Memory Chip Market

Memory Chip Market Size, Share & Trends Analysis Report by Type (Volatile Memory, and Non-Volatile Memory), and Application (Laptop/PC, Cameras, Smartphones, and Others (Gaming Systems, Servers)) Forecast Period (2025-2035)

Industry Overview

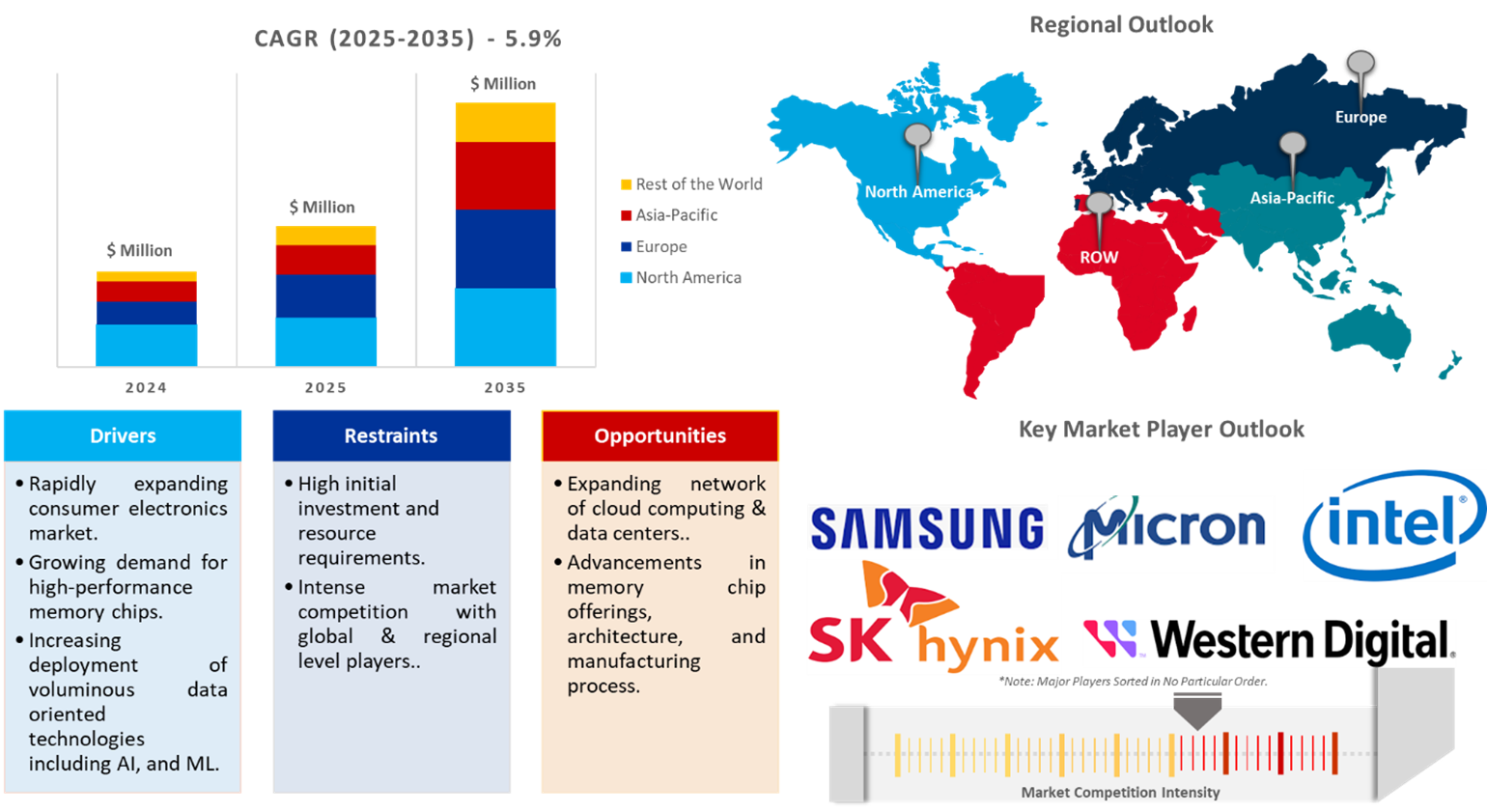

Memory chip market is anticipated to grow at a CAGR of 5.9% during the forecast period (2025-2035). The global digitization initiatives and rapid deployment of data-intensive devices are enabling the memory chip market to expand across the globe. The market players in the memory chip market, including Samsung, Micron, and Patriot Memory, are continuously innovating and developing novel memory solutions for next-generation utility, such as for AI workstations and autonomous driving, which is expected to make the memory chip market innovations relevant for the future. For instance, in June 2024, Micron Technology, Inc. announced samples of its GDDR7, the industry's highest bit-density graphics memory solution. Micron GDDR7 delivers up to 32 Gb/s of high-speed memory in an optimized power form, based on Micron's 1? DRAM process technology and next-generation architecture.

Market Dynamics

Rapidly Expanding Consumer Electronics Market

The rapid growth & mass availability of different consumer electronics devices including smartphones, laptops, cameras, and smartwatches have been among the major contributors to the growth of the memory chips market. The component serves as an integral part of electronic devices by ensuring smooth operations and providing storage capabilities. However, as the consumer electronics industry advances, most devices are incorporating novel technological & software-based developments, necessitating manufacturers to relatively upgrade the storage ecosystem to support seamless user interaction & device requirements. In October 2021, Micron Technology, Inc. reported that it will spend over $150 billion globally within the next decade for advanced memory manufacturing and R&D, potentially even on a future U.S. fab expansion, because the memory manufacturer seeks to seize upon growing demand that already approaches 30% of global semiconductor spending-impelled by everything from 5G, AI, to ballooning use of data centers, automobiles, and consumer products.

Growing Demand for High-Performance Memory Chips

The technology market globally has been driving memory chip producers to continuously invest in & design high-performance memory chips to keep themselves in line with the market demands. In recent years, work on a plethora of future technologies, including AI, VR/AR, and HPC, is gaining momentum; hence, such memory chips have to be introduced that support fast data flow and effective data storage. The deployment of similar technology-based devices is projected to maintain an upward trajectory, supporting demand from device manufacturers for high-performance memory chips such as high-bandwidth memory (HBM), graphics DDR, and SDRAM in the future. For instance, in August 2024, Samsung Electronics started mass-producing the industry's thinnest 12-nanometer-class, 12GB, and 16GB LPDDR5X DRAM packages, cementing its position as a leader in the low-power DRAM market. These ultra-slim packages enhance thermal control, which is vital for high-performance applications such as on-device AI.

