Medical Cameras Market

Global Medical Cameras Market Size, Share & Trends Analysis Report by Type (Endoscopy Cameras, Dermatology cameras, Ophthalmology Cameras, Dental Cameras, Surgical Microscopy Cameras and Others Medical Cameras) By Sensors (CMOS, and CCD) By Resolution (SD, and HD) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global medical cameras market is anticipated to grow at a CAGR of around 7.2% during the forecast period (2021-2027). The factors that are augmenting the growth of the global medical cameras market include the rising number of surgical procedures globally, growing demand for advanced visual solutions to get visual representation during surgeries, technology developments, and increasing endoscopy procedures. For instance, according to the International Society of Aesthetic Plastic Surgery, in 2019, there was a total of 11,363,569 plastic surgical procedures were performed globally, of which 1,493,673 procedures were performed in Brazil. Medical cameras during surgical procedures are used to visualize the internal organs of the human body, and the techniques captured by these cameras are further be used for training and analysis purposes. Moreover, the shift towards minimal-invasive surgery procedures along with the advancements in technology for surgeries accelerated the demand for advanced visualization solutions such as medical cameras.

Moreover, the lack of trained professionals and the high cost of the medical cameras are the factors that may restrain the growth of the market during the forecast period. Further, the emerging countries along with healthcare infrastructure developments can offer lucrative opportunities to the market during the forecast period. Besides, the government support in form of funding for healthcare sector development can also provide lucrative opportunities in the market. For an instance, in September 2020, the UK government has announced to provide funding of $44.02 million to six projects to develop revolutionary technological approaches to transform care in the NHS by 2050. Under this funding, $7.43 million was provided to the InlightenUs project, which was led by the University of Edinburgh, to use a combination of artificial intelligence (AI) and infra-red lasers to produce fast, high resolution 3D medical images, helping to identify diseases in patients more quickly.

Impact of COVID-19 on Global Medical Cameras Market

The global medical cameras market was hardly impacted by the outbreak of the COVID-19 pandemic. Due to lockdown, a large number of surgical procedures were delayed or cancelled, which has affected the demand for medical cameras. Moreover, the reduction in endoscopy procedures has also affected the overall growth of the medical cameras. According to Clinical Endoscopy, as of March 2020, the number of endoscopy procedures reduced by 44% compared to the previous year. The gastroscopy examinations were reduced by 39% and lower endoscopy by 57%. The demand for new medical cameras from hospitals and clinics were also reduced due to the smaller number of patient visits in the hospitals owing to the mobility restrictions. Asia-Pacific countries such as China and India were majorly affected by the COVID-19 pandemic due to having a large number of patient bases affected with multiple chronic diseases, and the number of surgical procedures performed in these countries every year.

Segmental Outlook

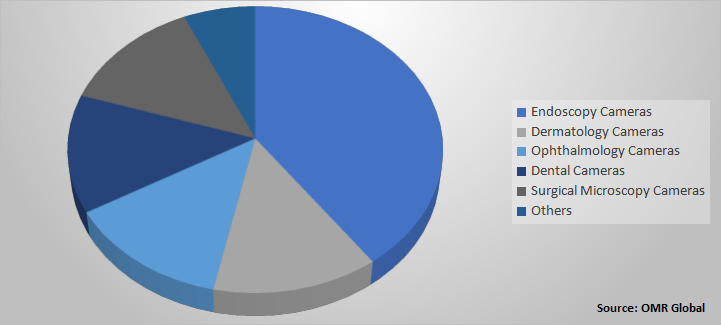

The global medical cameras market is segmented based on type, sensor, and resolution. Based on type, the market is segregated into endoscopy cameras, dermatology cameras, ophthalmology cameras, dental cameras, surgical microscopy cameras, and others. Among these, the endoscopy cameras segment dominated the market in 2020, and it is expected that it will further maintain its dominance during the forecast period. The segment growth is mainly attributed to the increasing number of endoscopy procedures globally. Based on the sensor, the market is bifurcated into CMOS sensors and CCD sensors. The CMOS sensor is accounted for the highest growth rate owing to the advantages associated with the CMOS compared to CCD cameras. Similarly, based on resolution, the market is divided into standard definition (SD) cameras and high-definition (HD) cameras. Based on the resolution, HD cameras holds the leading position in the market due to their high demand in the medical industry for capturing high-quality images.

Global Medical Cameras Market Share by Type, 2020 (%)

The Endoscopy Cameras Segment Accounted for the Largest Share in the Global Medical Cameras Market

Among the type of cameras, the endoscopy cameras segment is projected to grow with significant CAGR during the forecast period. Endoscopy is a medical procedure that allows a doctor to inspect and observe the inside of the body without performing major surgery. The rising endoscopy procedures globally are one of the major factors driving the growth of the segment. There are various diseases or medical conditions that can be detected by the endoscopy without undergoing the surgical procedure, and endoscopy cameras provide better results in most settings, such as SDI endoscopy cameras have the benefit of perfect quality video footage without any visual latency. This is the major reason the adoption of endoscopy cameras is growing in hospitals and clinics. On the other hand, endoscopy surgeries done by endoscopy cameras cause less trauma to soft tissue and muscles and provides numerous benefits. With growing geriatric population affected with numerous chronic diseases will increase the number of endoscopy procedures, which will further create the demand for endoscopy cameras during the forecast period.

Regional Outlook

Geographically, the global Medical Cameras market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Among these, Asia-Pacific is estimated to be the fastest-growing during the forecast period. The development in healthcare infrastructure, large patients base, increasing surgical procedures, and developments in medical cameras technology are the major factors driving the growth of the market in the region. Moreover, huge investment in R&D, technological advancement, and favorable laws set by the government are also prominent factors accelerating the growth of the market.

