MICE Market

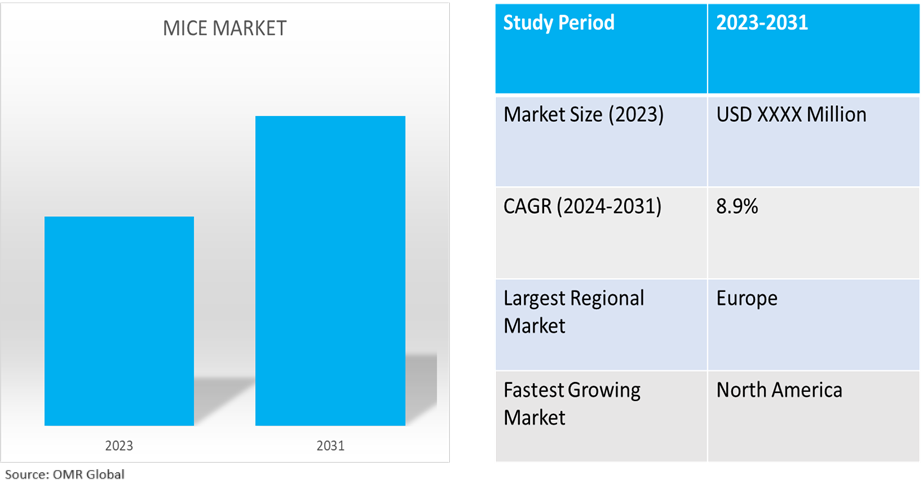

MICE Market Size, Share & Trends Analysis Report by Event Type (Meetings, Incentives, Conferences, and Exhibitions), Forecast Period (2024-2031).

MICE market is anticipated to grow at a CAGR of 8.9% during the forecast period (2024-2031). The MICE industry consists of organizers and suppliers that manage and deliver meetings, conferences, exhibitions, and other related events held to achieve a range of professional, business, cultural, or academic objectives. The activities of the MICE industry play a key role in the future growth of businesses, cities, destinations, and other covered spectrums. Organizers of MICE events also provide other creative services that include show displays, directional signage, banners, kiosks/exhibit space, event photography, AV/technical production, event marketing & sponsorship management, group air fulfillment, on-site event logistics and staffing, supplier management, virtual meetings, and risk management services.

Market Dynamics

The Digitalization of Travel Payments is Driving Growth in the MICE Market

With the increasing digitization in most sectors around the globe, the MICE market has taken advantage of this trend. The expansion of businesses globally is resulting in increasing business trips. There has been an increase in the number of travelers for domestic and international business trips. With the digitalization of payments, the booking and payment of travel plans have become easy for companies.

However, companies can carry out payments in a more secure manner due to the availability of options such as virtual payment options. Virtual payment cannot be misused as it is generated for individual use and specific purposes, such as paying for a hotel room. It also reduces the threat of theft. In addition, it helps to cut the number of documents an organization needs, since its expenditure data is automatically collected online. Hence, the rising digitization of travel payments will boost the development of the global market focus during the forecast period.

The Adoption of Geo-Cloning by Exhibition Organizers is Driving the Market

Globally, the adoption of geo-cloning by exhibition organizers is driving the market. Geo-cloning is a strategy being investigated by organizers and exhibitors to connect with audiences locally and internationally. The idea behind geo-cloning is to replicate well-known exhibition and event brands in different parts of the world. Reed Exhibitions, a division of RELX, successfully implements geo-cloning for brands, such as EuroBLECH, RAILTEX, and PSE Europe, which contributes to industry growth.

Market Segmentation

- Based on event type, the market is segmented into meetings, incentives, conferences, and exhibitions.

Meetings is Projected to Emerge as the Largest Segment

The meetings segment is expected to hold the largest share of the market. A meeting is a broad phrase for when several people join together in one location to discuss or do a certain task. Meetings offer a useful platform for many purposes. For instance, meetings facilitate idea-sharing, decision-making, and team-building and even help reduce feelings of isolation at work. They lead to quicker problem-solving through a free and open exchange of information, ideas, and insights. Meetings help establish trust, enhance communication, and improve productivity and efficiency of tasks. Meetings can take place at every level of the organization. Meetings are a means to gather and share knowledge. MICE is synonymous with meetings and is often referred to as the "meetings industry", indicating the dominance and importance of the segment in the global market.

The Korea MICE Expo 2023, supported by the Korea Tourism Organisation and Incheon Metropolitan City and hosted by the Ministry of Culture, Sports, and Tourism, was successfully wrapped up at Songdo Convensia. The Korea MICE Association and the Incheon Tourism Organisation organized the event. "KOREA MICE EXPO," in its 24th year, is the top B2B event for the Korean MICE sector. With over 3,500 MICE professionals in attendance this year, there has been a noticeable rise in engagement from organizations and companies as the expo transitions to a private sector-led effort supported by the government. 450 exhibitors during the show, representing 265 businesses, most of which were regional travel agencies. Additionally, more than 150 domestic and foreign buyers from 24 countries attended the event.

