Medical Robotics Market

Global Medical Robotics Market Size, Share & Trends Analysis Report by Product (Surgical Robotic Systems, Rehabilitative Robotic Systems, Noninvasive Radiosurgery Robots, Hospital & Pharmacy Robotic Systems, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global medical robotics market is growing at a significant CAGR of around 18.2% during the forecast period (2020-2026). The medical robots are self-powered and computer-controlled devices that are programmed to support in the manipulation and positioning of surgical instruments. It offers accuracy, control and flexibility to the surgeons. The robotic-assisted surgical systems is showing importance in this procedure due to minimal scarring, reduced blood loss and transfusion and reduced pain and discomfort. It is often regarded as an advanced form of laparoscopic or minimally invasive surgery where the surgeon utilizes a computer-controlled robot to provide support in some surgical procedures.

There are several pivotal factors that are driving the global medical robotics market, which includes funding for medical robot research and growth in automation across every industry. In addition, the continuous advancements in the robotic systems and the issuance of IPOs by the manufacturers if the medical robotics systems are further offering growth to the medical robotics market. Apart from these factors, the continuous rise in trend for minimally invasive surgeries with the rise in the prevalence of chronic diseases are further driving the market growth across the globe. However, high cost of advanced instruments such as robotic-assisted surgical systems are creating hurdles in the market growth. Decreasing cost of robotic-assisted systems may result in significant adoption of robotic systems across developed and developing countries.

Segmental Outlook

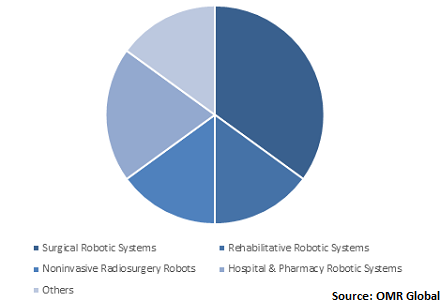

The medical robotics market is analyzed on the basis of revenue captured by all types of robotic systems. Based on products, the market is segmented into surgical robotic systems, rehabilitative robotic systems, noninvasive radiosurgery robots, hospital & pharmacy robotic systems, and others. Among these products, the surgical robotic system is contributing significantly in the medical robotics market growth. The growth driving factors of the surgical robotic systems are the increasing automation in the healthcare industry and the rising adoption of minimally invasive surgeries across the globe. In addition, the increasing demand for robotic-assisted surgeries for general and other procedures is further contributing to the growth of surgical robotic system market growth.

Global Medical Robotics Market Share by Product, 2019 (%)

Regional Outlook

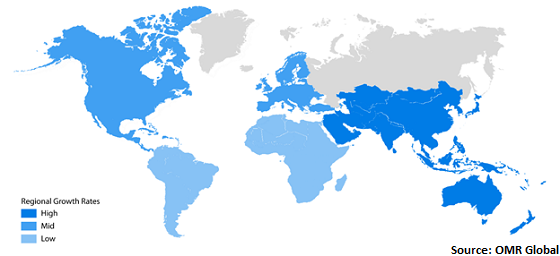

The global medical robotics market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America is contributing significantly in the global medical robotics market. The factors contributing to the market growth in the region comprise increasing adoption of robotic-assisted surgical instruments, significant number of hip and knee replacements and growing incidences of life-style oriented diseases in the region. In addition, the presence of major players such as Stryker Corp., Intuitive Surgical Inc., Zimmer Biomet Holdings, Inc. and is the major cause of rising innovations from the region. These players have introduced several new innovative devices in the market that has enabled to increase the effectiveness of the procedure. For instance, da Vinci series of surgical robotic system by Intuitive Surgical, Inc. which is designed for multiple procedures such as GI, urology, neurology and so on.

Global Medical Robotics Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global medical robotics market. The major factors positively influencing the market growth in the region includes improving healthcare infrastructure, growing medical tourism and growing prevalence of non-communicable diseases, such as chronic kidney disease and heart disease. In addition, the increasing prevalence of CVD diseases and significant rise in ageing population in the region is attributing to the market growth. According to UN ESCAP (United Nations Economic and Social Commission for Asia and the Pacific), in 2016, nearly 12.4% of the population in APAC was 60 years and above. However, it is projected to rise to more than a quarter or 1.3 billion people by 2050. Such rise in geriatric population leads to the occurrence of number of diseases, which in turn, increases the surgical procedures.

Moreover, the rise in cancer cases in the region further represents the need for improvement in cancer diagnosis and treatment in the region, which shows that the region is moving towards the effective treatment for cancer that is supporting the market growth. For instance, the hospitals in Australia such as the Wesley Hospital have performed more than 4,500 robotic cases across gynaecology, colorectal, general surgery, urology and gynae-oncology surgery, since 2010. It is the first hospital in Australia to have two Da Vinci surgical robotic systems. It has accredited as the first center of excellence in robotic surgery (COERS) by Surgical Review Corporation (SRC), an international accrediting body.

Market Players Outlook

The key players in the medical robotics market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global medical robotics market include Intuitive Surgical, Inc., Medtronic PLC, Stryker Corp., Auris Health, Inc., CMR Surgical Ltd., and TransEnterix Surgical, Inc. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in October 2019, CMR Surgical Ltd. announced that HCG Curie Manavata Cancer Centre in Nashik, India, has acquired Versius, a next-generation Surgical Robotic System. This announcement follows the commercial launch of Versius at Galaxy Care Hospital in Pune, India with further commercial agreements in Europe expected to be announced imminently.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical robotics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Intuitive Surgical, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Medtronic PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Stryker Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Auris Health, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. TransEnterix Surgical, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Medical Robotics Market by Product

5.1.1. Surgical Robotic Systems

5.1.2. Rehabilitative Robotic Systems

5.1.3. Noninvasive Radiosurgery Robots

5.1.4. Hospital & Pharmacy Robotic Systems

5.1.5. Others (Neuromate surgical system)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accuray Inc.

7.2. Auris Health, Inc.

7.3. AVRA Medical Robotics, Inc.

7.4. CMR Surgical Ltd.

7.5. Global Medical, Inc.

7.6. Hocoma AG

7.7. InTouch Technologies, Inc.

7.8. Intuitive Surgical, Inc.

7.9. Kirby Lester

7.10. Medrobotics Corp.

7.11. Medtronic PLC

7.12. Microbot Medical Inc.

7.13. Omnicell, Inc.

7.14. Renishaw PLC

7.15. Stereotaxis, Inc.

7.16. Stryker Corp.

7.17. Titan Medical Inc.

7.18. TransEnterix Surgical, Inc.

7.19. Verb Surgical Inc.

7.20. Zimmer Biomet Holdings, Inc.

1. GLOBAL MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL SURGICAL ROBOTIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL REHABILITATIVE ROBOTIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL NONINVASIVE RADIOSURGERY ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL HOSPITAL & PHARMACY ROBOTIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER ROBOTIC SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

10. EUROPEAN MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. EUROPEAN MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. ASIA-PACIFIC MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

14. REST OF THE WORLD MEDICAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

1. GLOBAL MEDICAL ROBOTICS MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL MEDICAL ROBOTICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

5. UK MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD MEDICAL ROBOTICS MARKET SIZE, 2019-2026 ($ MILLION)