Microbiology Testing Market

Microbiology Testing Market Size, Share & Trends Analysis Report by Product (Equipment, Reagents, and Others), by Test of Type (Bacterial, Viral, and Fungal), and by Application (Pharmaceutical, Diagnostic, Food and Beverage Testing, Environmental, Cosmetic, and Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Microbiology testing market is anticipated to grow at a CAGR of 9.4% during the forecast period (2023-2030). The market’s growth is attributed to regulatory compliance across the globe. To comply with rigid regulations in the healthcare, pharmaceutical, and food safety industries, specialized testing methods are required. A major concern is ensuring the quality and safety of the products. Accordingly, market players are coming up with new products to cater to the demand for advanced testing technology. For instance, in July 2020, NEOGEN Corp. launched an advanced testing technology that detects microorganisms automatically and more rapidly than conventional testing techniques. The company's automated microbiological testing system, includes all the features, positive aspects, and accessibility of earlier generations while additionally introducing improved hardware and software to simplify the process of producing, evaluating, and auditing results of tests.

Segmental Outlook

The global microbiology testing market is segmented on the product, type of test, and application. Based on the product, the market is sub-segmented into equipment, reagents, and others. Based on the type of test, the market is sub-segmented into bacterial, viral, and fungal. Furthermore, based on application, the market is sub-segmented into pharmaceutical, diagnostic, food and beverage testing, environmental, cosmetic, and others. The bacterial subcategory is expected to capture a significant portion of the market share within the type of test segment. This is attributed to the owing to the several medical benefits that microbiological testing provides in the identification and treatment of bacterial diseases.

The Diagnostic Sub-Segment is Anticipated to Hold a Considerable Share of the Global Microbiology Testing Market

Among the applications, the diagnostic sub-segment is expected to hold a considerable share of the global microbiology testing market. The segmental growth is attributed to the relevance of microbiology testing. Testing for microorganisms is essential to offering the safety and quality of products, particularly in sectors such as healthcare, food and beverage, and pharmaceuticals. It aids in infection control, assuring product effectiveness, and conforming to legal standards. For instance, in June 2022, STEMart, introduced sterile, non-pyrogenic products, thorough microbiological and sterility testing is performed. The company is committed to providing a broad range of services and has significant expertise in both sterility testing and microbiology. Possess knowledge that aids manufacturers in achieving regulatory objectives and reducing compliance risk.

Regional Outlook

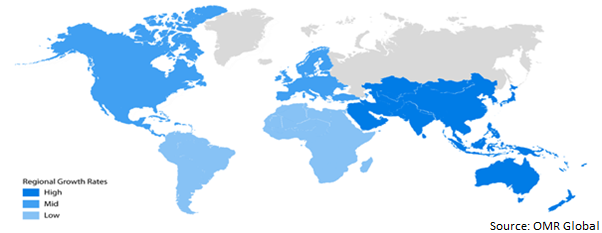

The global microbiology testing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the increase in public education campaigns and supportive rules and regulations to boost microbiological testing usage. Moreover, additional innovative diagnostic techniques and the increased need for high-quality healthcare in the region.

Global Microbiology Testing Market Growth by Region 2023-2030

The North American region is Expected to Grow at a Significant CAGR in the Global Microbiology Testing Market

Among all regions, the North American region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the rising development of antifungal drugs. The demand for diagnostic testing can increase as a result of the need for more potent antifungal medications, which drives research and development initiatives. According to Journal of Biomedical Science, in June 2023, Individuals with certain medical conditions are at an increased risk of opportunistic fungal infections, such as organ transplant recipients, hematologic patients, AIDS patients, diabetics, burn patients, neoplastic disease patients, and those with chronic respiratory diseases. Around 1.9 million patients get an acute invasive fungal infection (IFI) each year, while an estimated 3 million people globally suffer from chronic severe fungal infections. These infections have a high mortality rate, ranging from 25-90%, and can also be resistant to antifungal drugs. Treating IFIs can be very challenging due to the limited number of antifungal drugs available.

