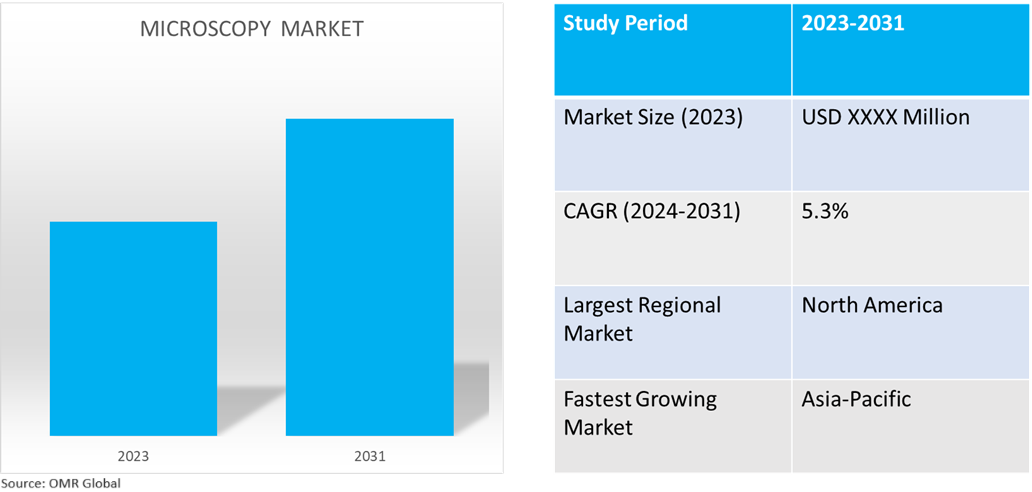

Microscopy Market

Microscopy Market Size, Share & Trends Analysis Report by Technology (Optical Microscopes (Upright Microscopes, Inverted Microscopes, Stereomicroscopes, Fluorescence Microscopes, Confocal Scanning Microscopes, & Near Field Scanning Microscopes), and Electron Microscopes Transmission Microscopes, & Scanning Electron Microscopes)), and by Application (Life Science & Healthcare, Semiconductors & Electronics, and Others (Food & Beverage, Automotive)), Forecast Period (2024-2031)

Microscopy market is anticipated to grow at a CAGR of 5.3% during the forecast period (2024-2031). Microscopy is a field of technical science that studies, magnifies, and views objects that are too small to see with the naked eye. Microscopy can be further divided into optical and electron microscopy. It is defined as the science of analyzing the nature, qualities, and structure of an object using a device known as a microscope. The growth of the microscopy market is attributed to increasing applications and advancements in microscopes such as high- and super-resolution microscopes, automated and intelligent microscopes, integrated imaging systems, and multi-photon microscopy.

Market Dynamics

Growing Research & Development Across Industries

The growing focus on research and development activities for applications such as semiconductors, nanotechnology, life sciences, and neuroscience is likely to drive rising demand for microscopy. Different microscopy types and tools are used for R&D based on industry requirements, such as multi-photon microscopy is used for research studies on tissues and biological structures. For instance, in October 2023, Leica Microsystems, a leader in microscopy and scientific instrumentation, announced the official launch of its $60.0 million medical production and research and development center in Singapore. As one of Leica's four global production facilities, Singapore is primarily responsible for the manufacture of surgical microscopes for export to global markets, accounting for 40.0% of the company's total income. The new facility combines product research and manufacture under one roof and is intended to increase the company's global production volume of surgical microscopes for international export.

Increasing Focus on the Healthcare Industry

Microscopy serves a crucial part in pharmaceutical research and medicine development. It gives instruments for researchers to closely monitor the interactions of prospective drugs with cells and tissues. The application of microscopy is very broad in the healthcare industry including surgical procedures, medical diagnostics, & research, and pharmaceutical development. Also, the industry records the highest investment & R&D from microscopy market players. For instance, in July 2023, the European Molecular Biology Laboratory (EMBL) and ZEISS established a long-term strategic relationship. The cooperation seeks to bridge the gap between early-stage imaging technology development and its use in life science research. The ongoing collaboration will provide Imaging Centre users with early access to ZEISS's latest microscopy breakthroughs.

