Medical Radiation Shielding Market

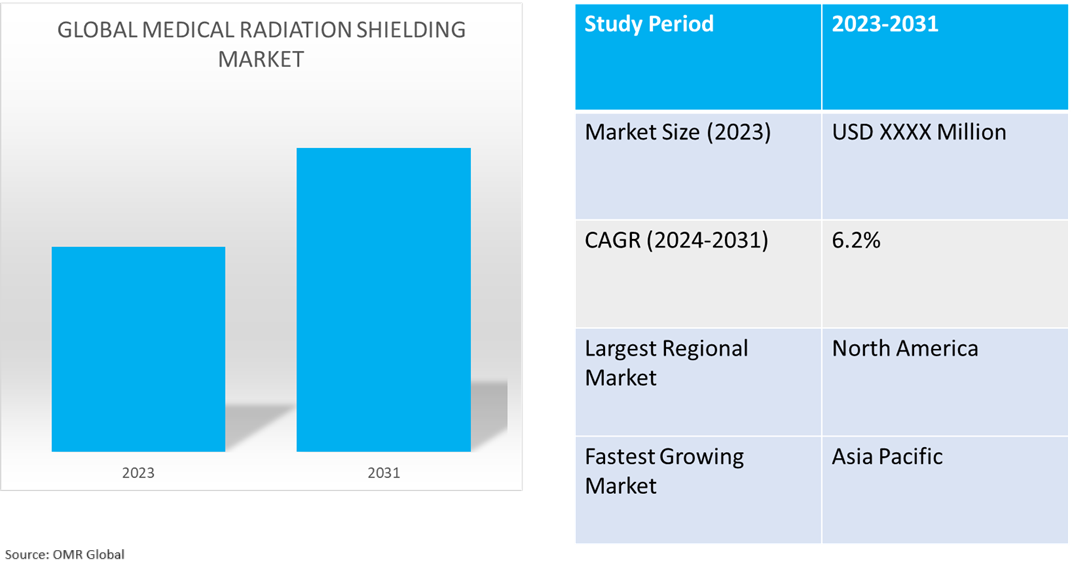

Medical Radiation Shielding Market Size, Share & Trends Analysis Report by Solution (Radiation Therapy Shielding and Diagnostic Shielding), and by End-User (Hospitals, Diagnostics centers and Other) Forecast Period (2024-2031)

Medical radiation shielding market is anticipated to grow at a significant CAGR of 6.2% during the forecast period (2024-2031). The market growth is attributed to pivotal factors such as the increase in safety awareness among practitioner while handling the radio-active system, increasing usage of nuclear medicine and radiation therapy for diagnosis and treatment, and rising incidences of chronic diseases including cancer. Medical radiation shielding is also used for radiologic applications including X-ray, MRI, and other diagnostic imaging applications, the increasing number of hospitals and installation base equipment and the rising number of diagnostic imaging centers also drive the growth of the radiation shielding market.

Market Dynamics

Rising Adoption of Nuclear Medicine and Radiation Therapy

The market is witnessing rapid growth due to the growing use of nuclear medicine and radiation therapy for the diagnosis and high prevalence of cancers. Nuclear medicine uses radiation to provide information about the functioning of a person's specific organs or to treat disease. Radiotherapy can be used to treat some medical conditions, especially cancer, using radiation to weaken or destroy targeted cells. According to the World Nuclear Association, the demand for radioisotopes rises by around 5% each year, and around 40 million nuclear medicine procedures are performed annually. About 1 in 50 individuals in developed nations (which account for 25% of the global population) use diagnostic nuclear medicine annually and the frequency of radioisotope therapy accounts for approximately one-tenth of these cases. In the US there are over 20 million nuclear medicine procedures per year, and in Europe about 10 million, with 2 million of these being therapeutic.