Market Segmentation

- Based on the type, the market is segmented into volatile memory, and non-volatile memory.

- Based on the application, the market is segmented into laptop/PC, cameras, smartphones, and others (gaming systems, servers).

Non-Volatile Memory to Lead the Market with the Largest Share

Under type, non-volatile memory remains the more prominent segment of the memory chip market. The memory type supports the future endeavors of market players for developing a resilient storage ecosystem & transitioning into cloud-based workflows based on its capabilities such as data persistence, storage capacity, and applicability. Further, the global demand for offline storage paired with innovation in non-volatile memory is expected to fuel the business footprint of the non-volatile memory type segment.

Smartphones A Key Segment in Market Growth

Smartphones account for the key application segment for memory chips, as the global smartphone market has remained the fastest-growing segment in the consumer electronics market in recent decades. This growth trajectory has pushed the consumer electronics type to gain mass availability and development momentum from memory chip manufacturers. Further, the cost-effectiveness & utility features of smartphones paired with the upcoming development plan of the smartphone industry to incorporate highly data-oriented features such as AI-driven software are expected to drive innovation and development of various smartphone-oriented memory types.

Regional Outlook

The global memory chip market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Supportive Technological Manufacturing Initiative & Policies in North America

The North American memory chip market is widely aided by supportive policies, schemes, and programs launched by state-owned organizations to push domestic manufacturing and R&D of diverse electronic components. In recent decades, the regional market has extensively recorded growth in terms of exports, manufacturing, and development of electronic components, including memory chips, based on several manufacturer-oriented initiatives such as the CHIPS incentive by the US Department of Commerce, stimulating manufacturers to invest & develop their ecosystem in the region. For example, in August 2022, Micron Technology, Inc. declared its intentions to invest a total of $40 billion in next-generation memory manufacturing in the U.S. The investment towards the most advanced memory manufacturing in the world is based on the CHIPS and Science Act.

