Mild Hybrid Vehicles Market

Mild Hybrid Vehicles Market Size, Share & Trends Analysis Report by Capacity (Less Than 48V, and 48V and Above), and by Vehicle Type (Passenger Vehicle and Commercial Vehicle) Forecast 2022-2028 Update Available - Forecast 2025-2035

Mild hybrid vehicles market is anticipated to grow at a significant CAGR of 8.9% during the forecast period. One of the major factors that are fuelling the market growth is the increasing demand for no-emission or lesser emission vehicles in the market. Vehicles are one of the core factors behind global pollution by emitting harmful exhaust gases such as carbon, hydrocarbon, and others which are not only harmful to the environment but for humans as well. To reduce it, market players are innovating several vehicle models such as plug-in hybrid, mild hybrid, electric vehicle, and others. These vehicles have gained a lot of support from consumers, and governments across the globe. Market players have been launching a new product to increase the competition in the market, as the demand increases. For instance, in October 2021, General Motors launched the Buick GL8 classic for 2022 with 48V capacity mild-hybrid technology.

Impact of COVID-19 Pandemic on Global Mild Hybrid Vehicles Market

The COVID-19 pandemic had impacted most of the industries across the globe owing to the nationwide lockdowns in several countries. The lockdown restricted most of the production as people’s movements were restricted to reduce the spread of the virus. This negatively impacted the overall vehicle industry including mild hybrid vehicles. As per Ford’s, which is one of the major market players of mild hybrid vehicles, annual report of 2020, the total sales dropped to 4,187,000 units, which was 5,386,000 units in 2019. However, as the situation got normal the sales increase of the vehicles exponentially. As per the Q1 2021 financial data of Ford, the revenue increased to $36,200 million, producing a net income of $3,300 million which was the best since 2011.

Segmental Outlook

The global mild hybrid vehicles market is segmented based on capacity and vehicle type. Based on the capacity, the market is segmented into less than 48V, and 48V and above. Based on the vehicle type, the market is sub-segmented into passenger vehicles and commercial vehicles. Based on capacity, less than 48V holds the considerable market share in the market but 48V and above is anticipated to grow fastest during the forecast period.

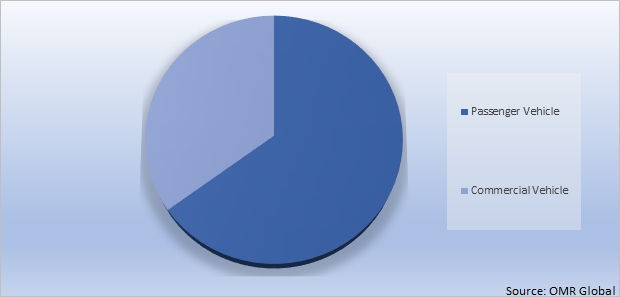

Global Mild Hybrid Vehicles Market Share by Vehicle Type, 2021 (%)

The Passenger Vehicle Segment Holds the Major Share in the Global Mild Hybrid Vehicles Market

The passenger vehicle segment holds the major share and is anticipated to grow fastest during the forecast period. The passenger vehicle has been dominating in the market since the inception of vehicles owing to economical pricing, made for personal uses, and appropriate size for parking in a society. Commercial vehicles are made to do some specific work for businesses and are usually larger in size which limits their users as compared to passenger vehicles. Thus, a larger number of mild hybrid passenger vehicles were produced as compared to the commercial mild hybrid vehicle. As per the data of Organisation Internationale des Constructeurs d'Automobiles (OICA) the production of the passenger vehicle was 55,834,456 in 2020, while the commercial vehicle was produced 21,787,126 which is 61% lesser than the production of passenger vehicles.

