Meat Snacks Market

Global Meat Snacks Market Size, Share & Trends Analysis Report by Product (Jerky, Sticks, Sausages, Others) by Distribution Channel (Convenience Stores, Supermarket/Hypermarket, Online Store) Forecast period (2020-2026) Update Available - Forecast 2025-2035

The global meat snack market is projected to grow at a considerable CAGR of 5.6% during the forecast period (2020-2026). The meat snacks market is largely driven by the robust demands of protein-rich delicacies, especially among the millennial's (Generation Y) and Gen Z population segments. The greater attention to the healthfulness aspect of snacking has led to the emergence of meat bars as a snack category. Processing modifications, such as slow roasting of meat and value addition with exotic spices have successfully captured the imaginations of the younger generation of consumers, who are seeking complete and portable protein snacking solutions. The emerging popularity of grass-fed meat snacks that are preservative-free, portion-controlled with a variety of flavor profiles and bite types is expected to sustain the growth of meat snacks in relatively mature markets of developed countries. The packaging of meat snacks ensures the consumer about product quality and improves the shelf life of the products. The easily portable packaged snacks make it a convenient option for consumers requiring healthy meat snacks for on-the-go. The rapid growth of the e-commerce sector is again anticipated to drive the growth of the meat snack market across the globe owing to its ease of accessibility.

In a nutshell, COVID-19 has temporarily disrupted the production and supply chains around the globe. Social distancing and strict guidelines to contain the COVID-19 pandemic has affected the global economies. In the context of the COVID-19 pandemic, the organizations whose product supply chain has been affected due to the pandemic are looking for alternate supply chains to reach the consumers. In the third quarter of 2020, the organizations that have already developed an e-commerce network, and a distribution app for retailers and consumers are reaping additional benefits. Even during the lockdown period, the packaged meat snack manufacturers have an opportunity to convert their consumers into regular buyers by ensuring that the product is safe for consumption.

Segmental Outlook

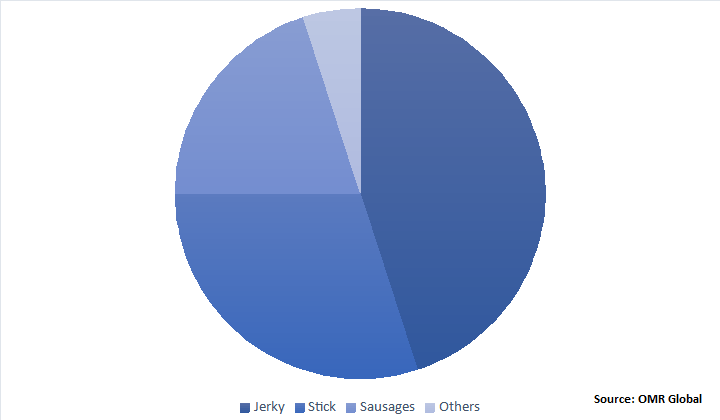

The meat snack market is segmented based on product type and distribution channels. Based on the product type, the meat snack market is segmented into jerky, sticks, sausages, and others. Based on the distribution channel, the meat snack market is segmented into convenience stores, supermarket/hypermarket, and online stores. Based on the distribution channels, supermarket/hypermarkets are considered to hold a major market share. The presence of a large number of supermarkets/ hypermarkets along with the availability of discounts on large quantity purchases at these places is a key factor driving the growth of this market segment.

Jerky to be considerable segment based on product type

Based on product type, jerky hold a considerable share in the meat snack market in 2018. Easy availability, affordability, and pleasing taste of beef jerky are the key factors contributing to the high share of jerky in the meat snack market. Duke’s, Field Trip, Jack Link’s, Krave, Slantshack, House of Jerkey, Blue Ox Jerky Co., Oh Boy Oberto, and so on are the major brands of jerky. Sausages are anticipated to exhibit considerable growth during the forecast period. Sausages are rapidly gaining confidence in non-traditional countries, such as India and China. The launch of new product forms such as handmade sausage crisps is likely to drive the growth of the sausages market.

Global Meat Snacks Market Share by Product Type, 2019 (%)

Regional Outlook

The global meat snacks market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to hold a major market share in the global meat snack market during the forecast period. The US is anticipated to hold a major market share in North America. The pivotal factors that are contributing to the growth of the market include the increased demand for convenient food amongst the people in the region. Owing to the quickening pace of life and changing lifestyles of people there has been an increased demand for the grab and go snacks across the region. Demands of protein-rich delicacies, especially among the millennial's (Generation Y) and Gen Z population segments is a key factor driving the meat snack market in North America.

Global Meat Snacks Market Growth, by Region 2020-2026

Asia-Pacific will augment with the significant growth rate in the meat snack market

Asia-Pacific meat snacks market has been witnessing optimal growth owing to the rising awareness regarding healthy on-the-go meat snacks, increasing disposable income, rising launches of innovative meat snacks, and expansion of global meat snacks manufacturers in the region. Consumers in Asia-Pacific countries are becoming potentially aware of the healthy benefits of meat snacks, which is driving the market growth in the region. The significant presence of the millennial population has further escalated the demand for healthy meat snacks in the region.

Market Players Outlook

PepsiCo, Inc., Conagra Brands Inc., Hormel Foods Corp., Jack Link's LLC, Thanasi Foods, and Beyond Meat, among others, are the major manufacturers of meat snacks. These manufacturers are adopting different growth strategies including capacity expansion, mergers and acquisitions, new product launch, and product innovation to remain competitive in the marketplace. For instance, in September 2020, Gov. Andy Beshear and executives from Wilde Brands Inc., a producer of high-protein, keto-diet-friendly snack chips made from all-natural chicken breast had announced to invest $9.8 million in its new distribution facility in Clark County.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global meat snacks market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Conagra Brands, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Hormel Foods Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. PepsiCo, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Jack Link's LLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. The Hershey Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Meat Snacks Market by Product

5.1.1. Jerky

5.1.2. Sticks

5.1.3. Sausages

5.1.4. Others

5.2. Global Meat Snacks Market by Distribution Channel

5.2.1. Convenience Stores

5.2.2. Supermarket/Hypermarket

5.2.3. Online Store

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Associated British Food Plc

7.2. Beyond Meat, Inc.

7.3. Big Chief Meat Snacks, Inc.

7.4. Bridgford Foods Corp.

7.5. Carl Buddig and Company

7.6. Conagra Brands, Inc.

7.7. Copperstone Foods, LLC

7.8. Country Archer Jerky Co.

7.9. FireCreek Snacks

7.10. Hormel Foods Corp.

7.11. Jack Link's LLC

7.12. Kerry Group

7.13. Kings Elite Snacks

7.14. Monogram Food Solutions LLC

7.15. New World Foods Pty, Ltd.

7.16. Oberto Sausage Co, Inc.

7.17. Old Trapper Beef Jerky

7.18. PepsiCo, Inc.

7.19. Stafford Meat Co.

7.20. The Hershey Co.

7.21. Werner Gourmet Meat Snacks, Inc.

1. GLOBAL MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL JERKY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL STICKS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SAUSAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

7. GLOBAL CONVENIENCE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL SUPERMARKET/HYPERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ONLINE STORE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. NORTH AMERICAN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

12. NORTH AMERICAN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

13. EUROPEAN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

15. EUROPEAN MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

19. REST OF THE WORLD MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

20. REST OF THE WORLD MEAT SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL MEAT SNACKS MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL MEAT SNACKS MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL MEAT SNACKS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD MEAT SNACKS MARKET SIZE, 2019-2026 ($ MILLION)