Medical Scheduling Software Market

Medical Scheduling Software Market Size, Share & Trends Analysis Report by Product (Patient Scheduling and Care Provider Scheduling), Deployment (Cloud-based and On-premise), and End-Use (Hospitals, Clinics, and Others) Forecast Period (2025-2035)

Industry Overview

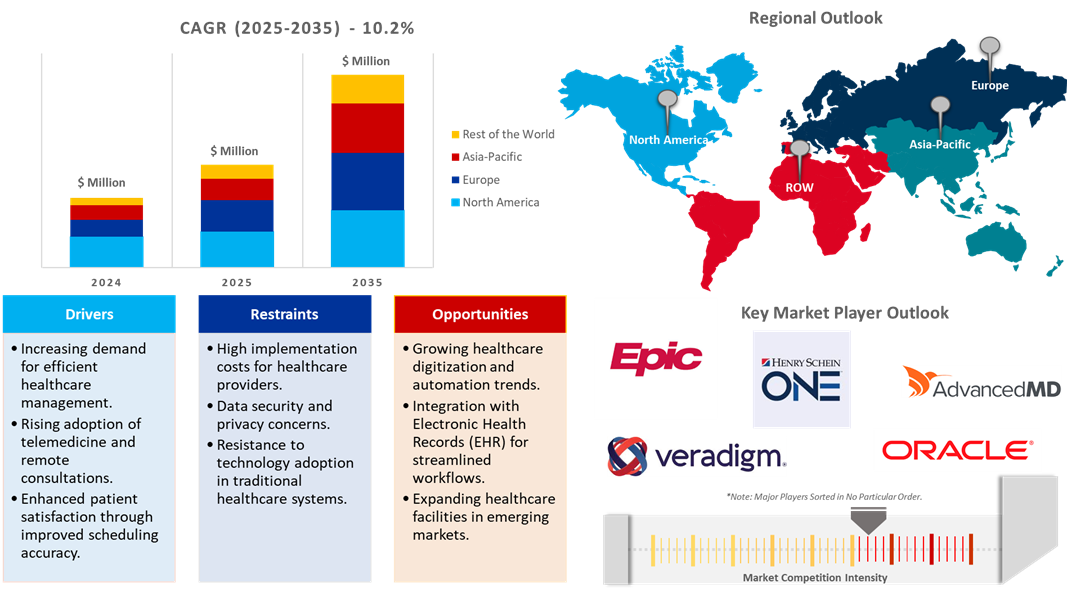

Medical scheduling software market is anticipated to grow at a CAGR of 10.2% during the forecast period (2025-2035). The primary drivers of market expansion include the increasing need for software to effectively manage and improve workflow and the growing acceptance of patient-centric approaches. Online appointment scheduling, prompt reminders, and direct contact with healthcare practitioners are all provided via patient-centric scheduling solutions. This lessens the administrative load on healthcare institutions and improves the patient’s experience.

Market Dynamics

Telehealth Service in Medical Scheduling Software

Increased integration of telehealth services into medical scheduling software. The rise in popularity of telemedicine has triggered an evolution in scheduling software toward supporting virtual consultations. It enables patients to schedule a video or phone consultation directly through the software. To avoid interfering with patient-provider contact, the integration synchronizes with telehealth systems. Through such integration, it is possible to manage the flow of patients by reducing in-office visits for minor medical problems. It also features automatic reminders for virtual sessions. There will be streamlined work processes for healthcare providers and more convenience for patients. Managing all virtual as well as in-office appointments within one system further improves the overall efficiency of care delivery. This movement will show industry progression through digital-first health solutions.

AI-Based Appointments Optimization

The artificial intelligence integrated into medical scheduling software is changing the dynamics of managing appointments. By using historical data, AI algorithms predict how long an appointment is going to take and prevent conflicting schedules. Filling gaps would be easy as these systems automatically allow waitlisted or high-priority patients into the schedule. Minimizing no-shows becomes easier by having personalized reminders with rescheduling options. AI tools also offer insights into provider availability and patient preferences, thereby enhancing satisfaction for both parties. Features such as automated rescheduling in case of emergencies further enhance reliability. This trend reflects the push of the healthcare sector toward using technology to enhance productivity. AI-powered scheduling software minimizes inefficiencies, thus enabling better resource allocation and cost savings.

Market Segmentation

- Based on the product, the market is segmented into patient scheduling and care provider scheduling.