Regional Outlooks

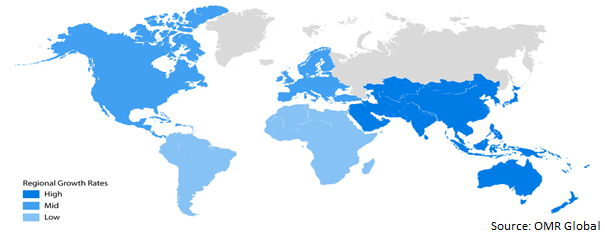

The global mild hybrid vehicles market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The Asia Pacific holds the prominet market share and is anticipated to grow fastest, while Europe holds the second largest market share followed by North America.

Global Mild Hybrid Vehicles Market Growth, by Region 2022-2028

The Asia-Pacific Region is Anticipated to Hold the Prominent Market Share in the Global Mild Hybrid Vehicles Market

The Asia Pacific region is expected to hold the prominent market share and is further anticipated to grow exponentially during the forecast period. Being the largest vehicle market across the globe, Asia Pacific also holds the major share in the electric, and hybrid vehicle market owing to the presence of emerging countries such as China, India, Japan, and others which are taking significant initiatives to reduce pollution via promoting electric and hybrid vehicles. As per the data of OICA, 44,289,900 vehicles were produced in the Asia Pacific region in 2020 which is 57% of the total vehicles were produced across the globe in 2020. For instance, in July 2019, the Indian government announced The National Electric Mobility Mission Plan (NEMMP) and the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) schemes to create interest in electric vehicles. FAME program was first implemented in 2015 and updated in 2019 by providing incentives to the companies with an outlay of $ 1,400 million through 2022.

Market Players Outlook

The major companies serving the global mild hybrid vehicles market include Ford Motor Co., Hyundai Motor Co., Nissan, Suzuki Motor Corp., TOYOTA MOTOR CORP., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2019, Morris Garages (MG), launched its Hector’s petrol hybrid version. The SUV is a mild hybrid vehicle with a 48V capacity.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.Key companies operating in the global mild hybrid vehicles market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Mild Hybrid Vehicles Market

• Recovery Scenario of Global Mild Hybrid Vehicles Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Ford Motor Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Hyundai Motor Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Nissan

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Suzuki Motor Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. TOYOTA MOTOR CORP.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Mild Hybrid Vehicles Market by Capacity

4.1.1. Less Than 48V

4.1.2. 48V and Above

4.2. Global Mild Hybrid Vehicles Market by Vehicle Type

4.2.1. Passenger Vehicle

4.2.2. Commercial Vehicle

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AB Volvo

6.2. AUDI AG

6.3. BMW AG

6.4. FCA Italy S.p.A.

6.5. General Motors

6.6. Hyundai Motor Co.

6.7. Kia Corp.

6.8. Mercedes-Benz Group AG

6.9. Mitsubishi Electric Corp.

6.10. Volkswagen AG

1. GLOBAL MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2021-2028 ($ MILLION)

2. GLOBAL LESS THAN 48V MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL 48V AND ABOVE MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

5. GLOBAL PASSENGER MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL COMMERCIAL MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

8. NORTH AMERICAN MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

11. EUROPEAN MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. EUROPEAN MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2021-2028 ($ MILLION)

13. EUROPEAN MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

14. ASIA-PACIFIC MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

17. REST OF THE WORLD MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. REST OF THE WORLD MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2021-2028 ($ MILLION)

19. REST OF THE WORLD MILD HYBRID VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MILD HYBRID VEHICLES MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MILD HYBRID VEHICLES MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL MILD HYBRID VEHICLES MARKET, 2022-2028 (%)

4. GLOBAL MILD HYBRID VEHICLES MARKET SHARE BY CAPACITY, 2021 VS 2028 (%)

5. GLOBAL LESS THAN 48V MILD HYBRID VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL 48V AND ABOVE MILD HYBRID VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL MILD HYBRID VEHICLES MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

8. GLOBAL PASSENGER MILD HYBRID VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL COMMERCIAL MILD HYBRID VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL MILD HYBRID VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

13. UK MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD MILD HYBRID VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)