Microalgae-Based Aqua Feed Market

Microalgae-Based Aqua Feed Market Size, Share & Trends Analysis Report by Species (Spirulina, Chlorella, Nannochloropsis, Isochrysis, and Others), and by Aquatic Animal (Fish, Mollusks, Crustaceans, and Others) Forecast Period (2024-2031)

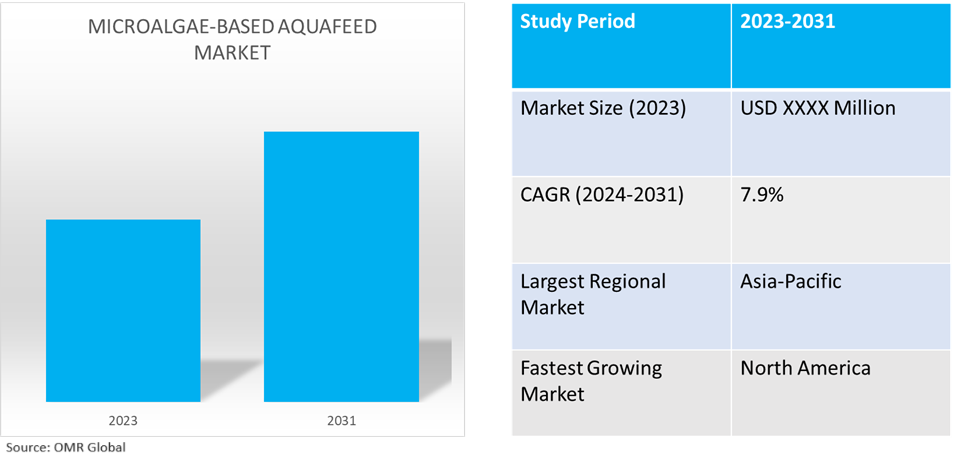

Microalgae-based aqua feed market is anticipated to grow at a CAGR of 7.9% during the forecast period (2024-2031). Aquafeed created from a variety of microalgae species is known as microalgae-based aquafeed. Microalgae are microscopic, single-celled plants that live in both freshwater and marine environments and can perform photosynthesis. They are extremely nutrient-dense and packed with many important elements, such as vitamins, minerals, amino acids, and protein. The growing demand for proteins in food is a key factor driving the global market.

Market Dynamics

Growing demand for environmental friendly proteins

The aquaculture industry is under increasing pressure to lessen its environmental impact in the modern world. As a result, the worldwide aquafeed market based on microalgae is receiving more attention. Aquafeed made from microalgae is emerging as a viable and long-term option for the aquaculture industry. This lessens the environmental impact of aquaculture operations while also assisting in satisfying the growing demand for fish protein.

Rising demand for seafood

According to the Food & Agriculture Association, seafood consumption will increase per capita across all continents except Africa, where it projects a decline from 9.8 kilograms – the rate of consumption between 2020 and 2022 – to 9.6 in 2032, with a larger decrease in Sub-Saharan Africa in particular. Rising interest in seafood, particularly fish and shrimp, is a key factor driving the growth of the global market. Microalgae are abundant in vital nutrients, including vitamins, minerals, and proteins. Omega-3 fatty acids such as docosahexaenoic acid (DHA) and EPA (eicosapentaenoic acid) are also abundant in some microalgae strains. As a result, aqua feed is using more microalgae as a sustainable feed element.

Market Segmentation

- Based on species, the market is segmented into spirulina, chlorella, nannochloropsis, isochrysis, and others including arthrospira platensis, and chaetoceros muelleri.

- Based on aquatic animals, the market is segmented into fish, mollusks, crustaceans, and others including oysters.

Spirulina is Projected to Emerge as the Largest Segment

The most popular species for creating aquafeed is spirulina. This can be attributed to its potential health advantages, high nutritional content, ease of availability, and adaptability. Due to its high nutritional profile, spirulina is a common form of blue-green microalgae that is utilized as a feed element in aquaculture. Compared to other strains, spirulina has larger concentrations of unsaturated fatty acids, proteins, vitamins, minerals, and other beneficial substances that support its higher adoption. These species are more suited to supplement aquaculture animals' diets, promoting their health and growth. This is becoming more and more of a viable and long-term substitute for fishmeal in fish diets.

Fish to Hold a Considerable Market Share

Manufacturers of aquafeed made from microalgae are expected to see substantial prospects for income production from the fish category, which is based on aquatic creatures. The high consumption of fish food globally is a key factor supporting the demand for microalgae-based feed for fish. Fish growers are shifting their feed production to microalgae due to the scarcity of wild-caught fishmeal. Fish health and growth are greatly aided by the critical nutrients included in this kind of sustainable feed. The fish industry is adopting microalgae feed at a high rate due to its sustainability. Global leaders in aquaculture are choosing more and more microalgae-based feeds to lessen their reliance on wild fishers and combat the effects of overfishing.