Market Players Outlook

The major companies serving the microbiology testing market include Becton, Dickinson, and Co., Biomerieux SA, Bio-Rad Laboratories, Inc., Bruker Corp., Hologic Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2022, Merck launched its first Microbiology Application and Training (MAT) Lab in Jigani, Bengaluru, that promises to offer resources and technical expertise to assist the growth of the national science community's capacity for microbiological quality control.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microbiology testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Microbiology Testing Market by Application

4.1.1. Pharmaceutical Application

4.1.2. Diagnostic Application

4.1.3. Food and Beverage Testing Application

4.1.4. Environmental Application

4.1.5. Cosmetic Application

4.1.6. Others (Veterinary Medicine, and Clinical Diagnostics)

4.2. Global Microbiology Testing Market by Product

4.2.1. Equipment

4.2.2. Reagents

4.2.3. Others (Laboratory Information Management Systems (LIMS), and Molecular Diagnostics Instruments and Kits)

4.3. Global Microbiology Testing Market by Test of Type

4.3.1. Bacterial

4.3.2. Viral

4.3.3. Fungal

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3M Co.

6.2. Abbott Laboratories

6.3. Agilent Technologies, Inc.

6.4. Becton, Dickinson, and Co.

6.5. Biomerieux SA

6.6. Bio-Rad Laboratories, Inc.

6.7. Bruker Corp.

6.8. F. Hoffmann-La Roche Ltd

6.9. Hologic, Inc.

6.10. Merck Group

6.11. NEOGEN Corp.

6.12. Promega Corp

6.13. Sartorius AG

6.14. Shimadzu Corp.

6.15. VWR International, Inc.

1. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

2. GLOBAL MICROBIOLOGY TESTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL MICROBIOLOGY TESTING REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL OTHERS MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY TYPE OF TEST, 2022-2030 ($ MILLION)

6. GLOBAL BACTERIAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL VIRAL TESTING BY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL FUNGAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

10. GLOBAL MICROBIOLOGY TESTING IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL MICROBIOLOGY TESTING IN DIAGNOSTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL MICROBIOLOGY TESTING IN FOOD AND BEVERAGE TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL MICROBIOLOGY TESTING IN COSMETIC MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL MICROBIOLOGY TESTING IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

18. NORTH AMERICAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY TYPE OF TEST, 2022-2030 ($ MILLION)

19. NORTH AMERICAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. EUROPEAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. EUROPEAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

22. EUROPEAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY TYPE OF TEST, 2022-2030 ($ MILLION)

23. EUROPEAN MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY TYPE OF TEST, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. REST OF THE WORLD MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

29. REST OF THE WORLD MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

30. REST OF THE WORLD MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY TYPE OF TEST, 2022-2030 ($ MILLION)

31. REST OF THE WORLD MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022 VS 2030 (%)

2. GLOBAL MICROBIOLOGY TESTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

3. GLOBAL MICROBIOLOGY TESTING REAGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

4. GLOBAL OTHERS MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

5. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY TYPE OF TEST, 2022 VS 2030 (%)

6. GLOBAL BACTERIAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

7. GLOBAL VIRAL MICROBIOLOGY TESTING BY MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

8. GLOBAL FUNGAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

9. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022 VS 2030 (%)

10. GLOBAL MICROBIOLOGY TESTING IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

11. GLOBAL MICROBIOLOGY TESTING IN DIAGNOSTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

12. GLOBAL MICROBIOLOGY TESTING IN FOOD AND BEVERAGE TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

13. GLOBAL MICROBIOLOGY TESTING IN ENVIRONMENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

14. GLOBAL MICROBIOLOGY TESTING IN COSMETIC MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

15. GLOBAL MICROBIOLOGY TESTING IN OTHERS APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

16. GLOBAL MICROBIOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

17. US MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

19. UK MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD MICROBIOLOGY TESTING MARKET SIZE, 2022-2030 ($ MILLION)