Microcellular Plastics Market

Microcellular Plastics Market Size, Share & Trends Analysis Report by Type (Polystyrene (PS), Polyvinyl Chloride (PVC), Polycarbonate (PC), Polyethylene Terephthalate (PET), and Polyurethane (PU)). and by End User (Healthcare, Building and Construction, Food Packaging, Electrical and Electronics, and Transportation). Forecast Period (2024-2031).

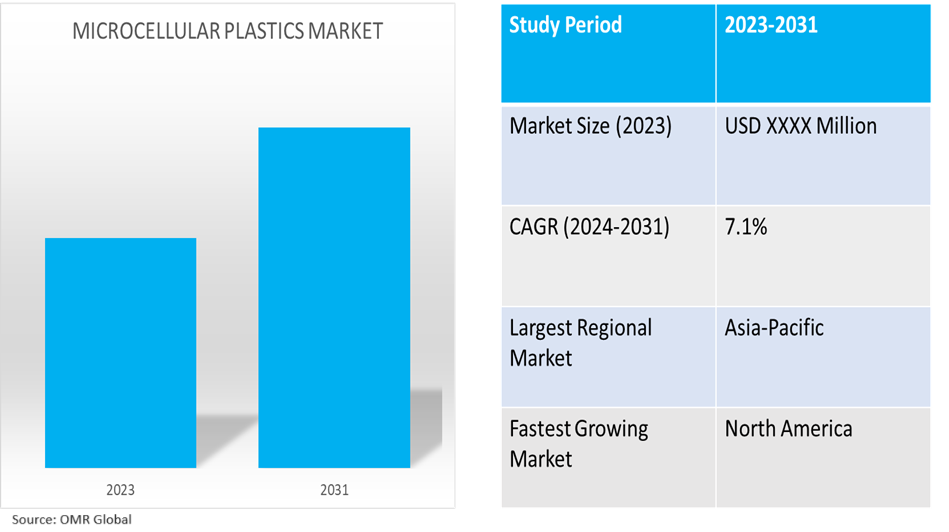

Microcellular plastics market is anticipated to grow at a CAGR of 7.1% during the forecast period (2024-2031). Microcellular plastic is an important material that is most used all over the globe, Microcellular plastic is available in a variety of types and can be used in several industries such as healthcare, construction, food packaging, transportation, electronics, and others. Furthermore, the consumption and sales of microcellular plastic depend on numerous factors such as trends in the demand for different products, which has manufactured by using this plastic. The rising demand for microcellular plastic, mainly in the packaging industry due to its environmentally favorable qualities and biodegradability, is expected to boost the market growth rate.

Market Dynamics

The Increasing Desire for Lightweight Automobiles

The automotive industry is one of the most important industries for composite materials. The automobile industry is constantly on the lookout for new materials that can help reduce vehicle weight while also meeting fuel economy and carbon emission objectives. The segment's primary growth drivers are predicted to be increased demand for lightweight materials from the automobile industry and a growing emphasis on fuel economy. Consumers demand greater miles per gallon (mpg) as fuel costs and distance traveled rise, and they frequently view gas mileage as a crucial issue when purchasing a vehicle. As a result, automobile manufacturers are changing from steel or aluminum to composite materials such as microcellular plastic, which are critical to achieving the cost-effectiveness of these highly automated manufacturing cycles, which lower vehicle weight. Over the projected period, demand is expected to be driven by an increase in demand for lightweight automotive vehicles, as well as an increase in the use of microcellular polymers in the manufacturing of car parts.

An increase in Technological Advancements Drives Growth

Globally, the production and application of microcellular plastics are enhanced by continuous technological innovations. Advanced manufacturing techniques enable precise control over the cellular structure, allowing for customization of the material's properties to fit specific industrial needs. These advancements are leading to the development of microcellular plastics with varied characteristics, tailored to different applications, ranging from automotive parts to medical devices which are boosting the market growth.

Market Segmentation

Our in-depth analysis of the global microcellular plastics market includes the following segments by type, and end-user:

- Based on type, the market is segmented into polystyrene (PS), polyvinyl chloride (PVC), polycarbonate (PC), polyethylene terephthalate (PET), and polyurethane (PU).

- Based on end users, the market is segmented into healthcare, building and construction, food packaging, electrical and electronics, and transportation.

Polyurethane is Projected to Emerge as the Largest Segment

The polyurethane segment is expected to hold the largest share of the market. Microcellular polyurethane plastics are lightweight and focus on reducing the weight of products, especially in the automotive and aerospace industries, microcellular polyurethane plastics are increasingly being used as a lightweight alternative to traditional materials such as metals and other plastics. According to Balance Money, US military spending in the aerospace industry, including polyurethane plastics, will total $934.0 billion from October 2020 to September 2021. Military spending is the second-largest item in the federal budget after Social Security. Microcellular polyurethane plastics are also increasingly being used in biomedical applications, such as tissue engineering and drug delivery systems. These materials can be designed to have specific mechanical and chemical properties, making them ideal for use in medical implants and devices.

Food Packaging Segment to Hold a Considerable Market Share

Food Packaging holds a considerable market share in the microcellular plastics market. Microcellular plastics are gaining traction in the food packaging sector due to compelling drivers that address both functionality and sustainability. Notably, their exceptional lightweight properties reduce packaging material usage and transportation costs, aligning with the industry's push for eco-friendly solutions. Microcellular plastics' ability to create a barrier against oxygen and moisture enhances food preservation, extending shelf life and reducing food waste. This aligns with the growing consumer demand for fresher and longer-lasting products. Furthermore, these plastics offer versatility in design, allowing for intricate shapes and customization, and enhancing branding opportunities for food companies. In line with regulatory trends toward safer packaging materials, microcellular plastics are often free from harmful chemicals that could migrate into food.

