomous navigation system. The autonomous navigation system was installed on the 11,413 gross ton large RORO cargo ship ‘HOKURENMARU No. 2’ operated by KAWASAKI KINKAI KISEN KAISHA, Ltd. (Kawasaki Kinkai Kisen) for a total of three voyages.

Regional Outlook

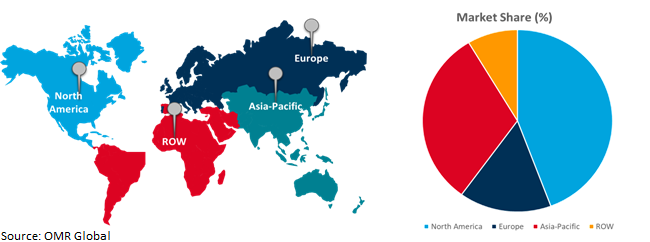

The globalmarine electronics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Marine Electronics Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to huge defense spending and the recreational boating industry. The US has remained the biggest investor on defense collectively. For instance, in 2025 Marine Corps requested a budget of $17.4 billion in operations and maintenance funding, $13.8 billion in procurement funding, $18.1 billion in personnel funding, $3 billion in research and development funding, and $1.4 billion in military construction funding. The US recreational boating industry is also on a boom post-COVID-19with huge growth due to a high number of individuals willing to spend on recreational boating for leisure.

Asia-Pacific Remains as the Fastest Growing

- Asia-Pacific region is home to some of the biggest ship manufacturers such as Mitsubishi, China Shipbuilding Group, and others, creating a market for marine electronics consumption.

- Asia-Pacific is also the biggest hub for export of goods and seaborne trade globally, with increasing port infrastructure, and trade, the region is expected to create demand for marine vessel manufacturing and exports.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global marine electronics market include Navico Group., Furuno Electric Co., Ltd., Garmin Ltd., Teledyne Technologies Inc., and Japan Radio Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2024, Navico Group announced a partnership with Oyster Yachts, a leading British manufacturer of bluewater sailing yachts. As a part of this new agreement, B&G, CZone, and Mastervolt will be the preferred electronics and power suppliers across Oyster’s fleet of 50-foot to 90-foot luxury sailing boats.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global marine electronics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Garmin Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Japan Radio Co., Ltd. (JRC)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Navico Group. (Brunswick Corp.)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Marine Electronics Market by Component Type

4.1.1. Hardware

4.1.2. Software

4.2. Global Marine Electronics Market by Application

4.2.1. Merchant Marine Electronics

4.2.2. Fishing Vessel Electronics

4.2.3. Yacht/Recreation Boat Electronics

4.2.4. Military Naval Electronics

4.2.5. Autonomous Shipping Electronics

4.2.6. Smart Boat Electronics

4.2.7. Underwater Drone Electronics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East and Africa

6. Company Profiles

6.1. Abengoa, S.A.

6.2. ACR Electronics, Inc.

6.3. AIRMAR Technology Corp

6.4. Alcom Marine Electronics

6.5. Atlantic Electronics Ltd.

6.6. Digital Yacht Ltd

6.7. Elcome International LLC

6.8. Furuno Electric Co., Ltd.

6.9. High Seas Technology

6.10. Icom Inc.

6.11. Jason Marine Group

6.12. Johnson Outdoors Inc.

6.13. Kongsberg Gruppen ASA

6.14. Marinsat Marine Electronics & IT Solutions

6.15. Maretron

6.16. ONWA Marine Electronics Co. Ltd

6.17. Teledyne Technologies Inc.

1. GLOBAL MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL MARINE HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MARINE SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL MERCHANT MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MARINE FISHING VESSEL ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL YACHT/RECREATION MARINE BOAT ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MILITARY NAVAL MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTONOMOUS SHIPPING MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SMART MARINE BOAT ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL UNDERWATER DRONE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2023-2031 ($ MILLION).

15. NORTH AMERICAN MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

16. EUROPEAN MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION).

17. EUROPEAN MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2023-2031 ($ MILLION).

18. EUROPEAN MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

19. ASIA-PACIFIC MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION).

20. ASIA-PACIFIC MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2023-2031 ($ MILLION).

21. ASIA-PACIFIC MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

22. REST OF THE WORLD MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION).

23. REST OF THE WORLD MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2023-2031 ($ MILLION).

24. REST OF THE WORLD MARINE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION).

1. GLOBAL MARINE ELECTRONICS MARKET SHARE BY COMPONENT TYPE, 2023 VS 2031 (%)

2. GLOBAL MARINE HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MARINE SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MARINE ELECTRONICS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL MERCHANT MARINE ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MARINE FISHING VESSEL ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL YACHT/RECREATION MARINE BOAT ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MILITARY NAVAL MARINE ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTONOMOUS SHIPPING MARINE ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SMART MARINE BOAT ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL UNDERWATER DRONE ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MARINE ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

15. UK MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

27. THE MIDDLE EAST AND AFRICA MARINE ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)