Micro-Computed Tomography (CT) Market

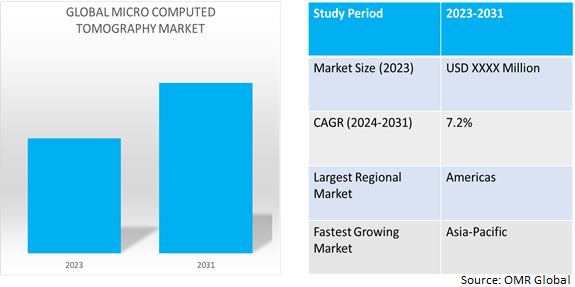

Micro-Computed Tomography (CT) Market Size, Share & Trends Analysis Report by Product (In-Vivo and Ex-Vivo), by Application (Life Sciences, Bones, Dentistry, Plants and Food, Material Science, and Geology/Oil and Gas Geology), and by End-User (Hospitals and Clinics, Diagnostic Laboratories, Academic and Research Institutions, and Pharmaceutical and Biotechnology Companies) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Micro-CT market is anticipated to grow at a CAGR of 7.2% during the forecast period (2024-2031). The market’s growth is attributed to the need for high-quality 3D imaging modalities like micro-CT is increasing owing to the expanding usage of 3D printing in healthcare, particularly in surgery planning, medical device production, and tissue engineering. According to the National Institute of Health (gov.), in September 2023, globally, 143 million additional surgical procedures are needed each year in low- and middle-income countries to save lives and prevent disability however, the application of AI in the production of organs models through 3D printing and highlights the challenges associated with achieving high-quality, high-throughput models. The integration of AI and ML technology into additive manufacturing (AM) has the potential to automate complex information processing and assist in making rational decisions, ultimately enhancing the development of organ models for preoperative simulations. However, there is currently limited research on the use of AI combined with 3D printing for clinical procedures, and further advancements are needed to optimize the accuracy and efficiency of this process.

Market Dynamics

Growing Prevalence of High-Resolution Imaging

Micro-CT offers high-resolution imaging for precise diagnosis and early cancer detection. By visualizing specific tumor characteristics, it helps physicians define their goals and plan the course of action. According to the National Institute of Health, (gov.) in January 2023, Cancer is the globe's most significant cause of mortality, accounting for 10. million deaths and 19.3 million new diagnoses globally in 2020. Early detection rates and therapeutic management have improved with the use of diagnostic tools such as positron emission tomography (PET), computed tomography (CT), magnetic resonance spectroscopy (MRS), and molecular diagnostics. Nevertheless, obstacles include superior target definition and high expense rendering it complicated to diagnose deep-seated malignancies accurately. To improve cancer care, especially in low- and middle-income nations, to examine imaging, molecular, and inexpensive diagnostic technologies in this study.

Increasing the Use of Healthcare Applications

High-resolution imaging systems are expected to grow more and more in demand as micro-CT is used progressively in healthcare for preclinical research, orthodontic studies, and dental imaging. For instance, in May 2023, Nikon Metrology introduced the VOXLS 40 C 450, a large-volume CT system designed for inspection and analysis across various industries. It featured a granite-based manipulator, rigid steel towers, motors, and encoders, and two microfocus X-ray sources.

Market Segmentation

Our in-depth analysis of the global Micro Computed Tomography market includes the following segments by product, application, and end-user:

- Based on product, the market is sub-segmented into in-vivo, and ex-vivo.

- Based on application, the market is sub-segmented into life sciences, bones, dentistry, plants and food, material science, and geology/oil and gas geology.

- Based on end-users, the market is bifurcated into hospitals and clinics, diagnostic laboratories, academic and research institutions, and pharmaceutical and biotechnology companies.

Ex-Vivo is Projected to Emerge as the Largest Segment

The ex-vivo sub-segment is expected to hold the largest share of the market owing to the increasing demand for high-resolution 3D visualization. According to the National Institute of Health (NIH.gov) survey published in September 2022, compared to other imaging modalities such as optical coherence tomography (OCT) and ultrasonography, micro-CT offers higher spatial resolution and precision in 3D imaging, enabling detailed characterization of ocular tissues and disease. Clinical ex-vivo imaging of ocular anatomy typically uses optical coherence tomography (OCT), magnetic resonance imaging (MRI), ocular ultrasonography, or fluorescence-based ophthalmoscopy. These methods offer fast and extensive investigations, though can reach resolutions down to 250 µm and 10 µm in depth. Hence, micro-CT is the preferred method for combining high-resolution imaging with 3D visualization on time. However, challenges include low radiodensity of untreated soft tissues and partial X-ray attenuation.

Diagnostic Laboratories Sub-segment to Hold a Considerable Market Share

The micro-CT systems are essential for materials science, metallurgy, and geology in both the commercial and academic domains. It improves failure analysis, process optimization, quality control, and materials characterization across a range of industries. For instance, in March 2021, Zeiss Research Microscopy Solutions introduced the Xradia CrystalCT micro-CT system, which enables 3D crystallographic imaging of polycrystalline materials for various applications in industrial and academic laboratories.

