Melamine Market

Global Melamine Market Size, Share & Trends Analysis Report by Application (Laminates, Wood Adhesives, Molding Compounds, Paints and Coatings, and Other Applications) Forecast Period 2022-2028 Update Available - Forecast 2025-2035

The global market for Melamine is projected to have a considerable CAGR of around 4.26% during the forecast period. Melamine foams exhibit high sound absorption capacity and possess an intrinsic property of flame retardancy. As a result, these foams are used in buildings, acoustic panels, suspended baffles, and metal ceiling panels. Melamine resins are also used in the production of adhesives that are largely employed in hotline fixing of car seats, panel laminations, trim, headlamps, and other interior component assemblies in the automotive industry. Strong growth in the global construction industry, as well as increased need for lightweight and low-emission automobiles, are driving melamine demand. Rapid urbanization, increase in disposable income, and rise in the standard of living are key factors contributing to the robust growth of the building and construction industry. Additionally, melamine's increasing use in high-resistance concrete and carbon nanotubes is also expected to boost the market growth. However, rising public concerns about the formaldehyde emission of melamine-based thermoset plastics, such as food containers and dinnerware, are likely to restrict the development of the melamine marker.

Impact of COVID-19 on Melamine market

The COVID-19 pandemic had a negative impact on the market owing to the pandemic scenario, the construction and automotive manufacturing activities were at a temporary halt during the government-imposed lockdown, which had negatively impacted the demand for construction materials such as paints and coatings, laminates, and wood adhesives. As a result, the demand for melamine in the COVID-19 pandemic was dropped.

Segmental Outlook

The global melamine market is segmented based on application. Based on the application the market is further classified into instruments and accessories, robotic systems, and services. Based on application, the market is segregated into laminates, wood adhesives, molding compounds, paints & coatings, and other applications.

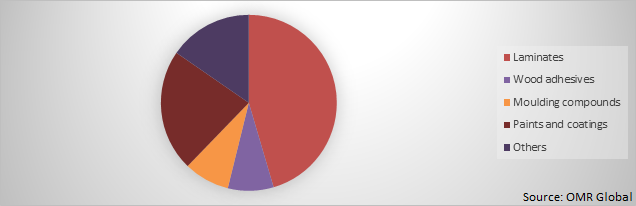

Global Melamine Market Share by Application, 2021 (%)

The Laminate is Considered as the Dominating Segment in the Global Melamine Market.

Among applications, the laminates segment is estimated as dominating segment during the forecast period as melamine resins are the polymers of choice used in the outer or decorative layer of laminates, as well as in the manufacture of counter and kitchen cabinets, tabletops, flooring, furniture, etc. Melamine laminated sheet is in a multilayer structure that includes decoration paper, surface paper, and bottom paper. This surface paper protects patterns and designs on the decorative page that brighten, solidify, and harden the surface, and enhance wear and corrosion resistance. Melamine laminated sheet has excellent heat-resistant properties, as it is made of the setting plastic. It does not get softened, cracked, or bubbled at a temperature over 100°C. It is well resistant to ironing and fire. These sheets are commonly applied to the surface decoration projects of columns, walls, tabletops, furniture, suspended ceilings, etc. Moreover, melamine-formaldehyde resin is widely used as it is clear, transparent, and wear-resistant and often serves as a surface dipping material.

Regional Outlook

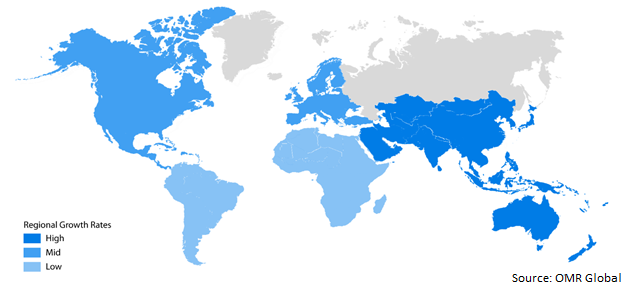

Geographically, the global Melamine market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Europe is projected to have a significant CAGR with Germany being the largest producer as well as consumer of melamine in the region. As the production of wood-based panels and laminates has increasingly shifted from Western Europe to Eastern Europe, the melamine market in Eastern Europe is expected to grow at a faster rate. Countries in Eastern Europe including Russia, Turkey, and Poland are anticipated to show high growth in the melamine market during the forecast period.