- Based on the deployment, the market is segmented into cloud-based and on-premise.

- Based on the end-user, the market is segmented into hospitals, clinics, and others (diagnostic centers and laboratories, rehabilitation centers).

Patient Scheduling Segment to Lead the Market with the Largest Share

The growth of medical scheduling software has been considerable as a result of the growing need for efficient solutions for patient scheduling. In line with this, as healthcare providers work towards enhancing the efficiency of operations and minimizing waiting times for patients, adoption has gradually increased. Optimized systems for managing appointments not only benefit patients in terms of satisfaction and ensure efficient resource utilization. The rising incidence of chronic diseases and the increasing number of in-hospital visits make the development of more advanced scheduling tools. For instance, Epic Systems' complete healthcare software suite contains sophisticated patient scheduling capabilities. Using the company's products, providers can effectively manage appointments and ensure better coordination of care. This trend, which focuses on accessibility and efficiency, is part of the larger digital transformation of healthcare.

Hospitals: A Key Segment in Market Growth

A significant growth in the medical scheduling software market has been observed owing to a high adoption of these solutions in hospitals. An increase in demand for an efficient patient management system has motivated healthcare institutions to implement the latest scheduling tools. Hospitals will mainly focus on optimizing appointment scheduling to improve care for patients and reduce operational inefficiencies. The solution enables seamless coordination between providers in healthcare organizations, thereby cutting down waiting time and improving general patient satisfaction. For instance, Athenahealth provides patient scheduling as part of complete medical scheduling software. This will ensure that the hospitals manage the appointments effectively while not disrupting the smooth flow of healthcare services. Digital transformation in the healthcare sector has further boosted such adoption.

Regional Outlook

The global medical scheduling software market is further divided by geography, including Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Medical Scheduling Software in Healthcare in Asia-Pacific

The Asia-Pacific medical scheduling software market is growing at a rapid pace as the demand for digital healthcare solutions is increasing in the region. The healthcare infrastructure is expanding in the region, and the patient population is growing. This increases the demand for efficient scheduling systems. Governments are encouraging healthcare digitization, which boosts the adoption of such software. Increasing awareness among healthcare providers regarding the benefits of automated scheduling solutions is another major factor driving the adoption of medical scheduling software. It integrates AI and cloud technologies to enable more features on scheduling platforms and make them attractive. More localized providers now present cost-effective options for small clinics and hospitals. Moreover, penetration rates for smartphones and Internet connectivity also mean that users of mobile-friendly applications for scheduling could increase rapidly in the near term. Thus, the Asia-Pacific market continues its emergence as the center of innovative and widespread health IT adoption.

North America Region Dominates the Market with Major Share

The North American medical scheduling software market is growing owing to several factors such as the growing adoption of electronic health solutions, high healthcare spending, and effective management of patients' needs. With such advancements in cloud-based technologies, scheduling software has grown more accessible to healthcare providers. Improving patient experience and reducing wait times have also been the emphasis. Supportive government initiatives that promote the adoption of healthcare IT further strengthen the growth of the market. For instance, in August 2024, Relatient introduced a newly enhanced version of its dash self. Released as the KLAS solution for patient self-scheduling in 2024, this new improved version of Dash Self redefines the patient experience and offers a lot of enhanced configuration options to provider organizations. The updates were made to considerably simplify the experience of self-scheduling for patients, both old and new, with significant reductions to the burden on appointment scheduling practice administrators and call centers.

Market Players Outlook

The major companies operating in the global medical scheduling software market include Epic Systems Corp., Henry Schein One, LLC, Oracle Corp., and Veradigm LLC, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In January 2024, ShiftMed launched ShiftAdvisor, a personalized scheduling AI solution for Nurses. It is expected that the new solution will help facilities and HCPs by optimizing shift scheduling, which enables facilities to reach ideal staffing levels while also making it easier for providers to identify the best shifts with the lowest cancellation risks.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical scheduling software market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Medical Scheduling Software Market Sales Analysis – Product | Deployment| End-Use ($ Million)

• Medical Scheduling Software Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Medical Scheduling Software Industry Trends

