Medical X-Ray Market

Global Medical X-Ray Market Size, Share & Trends Analysis Report by Type (Digital and Analog), By Technology (Film-based Radiography, Computed Radiography (CR), and Direct Radiography (DR)), By Application (Tumor/Cancer, Orthopedic, Cardiovascular Disease (CVD), Dental, and Others), By End-Use (Hospitals and Diagnostic Centers) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global medical x-ray market is estimated to grow significantly at a CAGR of 5.8% during the forecast period. The rising geriatric population is leading to the increasing volume of orthopedic and cardiovascular procedures, which in turn, is increasing the demand for x-ray devices in the medical sector. Apart from this, the growing application of medical x-ray devices in the diagnosis of cancer and dental is also driving the growth of the market.

X-ray devices have wide usage in the medical field, which includes computed tomography, radiography, angiography, mammography, and volumetric imaging data, among others. For instance, in March 2016, a new highly sensitive x-ray detector is built by researchers in the US, Netherland, and China that could be used for medical imaging. This x-ray detector allows the images to be taken using smaller doses of ionizing radiation and reduces cancer risks to patients.

Segmental Outlook

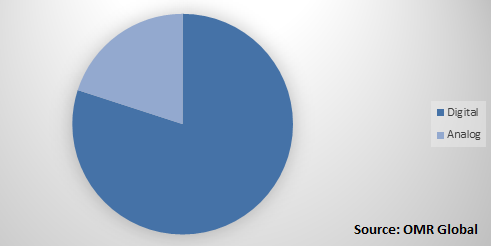

The global medical x-ray market is segmented on the basis of type, technology, application, end-use, and region. On the basis of type, the market is sub-segmented into digital medical x-ray devices and analog medical x-ray devices. Digital x-ray devices held the largest share in the global medical x-ray in 2018 due to their increased efficiency over analog medical x-ray devices. Based on the technology, the market is further classified into film-based radiography, CR, and DR. Moreover, the report analyzes various applications of x-ray devices which include tumor/cancer, orthopedic, cardiovascular diseases, dental, and others. Based on the end-use, the market is divided into hospitals and diagnostic centers.

Global Medical X-Ray Market Share by Type, 2018 (%)

CVD Application Segment to Grow Significantly During the Forecast Period

The global rise in the incidence and prevalence rates of CVD will lead to an increase in the size of the CVD segment in the global medical x-ray market. CVDs are estimated to be one of the major causes of mortality across the globe. According to WHO in 2017, CVDs account for more than 17.3 million mortalities per year, across the globe. Moreover, the number of mortalities by CVDs is further estimated to reach 23.6 million by 2030, globally.

CVDs account for 31.0% of the total population, with around 80.0% of mortalities occurring in low and middle-income countries. According to the American Heart Society, in 2017, CVDs were the cause of around 800,000 mortalities in the US. Around 370,000 Americans lose their lives every year, whereas, 2,200 each day, due to CVDs in the country. Direct and indirect costs associated with CVDs is estimated to be around $316 billion, globally, as there is an increase in the number of patients, it requires the advance and updated medical devices for the treatment, which in turn creates significant demand for diagnosis devices such as medical x-ray devices across the globe.

Regional Outlook

Geographically, the study of the global medical x-ray market covers the study of four major regions including North America (the US and Canada), Europe (Germany, UK, Italy, France, Italy, Spain, and Rest of Europe), and Rest of the World (RoW). Asia-Pacific is estimated to witness the fastest growth in the market over the forecast period. The rising geriatric population that is susceptible to several diseases such as CVD and skeletal deformities is driving the demand for medical x-ray devices in the regions. Moreover, government support along with the growing awareness regarding disease detection and treatment is further augmenting the regional business growth during the forecast period.

North America Held the Dominating Position in 2018

North America dominated the global medical x-ray market in 2018 and is further estimated to follow the same trend over the forecast period. The growth of the region is supported by factors that include high demand for preventive care and early disease diagnosis. Apart from this, the rising prevalence of gynecological disorders, orthopedic disorders, CVD and cancer in the region is further augmenting the need for medical x-ray devices. According to the International Osteoporosis Foundation, there were around 52 million people in the US that have osteoporosis and this number is expected to increase to more than 61 million in 2020. Such an increasing prevalence of orthopedic disorders will surge the demand for effective diagnosis and treatment of the disorder; which in turn, will spur the market growth in the region.

