Military Drones Market

Global Military Drones Market Size, Share & Trends Analysis Report, By Type (Rotary Wing, Fixed Wing, and Hybrid), By Application (Surveillance, Combat Operations, Transportation & Delivery, and Battle Damage Management) and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global military drones market is projected to grow at a significant CAGR of 10.9% during the forecast period. The major factor that is contributing to the growth of the market includes the growing application of unmanned aircraft vehicles (UAV) in various military operations such as monitoring, surveying, mapping, and combat operations. The growing adoption of advanced technology in surveillance and military operations coupled with the growing defense budget in emerging economies are other major factors that provides ample opportunity for market growth.

The defense sector is emerging considerably across the globe due to growing funding in the form of official budgets and ongoing investments by the governments. The countries are supporting the defense expenditure with huge budget sanctions which as a result is propelling the purchasing and acquisition of advanced systems such as drones and other systems for military operations that in turn, propels the market growth.

Segmental Outlook

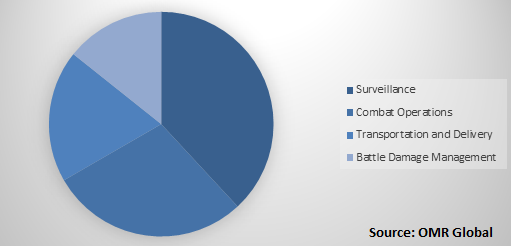

The global military drones market is classified on the basis of type and application. Based on type, the market is segmented into the rotary wing military drones, fixed wing military drones, and hybrid military drones. The hybrid military drones segment is projected to have significant growth in the market owing to the increasing preference of multiple wing type drones for various military applications. On the basis of application, the market is divided into surveillance, combat operations, transportation & delivery, and battle damage management. The transportation & delivery segment is projected to have significant growth during the forecast period owing to the increasing adoption of drones for the deployment of soldiers in remote locations as well as providing supply to them.

Global Military Drones Market Share by Application, 2018(%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global military drones market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Aeronautics Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. AeroVironment, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boeing Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Lockheed Martin Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Northrop Grumman Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Military Drones Market by Type

5.1.1. Rotary Wing

5.1.2. Fixed Wing

5.1.3. Hybrid

5.2. Global Military drones Market by Application

5.2.1. Surveillance

5.2.2. Combat Operations

5.2.3. Transportation and Delivery

5.2.4. Battle Damage Management

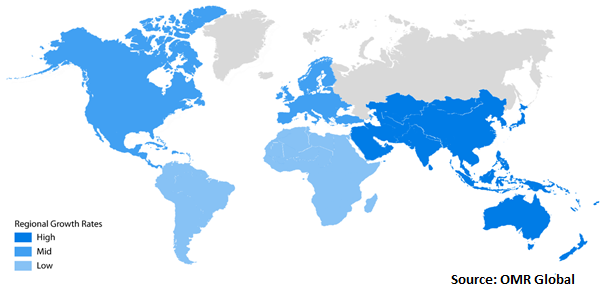

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aeronautics Ltd.

7.2. AeroVironment, Inc.

7.3. Airbus S.A.S.

7.4. Altavian, Inc.

7.5. BAE Systems PLC

7.6. Boeing Co.

7.7. China Aerospace Science and Technology Corp.

7.8. Dedrone Holdings, Inc.

7.9. FLIR Systems, Inc.

7.10. General Atomics

7.11. Leonardo S.p.A.

7.12. Lockheed Martin Corp.

7.13. Northrop Grumman Corp.

7.14. Raytheon Co.

7.15. Saab AB

7.16. Safran Group

7.17. Textron Systems Corp.

7.18. Thales Group

1. GLOBAL MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL ROTARY WING MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL FIXED WING MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL HYBRID MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

6. GLOBAL MILITARY DRONES FOR SURVEILLANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL MILITARY DRONES FOR COMBAT OPERATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL MILITARY DRONES FOR TRANSPORTATION AND DELIVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL MILITARY DRONES FOR BATTLE DAMAGE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. EUROPEAN MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. REST OF THE WORLD MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD MILITARY DRONES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL MILITARY DRONES MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL MILITARY DRONES MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL MILITARY DRONES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD MILITARY DRONES MARKET SIZE, 2018-2025 ($ MILLION)