Asia-Pacific Region is Projected to Become the Global Electronics Manufacturing Hub

Asia-Pacific is projected to exhibit substantial growth in the forecast period owing to the development of regional electronic device and component manufacturing ecosystems in various countries, including India, China, Japan, Vietnam, and others. This trend is aided by supportive policies, manufacturer inclination towards creating infrastructure in the region, and rapidly expanding regional consumption of memory chips in data centers, consumer electronics, and automotive. For instance, in June 2023, Micron Technology, Inc. plans to construct a new assembly and test facility in Gujarat, India, which will be used to produce both DRAM and NAND products.

Market Players Outlook

The major companies operating in the global memory chip market include Samsung Electronics Co. Ltd, SK Hynix Inc., Advanced Micro Devices, Inc., Micron Technology Inc., Elite Semiconductor Microelectronics Technology Inc., Integrated Silicon Solution, Inc., Patriot Memory, Inc., and Western Digital Corp, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2024, Samsung Electronics disclosed the world's first 24-gigabit (Gb) GDDR7 DRAM in terms of density and speed; the 24Gb GDDR7 will carry outstanding performance that should be widely welcomed in high-performance applications such as data centers and AI workstations and even reach beyond traditional graphics DRAM use cases in gaming consoles and autonomous driving.

- In April 2024, SK Hynix Inc. announced that it had signed a memorandum of understanding with TSMC to collaborate on producing next-generation HBM and enhancing logic and HBM integration through advanced packaging technology. The joint effort is to develop HBM4, the sixth generation of the HBM family, which is scheduled for mass production in 2026.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global memory chip market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.

Report Summary

Current Industry Analysis and Growth Potential Outlook

Global Memory

Chip Market Sales Analysis –Type | Application

($ Million)

Memory Chip Market Sales Performance of Top Countries

1.1.

Research

Methodology

·

Primary

Research Approach

·

Secondary

Research Approach

1.2.

Market Snapshot

2.

Market Overview and Insights

2.1.

Scope of

the Study

2.2. Analyst Insight & Current Market Trend

2.2.1.

Key Memory

Chip Industry Trends

2.2.2.

Market Recommendations

2.3.