Segmental Outlook

- Based on technology, the market is segmented into optical microscopes (upright microscopes, inverted microscopes, stereomicroscopes, fluorescence microscopes, confocal scanning microscopes, & near field scanning microscopes), and electron microscopes (transmission microscopes, & scanning electron microscopes).

- Based on application, the market is segmented into life science & healthcare, semiconductors & electronics, and others (food & beverage, automotive).

Electron Microscope May Dominant the Segment in the Future

The electron microscope segment is expected to dominate the market. Unlike optical microscopy, electron microscopy uses an accelerated electron beam as the illumination source, as electrons have shorter wavelengths than visible light, Industry and established research institutes are the only end-users of electron microscopy because these devices are relatively expensive when compared to optical devices. In addition, mining companies employ electron microscopes to characterize and analyze organic materials. Due to its increasing application across industries, the sub-segment is expected to create demand.

Life Science & Healthcare is the Major Application Segment

The life science and healthcare segment has been the prime applicator for microscopy in medicinal development, drug studies, microorganism studies, diagnostics, and research. Also, the industry has made several developments over the past few years, stimulating demand and investment in microscopy, as the industry is highly dependent on microscopy tools for its development. Furthermore, the segment has also recorded demand for quality monitoring and product development in the pharmaceutical industry, making it the dominant segment.

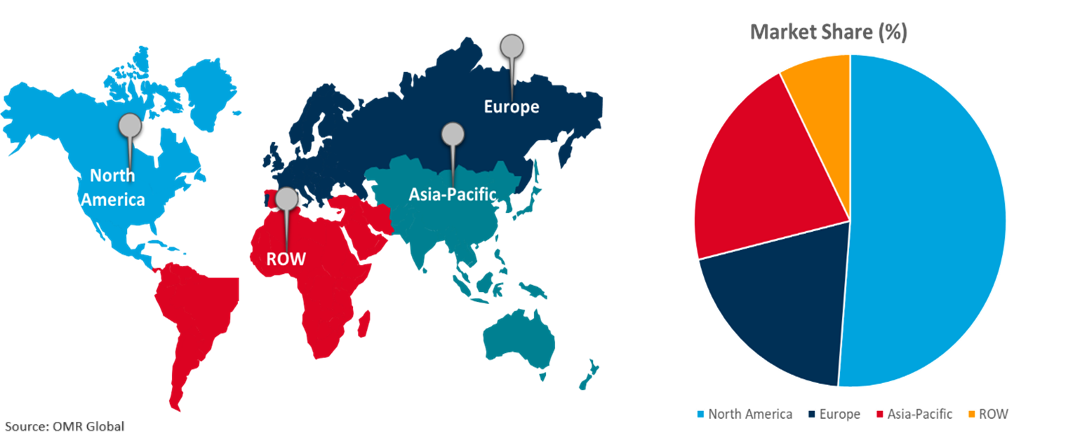

Regional Outlook

The global microscopy market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Microscopy Market

The regional expansion is driven by several factors, including expansion in research and development capabilities, rising investment in the healthcare and life science sectors, major electronics development and manufacturing in the region, the growth of the nanotechnology industry, and the presence of major research institutes. For instance, in March 2023, the US 2024 Budget invests in American science, technology, and innovation. The budget boosts the country's R&D enterprise, including more than $100.0 billion for basic and applied research, which has long been a hallmark of the American innovation engine. It also supports the new methods and investments required to solve issues, such as those at the Advanced Research Projects Agency for Health (ARPA-H), the National Science Foundation (NSF), and the National Institute of Standards and Technology. It includes nearly $2.8 billion in direct funding for the President and First Lady's Cancer Moonshot. This total includes $1.7 billion for dedicated moonshot activities across five HHS agencies, as well as $1.1 billion from the Departments of Veterans Affairs, Defense, and Agriculture, the Environmental Protection Agency, and the National Aeronautics and Space Administration.

