Metal Packaging Market

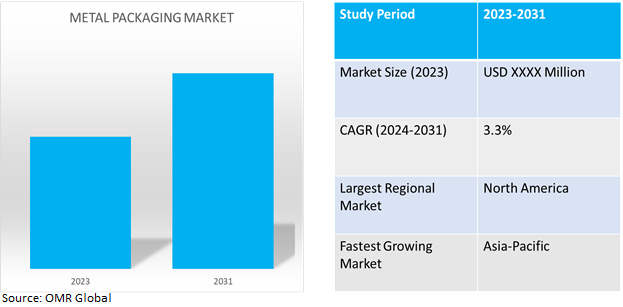

Metal Packaging Market Size, Share & Trends Analysis Report by Material (Steel and Aluminum), by Type (Aerosols, Cans, Caps and Closures, and Drums and Barrels), and by Application (Food, Beverages, Personal Care, Health Care, and Paints & Varnishes), Forecast Period (2024-2031)

Metal packaging market is anticipated to grow at a moderate CAGR of 3.3% during the forecast period (2024-2031).A metal packaging is made of two materials namely steel sheets called aluminum and a bin. Steel sheets are plated with tin and organic lac, therefore the direct contact of steel with food is inhibited. Hereby, corrosion-resistant metal packages are produced. It is produced as the corrosion-resistant metal packaging.

Market Dynamics

IncreasingTechnological Advancement Drives The Market Demand

Technological advancements have significantly impacted the industry, leading to improved designs, manufacturing processes, and functionalities. These innovations have made packaging more versatile, convenient, and sustainable, further driving its adoption. In addition, engineers have found ways to optimize metal thickness without compromising strength, reducing the weight of metal cans and containers, which lowers production costs, enhances transportation efficiency, and reduces fuel consumption and greenhouse gas (GHG) emissions during distribution, thus influencing the market growth. Moreover, the incorporation of smart packaging features such as radio frequency identification (RFID) tags and quick response (QR) codes on packaging allows enhanced supply chain visibility, traceability, and consumer engagement representing another major growth-inducing factor. This technology enables real-time tracking of products, ensuring efficient inventory management and reducing the risk of counterfeiting. Furthermore, advances in surface treatment technologies made metal packaging more resistant to corrosion and abrasion, extending the shelf life of packaged goods and enhancing the visual appeal of the packaging thus propelling the market growth.

Increasing Use of Metal Packaging with Excellent Corrosion Resistance

Some metals are naturally susceptible to corrosion, posing a significant obstacle for the packaging sector. However, increasingly corrosion-resistant metal packaging has accelerated the adoption of metal packaging throughout industries, particularly in the food and beverage industry. Steel sheets are more reactive when directly touching packaged goods, particularly beverages. Coating steel sheets remedy this issue with tin or organic lac to prevent food from coming into close touch with the metal. Thus, the increasing usage of tin-coated plates as major packaging materials in industries such as pharmaceuticals, cosmetics, personal care, and food and drinks contributes to the expansion of the market.

Market Segmentation

Our in-depth analysis of the global metal packaging market includes the following segments by material, type, and application:

- Based on material, the market is segmented into steel and aluminum.

- Based on type, the market is segmented into aerosols, cans, caps and closures, and drums and barrels.

- Based on application, the market is segmented into food, beverages, personal care, health care, and paints & varnishes.

Steel is Projected to Emerge as the Largest Segment

Thesteel segment is expected to hold the largest share of the market. The vast use of steel-based packing containers such as cans, bottles, drums, and jars, which guarantee good protection of packaged items from heat and other external conditions, is credited to the segment's growth. Steel is stronger and more durable than aluminum in the harsh handling of packaging containers during transit and storage.Besides this, steel’s ability to preserve the quality and integrity of food, beverages, and pharmaceuticals has led to a surge in demand for steel packaging solutions. Furthermore, advancements in steel manufacturing processes have led to the development of lightweight steel packaging without compromising its strength, which is further accelerating the steel's appeal as a cost-effective and efficient packaging solution. Along with this, the recyclability of steel supports sustainability initiatives, reducing the environmental impact and promoting a circular economy, thus influencing market growth.

Cans Segment to Hold a Considerable Market Share

The cans segment holds a considerable market share and is expected to dominate the market in the following years due to the widespread adoption of cans for beverage products. Steel cans are typically coated with tin and organic lac to prevent them from reacting with beverages when in close contact with them. The increasing consumption of energy drinks, carbonated soft drinks, and beer, particularly in developing nations, is a further important factor driving the category. Two-piece and three-piece metal cans, such as deodorants, are commonly used for aerosol and spray packing. During the forecast period, the segment of bulk containers is anticipated to account for a significant portion of the market due to the rising shipment of bulk industrial goods, which is influenced by expanding global trade and industrialization.

