Military Embedded Systems Market

Global Military Embedded Systems Market Size, Share & Trends Analysis Report by Component (Hardware and Software), by Platform (Air, Land, Naval, and Space), and by Application (Intelligence, Surveillance and Reconnaissance (ISR), Unmanned Aerial Vehicles (UAVs), Computing and Communication, Cyber Security, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global military embedded systems market is growing at a significant CAGR of around 5.9% during the forecast period (2020-2026). The military embedded systems focus on the integration of embedded electronics, including hardware and software. It provides a common tactical picture to military leaders, which aids them in overseeing and understanding their operational environment. The major factors accounting for the growth of the global military embedded systems market includes the rising defense expenditure and introduction of modern technologies, such as C4ISR, cloud, and wireless technologies. This, in turn, is shifting the defense sector towards the warfare based on electronics and novel technologies.

According to Stockholm International Peace Research Institute (SIPRI) in 2018, the total expenditure of North America was around $670 billion ($649 billion by the US and $21 billion by Canada). In addition, China spent around $249 billion on defense, and Russia spent around $61 billion. Apart from these, other countries such as Japan, India, France, UK, and Germany spent considerably in military and defense that support the growth of the defense industry globally. In addition, the rapid increase in the advancements in sensor technology, rising IoT and AI, and the proliferation of satellites, and unmanned aerial vehicles (UAVs) are increasing the adoption rate of military embedded systems across the globe. However, the high cost and complexities associated with the embedded systems certainly affect the market growth across the globe.

Segmental Outlook

The military embedded systems market is classified on the basis of component, platform, and application. Based on component, the market is bifurcated into hardware and software. Based on platform, the market is segmented into air, naval, land, and space. Based on application, the market is classified into intelligence, surveillance and reconnaissance (ISR), unmanned aerial vehicles (UAVs), computing and communication, cyber security, and others.

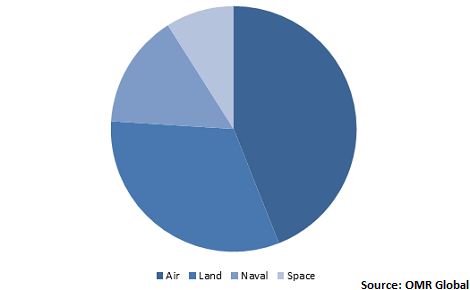

Global Military Embedded Systems Market Share by Platform, 2019 (%)

Land-based platform drives the global military embedded systems market

The military embedded systems are majorly used in land platforms. The increasing demand for land-based platforms has been witnessed over the decades due to significant demand for communication, and command and control instruments in land-based platforms, such as tanks and armored personnel carriers. Several instruments are equipped on land-based platforms, including the sensors that are deployed on the platforms, such as digital and film cameras, light-detection and ranging (lidar) systems, multispectral and hyperspectral scanners, and synthetic aperture radar (SAR) systems. The sensors are used for GIS (Geographic Information Systems) and mapping applications. This, in turn, is boosting the demand for advanced instruments that supports better military embedded systems capabilities.

Regional Outlook

The global military embedded systems market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global military embedded systems market. The increasing military expenditure in the region, particularly the US, contribute to the growth of the market in the North American region. With the huge investment on the military and defense sector, modernization is accelerating with a considerable rate. The US and Canada is rapidly emerging towards the modernization of the defense technology, which as a result account for the increase in the investment for advanced technologies in the region. Thus, the military embedded systems market is estimated to grow its share further in the region.

Global Military Embedded Systems Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific military embedded systems market has been witnessing optimistic growth due to increasing military spending and focus on increasing the capabilities of space and naval warfare systems. Globally, China held second position in military spending with $250 billion in 2018. Moreover, India held the fourth position and invested $66.5 billion in 2018, as per SIPRI. This rise in military spending results due to encouragement in the modernization of military power and rising demand for electronic warfare systems. Furthermore, China is undergoing space-related developments which are offering significant opportunity for military embedded systems. For instance, the Beidou-2 satellite series has already achieved full regional coverage and would achieve global coverage by 2020. Since April 2006, with at least 13 successful launches, the Yaogan series of electro-optical, electronic intelligence satellites, synthetic aperture radar, and electronic intelligence satellites are also considered as a major success. Such spur in the growth of military across all platforms is offering growth to the military embedded systems market in Asia-Pacific.

Market Players Outlook

The key players in the military embedded systems market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global military embedded systems market include Thales Group, Curtiss-Wright Corp., Kontron S&T AG, ADLINK Technology Inc., Microchip Technology Inc., and Advantech Co., Ltd. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global military embedded systems market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Military Embedded Systems Market by Component

5.1.1. Hardware

5.1.1.1. General purpose Graphic Processing Units

5.1.1.2. Multifunction I/O Boards

5.1.1.3. Rugged System

5.1.1.4. Others (Converters)

5.1.2. Software

5.2. Global Military Embedded Systems Market by Platform

5.2.1. Air

5.2.2. Land

5.2.3. Naval

5.2.4. Space

5.3. Global Military Embedded Systems Market by Application

5.3.1. Intelligence, Surveillance and Reconnaissance (ISR)

5.3.2. Unmanned Aerial Vehicles (UAVs)

5.3.3. Computing and Communication

5.3.4. Cyber Security

5.3.5. Others (Data Storage)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abaco Systems Ltd.

7.2. ADLINK Technology Inc.

7.3. Advanced Micro Peripherals

7.4. Advantech Co., Ltd.

7.5. Aitech

7.6. Astronics Corp.

7.7. Curtiss-Wright Corp.

7.8. ECRIN Systems

7.9. Elma Electronics Inc.

7.10. EUROTECH S.p.A.

7.11. General Dynamics Mission Systems, Inc.

7.12. Kontron S&T AG

7.13. Mercury Systems, Inc.

7.14. Microchip Technology Inc. (Microsemi Corp.)

7.15. National Instruments Corp.

7.16. NXP Semiconductors N.V.

7.17. Renesas Electronics Corp.

7.18. Teledyne Technologies Inc.

7.19. Texas Instruments Inc.

7.20. Thales Group

1. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

2. GLOBAL MILITARY EMBEDDED SYSTEMS HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL MILITARY EMBEDDED SYSTEMS SOFTWARE RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

5. GLOBAL MILITARY EMBEDDED SYSTEMS FOR AIR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL MILITARY EMBEDDED SYSTEMS FOR LAND MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MILITARY EMBEDDED SYSTEMS FOR NAVAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL MILITARY EMBEDDED SYSTEMS FOR SPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. GLOBAL MILITARY EMBEDDED SYSTEMS FOR ISR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL MILITARY EMBEDDED SYSTEMS FOR UAVS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MILITARY EMBEDDED SYSTEMS FOR COMPUTING AND COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL MILITARY EMBEDDED SYSTEMS FOR CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL MILITARY EMBEDDED SYSTEMS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

18. NORTH AMERICAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

19. NORTH AMERICAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. EUROPEAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

22. EUROPEAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

23. EUROPEAN MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

28. REST OF THE WORLD MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

29. REST OF THE WORLD MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

30. REST OF THE WORLD MILITARY EMBEDDED SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET SHARE BY COMPONENT, 2019 VS 2026 (%)

2. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET SHARE BY PLATFORM, 2019 VS 2026 (%)

3. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL MILITARY EMBEDDED SYSTEMS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD MILITARY EMBEDDED SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)