Medical Imaging Workstation Market

Medical Imaging Workstation Market Size, Share & Trends Analysis Report, By Component (Visualization Software, Display Units, Others) By Modality (Computed Tomography (CT), Magnetic Resonance Imaging, Ultrasound, Mammography, Others), By Usage Mode (Thick Client Workstation, Thin Client Workstation), Forecast Period (2022-2030) Update Available - Forecast 2025-2031

Medical imaging workstation market is anticipated to grow at a CAGR of 5.5% during the forecast period. The ongoing technological advancements in imaging systems that require sophisticated operating units and workstations for smooth operation are key factors driving the growth of the global medical imaging workstation market. The rising prevalence of chronic disorders coupled with the rising healthcare expenditure is driving the global market. Additionally, the introduction of advanced display and image processing modalities is anticipated to boost the existing workstation and further fuel the market growth.

For instance, in February 2022, Canon Medical Systems Europe introduced UltraExtend NX, a cost-effective solution for efficient yet affordable clinical case management and follow-up. UltraExtend NX offers a complete offline workflow from organizing, reviewing, and analyzing clinical data to documenting and reporting results. The software platform leverages Canon's raw data architecture, which allows users to streamline their workflow while freeing up the ultrasound machine for time-consuming procedures. Further, in December 2021, Lenovo and LG Electronics collaborated to advance new medical imaging solutions for the radiology community. The offering bundles LG’s medical monitors with the Lenovo OEM Solutions commercial third-party portfolio of offerings.

Segmental Outlook

The global medical imaging workstation market is segmented based on component, modality, and usage mode. Based on components, the market is segmented into visualization software, display units, and others. Based on modality, the market is segmented into Computed Tomography (CT), magnetic resonance imaging, ultrasound, mammography, and others. Based on usage mode, the market is segmented into thick client workstations and thin client workstations.

Ultrasound Held Considerable Share in Global Medical Imaging Workstation Market

Rising technological advancements and the growing prevalence of chronic diseases are the major factors propelling the growth of the ultrasound workstation market. According to the World Health Organization, Cancer was a leading cause of mortality worldwide, accounting for nearly 10 million mortalities in 2020, or nearly one in six deaths. The most common cancers are breast, lung, colon rectum, and prostate cancers. Additionally, according to estimates from the International Agency for Research on Cancer (IARC) updates from July 2021, by 2040, the global burden of cancers is expected to grow to 27.5 million new cancer cases and 16.3 million deaths worldwide.

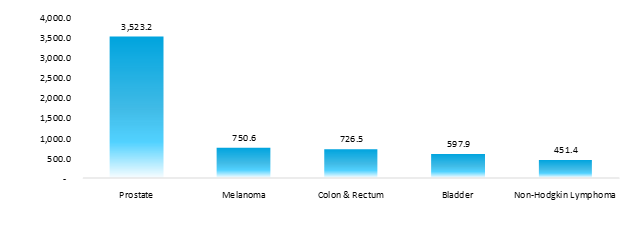

Estimated numbers of survivors for the 5 most prevalent cancers among Men in the US as of January 1, 2022 (in’ 000)

Source: American Cancer Society, Inc.

In March 2022, Royal Philips launched the Ultrasound Workspace at the American College of Cardiology’s Annual Scientific Session & Expo (ACC 2022). Philips Ultrasound Workspace is an industry-leading vendor-neutral echocardiography image analysis and reporting solution that can be accessed remotely via a browser. Clinicians can now leverage seamless diagnostic workflows from the ultrasound exam room to the reporting room and beyond, wherever echocardiography data needs to be reviewed and analyzed. New product launches is further contributing to the growth of this market segment.

Regional Outlooks

The global medical imaging workstation market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America).

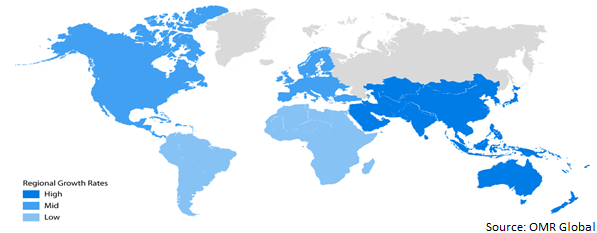

Global Medical Imaging Workstation Market Growth, by Region 2023-2030

North America Held Considerable Share in the Global Medical Imaging Workstation Market

The presence of well-established healthcare infrastructure, growing geriatric population, and high awareness among patients towards early diagnosis of diseases are major factors driving the regional market growth. For instance, in May 2023, the American Hospital Association's annual survey of hospitals in the US reports a total of 6,129 hospitals in the country, with 5,157 of them being community hospitals. The presence of a large number of diagnostic centers, growing prevalence of targeted diseases, rising healthcare expenditure, and adoption of technologically advanced imaging systems are further aiding to high share of the regional market.

