Microwave Absorbing Material Market

Microwave Absorbing Material Market Size, Share & Trends Analysis Report by Type (Films & Elastomers, Foams, Military Specialty Microwave, Custom Magnetic Absorbers, and Others), and by Application (Military & Defense, Automobile Industry, Electronic Industry, Telecommunications Industry, Chemical Industry, and Textile Industry) Forecast Period (2024-2031)

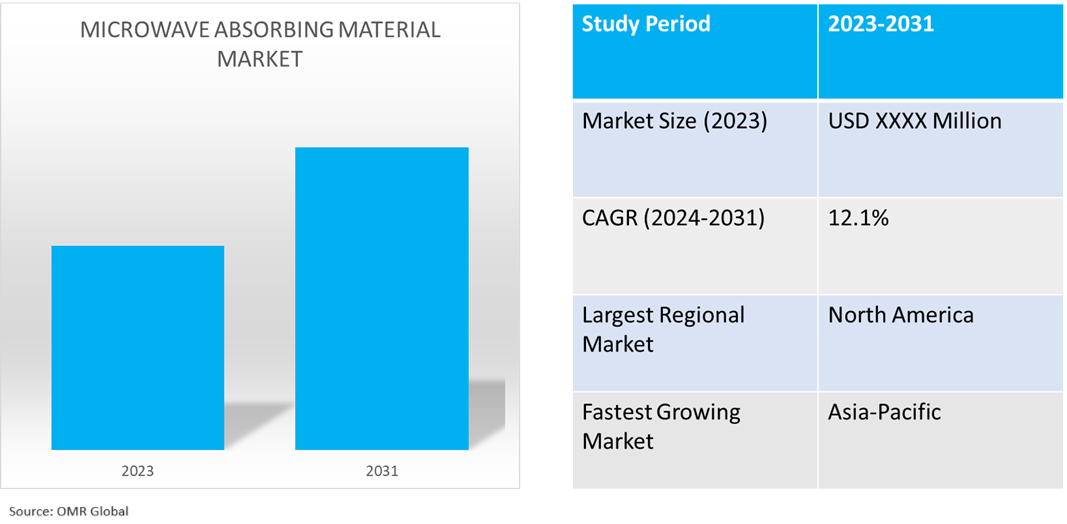

Microwave absorbing material market is anticipated to grow at a significant CAGR of 12.1% during the forecast period (2024-2031). The market growth is attributed to increasing demand from several end-user sectors, including electronics, automotive, aerospace, and military. The development of lightweight, high-performance materials as a result of technological innovation globally drives the growth of the market. The adoption of these materials is also being aided by increased awareness of electromagnetic pollution and the necessity of electromagnetic compatibility (EMC).

Market Dynamics

Increasing utilization of microwave absorbing materials in wireless communication systems

The growing use of materials that absorb microwaves in wireless communication systems is increasing rapidly. The market is anticipated to rise as a result of the growing use of IoT devices and the deployment of 5G technology, which increases demand for efficient electromagnetic absorption solutions. Furthermore, it is anticipated that the expanding automobile industry, particularly in developing nations, presents profitable prospects for industry market players. Market players are highly focused on the development of lightweight and flexible materials and hence are investing in research and development of lightweight and thin materials. These advancements are crucial for industries seeking more efficient and cost-effective solutions.

Expansion of telecommunication networks

The demand for materials that can absorb microwaves increased as communication networks expanded. The market is being influenced by ongoing developments in composite materials, nanotechnology, and material science. Microwave-absorbing materials are more popular as the telecom industry has seen a rising integration of electrical systems and improved demand.

Market Segmentation

- Based on the type, the market is segmented into films & elastomers, foams, military specialty microwaves, custom magnetic absorbers, and others (cast liquids and coating).

- Based on the application, the market is segmented into military & defense, automobile industry, electronic industry, telecommunications industry, chemical industry, and textile industry.

