Medical Gloves Market

Global Medical Gloves Market Size, Share & Trends Analysis Report by Material (Latex, Nitrile, Vinyl, Neoprene, and Others), By Type (Medical Gloves and Reusable/ Non-Medical Gloves), By Application (Examination and Surgical), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global medical gloves market is projected to grow at a significant CAGR during the forecast period. The key factors that drive the market include the benefits offered by medical gloves. Medical gloves are vital in microbial protection, both for medical professionals and patients. As per the CDC, gloves are used by health professionals in order to minimize the risk of microbial transmission from patients to medical personnel, protect patients against the transfer of bacterial flora from medical workers, minimize the contamination of the hands of medical personnel with transient microbial flora which may be transferred from one patient to another. Gloves reduce the likelihood of contamination of the hands with bacterial flora by about 70–80%.

Further, the increased incidences of infectious diseases also encourage the adoption of these gloves amongst the users. Besides, some microorganisms, such as hepatitis B or herpes virus, can pass through the microscopic pores formed during normal use of gloves or be transferred when gloves are removed from the hands in a non-aseptic manner. Thus, for this situation, medical gloves are mandated, which in turn, enhances the growth of the market during the forecast period. However, to ensure that the gloves preserve their protective function, appropriate care should be taken during their handling and use. It is also necessary to remove them from the hands with due care and dispose of them immediately after use, thereby reducing the likelihood of cross-transmission of microorganisms.

Segmental Outlook

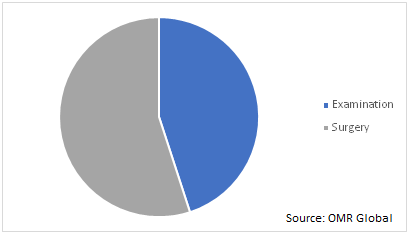

The medical gloves market is segmented based on material, type, and application. Based on the material, the market is segmented into natural rubber latex, nitrile, vinyl, neoprene, and others. Based on the type, the market is segmented into disposable gloves and reusable/ non-disposable gloves. Further, based on the applications, the market is segmented into the examination, and surgical. The surgical segment is expected to hold significant market share.

Global Medical Gloves Market, by Application 2019 (%)

Surgical Gloves to Hold Significant Market Share

Amongst the applications segment of the market, the surgical segment is estimated to hold the most significant share in the market during the forecast period. The segmental growth of the market is accredited to the increase in the number of surgical procedures and higher quality offered by the gloves during the surgeries. Gloves are the most useful item in surgery to maintain hygiene and safety. The easy availability and cost-effectiveness of these gloves make them an incomparable medical item in the context of various uses. Thus, the segment is likely to witness significant growth in the market during the forecast period.

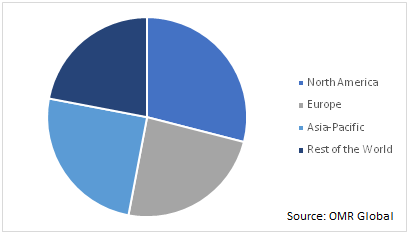

Regional Outlook

The global medical gloves market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America region is estimated to grow significantly during the forecast period. The growth of the region is backed by several factors including a significant presence of diversified healthcare industry coupled with stringent regulation that mandates the use of medical gloves for safety purposes.

According to the Center for Medicare and Medicaid Services, in 2018, the US national healthcare expenditure was around $3.6 trillion showing a 4.4% increase in healthcare expenditure up from 3.9% in 2017. It is further expected to reach $6.0 trillion by 2027. The US has the highest healthcare spending across the globe. In the US, the per capita healthcare expenditure per person in 2018 was around $10,800. Thus, high expenditure is likely to support the growth of the market.

Global Medical Gloves Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global medical gloves market include 3M CO., Ansell ltd., Honeywell International Inc., Kimberly-Clark Corp., The Top Glove Corp. Bhd, B. Braun Melsungen AG, Jiangsu Jaysun Glove Co. Ltd., Cardinal Health, Inc., Kossan Rubber Industries Bhd, and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global medical gloves market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical gloves market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. 3M Co.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Top Glove Corp. Bhd.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Ansell Ltd.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Kimberly-Clark Corp.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Medical Gloves Market by Material

5.1.1. Latex

5.1.2. Nitrile

5.1.3. Vinyl

5.1.4. Neoprene

5.1.5. Others

5.2. Global Medical Gloves Market by Type

5.2.1. Disposable Gloves

5.2.2. Reusable/ Non-Disposable Gloves

5.3. Global Medical Gloves Market by Application

5.3.1. Examination

5.3.2. Surgical

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M CO.

7.2. Akzenta International SA

7.3. Ansell Ltd.

7.4. B. Braun Melsungen AG

7.5. Berner International GmbH

7.6. Cardinal Health, Inc.

7.7. Cypress Medical Products, LLC

7.8. Diamond Gloves Inc

7.9. Hartalega Holdings Berhad

7.10. Honeywell International Inc.

7.11. Jiangsu Jaysun Glove Co. Ltd.

7.12. Kimberly-Clark Corp.

7.13. Kossan Rubber Industries Bhd

7.14. Lakeland Inc.

7.15. Marvel Gloves Industries

7.16. McKesson Corp.

7.17. Medline Industries Inc.

7.18. Mölnlycke Health Care AB

7.19. Rubberex Corp. M Bhd

7.20. Semperit AG Holding

7.21. Supermax Healthcare Inc.

7.22. Top Glove Corp. Bhd

1. GLOBAL MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL LATEX MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL NITRILE MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL VINYL MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL NEOPRENE MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

8. GLOBAL DISPOSABLE MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL REUSABLE/ NON-DISPOSABLE MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. GLOBAL MEDICAL GLOVES FOR EXAMINATION APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MEDICAL GLOVES FOR SURGICAL APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

16. NORTH AMERICAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. EUROPEAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

20. EUROPEAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. EUROPEAN MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

26. REST OF THE WORLD MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

27. REST OF THE WORLD MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

28. REST OF THE WORLD MEDICAL GLOVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MEDICAL GLOVES MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL MEDICAL GLOVES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL MEDICAL GLOVES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL MEDICAL GLOVES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

7. UK MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD MEDICAL GLOVES MARKET SIZE, 2019-2026 ($ MILLION)