Regional Outlook

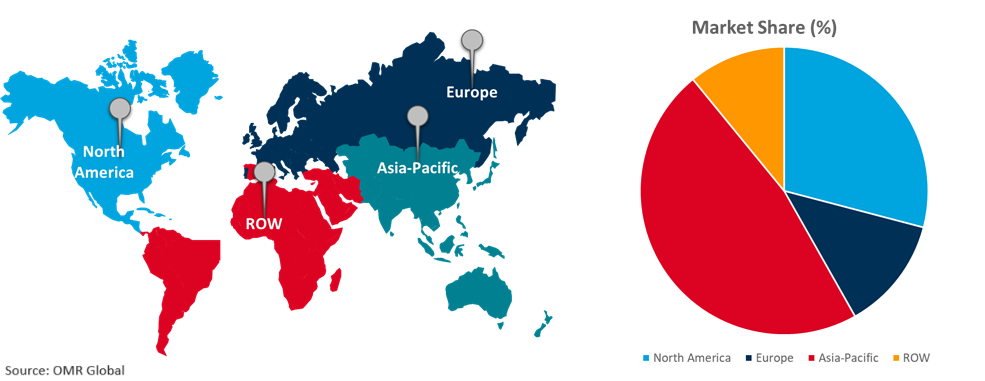

The global microalgae-based aqua feed market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to have sustainable fish feed

- Environmental effects of traditional feed sources, such as fishmeal, are becoming increasingly evident to American fish producers.

- Due to the increasing need for sustainable aquafeed options, North America is expected to grow in fish feeds based on microalgae.

Global Microalgae-Based Aqua Feed Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Fish meals based on microalgae are expected to continue to be widely consumed in Asia-Pacific. The increased need for sustainable aqua feed solutions is a key contributor to the regional market growth. The East Asian microalgae-based aqua feed industry is growing due in part to rising shrimp cultivation and rising seafood demand. The presence of major manufacturers and consumers of microalgae-based aqua feed is a key contributor to the high share of the regional market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global microalgae-based aqua feed market include DSM Corp., Cargill Inc., Corbion N.V., Cellana, Inc., and The Archer-Daniels-Midland Company among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, Green Aqua, partnered with Algikey to provide high-quality algae products to hatcheries. It is a strategic partnership to produce and commercialize algae products for the aquaculture market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microalgae-based aqua feed market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cargill, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Corbion N.V.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DSM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Microalgae-based Aqua Feed Market by Species

4.1.1. Spirulina

4.1.2. Chlorella

4.1.3. Nannochloropsis

4.1.4. Isochrysis

4.1.5. Others (Arthrospira Platensis, and Chaetoceros Muelleri)

4.2. Global Microalgae-based Aqua Feed Market by Aquatic Animal

4.2.1. Fish

4.2.2. Mollusks

4.2.3. Crustaceans

4.2.4. Others (Oysters)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. A4F Algae for future

6.2. Algalimento S.L.

6.3. Aller Aqua Group

6.4. ALLmicroalgae

6.5. Algatechnologies Ltd.

6.6. Biomar Group

6.7. Cellana Inc.

6.8. CP Kelco

6.9. Evergen Resources

6.10. Greentech Group

6.11. Kessler Zoologiegrosshandel GmbH & Co. KG

6.12. Solabia Group

6.13. The Archer-Daniels-Midland Company

1. GLOBAL MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY SPECIES, 2023-2031 ($ MILLION)

2. GLOBAL SPIRULINA-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CHLORELLA-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NANNOCHLOROPSIS-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ISOCHRYSIS-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY AQUATIC ANIMAL, 2023-2031 ($ MILLION)

8. GLOBAL MICROALGAE-BASED AQUA FEED FOR FISH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MICROALGAE-BASED AQUA FEED FOR MOLLUSKS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MICROALGAE-BASED AQUA FEED FOR CRUSTACEANS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MICROALGAE-BASED AQUA FEED FOR OTHER AQUATIC ANIMALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY SPECIES, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY AQUATIC ANIMAL, 2023-2031 ($ MILLION)

16. EUROPEAN MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY SPECIES, 2023-2031 ($ MILLION)

18. EUROPEAN MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY AQUATIC ANIMAL, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY SPECIES, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY AQUATIC ANIMAL, 2023-2031 ($ MILLION)

22. REST OF THE WORLD MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY SPECIES, 2023-2031 ($ MILLION)

24. REST OF THE WORLD MICROALGAE-BASED AQUA FEED MARKET RESEARCH AND ANALYSIS BY AQUATIC ANIMAL, 2023-2031 ($ MILLION)

1. GLOBAL MICROALGAE-BASED AQUA FEED MARKET SHARE BY SPECIES, 2023 VS 2031 (%)

2. GLOBAL SPIRULINA-BASED AQUA FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CHLORELLA-BASED AQUA FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NANNOCHLOROPSIS-BASED AQUA FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ISOCHRYSIS -BASED AQUA FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER MICROALGAE-BASED AQUA FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MICROALGAE-BASED AQUA FEED MARKET SHARE BY AQUATIC ANIMAL, 2023 VS 2031 (%)

8. GLOBAL MICROALGAE-BASED AQUA FEED FOR FISH MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MICROALGAE-BASED AQUA FEED FOR MOLLUSKS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MICROALGAE-BASED AQUA FEED FOR CRUSTACEANS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MICROALGAE-BASED AQUA FEED FOR OTHER AQUATIC ANIMALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MICROALGAE-BASED AQUA FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

15. UK MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA MICROALGAE-BASED AQUA FEED MARKET SIZE, 2023-2031 ($ MILLION)