Micro LED Market

Global Micro LED Market Size, Share & Trends Analysis Report by Application (Display and Lightning), By End-User (Consumer Electronics, Automotive, Aerospace & Defense, and Others), Forecast 2019-2025 Update Available - Forecast 2025-2031

The micro LED market is anticipated to grow at a CAGR of 32.5% during the forecast period. This market growth is attributed to the extensive investment in the field of micro led technology by tech giants such as Samsung and Apple. The development of expanded micro-LED panels has delivered an excellent viewing angle that provides brighter pictures and delivered with less power consumption. For enhancement of consumer experience, micro LED provides quick response time. Further, the market has significant growth opportunities owing to its high wavelength uniformity for fine pixel pitch display along with the growing application in consumer electronics such as smartphones, smartwatches, monitors, virtual reality/ augmented reality and laptops. The consumer electronics manufacturers are adopting micro LED displays to expand picture clarity and reduce power consumption.

Micro LED is the latest display technology and it is a significantly brighter source that offering brightness around three or four orders of magnitude higher than OLED that deliver around 1000 Nits as compared to micro-LED deliver hundreds of thousands of Nits for power consumption. The demand for micro LED has gained traction as LED has been long in demand and visual technology has strong acceptance among consumers. The evolution and focus of the key industry market players in developing innovative products includes VR/MR and near to eye camera is expected to create demand for micro led across the globe. There are various factors such as growing consumer spending on personal entertainment is propelling the market growth for non-commercial and commercial applications. The non-commercial application consists of laptops, smartphones, and home theaters that have grown significantly over the forecast period.

Segmental Outlook

The global micro LED market is segmented on the basis of application and end-user. Based on the application, the market is diversified into display and lighting. The display segment has a significant market share owing to a wide application in consumer electronics such as smartphones, laptops, and tablets. The micro LED manufacturers are launching a display screen along with large power efficiency and contrast brightness features. Additionally, enhancement in micro LED technology has resulted in the introduction of several new lighting and display technologies include indium gallium zinc oxygen which is expected to contribute the market growth.

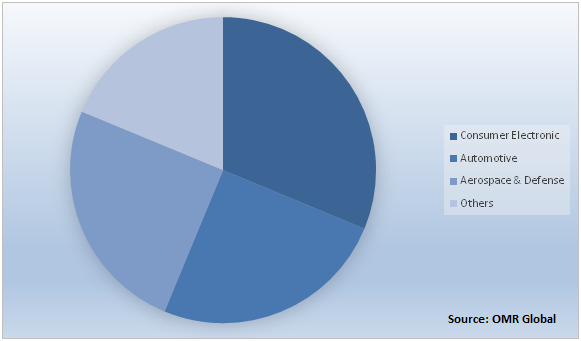

Consumer Electronics to Account for Significant Share

Based on end-user, the market is diversified into consumer electronics, automotive, aerospace & defense, and others. Consumer electronics is expected to hold the largest market share in the micro LED market due to increasing consumer interest in micro-LED technology which is propelling major market players to grow their investments in R&D activities. Moreover, flourishing the demand for micro LED displays in smartwatches, tablets, and smartphones are boosting the growth of the micro LED market during the forecast period.

Global Micro LED Market Share by End-User, 2018 (%)

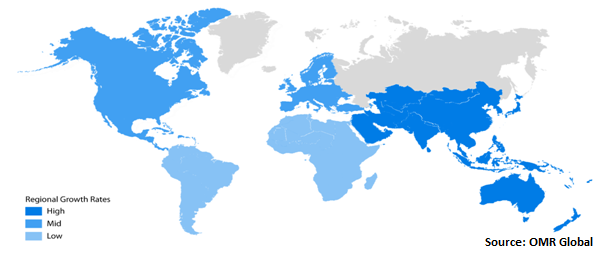

Regional Outlook

The global micro-LED market is further segmented based on geography including North America, Europe, Asia-Pacific and Rest of the World (RoW). North America is expected to have the largest share in the market due to the high penetration of advanced technology owing to which the region is considered as the biggest contributor toward the adoption of micro LED displays. Along with it, rising penetration of smartwatches is augmented the adoption of micro LED market. Different companies include LG electronics are planning to introduce a smartwatch with LG V40 ThinQ smartphone in the US. Europe has a significant market growth during the forecast period due to the increasing automotive application of micro LEDs and demand is trending in the automotive industry for different applications includes in-car entertainment systems, HUDs, dashboards, and rear-view windows.

Global Micro LED Market Growth, by Region 2019-2025

Asia-Pacific will augment with the fastest rate in Micro LED market

The market in Asia-Pacific is expected to be the fastest-growing mainly due to the presence of leading brand product manufacturers, display panel manufactures, and several market key players such as LG, Sony, and Samsung which will account for micro-LED display demand.

Market Players Outlook

The key players of the micro LED market include Innolux Corp., Aledia SA, Samsung Electronics Co. Ltd., VueReal Inc., GLO AB, Sony Corp., LG Display Co Ltd., Rohinni LLC, Mikro Mesa Technology, JBD, Inc. and Apple, Inc. These companies are actively performing research and development along with filing patents in order to launch products in the market. For instance, in October 2019, Apple was granted a new micro LED Patent for future high-resolution displays.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global micro LED market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Patent Analysis

2.3. Analyst Insight & Current Market Trends

2.3.1. Key Findings

2.3.2. Recommendations

2.3.3. Conclusion

2.4. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Sony Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. LG Display Co., Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Samsung Electronics Co., Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Apple, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Micro LED Market by Application

5.1.1. Display

5.1.1.1. Television

5.1.1.2. Smartwatches

5.1.1.3. Smartphone and Tablet

5.1.1.4. Monitor and Laptop

5.1.1.5. Near to Eye Devices

5.1.1.6. Head-up Display

5.1.1.7. Digital Signage

5.1.2. Lighting

5.1.2.1. General lightning

5.1.2.2. Automotive Lightning

5.2. Global Micro LED Market by End-User

5.2.1. Consumer Electronics

5.2.2. Automotive

5.2.3. Aerospace & Defense

5.2.4. Others (Retail)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aledia SA

7.2. ALLOSSemiconductors GmbH

7.3. Apple, Inc.

7.4. EPISTAR Corp.

7.5. GLO AB

7.6. Innolux Corp.

7.7. JBD, Inc.

7.8. LG Display Co., Ltd.

7.9. Lumiode, Inc.

7.10. Mikro Mesa Technology

7.11. Optovate, Ltd.

7.12. PlayNitride, Inc.

7.13. Plessey Semiconductors, Ltd.

7.14. Rohinni, LLC

7.15. Samsung Electronics Co. Ltd.

7.16. Sony Corp.

7.17. Veeco Instruments, Inc.

7.18. VerLASE Technologies, LLC

7.19. VueReal, Inc.

7.20. X-Celeprint

1. GLOBAL MICRO LED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL DISPLAY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

4. GLOBAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MICRO LED MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

6. GLOBAL CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL AEROSPACE &DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. NORTH AMERICANMICRO LED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN MICRO LED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

12. NORTH AMERICAN MICRO LEDMARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. EUROPEANMICRO LED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEANMICRO LED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. EUROPEANMICRO LED MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC MICRO LED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC MICRO LED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC MICRO LED MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. REST OF THE WORLD MICRO LED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. REST OF THE WORLD MICRO LED MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL MICRO LEDMARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL MICRO LED MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL MICRO LED MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. THE US MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

6. UK MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD MICRO LED MARKET SIZE, 2018-2025 ($ MILLION)