Market Players Outlook

The major companies serving the global medical imaging workstation market include Fujifilm Holdings Corp., Siemens AG, Koninklijke Philips NV, General Electric Co., and Hologic, Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

For instance, In February 2023, Agfa and Lunit collaborated to deliver clinicians a new critical findings notification workflow, by integrating the Lunit INSIGHT CXR software in the MUSICA Workstation. Radiographers will automatically be notified in case of life-threatening pathologies detected in chest X-rays such as pneumothorax, pleural effusion, and atelectasis. This will help hospitals ensure patient safety with timely communication to clinicians in the event of urgent and unexpected findings, especially in outpatient settings where patients return home after their X-ray exams.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical imaging workstation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Fujifilm Holdings Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hologic, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Koninklijke Philips NV

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medical Imaging Workstation Market by Component

4.1.1. Visualization Software

4.1.2. Display Unit

4.1.3. Other

4.2. Global Medical Imaging Workstation Market by Usage Mode

4.2.1. Thick Client Workstation

4.2.2. Thin Client Workstation

4.3. Global Medical Imaging Workstation Market by Modality

4.3.1. Computed Tomography (CT)

4.3.2. Magnetic Resonance Imaging

4.3.3. Ultrasound

4.3.4. Mammography

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East And Africa

6. Company Profiles

6.1. Agfa-Gevaert N.V.

6.2. Aycan Medical Systems, LLC

6.3. Barco NV

6.4. Benetec Medical Systems

6.5. Carestream Health, Inc.

6.6. EIZO Inc.

6.7. Esaote SPA

6.8. JPI Healthcare Solutions

6.9. Konica Minolta Healthcare Americas, Inc.

6.10. Medical Scientific Ltd.

6.11. Merge Healthcare Solutions, Inc. (a part of IBM Watson)

6.12. Neusoft Corp.

6.13. Novarad Corp.

6.14. PerkinElmer, Inc.

6.15. PLANMED OY

6.16. Sectra AB

1. GLOBAL MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL VISUALIZATION SOFTWARE IN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL MEDICAL IMAGING WORKSTATION DISPLAY UNIT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL MEDICAL IMAGING WORKSTATION OTHER COMPONENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY USAGE MODE, 2022-2030 ($ MILLION)

6. GLOBAL THICK CLIENT WORKSTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL THIN CLIENT WORKSTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY MODALITY, 2022-2030 ($ MILLION)

9. GLOBAL MEDICAL IMAGING WORKSTATION FOR COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL MEDICAL IMAGING WORKSTATION FOR HEALTHCARE & LIFESCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL MEDICAL IMAGING WORKSTATION FOR ULTRASOUND MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL MEDICAL IMAGING WORKSTATION FOR MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL MEDICAL IMAGING WORKSTATION FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

17. NORTH AMERICAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY USAGE MODE, 2022-2030 ($ MILLION)

18. NORTH AMERICAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY MODALITY, 2022-2030 ($ MILLION)

19. EUROPEAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. EUROPEAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

21. EUROPEAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY USAGE MODE, 2022-2030 ($ MILLION)

22. EUROPEAN MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY MODALITY, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY USAGE MODE, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY MODALITY, 2022-2030 ($ MILLION)

27. REST OF THE WORLD MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

28. REST OF THE WORLD MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

29. REST OF THE WORLD MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY USAGE MODE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD MEDICAL IMAGING WORKSTATION MARKET RESEARCH AND ANALYSIS BY MODALITY, 2022-2030 ($ MILLION)

1. GLOBAL MEDICAL IMAGING WORKSTATION MARKET SHARE BY COMPONENT, 2022 VS 2030(%)

2. GLOBAL MEDICAL IMAGING WORKSTATION MARKET SHARE BY USAGE MODE, 2022 VS 2030(%)

3. GLOBAL MEDICAL IMAGING WORKSTATION MARKET SHARE BY MODALITY, 2022 VS 2030(%)

4. GLOBAL VISUALIZATION SOFTWARE IN MEDICAL IMAGING WORKSTATION MARKET SHARE BY REGION, 2022 VS 2030(%)

5. GLOBAL MEDICAL IMAGING WORKSTATION DISPLAY UNIT MARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBAL MEDICAL IMAGING WORKSTATION OTHER COMPONENT MARKET SHARE BY REGION, 2022 VS 2030(%)

7. GLOBAL THICK CLIENT WORKSTATION MARKET SHARE BY REGION, 2022 VS 2030(%)

8. GLOBAL THIN CLIENT WORKSTATION MARKET SHARE BY REGION, 2022 VS 2030(%)

9. GLOBAL MEDICAL IMAGING WORKSTATION FOR COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY REGION, 2022 VS 2030(%)

10. GLOBAL MEDICAL IMAGING WORKSTATION FOR HEALTHCARE & LIFESCIENCES MARKET SHARE BY REGION, 2022 VS 2030(%)

11. GLOBAL MEDICAL IMAGING WORKSTATION FOR ULTRASOUND MARKET SHARE BY REGION, 2022 VS 2030(%)

12. GLOBAL MEDICAL IMAGING WORKSTATION FOR MAMMOGRAPHY MARKET SHARE BY REGION, 2022 VS 2030(%)

13. GLOBAL MEDICAL IMAGING WORKSTATION FOR OTHERS MARKET SHARE BY REGION, 2022 VS 2030(%)

14. GLOBAL MEDICAL IMAGING WORKSTATION MARKET SHARE BY REGION, 2022 VS 2030(%)

15. US MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

17. UK MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

28. LATIN AMERICA MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)

29. MIDDLE EAST AND AFRICA MEDICAL IMAGING WORKSTATION MARKET SIZE, 2022-2030 ($ MILLION)