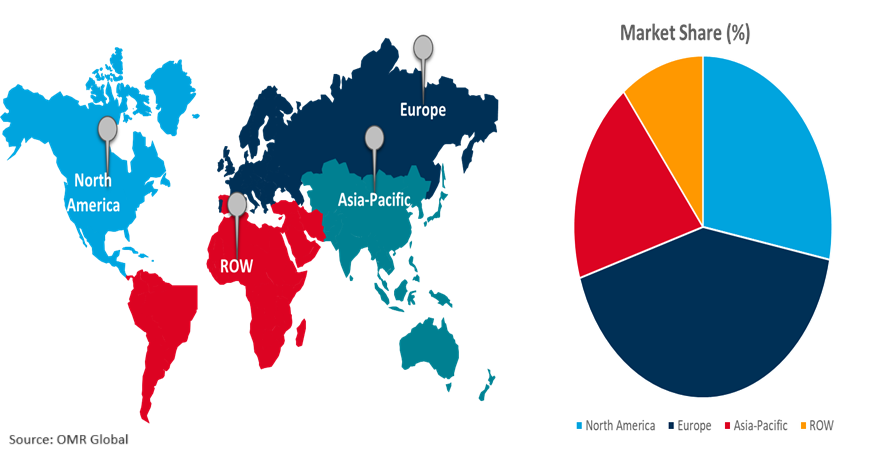

Regional Outlook

The global MICE market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global MICE Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe region dominated the global MICE industry in 2022 and is expected to sustain its dominance during the MICE Industry forecast period. On a positive note, Europe has been extremely successful in winning conferences of international associations with over half of its top cities and countries selected as destinations for international association conferences. The UK and Germany are the top investing pockets for the MICE industry in Europe. Moreover, the market is witnessing growth due to an increase in the trend of online booking. As the penetration of MICE events increases in Europe, resorts in the region are adapting to specialized MICE hotel locations and services. This diversification of hotel operations provides a greater advantage for MICE reservations. Companies throughout Europe have been reconsidering corporate travel policies and introducing new expense technologies to respond to shifting economic and workforce situations. For instance, Europe Incoming- a provider of hotels, European tours, and ground services offers specialized MICE tour bookings.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global MICE market include ATPI Ltd., Conference Care., Meetings and Incentives Worldwide, Inc., and One10, LLC, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2022, presenting the budget for 2022/23, the Chief Minister of the State announced the upgradation of Bangalore into a Meeting, Incentive, Conferences, and Exhibitions (MICE) hub of the country by leveraging the city's advantages as a business capital, IT Capital as well as its developed infrastructure in technology, transport, and air connectivity.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global MICE market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ATPI Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Conference Care

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Meetings and Incentives Worldwide, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. One10, LLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global MICE Market by Event Type

4.1.1. Meetings

4.1.2. Incentives

4.1.3. Conferences

4.1.4. Exhibitions

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. 360 Destination Group

6.2. Access

6.3. American Express Global Business Travel (GBT)

6.4. AVIAREPS AG

6.5. BCD Meetings & Events

6.6. BEYOND SUMMITS LTD.

6.7. Cambria DMC

6.8. Capita Plc.

6.9. Ci Events

6.10. Creative Group, Inc.

6.11. CSI DMC

6.12. CWT Meetings & Events

6.13. FLIGHT CENTRE TRAVEL GROUP LIMITED

6.14. Freeman

6.15. IBTM World

6.16. ITL World Co. (MICEMINDS)

6.17. Maritz

6.18. Questex

1. GLOBAL MICE MARKET RESEARCH AND ANALYSIS BY EVENT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL MEETINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INCENTIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CONFERENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL EXHIBITIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. NORTH AMERICAN MICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

8. NORTH AMERICAN MICE MARKET RESEARCH AND ANALYSIS BY EVENT TYPE, 2023-2031 ($ MILLION)

9. EUROPEAN MICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. EUROPEAN MICE MARKET RESEARCH AND ANALYSIS BY EVENT TYPE, 2023-2031 ($ MILLION)

11. ASIA-PACIFIC MICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. ASIA-PACIFIC MICE MARKET RESEARCH AND ANALYSIS BY EVENT TYPE, 2023-2031 ($ MILLION)

13. REST OF THE WORLD MICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. REST OF THE WORLD MICE MARKET RESEARCH AND ANALYSIS BY EVENT TYPE, 2023-2031 ($ MILLION)

1. GLOBAL MICE MARKET SHARE BY EVENT TYPE, 2023 VS 2031 (%)

2. GLOBAL MEETINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INCENTIVES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CONFERENCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL EXHIBITIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. US MICE MARKET SIZE, 2023-2031 ($ MILLION)

8. CANADA MICE MARKET SIZE, 2023-2031 ($ MILLION)

9. UK MICE MARKET SIZE, 2023-2031 ($ MILLION)

10. FRANCE MICE MARKET SIZE, 2023-2031 ($ MILLION)

11. GERMANY MICE MARKET SIZE, 2023-2031 ($ MILLION)

12. ITALY MICE MARKET SIZE, 2023-2031 ($ MILLION)

13. SPAIN MICE MARKET SIZE, 2023-2031 ($ MILLION)

14. REST OF EUROPE MICE MARKET SIZE, 2023-2031 ($ MILLION)

15. INDIA MICE MARKET SIZE, 2023-2031 ($ MILLION)

16. CHINA MICE MARKET SIZE, 2023-2031 ($ MILLION)

17. JAPAN MICE MARKET SIZE, 2023-2031 ($ MILLION)

18. SOUTH KOREA MICE MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF ASIA-PACIFIC MICE MARKET SIZE, 2023-2031 ($ MILLION)

20. LATIN AMERICA MICE MARKET SIZE, 2023-2031 ($ MILLION)

21. MIDDLE EAST AND AFRICA MICE MARKET SIZE, 2023-2031 ($ MILLION)