Global Medical Cameras Market Growth, By Region 2021-2027

North America Projected to Hold Dominant Position in the Global Medical Cameras Market

Geographically, North America held the leading position in the market in 2020, and it is estimated that it will maintain its dominance by accounting largest share in the market during the forecast period. In North America, the US contributes the major share in terms of revenue. The presence of key players such as Stryker Corp., Danaher Corp., Carestream Dental LLC, among others and technology development in medical cameras by them is the reason that driving the growth of the medical cameras market in the US. For instance, in March 2019, Stryker Corp announced the launch of transformative visualization tools HipCheck, HipMap, the 1688 Advanced Imaging Modalities (AIM) 4K Visualization Platform, and the Connected OR Hub designed to enhance the surgical experience for arthroscopy. Moreover, increasing surgical procedures that require medical cameras, and a rising aging population are also the factors significantly enhancing the market growth.

Market Players Outlook

The key players in the medical cameras market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Basler AG, Canon Inc., Carestream Dental LLC, Carl Zeiss AG, Danaher Corp., Olympus Corp, Richard Wolf GmbH, Smith & Nephew PLC, Sony Corp., Stryker Corp., Topcon Corp., among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in October 2019, Canon Medical Systems Corp. has expanded its business by opening its Middle East Division in Canon Middle East Dubai, UAE to deliver the best medical imaging solutions to the hospitals sector in the region.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Medical Cameras market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Medical Cameras Industry

• Recovery Scenario of Global Medical Cameras Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Porter’s Analysis

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Medical Cameras Market by Type

5.1.1. Endoscopy Cameras

5.1.2. Dermatology Cameras

5.1.3. Ophthalmology Cameras

5.1.4. Dental Cameras

5.1.5. Surgical Microscopy Cameras

5.1.6. Other Medical Cameras

5.2. Global Medical Cameras Market by Sensor

5.2.1. CMOS Sensors

5.2.2. CCD Sensors

5.3. Global Medical Cameras Marketby Resolution

5.3.1. Standard Definition (SD) Cameras

5.3.2. High-definition (HD) Cameras

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. ATMOS MedizinTechnik GmbH & Co. KG

7.2. Basler AG

7.3. Canon Inc.

7.4. Carestream Dental LLC.

7.5. Carl Zeiss AG

7.6. CYMO B.V.

7.7. Dage-MTI

7.8. Diaspective Vision GmbH

7.9. ESC Medicams

7.10. Equitech Engineers Private Ltd.

7.11. IDS Imaging Development Systems GmbH

7.12. IMPERX, Inc

7.13. Medicam

7.14. Olympus Corp.

7.15. Optomed Plc

7.16. Richard Wolf GmbH

7.17. SCHÖLLY FIBEROPTIC GMBH

7.18. Smith & Nephew plc

7.19. Sony Corp.

7.20. Stryker Corp.

7.21. Topcon Corp.

1. GLOBAL MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL ENDOSCOPY MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL DERMATOLOGY MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL OPHTHALMOLOGY MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL DENTAL MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL SURGICAL MICROSCOPY MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHERS MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY SENSOR, 2020-2027 ($ MILLION)

9. GLOBAL CMOS SENSORS BASED MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL CCD SENSORS BASED MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY RESOLUTION, 2020-2027 ($ MILLION)

12. GLOBAL STANDARD DEFINITION (SD) MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL HIGH-DEFINITION (HD) MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. NORTH AMERICAN MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

16. NORTH AMERICAN MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY SENSOR, 2020-2027 ($ MILLION)

17. EUROPEAN MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. EUROPEAN MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

19. EUROPEAN MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY SENSOR, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

22. ASIA-PACIFIC MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY SENSOR, 2020-2027 ($ MILLION)

23. REST OF THE WORLD MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. REST OF THE WORLD MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

25. REST OF THE WORLD MEDICAL CAMERAS MARKET RESEARCH AND ANALYSIS BY SENSOR, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MEDICAL CAMERAS MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MEDICAL CAMERAS MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL MEDICAL CAMERAS MARKET, 2020-2027 (%)

4. GLOBAL MEDICAL CAMERAS MARKET SHARE BY TYPE,2020 VS 2027 (%)

5. GLOBAL MEDICAL CAMERAS MARKET SHARE BY SENSOR, 2020 VS 2027 (%)

6. GLOBAL MEDICAL CAMERAS MARKET SHARE BY RESOLUTION, 2020 VS 2027 (%)

7. GLOBAL MEDICAL CAMERAS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL ENDOSCOPY MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL DERMATOLOGY MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL OPHTHALMOLOGY MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL DENTAL MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL SURGICAL MICROSCOPY MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL OTHERS MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL CMOS SENSORS MEDICAL CAMERAS MARKET RESEARCH SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL CCD SENSORS MEDICAL CAMERAS MARKET RESEARCH SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL STANDARD DEFINITION (SD) MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL HIGH-DEFINITION (HD) MEDICAL CAMERAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. US MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

19. CANADA MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

20. UK MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

21. FRANCE MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

22. GERMANY MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

23. ITALY MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

24. SPAIN MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF EUROPE MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

26. INDIA MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

27. CHINA MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

28. JAPAN MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

29. SOUTH KOREA MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF ASIA-PACIFIC MEDICAL CAMERAS MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD MEDICAL CAMERAS MARKET SIZE, 2021-2027($ MILLION