Increase in Adoption of Radiologic Applications

Medical radiation shielding is also utilized in radiologic applications such as MRIs, X-rays, and other forms of diagnostic imaging. The public, radiation workers (such as dentists and veterinarians), and even adjacent office workers may be exposed to radiation levels that exceed permitted exposure limits in the absence of shielding, which may have harmful health effects. The rising effort on building innovative healthcare infrastructures and increasing access to modern medical technology is expected to boost the market growth. New technology such as 7T MRI equipment, 4D and 5D ultrasound imaging, and high-slice CT scanners has been a key promoter of radiation shielding.

Market Segmentation

- Based on the solution, the market is segmented into radiation therapy shielding and diagnostic shielding.

- Based on the end-user, the market is segmented into hospitals, diagnostics centers, and others.

Diagnostic Shielding Segment to Hold a Considerable Market Share

The diagnostic shielding segment is projected for a significant market share in the given forecast period owing to the growing number of people suffering from oncological disorders that require a diagnosis. The most common human-made sources of ionizing radiation are medical devices, including X-ray machines and Computed Tomography (CT) scanners. Technological advancements and increasing the adoption rate of medical diagnostic equipment will spur segmental growth. The advancement of medical technology has witnessed remarkable progress in recent years. For instance, in January 2024, Carestream Health launched a new x-ray system called DXR-Excel Plus with features designed to help simplify workflow and enhance productivity. DXR-Excel Plus is a dual-purpose system that includes general radiology and fluoroscopy capabilities. It provides real-time imaging for various exams and offers features that improve user and administrator experiences.

Regional Outlook

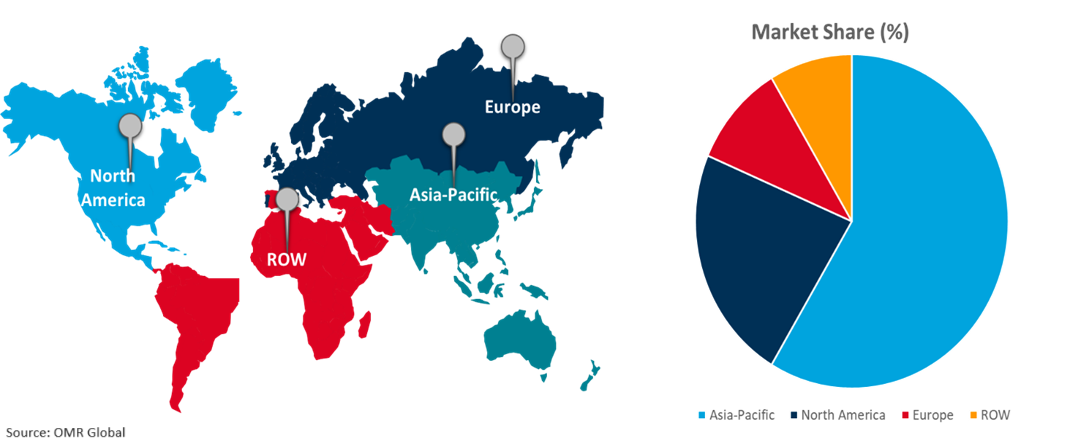

The global medical radiation shielding market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Medical Radiation Shielding Market Growth by Region 2024-2031

Asia Pacific Area to Expand At the Quickest Rate

Asia Pacific area to expand at the quickest rate owing to the rising prevalence of cancer, growing use of nuclear medicine and radiation therapy for diagnosis, expanding diagnostic imaging facilities, and increasing radiation safety awareness. In India, The Radiation Medicine Centre (RMC) of Bhabha Atomic Research Centre (BARC) in Mumbai, has become the nucleus for the growth of nuclear medicine in the country and carries out many patient investigations every year. Similarly, Tata Memorial Centre (TMC), provides comprehensive treatment for cancer and allied diseases and is one of the best radiation oncology centers in the country. Every year nearly 40,000 new patients visit the clinics from all over India and neighboring countries. Nearly 60% of these cancer patients receive primary care at the Hospital. Every year, about 6300 major surgeries and 6000 patients receiving chemotherapy and radiation therapy are handled by multidisciplinary programmes that provide well-established medical care

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to favorable government initiatives, a higher number of active nuclear power plants, increasing prevalence of cancer, and growing awareness of radiation safety, in this region. In 2022 more than 18 million Americans with a history of invasive cancer were alive. According to the American Cancer Society, in the US, an estimated 41 out of 100 men and 39 out of 100 women will develop cancer during their lifetime.