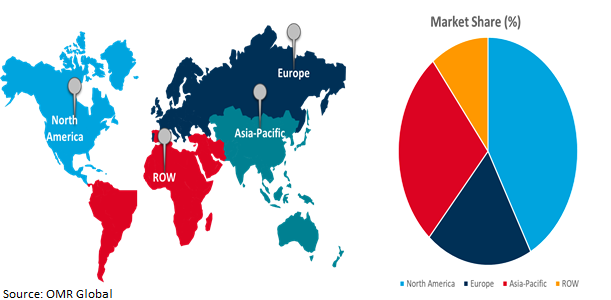

Regional Outlook

The globalmetal packagingmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Grow at the Fastest CAGR

Asia-Pacific is the fastest-growing market, with the regional market expected to rise significantly during the projection period. The increasing demand for metal packaging in the area, influenced by the rapid expansion of the food & beverage, household & consumer, and personal & cosmetics industries, is driving market growth in Asia-Pacific. China is the largest market in the region, and the country is expected to outpace the entire expansion of the US metal packaging industry in the future years.

Global Metal Packaging Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant shareowing to the country's increasing rate of metal consumption in the packaging industry. Furthermore, the presence of significant global companies and their expanding R&D programs for novel metal components for industrial packaging fuels the regional market.The growing demand for packaged food and beverage items, particularly canned drinks, significantly impacts regional market growth.The rising proliferation of metal packaging products in the region is due to strict government regulations and standards. The massive rise of the metal packaging sector is also due to the tremendous consumption of canned food in North America.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global metal packagingmarket includeArdagh Group, Ball Corp., Crown Holdings, Inc., and Silgan Holdings Inc.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in September 2022, Alcoa Corp., a large metal-producing business based in the US, introduced A210 ExtruStrongTM as part of its breakthroughs in aluminum alloy development and deployment. The company asserted that the new product would have advanced characteristics, such as a high-strength capacity and a smaller size, making it suitable for various extruded applications in consumer products, transportation, and construction industries.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global metal packagingmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ardagh Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ball Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Crown Holdings, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Silgan Holdings Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Metal Packaging Market by Material

4.1.1. Steel

4.1.2. Aluminum

4.2. Global Metal Packaging Market by Type

4.2.1. Aerosols

4.2.2. Cans

4.2.3. Caps and Closures

4.2.4. Drums and Barrels

4.3. Global Metal Packaging Market by Application

4.3.1. Food

4.3.2. Beverages

4.3.3. Personal Care

4.3.4. Health Care

4.3.5. Paints & Varnishes

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Alcoa Corp.

6.2. Amcor Plc.

6.3. BERICAP Holding GmbH

6.4. Bway Corp.

6.5. CANPACK

6.6. Colep Packaging (RAR Group Company)

6.7. CPMC Holdings Ltd.

6.8. Emballator Metal Group

6.9. Greif

6.10. MAUSER Corporate GmbH

6.11. Metal Packaging Europe G.I.E.

6.12. Nampak Ltd.

6.13. Rexam Plc.

6.14. Tata Steel

6.15. TON YI INDUSTRIAL CORP.

6.16. TUBEX Packaging GmbH

1. GLOBALMETAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL STEELMETAL PACKAGINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALALUMINUM METAL PACKAGINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL METALPACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

5. GLOBAL METAL AEROSOLSPACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL METAL CANSPACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL METAL CAPS AND CLOSURESPACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL METAL DRUMS AND BARRELS PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL METAL PACKAGINGMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL METAL PACKAGING FOR FOODMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL METAL PACKAGING FORBEVERAGESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL METAL PACKAGING FORPERSONAL CAREMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL METAL PACKAGING FORHEALTH CAREMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL METAL PACKAGING FOR PAINTS & VARNISHESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

18. NORTH AMERICAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

20. EUROPEAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

22. EUROPEAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICMETAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

26. ASIA-PACIFICMETAL PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFICMETAL PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

30. REST OF THE WORLD METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD METAL PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBALMETAL PACKAGING MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL STEEL METAL PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBALALUMINUM METAL PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL METALPACKAGING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

5. GLOBAL METAL AEROSOLSPACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL METAL CANSPACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL METALCAPS AND CLOSURESPACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL METALDRUMS AND BARRELS PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL METAL PACKAGINGMARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL METAL PACKAGING FOR FOODMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL METAL PACKAGING FORBEVERAGESMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL METAL PACKAGING FORPERSONAL CAREMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL METAL PACKAGING FORHEALTH CAREMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL METAL PACKAGING FORPAINTS & VARNISHES MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL METAL PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

18. UK METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC METAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICAMETAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICAMETAL PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)