Global Melamine Market Growth, by region 2022-2028

Asia-Pacific to Hold a Considerable Share in the Global Melamine Market

Geographically, Asia-Pacific is projected to hold a significant share global melamine market. The factors that are contributing to the growth of the market include growing construction activities and the increasing demand for wood adhesives, laminates and paints, and coatings in countries such as China, India, and Japan, the usage of melamine is increasing. Despite the real estate market's instability, the Chinese government's major development of rail and road infrastructure, to cope with the rising industrial and service sectors, has resulted in significant growth of the Chinese construction industry. According to the National Bureau of Statistics of China, the construction industry in China was valued at about USD 1,049 billion in 2020. China currently accounts for more than a quarter of the global coatings market. According to the China National Coatings Industry Association, the coatings industry has grown by 7% in recent years.

Market Players Outlook

The key players in the melamine market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include BASF SE, Henan Xinlianxin Chemicals Group Co. Ltd, Nissan Chemical Corp, Qatar Melamine Co. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In March 2020, BASF has expanded its range of the melamine resin foam Basotect. The new grade Basotect UF+ with improved emission properties replaces the successful Basotect UF and opens up additional fields of application. The exceptionally lightweight and flexible foam is ideally suited for the insulation of rail vehicles as well as heating, ventilation, and air-conditioning (HVAC) technology in buildings. The high flexibility of Basotect enables individual solutions to fit into very small gaps as well as for highly curved surfaces, such as ceilings and walls.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global melamine market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Melamine Market Industry

• Recovery Scenario of Global Melamine Market Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Melamine Market by Application

5.1.1. Laminates

5.1.2. Wood Adhesives

5.1.3. Molding Compounds

5.1.4. Paints and Coatings

5.1.5. Other Applications (Flame Retardants, Textile Resins, etc.)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. BASF SE

7.2. Borealis AG

7.3. Cornerstone Chemical Company

7.4. Grupa Azoty

7.5. Gujarat State Fertilizers & Chemicals Limited (GSFC)

7.6. Prefere Resins Holding GmbH

7.7. Methanol Holdings (Trinidad) Limited (MHTL)

7.8. Mitsui Chemicals Inc.

7.9. Hexion

7.10. Nissan Chemical Corporation

7.11. OCI NV

7.12. Qatar Melamine Company

7.13. Sichuan Chemical Works Group Ltd

7.14. Henan Xinlianxin Chemicals Group Co. Ltd

7.15. Eurochem Group

1. GLOBAL MELAMINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

2. GLOBAL MELAMINE FOR LAMINATES APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MELAMINE FOR WOOD ADHESIVES APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MELAMINE FOR MOLDING COMPOUNDS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL MELAMINE FOR PAINTS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL MELAMINE FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MELAMINE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

8. NORTH AMERICAN MELAMINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN MELAMINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

10. EUROPEAN MELAMINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. EUROPEAN MELAMINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

12. ASIA-PACIFIC MELAMINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. ASIA-PACIFIC MELAMINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

14. REST OF THE WORLD MELAMINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PROCESS ANALYZER, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MELAMINE MARKETBY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL MELAMINE MARKET, 2021-2028 (%)

4. GLOBAL MELAMINE MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

5. GLOBAL MELAMINE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL MELAMINE FOR LAMINATES APPLICATION MARKET SIZE, 2021-2028 ($ MILLION)

7. GLOBAL MELAMINE FOR WOOD ADHESIVES APPLICATION MARKET SIZE, 2021-2028 ($ MILLION)

8. GLOBAL MELAMINE FOR MELAMINE FOR MOLDING COMPOUNDS MARKET SIZE, 2021-2028 ($ MILLION)

9. GLOBAL MELAMINE FOR PAINTS AND COATINGS APPLICATION MARKET SIZE, 2021-2028 ($ MILLION)

10. GLOBAL MELAMINE FOR OTHER APPLICATIONS APPLICATION MARKET SIZE, 2021-2028 ($ MILLION)

11. US MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

13. UK MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

18. ROE MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

22. ASEAN MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD MELAMINE MARKET SIZE, 2021-2028 ($ MILLION)