Military Specialty is projected to Hold the Largest Segment

The military specialty segment is expected to hold the largest share of the market. The primary factors supporting the growth include the growing demand for microwave absorbing material for coating or painting in defense equipment and facilities such as stealth aircraft, warships (warships), and army clothing, especially for troops in the guard front. Laird Technologies, Inc. offers specialty microwave and custom magnetic absorbers with free space reflectivity reduction, cavity resonance as well as tuned functionality, Laird can offer military- and aerospace-compliant products and technologies. Complex, highly sensitive military/aerospace electronics must perform flawlessly, every time and often in extreme environments across land, air, and sea.

Telecommunications Industry Segment to Hold a Considerable Market Share

In telecommunication networks, materials that absorb microwaves are crucial for reducing electromagnetic interference and guaranteeing signal quality. The growing demand for microwave absorbing material in telecom industries can be attributed to the demand for protection against electromagnetic interference and compliance with EMC (electromagnetic compatibility) standards. To lessen undesired reflecting signals into microwave wireless housings, microwave absorbers are used. Microwave radio systems mix several frequencies that could cause interference within the device absorber materials can reduce crosstalk and keep the RF portions apart inside a metal enclosure. For instance, Parker Hannifin Corp. offers CHO-MUTE 9025 microwave absorber materials for telecom infrastructure equipment. The CHO-MUTE can be used near electronic circuitry due to a UL 94 V-0 flammability rating. CHO-MUTE is designed to reduce unwanted electromagnetic radiation as well as minimize cavity-to-cavity cross-coupling and cavity resonance.

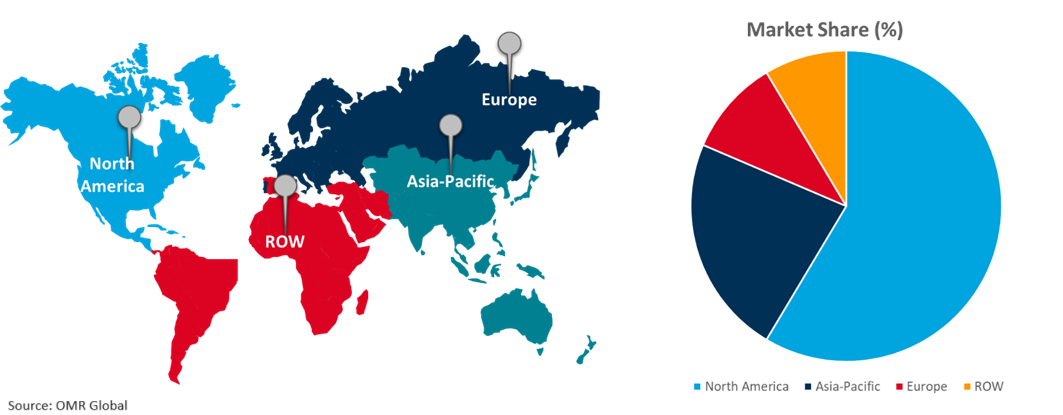

Regional Outlook

The global microwave absorbing material market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Microwave Absorbing Material in Asia-Pacific

- The regional growth is attributed to the rapid expansion of high-performance insulation solutions in countries like China, India, and Japan. Microwave absorbing materials in the Asia Pacific area are also seeing a lot of growth potential owing to the growing advancements in insulation materials.

Global Microwave Absorbing Material Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of numerous prominent microwave absorbing material companies and providers such as Laird Technologies, Inc., Parker Hannifin Corp., Resin Systems Corp., and Rogers Corp., in the region. The expansion of the market in the region is driven by the growing adoption of microwave absorbing materials by the modernization of military capabilities, investments in radar systems, stealth technologies, electronic warfare, and next-generation military vehicles in the region. The market players in the region offer microwave absorbing material in telecom applications, absorber materials are usually used on dish antenna radomes, LNBs, Wlan, Satcom, and others. By suppressing reflected signals and absorbing surface currents, absorber material in radomes and feeds usually improves the antenna pattern. For instance, Rogers Corp. offers RO4000 Series material, used in cost-sensitive Microwave/RF designs. Rogers RO4000 hydrocarbon ceramic laminates and prepregs are the industry leader. Used in microwave and millimeter wave frequencies, this low-loss material offers easier use in circuit fabrication and streamlined properties over traditional PTFE materials.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the microwave absorbing material market include 3M, Parker Hannifin Corp., Rogers Corp., TDK Corp., and Trelleborg AB among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In June 2022, SDK and Microwave Chemical started joint development of new microwave-based chemical recycling technology to directly transform used plastic into basic chemical feedstock. With its high-level technologies and deep expertise in process development, Microwave Chemical can scale up microwave technologies.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the microwave absorbing material market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Parker Hannifin Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rogers Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. TDK Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Trelleborg AB

