Membrane Electrode Assembly Market

Membrane Electrode Assembly Market Size, Share & Trends Analysis Report by Product (3-Layer Membrane Electrode Assemblies, 5-Layer Membrane Electrode Assemblies and 7-Layer Membrane Electrode Assemblies), and by Application (Proton-Exchange Membrane Fuel Cell (PEMFC), Direct Methanol Fuel Cell (DMFC), Electrolyzers and Hydrogen / Oxygen Fuel Cells), Forecast Period (2024-2031)

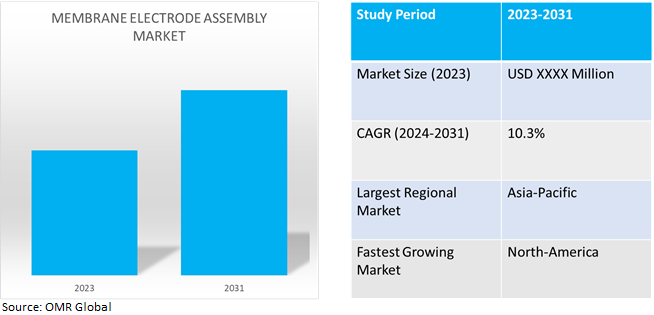

Membrane electrode assemblymarket is anticipated to grow at a significant CAGR of 10.3% during the forecast period (2024-2031).The market growth is attributed to the increasing adoption ofMembrane Electrode Assembly(MEA) technology to increase power density, efficiency, and durability.MEAs are a desired option for lowering greenhouse gas emissions and lessening the effects of climate change, which is a major concern for numerous nations and sectors of the economy. Governments are investing in fuel cell research and development as well as putting laws and incentives in place to encourage the use of fuel cells in response to the increasing demand for fuel cells on a global scale. As a result, the MEAs market is seeing expansion and investment, which is propelling the creation of new applications and the commercialization of already-existing technology.

Market Dynamics

Increasing Membrane Electrode AssemblyMiniaturization and Portable Applications

The increasing miniaturization for portable and mobile applications including portable power generators and fuel cell-powered vehicles drives demand for membrane electrode assembly. The advantages of mobile energy storage technologies over traditional ones include low cost and high energy conversion efficiency, flexibility in placement, and a wide range of system sizes and densities, from high energy density to high power density. Regenerative fuel cells can be used to store electricity in chemical form and convert the stored energy back into electricity when needed. The quality and suitability of an MEA for a specific application depend strongly on its physical, chemical, and mechanical properties

Growing Adoption of Renewable Energy Sources

Fuel cells offer a highly efficient and fuel-flexible technology that cleanly produces power and heat with low or zero emissions. Using renewably produced fuels such as hydrogen fuel cells can reduce the dependence on oil, leading to a secure energy future. Proton Exchange Membrane Fuel Cells (PEMFCs) have received intense attention owing to their wide and diverse applications in chemical sensors, electrochemical devices, batteries, supercapacitors, and power generation, which has led to the design of MEAs that operate in different fuel cell types. The fuel cell is combined with a fuel generation device, commonly an electrolyzer, to create a Regenerative Fuel Cell (RFC) system, which can convert electrical energy to a storable fuel and then use this fuel in a fuel cell reaction to provide electricity when needed.

Market Segmentation

Our in-depth analysis of the global membrane electrode assembly market includes the product and application segments.

- Based on the product, the market is sub-segmented into3-layer membrane electrode assemblies, 5-layer membrane electrode assemblies, and 7-layer membrane electrode assemblies.

- Based on application, the market is sub-segmented intoProton-Exchange Membrane Fuel Cells(PEMFC), Direct Methanol Fuel Cells(DMFC), electrolyzers, and hydrogen/oxygen fuel cells.

