Micro Mobile Data Center Market

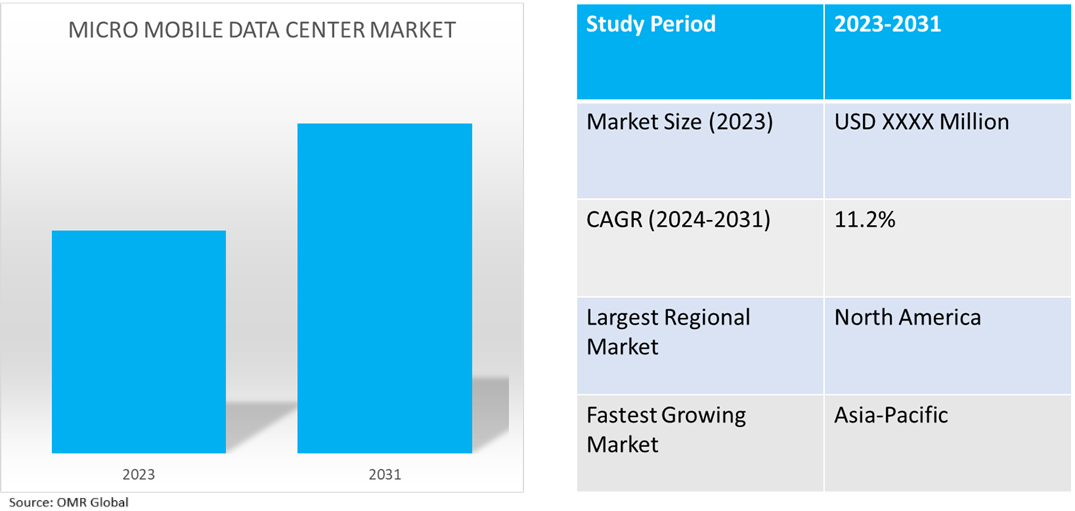

Micro Mobile Data Center Market Size, Share & Trends Analysis Report by Rack Size (5-25 RU, 26-50 RU, and 51-100 RU), by Enterprise Type (Small & Medium Enterprise and Large Enterprise), and by Verticals (BFSI, Healthcare, Oil & Gas, Retail, Manufacturing, Mining, IT & Telecommunication and Others) Forecast Period (2024-2031)

Micro mobile data center market is anticipated to grow at a significant CAGR of 11.2% during the forecast period (2024-2031). The increasing demand for improved data security and compliance, the rising use of cloud services, the development of 5G network deployments, and the growing demand for IT infrastructure in remote locations are all factors contributing to the market's growth. According to the International Energy Agency (IEA), in October 2024, the entire US oil and gas market, which accounts for around 0.5% of the US GDP, was less than the capital investment made by Google, Microsoft, and Amazon, players in the adoption of AI and the construction of data centers in 2023.

Market Dynamics

Increasing Demand for Edge Computing Solutions

The increasing use of edge computing solutions is directly related to the expansion of micro mobile data centers (MMDCs). MMDCs offer the infrastructure required for low-latency computing as businesses depend increasingly on real-time data processing. Compact modular data centers permit businesses to forward IT resources near the data source, enhance performance, and lower network congestion. The increasing utilization of MMDCs by end-use industries such as manufacturing, retail, healthcare, and telecommunications, require dependable solutions to support IoT analytics and applications. Additionally, MMDCs are well-suited to handle the expanding bandwidth and computational demands at the network edge, the rollout of 5G networks is anticipated to boost market expansion.

Energy-Efficient and Cost-Effective Solutions

The market for micro mobile data centers is expanding significantly owing to consumer desire for affordable and energy-efficient solutions. Edge computing and IoT technologies are being used increasingly, resulting in the market growing. Its modular design provides rapid deployment, decreases setup costs, and improves operational efficacy. The growing industry commitment toward increasing scalability benefits businesses by enabling them to adjust to shifting IT needs.

Market Segmentation

- Based on the rack size, the market is segmented into 5-25 RU, 26-50 RU, and 51-100 RU.

- Based on the enterprise type, the market is segmented into small & medium enterprises and large enterprises.

- Based on the verticals, the market is segmented into BFSI, healthcare, oil & gas, retail, manufacturing, mining, IT & telecommunication, and others (government and defense).