Regional Outlook

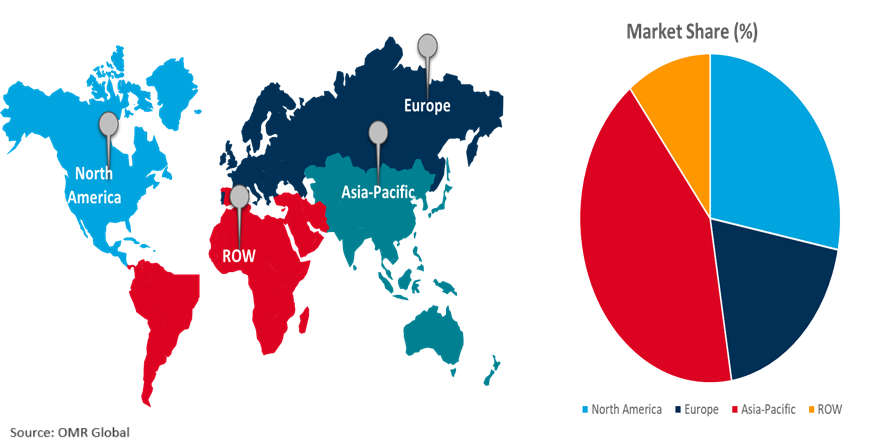

The global microcellular plastics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Register Highest Growth Rate

North America is estimated to witness steady growth in the microcellular plastics market due to the recovery of the industrial sector along with rising expenditure on renovation & maintenance of the construction sector over the estimated period. The US and Canada are among the leading contributors to North American regional market growth and are estimated to witness moderate growth due to increasing usage in food packaging and continuous growth of the healthcare sector.

Global Microcellular Plastics Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to increasing demand from various industries such as automotive, packaging, and construction. In the automotive industry, microcellular plastics are being used in Asia to reduce the weight of vehicles and improve fuel efficiency. For example, Toyota Motor Corporation is using a technology called "Microscopic Foam Injection Molding" (MFIM) to produce lightweight components made from microcellular plastics. This technology involves injecting gas into the molten plastic during the molding process, creating a microcellular structure that reduces the weight of the component while maintaining its strength and durability.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global microcellular plastics market include ARMACELL., BASF SE, Evonik Industries AG, SABIC, and Trexel, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in 2022, INEOS launched a lineup of commercially available sustainable polystyrene products. The new products allow customers to select the best fit for their application. INEOS polystyrene portfolio includes general purpose polystyrene (GPPS) resins and high impact polystyrene (HIPS) resins. This product launch is projected to increase the growth of the microcellular plastics market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microcellular plastics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ARMACELL

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BASF SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Evonik Industries AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SABIC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Microcellular Plastics Market by Type

4.1.1. Polystyrene (PS)

4.1.2. Polyvinyl Chloride (PVC)

4.1.3. Polycarbonate (PC)

4.1.4. Polyethylene Terephthalate (PET)

4.1.5. Polyurethane (PU)

4.2. Global Microcellular Plastics Market by End User

4.2.1. Healthcare

4.2.2. Building and Construction

4.2.3. Food Packaging

4.2.4. Electrical and Electronics

4.2.5. Transportation

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Borealis AG

6.2. Dow Chemical Company

6.3. Formosa Plastics Corporation

6.4. Gracious Living Innovations Inc.

6.5. Horizon Plastics International, Inc.

6.6. INEOS Capital Ltd.

6.7. INOAC CORPORATION

6.8. LKAB Minerals

6.9. Mearthane Products Corporate

6.10. MicroGREEN Polymers, Inc.

6.11. N.E. CHEMCAT CORPORATION

6.12. RTP Company

6.13. Sealed Air Corporation

6.14. Sekisui Chemical Co., Ltd.

6.15. Sonoco Products Company

6.16. TotalEnergies SE

6.17. Trexel, Inc.

6.18. Trinseo PLC

1. GLOBAL MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL MICROCELLULAR POLYSTYRENE (PS) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MICROCELLULAR POLYVINYL CHLORIDE (PVC) PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MICROCELLULAR POLYCARBONATE (PC) PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MICROCELLULAR POLYETHYLENE TEREPHTHALATE (PET) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MICROCELLULAR POLYURETHANE (PU) PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MICROCELLULAR PLASTICS FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MICROCELLULAR PLASTICS FOR BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MICROCELLULAR PLASTICS FOR FOOD PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MICROCELLULAR PLASTICS FOR ELECTRICAL AND ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MICROCELLULAR PLASTICS FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

17. EUROPEAN MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

23. REST OF THE WORLD MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD MICROCELLULAR PLASTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL MICROCELLULAR PLASTICS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL MICROCELLULAR POLYSTYRENE (PS) PLASTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MICROCELLULAR POLYVINYL CHLORIDE (PVC) PLASTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MICROCELLULAR POLYCARBONATE (PC) MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MICROCELLULAR POLYETHYLENE TEREPHTHALATE (PET) PLASTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MICROCELLULAR POLYURETHANE (PU) PLASTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MICROCELLULAR PLASTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MICROCELLULAR PLASTICS FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MICROCELLULAR PLASTICS FOR BUILDING AND CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MICROCELLULAR PLASTICS FOR FOOD PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MICROCELLULAR PLASTICS FOR ELECTRICAL AND ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MICROCELLULAR PLASTICS FOR TRANSPORTATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MICROCELLULAR PLASTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA MICROCELLULAR PLASTICS MARKET SIZE, 2023-2031 ($ MILLION)