Market Players Outlook

Furthermore, the market consists of several market players that are designing, developing, and marketing various medical x-ray devices to cater to a wide range of customers across the globe. The global medical x-ray industry is fragmented in nature, thereby players operating in the industry faces tough competition. Key players of the market include Canon Inc., Fujifilm Holdings Corp., General Electric Co., Koninklijke Philips NV, Siemens AG, and many others. In order to remain competitive in the market, these market players adopt various strategies such as mergers and acquisitions, product offering expansion, geographical expansion, partnerships and collaborations, and others.

Recent Developments

- In August 2019, Koninklijke Philips NV, one of the prominent players in health technology, announced that it has completed the acquisition of Carestream Health Inc.’s Healthcare Information Systems (HCIS) business in 26 of the 38 countries in which it operates. Carestream HCIS’s cloud-enabled enterprise imaging platform will expand Philips’ enterprise diagnostic informatics solutions, including productivity enhancement, imaging data management, and advanced visualization and analysis. Thereby, strengthening the revenue stream of the company.

- In March 2019, Varex Imaging Corp. has announced to acquire at least 90% of the shares of common stock of Direct Conversion AB, manufacturer and marketer of linear array digital detectors utilizing direct conversion and photon counting technology. The acquisition was aimed to expand product portfolio and to extend geographical outreach.

- In March 2018, Teledyne Technologies Inc. announced that the company’s subsidiary, Teledyne DALSA, Inc., is expanding its manufacturing facility due to the increasing demand for the company’s proprietary complementary metal-oxide-semiconductor-based x-ray detectors across the globe.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical x-ray market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Canon Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Fujifilm Holdings Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. General Electric Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Koninklijke Philips NV

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Medical X-Ray Market by Type

5.1.1. Digital

5.1.2. Analog

5.2. Global Medical X-Ray Market by Technology

5.2.1. Film-based Radiography

5.2.2. Computed Radiography (CR)

5.2.3. Direct Radiography (DR)

5.3. Global Medical X-Ray Market by Application

5.3.1. Tumor/Cancer

5.3.2. Orthopedic

5.3.3. Cardiovascular Diseases

5.3.4. Dental

5.3.5. Others (Mammography and Pneumonia)

5.4. Global Medical X-Ray Market by End-Use

5.4.1. Hospitals

5.4.2. Diagnostic Centers

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Analogic Corp.

7.2. Canon Inc.

7.3. Dentsply Sirona, Inc.

7.4. Fujifilm Holdings Corp.

7.5. General Electric Co.

7.6. Hitachi Medical Systems Holding

7.7. Hologic Inc.

7.8. Idetec Medical Imaging

7.9. KA Imaging Inc.

7.10. Konica Minolta Healthcare Americas, Inc.

7.11. Koninklijke Philips NV

7.12. Midmark Corp.

7.13. PerkinElmer Inc.

7.14. Rayence Inc.

7.15. Shimadzu Corp.

7.16. Siemens AG

7.17. Teledyne Technologies Inc.

7.18. Thales Group

7.19. Varex Imaging Corp.

7.20. Varian Medical Systems

7.21. YXLON International GmbH

1. GLOBAL MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL DIGITAL MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ANALOG MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

5. GLOBAL FILM-BASED RADIOGRAPHY TECHNOLOGY IN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL CR TECHNOLOGY IN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL DR TECHNOLOGY IN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

9. GLOBAL MEDICAL X-RAY FOR TUMOR/CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL MEDICAL X-RAY FOR ORTHOPEDIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL MEDICAL X-RAY FOR CARDIOVASCULAR DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL MEDICAL X-RAY FOR DENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL MEDICAL X-RAY FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

15. GLOBAL MEDICAL X-RAY IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL MEDICAL X-RAY IN DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. NORTH AMERICAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

21. NORTH AMERICAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. NORTH AMERICAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

23. EUROPEAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. EUROPEAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

25. EUROPEAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

26. EUROPEAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. EUROPEAN MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

30. ASIA-PACIFIC MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

31. ASIA-PACIFIC MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

32. ASIA-PACIFIC MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

33. REST OF THE WORLD MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

34. REST OF THE WORLD MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

35. REST OF THE WORLD MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

36. REST OF THE WORLD MEDICAL X-RAY MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

1. GLOBAL MEDICAL X-RAY MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL MEDICAL X-RAY MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

3. GLOBAL MEDICAL X-RAY MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL MEDICAL X-RAY MARKET SHARE BY END-USE, 2018 VS 2025 (%)

5. GLOBAL MEDICAL X-RAY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

6. US MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

7. CANADA MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

8. UK MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

9. FRANCE MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

10. GERMANY MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

11. ITALY MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

12. SPAIN MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

13. ROE MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

16. INDIA MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF ASIA-PACIFIC MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)

18. REST OF THE WORLD MEDICAL X-RAY MARKET SIZE, 2018-2025 ($ MILLION)