26-50 RU Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth are being driven by the increasing acceptance of 26-50 RU provides an equilibrium between robust capacity and small size, meeting the expanding needs of remote operations and edge computing. These results are being used by industries corresponding to manufacturing, IT, and telecoms to increase adaptability and scalability. In surroundings with limited resources, the 26- 50 RU segment facilitates efficient data processing, administration, and storehousing. It meets the demands for fast connectivity and low quiescence which are critical for ultramodern operations. Furthermore, improvements in cooling and power efficiency make them even more attractive. These systems grow increasingly prevalent among organizations owing to their simplicity of deployment and modularity. For instance, Eaton Corp. offers SmartRack modular data centers with a 44U rack enclosure. Eaton’s SmartRack Modular Data Centers address growing demand with IT rack, cooling, and service enclosures that form a performance-optimized data center, or Performance Optimized Datacenter (POD). The innovative design enables easy configuration and maintenance while reducing the overall cycle time to deploy a data center from months or weeks to just days.

IT & Telecommunication to Hold a Considerable Market Share

The factors supporting segment growth include the growing demand for scalable and energy-efficient systems to handle massive data volumes. Compact, flexible data center deployment is growing important as telecom networks adapt to 5G and edge computing. These systems meet the changing demands of the market by enabling quick deployment, lower interruption, and enhanced data processing capabilities. Further, the demand for decentralized data processing and storehouse results is growing owing to the integration of cloud computing and the Internet of Things in telecommunications. Micro mobile data centers help enterprises retain functional effectiveness by providing flexible and affordable structures. The acceptance of these technologies is also being assisted by the focus on data security and governmental compliance.

Regional Outlook

The global micro mobile data center market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

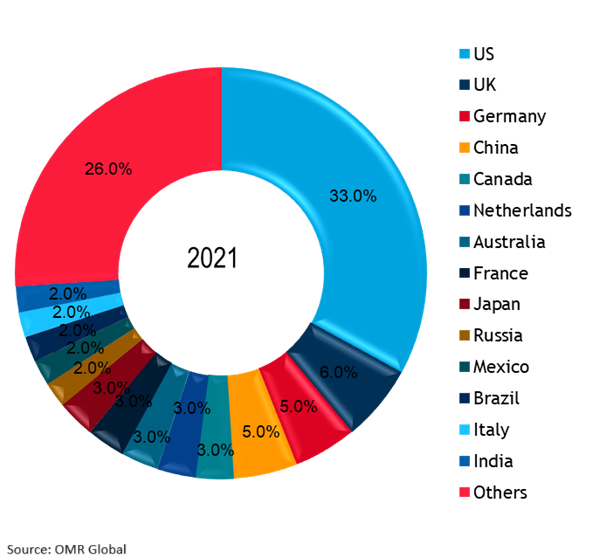

Data Center Share of Global Total by Major Country 2021 (%)

Source: US International Trade Commission

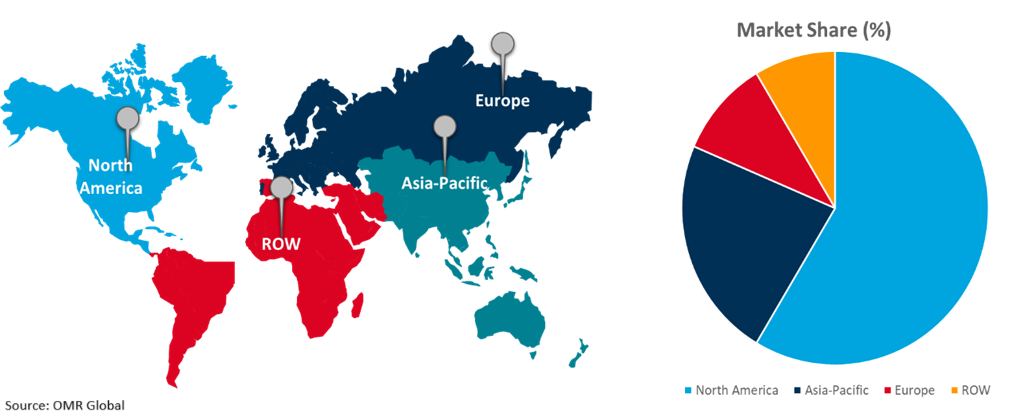

Growing Adoption of Micro Mobile Data Centers in Asia-Pacific

The rising adoption of sustainable designs to ensure that data centers operate efficiently, including eco-friendly construction practices, enhanced power technologies, and air-based cooling solutions, expand the market for micro mobile data centers in the Asia-Pacific market. According to the People's Republic of China, in July 2024, by the end of 2023, the number of data center racks in solution across the nation overpassed 8.1 million. Industrial data indicate that China ranks second globally in terms of comprehensive computing power scale.