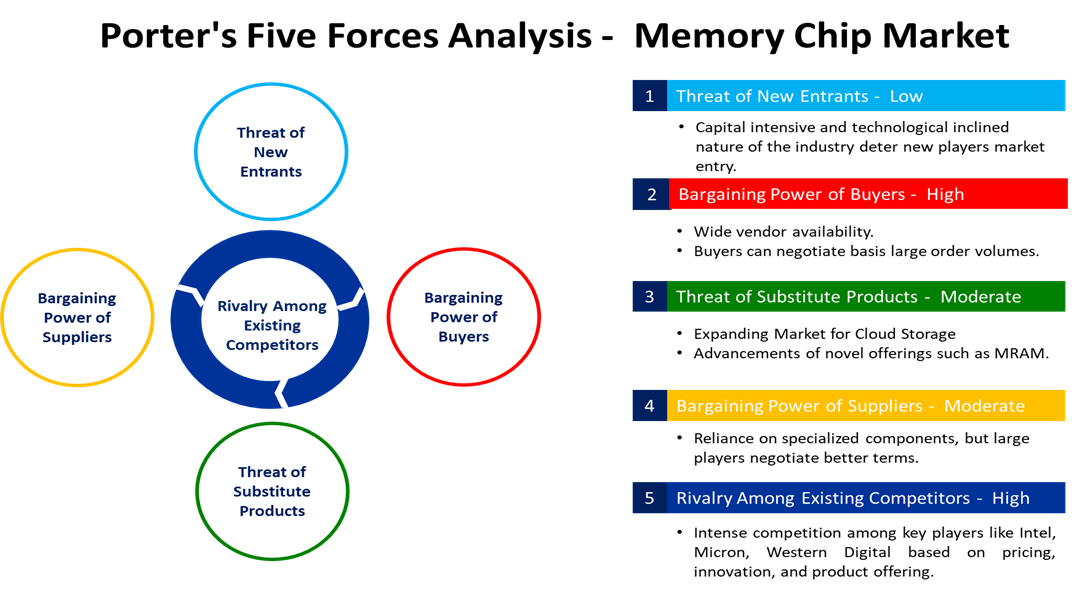

Porter's

Five Forces Analysis for the Memory Chip Market

2.3.1.

Competitive

Rivalry

2.3.2.

Threat

of New Entrants

2.3.3.

Bargaining

Power of Suppliers

2.3.4.

Bargaining

Power of Buyers

2.3.5.

Threat

of Substitutes

3.

Market Determinants

3.1.

Market Drivers

3.1.1.

Drivers For Global Memory Chip Market:

Impact Analysis

3.2.

Market Pain Points and Challenges

3.2.1.

Restraints For Global Memory Chip Market:

Impact Analysis

3.3.

Market Opportunities

4.

Competitive Landscape

4.1.

Competitive

Dashboard – Memory Chip Market Revenue and Share by Manufacturers

·

Memory

Chip Product Comparison Analysis

·

Top

Market Player Ranking Matrix

4.2.

Key

Company Analysis

4.2.1.

Micron

Technology, Inc.

4.2.1.1.

Overview

4.2.1.2.

Product Portfolio

4.2.1.3.

Financial

Analysis (Subject to Data Availability)

4.2.1.4.

SWOT

Analysis

4.2.1.5.

Business

Strategy

4.2.2.

Samsung

Electronics Co., Ltd.

4.2.2.1.

Overview

4.2.2.2.

Product Portfolio

4.2.2.3.

Financial

Analysis (Subject to Data Availability)

4.2.2.4.

SWOT

Analysis

4.2.2.5.

Business

Strategy

4.2.3.

SK HYNIX Inc.

4.2.3.1.

Overview

4.2.3.2.

Product Portfolio

4.2.3.3.

Financial

Analysis (Subject to Data Availability)

4.2.3.4.

SWOT

Analysis

4.2.3.5.

Business

Strategy

4.2.4.

Advanced Micro Devices, Inc.

4.2.4.1.

Overview

4.2.4.2.

Product Portfolio

4.2.4.3.

Financial

Analysis (Subject to Data Availability)

4.2.4.4.

SWOT

Analysis

4.2.4.5.

Business

Strategy

4.3.

Top

Winning Strategies by Market Players

4.3.1.

Merger

and Acquisition

4.3.2.

Product

Launch

4.3.3.

Partnership

And Collaboration

5.

Global Memory Chip Market

Sales Analysis by Type ($ Million)

5.1.

Volatile Memory

5.1.1.

DRAM

5.1.2.

SRAM

5.2.

Non-Volatile

Memory

5.2.1.

PROM

5.2.2.

EEPROM

5.2.3.

NAND

Flash

6.

Global Memory Chip Market

Sales Analysis by Application ($

Million)

6.1.

Laptop/PC

6.2.

Cameras

6.3.

Smartphones

6.4.

Others

(Gaming Systems, Servers)

7.

Regional Analysis

7.1.

North

American Memory Chip Market Sales Analysis –Type | Application | Country ($

Million)

·

Macroeconomic Factors for North

America

7.1.1.

United

States

7.1.2.

Canada

7.2.

European

Memory Chip Market Sales Analysis –Type | Application| Country ($ Million)

·

Macroeconomic Factors for Europe

7.2.1.

UK

7.2.2.

Germany

7.2.3.