Global Microscopy Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing Microscopy market

- Asia-Pacific regional growth is driven by increasing manufacturing capabilities and investment in the pharmaceutical and electronics industries.

- The Asia-Pacific microscopy market is also expected to grow owing to investment in microscopy R&D, a growing nanotechnology industry, and increasing financial aid to research institutes.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global microscopy market include Carl Zeiss AG, Danaher Corporation, Thermal Fisher Scientific, Inc., JEOL Ltd., and Nikon Instruments Inc., among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in January 2024, Bruker announced the acquisition of Nion, a privately held business that designs and manufactures innovative high-end scanning transmission electron microscopes (STEM). This acquisition broadens Bruker's product offerings and technology portfolio in materials science research, as well as providing a technological foundation for electron diffraction crystallographic applications.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microscopy market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Carl Zeiss AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Danaher Corporation

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Thermal Fisher Scientific, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. JEOL Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Nikon Instruments Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Microscopy Market by Technology

4.1.1. Optical Microscopes

4.1.1.1. Upright Microscopes

4.1.1.2. Inverted Microscopes

4.1.1.3. Stereomicroscopes

4.1.1.4. Phase Contrast Microscopes

4.1.1.5. Fluorescence Microscopes

4.1.1.6. Confocal Scanning Microscopes

4.1.1.7. Near Field Scanning Microscopes

4.1.2. Electron microscopes

4.1.2.1. Transmission Microscopes

4.1.2.2. Scanning Electron Microscopes

4.2. Global Microscopy Market by Application

4.2.1. Life Science & Healthcare

4.2.2. Semiconductors & Electronics

4.2.3. Others (Food & Beverage, Automotive)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. ACCU-SCOPE Inc.

6.2. Abbott Laboratories

6.3. Agilent Technoolgies Inc.

6.4. AMETEK Inc.

6.5. BICO Group AB

6.6. Brukewr Corp.

6.7. CrestOptics S.p.A.

6.8. UNITRON Ltd.

6.9. GE Healthcare Technologies Inc.

6.10. Hitachi High-Tech Corporation

6.11. Micron Instrument Industries

6.12. Oxford Instruments (Asylum Corp.)

6.13. Labo America, Inc.

6.14. Leica Microsystems

6.15. Radical Scientific Equipments Pvt Ltd.

1. GLOBAL MICROSCOPY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

2. GLOBAL OPTICAL MICROSCOPES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL UPRIGHT MICROSCOPES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL INVERTED MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL STEREOMICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PHASE CONTRAST MICROSCOPES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FLUORESCENCE MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CONFOCAL SCANNING MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL NEAR-FIELD SCANNING MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ELECTRON MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TRANSMISSION MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SCANNING ELECTRON MICROSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MICROSCOPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. GLOBAL MICROSCOPY IN LIFE SCIENCE & HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL MICROSCOPY IN SEMICONDUCTORS & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL MICROSCOPY IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL MICROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN MICROSCOPY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN MICROSCOPY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN MICROSCOPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN MICROSCOPY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN MICROSCOPY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

23. EUROPEAN MICROSCOPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC MICROSCOPY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC MICROSCOPY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC MICROSCOPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD MICROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD MICROSCOPY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

29. REST OF THE WORLD MICROSCOPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL MICROSCOPY MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

2. GLOBAL OPTICAL MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL UPRIGHT MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL INVERTED MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL STEREOMICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PHASE CONTRAST MICROSCOPES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONFOCAL SCANNING MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL NEAR FIELD SCANNING MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ELECTRON MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL TRANSMISSION MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SCANNING ELECTRON MICROSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MICROSCOPY MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL MICROSCOPY IN LIFE SCIENCE & HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL MICROSCOPY IN SEMICONDUCTORS & ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL MICROSCOPY IN OTHER MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL MICROSCOPY MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

19. UK MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)

31. THE MIDDLE EAST AND AFRICA MICROSCOPY MARKET SIZE, 2023-2031 ($ MILLION)