Global Micro Mobile Data Center Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of micro mobile data center offering companies such as Cisco Systems Inc., Dell Technologies Inc., Delta Power Solutions, IBM Corp., Vertiv Group Corp., and others. The increasing demand for cloud technology across North American organizations induces the need for large-scale data centers for companies to store and access data across networks. The adoption of such technologies across the US is expected to increase the demand for data center infrastructure, with the growing requirement for services to store data.

According to the National Telecommunications and Information Administration (NTIA), in September 2024, Data centers are facilities with computing machines that process, store, and transmit large amounts of data. Critical and emerging technologies such as AI have accelerated demand for the computing and storage infrastructure data centers provide. While there are more than 5,000 data centers in the US, demand for data centers in the US is projected to grow by 9.0% annually through 2030. In North America, the need for a data center is also being driven by the deployment of artificial intelligence (AI) and machine learning (ML), demanding significant processing power and resources.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the micro mobile data center market include Delta Power Solutions, Huawei Technologies Co. Ltd., IBM Corp., Schneider Electric, and Vertiv Group Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In October 2024, Zella DC launched Zella Outback – the ultimate outdoor micro data center. This latest evolution of the Zella Hut outdoor micro data center builds upon the foundations of its predecessor and also redefines the standards of outdoor micro data centers. The enhanced design and functionality, the Zella Outback is equipped to meet the escalating demands of edge computing environments.

- In August 2024, MARA announced a 25-megawatt micro data center project powered by excess natural gas from oilfields. This marks an important milestone for the company, as MARA operates its first owned power generation assets to convert this excess gas into electricity for use in on-site data centers. MARA has partnered on this operation with NGON, an on-site mitigation services provider, to increase the utilization of natural gas and mitigate flaring – the controlled burning of gas – to reduce methane emissions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global micro mobile data center market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.1.1. Proliferation of 5G Network Deployments

2.2.1.2. Growing Adoption of Cloud Services

2.2.1.3. Rising IT Infrastructure Demand in Remote Locations

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Delta Power Solutions

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Huawei Technologies Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schneider Electric SE

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Vertiv Group Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Micro Mobile Data Center Market by Rack Size

4.1.1. 5-25 RU

4.1.2. 26-50 RU

4.1.3. 51-100 RU

4.2. Global Micro Mobile Data Center Market by Enterprise Type

4.2.1. Small & Medium Enterprise

4.2.2. Large Enterprise

4.3. Global Micro Mobile Data Center Market by Verticals

4.3.1. BFSI

4.3.2. Healthcare

4.3.3. Oil & Gas

4.3.4. Retail

4.3.5. Manufacturing

4.3.6. Mining

4.3.7. IT & Telecommunication

4.3.8. Others (Government and Defense)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Cannon Technologies Ltd.

6.2. Canovate Group

6.3. Cisco Systems Inc.

6.4. Dell Technologies Inc.

6.5. Eaton Corp.

6.6. green4T

6.7. Hewlett Packard Enterprise (HPE)

6.8. INSPUR Co., Ltd.

6.9. NDC Solutions

6.10. NVIDIA Corp.

6.11. Panduit Corp.

6.12. Portwell Technology, Inc.

6.13. Rittal GmbH & Co. KG

6.14. Rittal Pvt. Ltd.

6.15. RSC Technologies

6.16. ScaleMatrix Holdings, Inc.

6.17. STULZ GMBH

6.18. Subzero Engineering

6.19. Zella DC

6.20. ZTT Group

1. Global Micro Mobile Data Center Market Research And Analysis By Rack Size, 2023-2031 ($ Million)

2. Global 5-25 RU Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global 26-50 RU Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global 51-100 RU Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Micro Mobile Data Center Market Research And Analysis By Enterprise Type, 2023-2031 ($ Million)

6. Global Small & Medium Enterprise Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Large Enterprise Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Micro Mobile Data Center Market Research And Analysis By Verticals, 2023-2031 ($ Million)