The US Nuclear Regulatory Commission (NRC) is committed to shielding the public and industrial workers from radiation risks associated with the many applications of radioactive materials in industry, academia, medicine, and science. The NRC conducts comprehensive technical reviews of radiation protection plans for all new reactor license applications in addition to Radiation Monitoring at Operating Nuclear Power Plants. The NRC's Health Physics staff examines public radiation safety, radioactive waste management, and occupational radiation protection. Furthermore, the NRC inspects radiation protection devices and design elements when new nuclear facilities are being built to make sure they adhere to the agency's set safety standards.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the medical radiation shielding market include ESCO Technologies Inc., MarShield (Mars Metal Company), ETS-Lindgren, Inc., Gaven Industries, Inc., Nelco, Inc., and Universal Medical Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2022, Radiaction Medical, Ltd received an additional 510(k) Clearance from the Food and Drug Administration (FDA) for its Radiation Shielding System, one that enables compatibility with the Siemens Artis family of fluoroscopy C-Arm machines. The Shield System functions as an accessory to new and legacy C-arm models. Building upon its previous clearance with Toshiba Infinix-I systems, this authorization permits the Shield System to be used in a greater number of interventional cardiology and electrophysiology labs across the US.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the medical radiation shielding market. Based on the availability of data, information related to new service deployment, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current End-User Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ESCO Technologies Inc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. MarShield Custom Medical Radiation Shielding Products (Mars Metal Company)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nelco, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medical Radiation Shielding Market by Solution

4.1.1. Radiation Therapy Shielding

4.1.1.1. Linear Accelerator

4.1.1.2. Multimodality

4.1.1.3. Proton Therapy

4.1.1.4. Cyclotron

4.1.1.5. Brachytherapy

4.1.2. Diagnostic Shielding

4.1.2.1. PET & SPECT

4.1.2.2. MRI

4.1.2.3. CT

4.1.2.4. Nuclear Medicine

4.1.2.5. X-Ray

4.2. Global Medical Radiation Shielding Market by Technology

4.2.1. Hospitals

4.2.2. Diagnostics centers

4.2.3. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. A&L Shielding

6.2. Alimed, Inc.

6.3. Amray Medical (Surg Equip,) Ltd.

6.4. Bar·Ray Products

6.5. Brown’s Medical Imaging

6.6. ETS-Lindgren, Inc.

6.7. Gaven Industries, Inc.

6.8. Global Partners in Shielding, Inc.

6.9. Globe Composite Solutions LLC.

6.10. Lite Tech, Inc. (Xenolite)

6.11. Mirion Technologies, Inc

6.12. Protech Medical LLC

6.13. Radiation Protection Products, Inc.

6.14. RadNet, Inc.

6.15. Ray Bar Engineering Corp.

6.16. Thogus.

6.17. Ultraray Group, Inc.

6.18. Universal Medical Inc.

6.19. Veritas Medical Solutions LLC

6.20. Von Gahlen Nederland B.V.

1. Global Medical Radiation Shielding Market Research And Analysis By Solution, 2023-2031 ($ Million)

2. Global Medical Radiation Shielding For Radiation Therapy Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Medical Radiation Shielding For Linear Accelerator Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Medical Radiation Shielding For Multimodality Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Medical Radiation Shielding For Proton Therapy Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Medical Radiation Shielding For Cyclotron Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Medical Radiation Shielding For Brachytherapy Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Medical Radiation Shielding For Diagnostic Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Medical Radiation Shielding For PET & SPECT Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Medical Radiation Shielding For MRI Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Medical Radiation Shielding For CT Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Medical Radiation Shielding For Nuclear Medicine Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Medical Radiation Shielding For X-Ray Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Medical Radiation Shielding Market Research And Analysis By End-User, 2023-2031 ($ Million)