Italy

1. Global Memory Chip Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Volatile Memory Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global DRAM Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global SRAM Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Non-Volatile Memory Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global PROM Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global EEPROM Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global NAND Flash Memory Chip Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Memory Chip Market Research And Analysis By Application, 2024-2035 ($ Million)

10. Global Memory Chip In Laptop/PC Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Memory Chip In Cameras Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Memory Chip In Smartphones Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Memory Chip In Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Memory Chip Market Research And Analysis By Region, 2024-2035 ($ Million)

15. North American Memory Chip Market Research And Analysis By Country, 2024-2035 ($ Million)

16. North American Memory Chip Market Research And Analysis By Type, 2024-2035 ($ Million)

17. North American Memory Chip Market Research And Analysis By Application, 2024-2035 ($ Million)

18. European Memory Chip Market Research And Analysis By Country, 2024-2035 ($ Million)

19. European Memory Chip Market Research And Analysis By Type, 2024-2035 ($ Million)

20. European Memory Chip Market Research And Analysis By Application, 2024-2035 ($ Million)

21. Asia-Pacific Memory Chip Market Research And Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific Memory Chip Market Research And Analysis By Type, 2024-2035 ($ Million)

23. Asia-Pacific Memory Chip Market Research And Analysis By Application, 2024-2035 ($ Million)

24. Rest Of The World Memory Chip Market Research And Analysis By Region, 2024-2035 ($ Million)

25. Rest Of The World Memory Chip Market Research And Analysis By Type, 2024-2035 ($ Million)

26. Rest Of The World Memory Chip Market Research And Analysis By Type, 2024-2035 ($ Million)

27. Rest Of The World Memory Chip Market Research And Analysis By Application, 2024-2035 ($ Million)

1.

Global Memory Chip Market Share

By Type, 2024 Vs 2035 (%)

2.

Global Volatile Memory Market

Share By Region, 2024 Vs 2035 (%)

3.

Global DRAM Market Share By

Region, 2024 Vs 2035 (%)

4.

Global SRAM Market Share By

Region, 2024 Vs 2035 (%)

5.

Global Non-Volatile Memory Market

Share By Region, 2024 Vs 2035 (%)

6.

Global PROM Market Share By

Region, 2024 Vs 2035 (%)

7.

Global EEPROM Market Share By

Region, 2024 Vs 2035 (%)

8.

Global NAND Flash Memory Market

Share By Region, 2024 Vs 2035 (%)

9.

Global Memory Chip Market Share

By Application, 2024 Vs 2035 (%)

10.

Global Memory Chip In Laptop/PC

Market Share By Region, 2024 Vs 2035 (%)

11.

Global Memory Chip In Cameras Market

Share By Region, 2024 Vs 2035 (%)

12.

Global Memory Chip In Smartphones

Market Share By Region, 2024 Vs 2035 (%)

13.

Global Memory Chip In Other

Application Market Share By Region, 2024 Vs 2035 (%)

14.

Global Memory Chip Market Share By

Region, 2024 Vs 2035 (%)

15.

US Memory Chip Market Size, 2024-2035

($ Million)

16.

Canada Memory Chip Market Size,

2024-2035 ($ Million)

17.

UK Memory Chip Market Size, 2024-2035

($ Million)

18.

France Memory Chip Market Size,

2024-2035 ($ Million)

19.

Germany Memory Chip Market

Size, 2024-2035 ($ Million)

20.

Italy Memory Chip Market Size, 2024-2035

($ Million)

21.

Spain Memory Chip Market Size, 2024-2035

($ Million)

22.

Russia Memory Chip Market Size,

2024-2035 ($ Million)

23.

Rest Of Europe Memory Chip Market

Size, 2024-2035 ($ Million)

24.

India Memory Chip Market Size, 2024-2035

($ Million)

25.

China Memory Chip Market Size, 2024-2035

($ Million)

26.

Japan Memory Chip Market Size, 2024-2035

($ Million)

27.

South Korea Memory Chip Market

Size, 2024-2035 ($ Million)

28.

ASEAN Memory Chip Market Size, 2024-2035

($ Million)

29.

Australia and New Zealand Memory

Chip Market Size, 2024-2035 ($ Million)

30.

Rest Of Asia-Pacific Memory

Chip Market Size, 2024-2035 ($ Million)

31.

Latin America Memory Chip Market

Size, 2024-2035 ($ Million)

32.

Middle East And Africa Memory

Chip Market Size, 2024-2035 ($ Million)