9. Global Micro Mobile Data Center For BFSI Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Micro Mobile Data Center For Healthcare Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Micro Mobile Data Center For Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Micro Mobile Data Center For Retail Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Micro Mobile Data Center For Manufacturing Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Micro Mobile Data Center For Mining Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Micro Mobile Data Center For IT & Telecommunication Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Micro Mobile Data Center For Others Verticals Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

18. North American Micro Mobile Data Center Market Research And Analysis By Country, 2023-2031 ($ Million)

19. North American Micro Mobile Data Center Market Research And Analysis By Rack Size, 2023-2031 ($ Million)

20. North American Micro Mobile Data Center Market Research And Analysis By Enterprise Type, 2023-2031 ($ Million)

21. North American Micro Mobile Data Center Market Research And Analysis By Verticals, 2023-2031 ($ Million)

22. European Micro Mobile Data Center Market Research And Analysis By Country, 2023-2031 ($ Million)

23. European Micro Mobile Data Center Market Research And Analysis By Rack Size, 2023-2031 ($ Million)

24. European Micro Mobile Data Center Market Research And Analysis By Enterprise Type, 2023-2031 ($ Million)

25. European Micro Mobile Data Center Market Research And Analysis By Verticals, 2023-2031 ($ Million)

26. Asia-Pacific Micro Mobile Data Center Market Research And Analysis By Country, 2023-2031 ($ Million)

27. Asia-Pacific Micro Mobile Data Center Market Research And Analysis By Rack Size, 2023-2031 ($ Million)

28. Asia-Pacific Micro Mobile Data Center Market Research And Analysis By Enterprise Type, 2023-2031 ($ Million)

29. Asia-Pacific Micro Mobile Data Center Market Research And Analysis By Verticals, 2023-2031 ($ Million)

30. Rest Of The World Micro Mobile Data Center Market Research And Analysis By Region, 2023-2031 ($ Million)

31. Rest Of The World Micro Mobile Data Center Market Research And Analysis By Rack Size, 2023-2031 ($ Million)

32. Rest Of The World Micro Mobile Data Center Market Research And Analysis By Enterprise Type, 2023-2031 ($ Million)

33. Rest Of The World Micro Mobile Data Center Market Research And Analysis By Verticals, 2023-2031 ($ Million)

1. Global Micro Mobile Data Center Market Research And Analysis By Rack Size, 2023 Vs 2031 (%)

2. Global 5-25 RU Micro Mobile Data Center Market Share By Region, 2023 Vs 2031 (%)

3. Global 26-50 RU Micro Mobile Data Center Market Share By Region, 2023 Vs 2031 (%)

4. Global 51-100 RU Micro Mobile Data Center Market Share By Region, 2023 Vs 2031 (%)

5. Global Micro Mobile Data Center Market Research And Analysis By Enterprise Type, 2023 Vs 2031 (%)

6. Global Small & Medium Enterprise Micro Mobile Data Center Market Share By Region, 2023 Vs 2031 (%)

7. Global Large Enterprise Micro Mobile Data Center Market Share By Region, 2023 Vs 2031 (%)

8. Global Micro Mobile Data Center Market Research And Analysis By Verticals, 2023 Vs 2031 (%)

9. Global Micro Mobile Data Center For BFSI Market Share By Region, 2023 Vs 2031 (%)

10. Global Micro Mobile Data Center For Healthcare Market Share By Region, 2023 Vs 2031 (%)

11. Global Micro Mobile Data Center For Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

12. Global Micro Mobile Data Center For Retail Market Share By Region, 2023 Vs 2031 (%)

13. Global Micro Mobile Data Center For Manufacturing Market Share By Region, 2023 Vs 2031 (%)

14. Global Micro Mobile Data Center For Mining Market Share By Region, 2023 Vs 2031 (%)

15. Global Micro Mobile Data Center For Others Verticals Market Share By Region, 2023 Vs 2031 (%)

16. Global Micro Mobile Data Center For Manufacturing Market Share By Region, 2023 Vs 2031 (%)

17. Global Micro Mobile Data Center Market Share By Region, 2023 Vs 2031 (%)

18. US Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

19. Canada Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

20. UK Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

21. France Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

22. Germany Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

23. Italy Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

24. Spain Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

25. Rest Of Europe Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

26. India Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

27. China Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

28. Japan Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

29. South Korea Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

30. Rest Of Asia-Pacific Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

31. Latin America Micro Mobile Data Center Market Size, 2023-2031 ($ Million)

32. Middle East And Africa Micro Mobile Data Center Market Size, 2023-2031 ($ Million)