Meat Stabilizers Blends Market

Global Meat Stabilizers Blends Market Size, Share & Trends Analysis Report by Source (Animal-Based, Plant-Based, Synthetic, and Others) and by Application (Meat Processing, HoReCa, and Pet Food) and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global meat stabilizers blends market is growing at a significant CAGR of around 7.5% during the forecast period (2020-2026). The meat stabilizers blends are used in several applications, such as meat processing, to control moisture content of the meat and provide quality-based food products. The meat stabilizers blends market is driven by the growing meat consumption and pet adoption rate across the globe. The trend to adopt the companion animals is increasing across the globe especially in developed and emerging economies, which is driving the demand for pet food. As per Pet Food Manufacturer Association, there were more than 51 million pets in UK in 2018 and about 40% household had at least one pet in UK. Moreover, the urbanization plays a significant role in increasing the global demand for meat products at restaurants and hotels, owing to which, a considerable growth is estimated for the meat stabilizers blends market. However, the outbreak of COVID-19 pandemic in 2020 has slowed down the consumption rate of meat across the globe. This, in turn, has decreased the demand for meat products across the globe, affecting the global meat stabilizers blends market in 2020.

Segmental Outlook

The meat stabilizers blends market is classified on the basis of source and application. Based on source, the market is segmented into plant-based, animal-based, synthetic, and others. Based on application, the market is segregated into meat processing, HoReCa, and pet food.

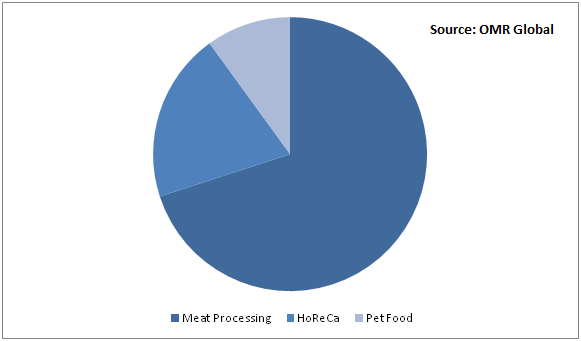

Global Meat Stabilizers Blends Market Share by Application, 2019 (%)

Global meat stabilizers blends market is driven by its rising application in meat processing

Meat stabilizers blends find significant application in meat processing application. The meat stabilizers blends for meat processing market is further estimated project a considerable CAGR during the forecast period. The growth of the segment is backed by the continuous increase in the demand for meat across the globe. The global meat consumption has been tripled in the last four decades and increased 20% in just the last 10 years, as per the World Watch Institute. These statistics are further expected to keep increasing during the forecast period, which in turn, will drive the growth of the global meat stabilizers blends market.

Regional Outlook

The global meat stabilizers blends market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global meat stabilizers blends market. The US plays the critical role in geographic contribution of North America in global meat stabilizers blends market, attributing to the increasing adoption of pets by US households and increasing meat consumption. The US has the highest 26.7 kg per capita consumption of Beef and Veal among major economies whereas China and South Korea had the highest 30.8 kg per capita pork meat consumption in 2019 according to OECD. Moreover, according to the 2019-2020 National Pet Owners Survey conducted by the American Pet Products Association (APPA), nearly 67.0% of the US household that accounts for 85 million families living in the US, owned at least a pet.

The overall spending of the US pet industry has also increased significantly in the past years. According to APPA, in 2019, around $95.7 billion was spent on pets in the US, out of which vet care & product sales were accounted for around $29.3 billion. In addition to this, for 2020, it is estimated by APPA that the spending will go to approximately $99 billion for pets in the US. As the expenditure increases, the demand for pet food is also expected to increase significantly, thereby, creating opportunities for growth of the market during the forecast period.

Global Meat Stabilizers Blends Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global meat stabilizers blends market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. Increasing meat production coupled with the introduction of new market entrants in the region. China consumes nearly 25.0% of the total meat produced across the globe every year, as stated by the USDA. According to the Foreign Agricultural Service (FAS), the country’s beef and veal consumption accounted for around 8,530 metric tons in 2018. This, in turn, is increasing the meat industry in the region, which in turn, is augmenting the demand for meat stabilizers blends in Asia-Pacific.

Market Players Outlook

The key players in the meat stabilizers blends market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global meat stabilizers blends market include Amesi Group, Caldic B.V., Cargill, Inc., DuPont de Nemours, Inc., ICL Innovation, and Meat Cracks Technologie GmbH. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global meat stabilizers blends market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Meat Stabilizers Blends Market by Source

5.1.1. Plant

5.1.2. Animal

5.1.3. Synthetic

5.1.4. Others (Seaweed and Microbial)

5.2. Global Meat Stabilizers Blends Market by Application

5.2.1. Meat Processing

5.2.2. HoReCa

5.2.3. Pet Food

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amesi Group

7.2. Arthur Branwell

7.3. Ashland

7.4. Caldic B.V.

7.5. Cargill, Inc.

7.6. DuPont de Nemours, Inc.

7.7. ICL Innovation

7.8. Lucid Colloids Ltd.

7.9. Meat Cracks Technologie GmbH

7.10. Pacific Blends

7.11. Palsgaard A/S

7.12. Tate & Lyle PLC

1. GLOBAL MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

2. GLOBAL PLANT-BASED MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ANIMAL-BASED MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SYNTEHTIC MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

7. GLOBAL MEAT STABILIZERS BLENDS FOR MEAT PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL MEAT STABILIZERS BLENDS FOR HORECA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MEAT STABILIZERS BLENDS FOR PET FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

16. EUROPEAN MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD MEAT STABILIZERS BLENDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MEAT STABILIZERS BLENDS MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

2. GLOBAL MEAT STABILIZERS BLENDS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL MEAT STABILIZERS BLENDS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD MEAT STABILIZERS BLENDS MARKET SIZE, 2019-2026 ($ MILLION)