3-Layer Membrane Electrode Assemblies is Projected to Emerge as the Largest Segment

Based on theproduct, the global membrane electrode assembly market is sub-segmented into 3-layer membrane electrode assemblies, 5-layer membrane electrode assemblies, and 7-layer membrane electrode assemblies.Among these3-layer membrane electrode assemblies,sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing adoption of 3-layer membrane electrode assemblies in proton exchange membrane electrolyzers that facilitate the electrochemical reactions in hydrogen production. Iridium anode and platinum cathode are placed on the membrane in 3-layer membrane electrode assemblies to increase the production of hydrogen. For instance, in December 2022, Cheersonic Ultrasonics introduced an alternative version of the membrane electrode module 3-layer MEA, which is composed of a proton exchange membrane.The main function of the proton exchange membrane in fuel cells is to realize rapid proton transmission and also to block the permeation of hydrogen, oxygen, and nitrogen between the cathode and anode.

Proton-Exchange Membrane Fuel Cell (PEMFC) Sub-segment to Hold a Considerable Market Share

Based onapplication,the global membrane electrode assemblymarket is sub-segmented into Proton-Exchange Membrane Fuel Cells (PEMFC), Direct Methanol Fuel Cells (DMFC), electrolyzers, and hydrogen/oxygen fuel cells. Among these, the PEMFCsub-segment is expected to holdaconsiderable share of the market.The segmental growth is attributed to the increasing use of PEMFC in automobiles, forklifts, telecommunications, backup power systems, and primary systems. For instance, in June 2021, Tata Motors ordered 15 hydrogen-based fuel cell buses from Indian Oil Corp. Ltd.

Regional Outlook

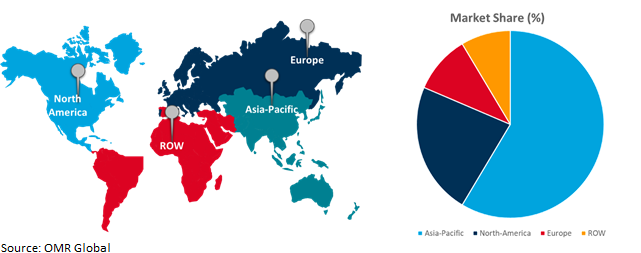

The globalmembrane electrode assembly market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Membrane Electrode Assemblyin North America

- The adoption of electrolyzers is likely to increase owing to the rising demand for such commercial vehicles. Additionally, rising investments in the North American region to produce electricity using renewable sources are anticipated to support the expansion of the membrane electrode assembly market.

- The growing integration of fuel cell technology and significant funding for fuel cell technology research and development drive the growth of membrane electrode assembly in the region.The U.S. Department of Energy (DoE) fuel cell technologies administration has set goals for promoting the widespread commercialization of fuel cell technologies.

Global Membrane Electrode Assembly Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to numerous prominent technology companies and membrane electrode assemblyproviders in the region such as3M Inc.,Toshiba Energy Systems & Solutions Corp., and Kolon Industries, Inc.among others. The growth is mainly attributed to the increased adoption of membrane electrode assembly solutions in the automotive industry. Growing efforts to achieve zero-emission vehicles have encouraged consumers to purchase Electric Vehicles (EVs) or Zero-Emission Vehicles (ZEVs), which first start as fuel cell electric vehicles, opening up new market prospects. Fuel cell technology has a lot of prospects as a result of the massive investments made by automakers to construct powerful and efficient vehicles. For instance, in January 2024, Hyundai Motor Company (Hyundai Motor), Kia Corporation (Kia), and W. L. Gore & Associates (Gore) signed an agreement at the Mabuk Eco-Friendly R&D Center, Korea, to collaborate on the development of advanced Polymer Electrolyte Membrane (PEM) for hydrogen fuel cell systems.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global membrane electrode assemblymarket include G3M Inc., Ballard Power Systems Inc., BASF SE, DuPont de Nemours, Inc., and Toshiba Energy Systems & Solutions Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2023, Bekaert and Toshiba signed a Memorandum of Understanding (MoU) to develop a global partnership around MEA for PEM electrolysis. Toshiba ESS is developing MEAs for high-performance, large-capacity PEM water electrolyzers.