2.2.2. Market Recommendations

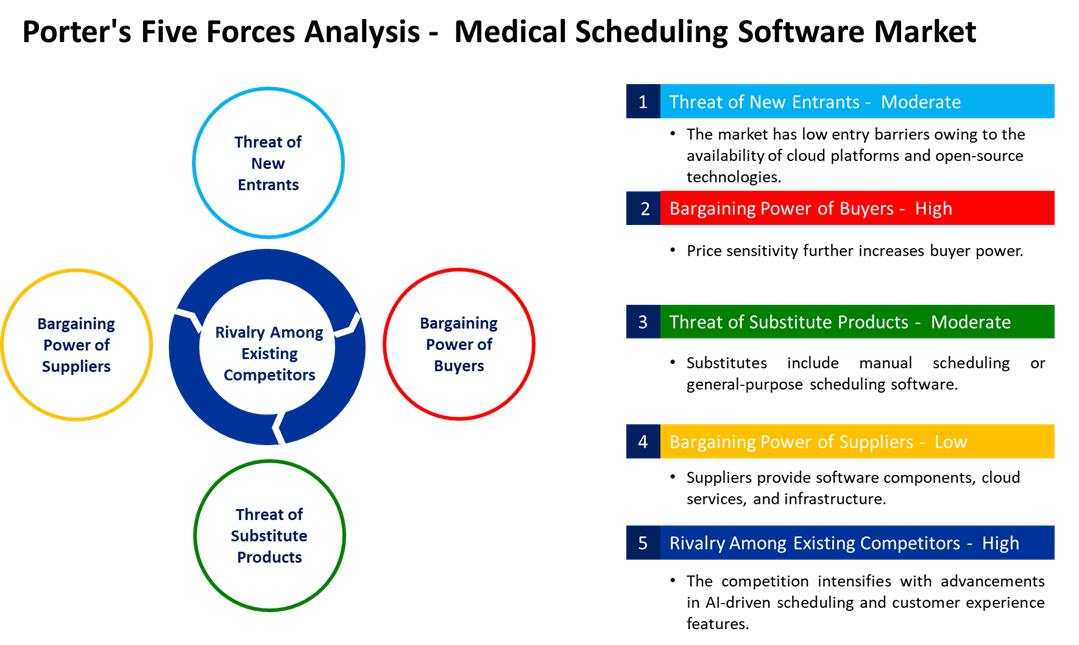

2.3. Porter's Five Forces Analysis for the Medical Scheduling Software Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Medical Scheduling Software Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Medical Scheduling Software Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Medical Scheduling Software Market Revenue and Share by Manufacturers

• Medical Scheduling Software Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Epic Systems Corp.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Henry Schein One, LLC

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Oracle Corp

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Veradigm LLC

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Medical Scheduling Software Market Sales Analysis by Product ($ Million)

5.1. Patient Scheduling

5.2. Care Provider Scheduling

6. Global Medical Scheduling Software Market Sales Analysis by Deployment ($ Million)

6.1. Cloud-based

6.2. On-premise

7. Global Medical Scheduling Software Market Sales Analysis by End-Use ($ Million)

7.1. Hospitals

7.2. Clinics

7.3. Others (Diagnostic Centers and Laboratories, Rehabilitation Centers)

8. Regional Analysis

8.1. North American Medical Scheduling Software Market Sales Analysis – Product | Deployment| End-Use | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Medical Scheduling Software Market Sales Analysis – Product | Deployment| End-Use | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Medical Scheduling Software Market Sales Analysis – Product | Deployment| End-Use | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Medical Scheduling Software Market Sales Analysis – Product | Deployment| End-Use | Country ($ Million)

•Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. AdvancedMD, Inc.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. American Medical Software

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. CareCloud, Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Caspio, Inc.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. CentralReach, LLC

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. eClinicalWorks, LLC

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Epic Systems Corp.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. EverHealth Solutions Inc.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Experian Information Solutions, Inc.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Henry Schein One, LLC

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Kyruus, Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Medsphere Systems Corporation

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. NextGen Healthcare, Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Oracle Corp.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. PatientStudio

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Practice Fusion, Inc.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Q-nomy Inc.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Relatient

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Sign In Solutions Inc.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. SuperSaaS

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Tebra Technologies, Inc. (Kareo, Inc.)