15. Global Medical Radiation Shielding For Hospitals Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Medical Radiation Shielding For Diagnostics Centers Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Medical Radiation Shielding For Other End-Users Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Medical Radiation Shielding Market Research And Analysis By Region, 2022-2030 ($ Million)

19. North American Medical Radiation Shielding Market Research And Analysis By Country, 2023-2031 ($ Million)

20. North American Medical Radiation Shielding Market Research And Analysis By Solution, 2023-2031 ($ Million)

21. North American Medical Radiation Shielding Market Research And Analysis By End-User, 2023-2031 ($ Million)

22. European Medical Radiation Shielding Market Research And Analysis By Country, 2023-2031 ($ Million)

23. European Medical Radiation Shielding Market Research And Analysis By Solution, 2023-2031 ($ Million)

24. European Medical Radiation Shielding Market Research And Analysis By End-User, 2023-2031 ($ Million)

25. Asia-Pacific Medical Radiation Shielding Market Research And Analysis By Country, 2023-2031 ($ Million)

26. Asia-Pacific Medical Radiation Shielding Market Research And Analysis By Solution, 2023-2031 ($ Million)

27. Asia-Pacific Medical Radiation Shielding Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Rest Of The World Medical Radiation Shielding Market Research And Analysis By Region, 2023-2031 ($ Million)

29. Rest Of The World Medical Radiation Shielding Market Research And Analysis By Solution, 2023-2031 ($ Million)

30. Rest Of The World Medical Radiation Shielding Market Research And Analysis By Technology, 2023-2031 ($ Million)

31. Rest Of The World Medical Radiation Shielding Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Medical Radiation Shielding Market Share By Solution, 2023 Vs 2031 (%)

2. Global Medical Radiation Shielding For Radiation Therapy Market Share By Region, 2023 Vs 2031 (%)

3. Global Medical Radiation Shielding For Linear Accelerator Market Share By Region, 2023 Vs 2031 (%)

4. Global Medical Radiation Shielding For Multimodality Market Share By Region, 2023 Vs 2031 (%)

5. Global Medical Radiation Shielding For Proton Therapy Market Share By Region, 2023 Vs 2031 (%)

6. Global Medical Radiation Shielding For Cyclotron Market Share By Region, 2023 Vs 2031 (%)

7. Global Medical Radiation Shielding For Brachytherapy Market Share By Region, 2023 Vs 2031 (%)

8. Global Medical Radiation Shielding For Diagnostic Market Share By Region, 2023 Vs 2031 (%)

9. Global Medical Radiation Shielding For PET & SPECT Market Share By Region, 2023 Vs 2031 (%)

10. Global Medical Radiation Shielding For MRI Market Share By Region, 2023 Vs 2031 (%)

11. Global Medical Radiation Shielding For CT Market Share By Region, 2023 Vs 2031 (%)

12. Global Medical Radiation Shielding For Nuclear Medicine Market Share By Region, 2023 Vs 2031 (%)

13. Global Medical Radiation Shielding For X-Ray Market Share By Region, 2023 Vs 2031 (%)

14. Global Medical Radiation Shielding Market Share By End-User, 2023 Vs 2031 (%)

15. Global Medical Radiation Shielding Hospitals Market Share By Region, 2023 Vs 2031 (%)

16. Global Medical Radiation Shielding Diagnostics Centers Market Share By Region, 2023 Vs 2031 (%)

17. Global Medical Radiation Shielding For Other End-Users Market Share By Region, 2023 Vs 2031 (%)

18. Global Medical Radiation Shielding Market Share By Region, 2023 Vs 2031 (%)

19. US Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

20. Canada Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

21. UK Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

22. France Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

23. Germany Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

24. Italy Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

25. Spain Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

26. Rest Of Europe Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

27. India Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

28. China Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

29. Japan Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

30. South Korea Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

31. Rest Of Asia-Pacific Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

32. Latin America Medical Radiation Shielding Market Size, 2023-2031 ($ Million)

33. Middle East And Africa Medical Radiation Shielding Market Size, 2023-2031 ($ Million)