Recent Development

- In September 2022, Advent Technologies introduced Advent’s next-generation membrane electrode assembly. The Advent MEA is developed within the framework of L’Innovator, the Company’s joint development program with the U.S. Department of Energy’s Los Alamos National Laboratory (LANL), Brookhaven National Laboratory (BNL), and National Renewable Energy Laboratory (NREL).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global membrane electrode assembly market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ballard Power Systems Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BASF SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Toshiba Energy Systems & Solutions Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Membrane Electrode Assembly Market by ProductType

4.1.1. 3-Layer Membrane Electrode Assemblies

4.1.2. 5-Layer Membrane Electrode Assemblies

4.1.3. 7-Layer Membrane Electrode Assemblies

4.2. Global Membrane Electrode Assembly Market by Application

4.2.1. Proton-Exchange Membrane Fuel Cell (PEMFC)

4.2.2. Direct Methanol Fuel Cell (DMFC)

4.2.3. Electrolyzers

4.2.4. Hydrogen / Oxygen Fuel Cells

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. 3M

6.2. Advent Technologies

6.3. DuPont de Nemours, Inc.

6.4. Freudenberg Performance Materials

6.5. FuelCellStore

6.6. Giner Inc.

6.7. HyPlat Pty Ltd.

6.8. Industrie De Nora S.P.A.

6.9. Infinity Fuel Cell and Hydrogen, Inc.

6.10. Ion Power, Inc.

6.11. Johnson Matthey plc

6.12. Kolon Industries, Inc.

6.13. Maranata-Madrid SL

6.14. Motomea

6.15. NovoCell Inc.

6.16. Pajarito Powder

6.17. Sainergy Tech, Inc.

6.18. SGL Carbon

6.19. TW Horizon Fuel Cell Technologies

6.20. W. L. Gore & Associates, Inc.

1. GLOBAL MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY PRODUCT,2023-2031 ($ MILLION)

2. GLOBAL 3-LAYER MEMBRANE ELECTRODE ASSEMBLYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL 5-LAYER MEMBRANE ELECTRODE ASSEMBLY SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 7-LAYER MEMBRANE ELECTRODE ASSEMBLY SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

6. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR PROTON-EXCHANGE MEMBRANE FUEL CELL (PEMFC)MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR DIRECT METHANOL FUEL CELL (DMFC)MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR ELECTROLYZERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR HYDROGEN / OXYGEN FUEL CELLSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BYPRODUCT,2023-2031 ($ MILLION)

13. NORTH AMERICAN MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

14. EUROPEAN MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY PRODUCT,2023-2031 ($ MILLION)

16. EUROPEAN MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

17. ASIA-PACIFIC MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFICMEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY PRODUCT,2023-2031 ($ MILLION)

19. ASIA-PACIFICMEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

20. REST OF THE WORLD MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. REST OF THE WORLD MEMBRANE ELECTRODE ASSEMBLY MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

1. GLOBAL MEMBRANE ELECTRODE ASSEMBLY MARKET SHARE BY PRODUCT,2023 VS 2031 (%)

2. GLOBAL 3-LAYER MEMBRANE ELECTRODE ASSEMBLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL 5-LAYER MEMBRANE ELECTRODE ASSEMBLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL 7-LAYER MEMBRANE ELECTRODE ASSEMBLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MEMBRANE ELECTRODE ASSEMBLYMARKET SHAREBY APPLICATION,2023 VS 2031 (%)

6. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR PROTON-EXCHANGE MEMBRANE FUEL CELL (PEMFC)MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR DIRECT METHANOL FUEL CELL (DMFC)MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR ELECTROLYZERSMARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MEMBRANE ELECTRODE ASSEMBLY FOR HYDROGEN / OXYGEN FUEL CELLSMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MEMBRANE ELECTRODE ASSEMBLY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

13. UK MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC MEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICAMEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICAMEMBRANE ELECTRODE ASSEMBLY MARKET SIZE, 2023-2031 ($ MILLION)