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. TIMIFY

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Veradigm LLC

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. WebPT, Inc.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

1. Global Medical Scheduling Software Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Patient Scheduling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Care Provider Scheduling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Medical Scheduling Software Market Research And Analysis By Deployment, 2024-2035 ($ Million)

5. Global Cloud-Based Medical Scheduling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global On-Premise Medical Scheduling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Medical Scheduling Software Market Research And Analysis By End-Use, 2024-2035 ($ Million)

8. Global Medical Scheduling Software For Hospitals Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Medical Scheduling Software For Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Medical Scheduling Software For Other End-Use Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Medical Scheduling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

12. North American Medical Scheduling Software Market Research And Analysis By Country, 2024-2035 ($ Million)

13. North American Medical Scheduling Software Market Research And Analysis By Product, 2024-2035 ($ Million)

14. North American Medical Scheduling Software Market Research And Analysis By Deployment, 2024-2035 ($ Million)

15. North American Medical Scheduling Software Market Research And Analysis By End-Use, 2024-2035 ($ Million)

16. European Medical Scheduling Software Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Medical Scheduling Software Market Research And Analysis By Product, 2024-2035 ($ Million)

18. European Medical Scheduling Software Market Research And Analysis By Deployment, 2024-2035 ($ Million)

19. European Medical Scheduling Software Market Research And Analysis By End-Use, 2024-2035 ($ Million)

20. Asia-Pacific Medical Scheduling Software Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Asia-Pacific Medical Scheduling Software Market Research And Analysis By Product, 2024-2035 ($ Million)

22. Asia-Pacific Medical Scheduling Software Market Research And Analysis By Deployment, 2024-2035 ($ Million)

23. Asia-Pacific Medical Scheduling Software Market Research And Analysis By End-Use, 2024-2035 ($ Million)

24. Rest Of The World Medical Scheduling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

25. Rest Of The World Medical Scheduling Software Market Research And Analysis By Product, 2024-2035 ($ Million)

26. Rest Of The World Medical Scheduling Software Market Research And Analysis By Deployment, 2024-2035 ($ Million)

27. Rest Of The World Medical Scheduling Software Market Research And Analysis By End-Use, 2024-2035 ($ Million)

1. Global Medical Scheduling Software Market Share By Product, 2024 Vs 2035 (%)

2. Global Patient Scheduling Software Market Share By Region, 2024 Vs 2035 (%)

3. Global Care Provider Scheduling Software Market Share By Region, 2024 Vs 2035 (%)

4. Global Medical Scheduling Software Market Share By Deployment, 2024 Vs 2035 (%)

5. Global Cloud-Based Medical Scheduling Software Market Share By Region, 2024 Vs 2035 (%)

6. Global On-Premise Medical Scheduling Software Market Share By Region, 2024 Vs 2035 (%)

7. Global Medical Scheduling Software Market Share By End-Use, 2024 Vs 2035 (%)

8. Global Medical Scheduling Software For Hospitals Market Share By Region, 2024 Vs 2035 (%)

9. Global Medical Scheduling Software For Clinics Market Share By Region, 2024 Vs 2035 (%)

10. Global Medical Scheduling Software For Other End-use Market Share By Region, 2024 Vs 2035 (%)

11. Global Medical Scheduling Software Market Share By Region, 2024 Vs 2035 (%)

12. US Medical Scheduling Software Market Size, 2024-2035 ($ Million)

13. Canada Medical Scheduling Software Market Size, 2024-2035 ($ Million)

14. UK Medical Scheduling Software Market Size, 2024-2035 ($ Million)

15. France Medical Scheduling Software Market Size, 2024-2035 ($ Million)

16. Germany Medical Scheduling Software Market Size, 2024-2035 ($ Million)

17. Italy Medical Scheduling Software Market Size, 2024-2035 ($ Million)

18. Spain Medical Scheduling Software Market Size, 2024-2035 ($ Million)

19. Russia Medical Scheduling Software Market Size, 2024-2035 ($ Million)

20. Rest Of Europe Medical Scheduling Software Market Size, 2024-2035 ($ Million)

21. India Medical Scheduling Software Market Size, 2024-2035 ($ Million)

22. China Medical Scheduling Software Market Size, 2024-2035 ($ Million)

23. Japan Medical Scheduling Software Market Size, 2024-2035 ($ Million)

24. South Korea Medical Scheduling Software Market Size, 2024-2035 ($ Million)

25. Australia and New Zealand Medical Scheduling Software Market Size, 2024-2035 ($ Million)

26. ASEAN Medical Scheduling Software Market Size, 2024-2035 ($ Million)

27. Rest Of Asia-Pacific Medical Scheduling Software Market Size, 2024-2035 ($ Million)

28. Latin America Medical Scheduling Software Market Size, 2024-2035 ($ Million)

29. Middle East And Africa Medical Scheduling Software Market Size, 2024-2035 ($ Million)