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Microwave Absorbing Material Market by Type

4.1.1. Films & Elastomers

4.1.2. Foams

4.1.3. Military Specialty Microwave

4.1.4. Custom Magnetic Absorbers

4.1.5. Other (Cast Liquids and Coating)

4.2. Global Microwave Absorbing Material Market by End-User Industry

4.2.1. Military & Defense

4.2.2. Automobile Industry

4.2.3. Electronic Industry

4.2.4. Telecommunications Industry

4.2.5. Chemical Industry

4.2.6. Textile Industry

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ABS Technics BV

6.2. Cuming Microwave Corp.

6.3. Dutch Microwave Absorber Solutions BV

6.4. ETS-Lindgren Inc.

6.5. EURO TECHNOLOGIES SRL

6.6. Everything RF

6.7. Glocom Marketing Pte Ltd.

6.8. HCA Corp.

6.9. Holland Shielding Systems BV

6.10. KEMET Electronics Corp.

6.11. Laird Technologies, Inc.

6.12. Leader Tech Inc.

6.13. Lisat Pte Ltd.

6.14. MA Electronics

6.15. MAST Technologies

6.16. Microwave Vision Group (MVG)

6.17. MTC Micro Tech Components GmbH

6.18. MWT Materials, Inc.

6.19. Parafix Tapes & Conversions Ltd.

6.20. PRONAT Industries Ltd.

6.21. Resin Systems Corp.

6.22. Thorndike Corp.

1. GLOBAL MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL MICROWAVE ABSORBING FILMS & ELASTOMERS MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MICROWAVE ABSORBING FOAMS MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MICROWAVE ABSORBING MILITARY SPECIALTY MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MICROWAVE ABSORBING CUSTOM MAGNETIC ABSORBERS MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER MICROWAVE ABSORBING MATERIAL TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

8. GLOBAL MICROWAVE ABSORBING MATERIAL FOR MILITARY & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MICROWAVE ABSORBING MATERIAL FOR AUTOMOBILE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MICROWAVE ABSORBING MATERIAL FOR ELECTRONIC INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MICROWAVE ABSORBING MATERIAL FOR TELECOMMUNICATIONS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MICROWAVE ABSORBING MATERIAL FOR CHEMICAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MICROWAVE ABSORBING MATERIAL FOR TEXTILE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

18. EUROPEAN MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

24. REST OF THE WORLD MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD MICROWAVE ABSORBING MATERIAL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL MICROWAVE ABSORBING MATERIAL MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL MICROWAVE ABSORBING FILMS & ELASTOMERS MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MICROWAVE ABSORBING FOAMS MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MICROWAVE ABSORBING MILITARY SPECIALTY MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MICROWAVE ABSORBING CUSTOM MAGNETIC ABSORBERS MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER MICROWAVE ABSORBING MATERIAL TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MICROWAVE ABSORBING MATERIAL MARKET SHARE BY END-USER INDUSTRY, 2023 VS 2031 (%)

8. GLOBAL MICROWAVE ABSORBING MATERIAL FOR MILITARY & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MICROWAVE ABSORBING MATERIAL FOR AUTOMOBILE INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MICROWAVE ABSORBING MATERIAL FOR ELECTRONIC INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MICROWAVE ABSORBING MATERIAL FOR TELECOMMUNICATIONS INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MICROWAVE ABSORBING MATERIAL FOR CHEMICAL INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MICROWAVE ABSORBING MATERIAL FOR TEXTILE INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL MICROWAVE ABSORBING MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

17. UK MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA MICROWAVE ABSORBING MATERIAL MARKET SIZE, 2023-2031 ($ MILLION)