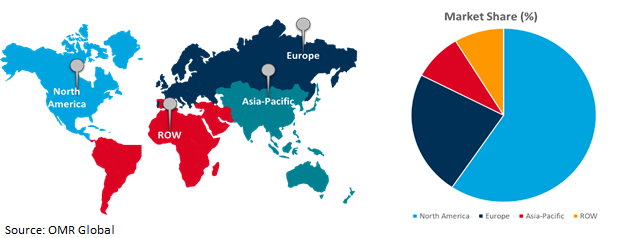

Regional Outlook

The global micro-computed tomography (CT) market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Explosive Growth of Biotechnology Industry in Asia-Pacific Region

- Advanced imaging technologies such as micro-CT are essential for high-resolution, precise biotechnological research owing to the biotechnology industry's rapid growth in India, which is driven by genetic engineering, bioprocessing, and bioinformatics.

- According to the India Brand Equity Foundation (IBEF ), in February 2024, India's bio-economy industry has grown significantly, from $10 billion in 2015 to $80 billion in 2023, contributing 2.6% to the country's GDP. The COVID-19 vaccination and testing drive has contributed nearly a 5th of the industry's worth, worth $14. 6 billion. Biopharma, accounting for 49% of the bio-economy, contributes the largest portion, estimated at $394 billion. The Indian biotechnology industry, which doubled from $30.2 billion to $70.2 billion between 2015 and 2020, is expected to reach $150 billion by 2025 and reach $270-300 billion by 2030.

Global Micro Computed Tomography Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the growing demand for advanced imaging technologies such as micro-CT is driven by the increasing geriatric population.The aging population, an increasing number of persistent diseases, the change in medical treatment toward image-guided treatments, and technology developments have been driving the market.

Furthermore, according to the National Institute of Health (gov.) in May 2022, chronic bone metabolic condition that increases the risk of fractures is low bone mineral density (LBMD), which includes osteoporosis and low bone mass. In the US, it affects more than 10 million people, and by 2020, 14 million individuals over 50 are predicted to be impacted. The most serious consequence is fractures, with a predicted 240% and 310% increase in hip fracture incidence by 2050. Patients with LBMD are more likely to experience fractures, with fragility fractures being the most common type.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving the global micro computed tomography market include AggreDyne, Inc., Medtronic Pvt. Ltd., Siemens Healthineers Co., Sysmex Corp. Werfen, S.A., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in May 2023, Revvity launched three state-of-the-art imaging systems such as the Vega ultrasound system, the QuantumTM GX3 micro-CT structural imaging solution, and the IVIS Spectrum 2 and SpectrumCT 2. These innovations are expected to be on display in Prague at the World Molecular Imaging Congress.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global micro-computed tomography (CT) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bruker Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Carl Zeiss AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. GE HealthCare Technologies Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Micro-Computed Tomography (CT) Market by Product

4.1.1. In-Vivo

4.1.2. Ex-vivo

4.2. Global Micro-Computed Tomography (CT) Market by Application

4.2.1. Life Sciences

4.2.2. Bones

4.2.3. Dentistry

4.2.4. Plants and Food

4.2.5. Material Science

4.2.6. Geology/Oil and Gas Geology

4.3. Global Micro-Computed Tomography (CT) Market by End-User

4.3.1. Hospitals and Clinics

4.3.2. Diagnostic Laboratories

4.3.3. Academic and Research Institutions

4.3.4. Pharmaceutical and Biotechnology Companies

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Animage, LLC

6.2. Aspect Imaging Ltd.

6.3. Comet Yxlon GmbH

6.4. Hitachi, Ltd.

6.5. Mediso Kft.

6.6. MILabs B.V.

6.7. Nikon India Pvt. Ltd.

6.8. PerkinElmer AES

6.9. Rigaku Holdings Corp.

6.10. SCANCO Medical AG

6.11. Siemens Healthineers Co.

6.12. TESCAN GROU

6.13. Thermo Fisher Scientific Inc.

1. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL IN-VIVO MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL EX-VIVO MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN LIFE SCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN BONES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN DENTISTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN PLANTS AND FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN MATERIAL SCIENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN GEOLOGY/OIL AND GAS GEOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR ACADEMIC AND RESEARCH INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. NORTH AMERICAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. EUROPEAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. EUROPEAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. EUROPEAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

29. REST OF THE WORLD MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

31. REST OF THE WORLD MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD MICRO-COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL IN-VIVO MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL EX-VIVO MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN LIFE SCIENCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN BONES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN DENTISTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN PLANTS AND FOOD MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN MATERIAL SCIENCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) IN GEOLOGY/OIL AND GAS GEOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY END-USER, 2023 VS 2031 (%)

12. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR DIAGNOSTIC LABORATORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR ACADEMIC AND RESEARCH INSTITUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

19. UK MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)

31. THE MIDDLE EAST AND AFRICA MICRO-COMPUTED TOMOGRAPHY (CT) MARKET SIZE, 2023-2031 ($ MILLION)