Military Training Aircraft Market

Military Training Aircraft Market Size, Share & Trends Analysis Report by Training Types (Combat Training, Basic and Intermediate Pilot Training, And Advanced Pilot Training), by Type (Fixed-Wing, and Rotary-Wing), and by Application (Armed and Unarmed) Forecast Period (2024-2031)

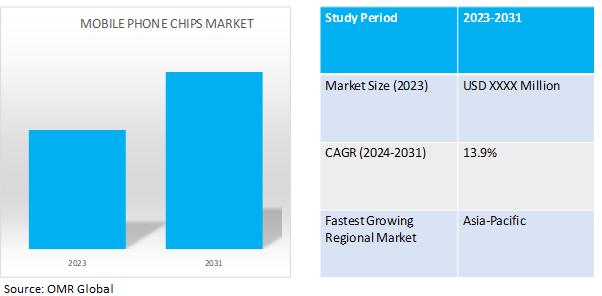

Military training aircraft market is anticipated to grow at a CAGR of 6.9% during the forecast period (2024-2031).Pilots and aircrew are trained for military operations using military trainer aircraft. They offer the fundamental, advanced, and instrument-based flying training required to pilot military aircraft and carry out missions.

Market Dynamics

Rising Defense Budgets: Fueling Modernization in the Global Military Trainer Aircraft Market

A pronounced rise in global defense spending emerges as a significant driver of growth in the military trainer aircraft market. This upward trend in military budgets empowers air forces across the globe to embark on the crucial modernization of their training fleets. Previously constrained budgetary limitations often hampered the ability to replace aging trainer aircraft. However, with increased financial resources at their disposal, air forces can now prioritize investments in advanced platforms equipped with cutting-edge technologies. For instance, in May 2023the planned increase in national defense spending is set to give the Spanish Air Force a much-needed boost. Fueled in part by the ongoing war in Ukraine, Spain's defense budget is slated to reach 2% of GDP by the end of the decade. This significant financial boost will allow the Air Force to acquire new equipment and upgrade its capabilities. General Javier Salto Martinez-Avial, the chief of staff of the Spanish Air and Space Force, outlined several key priorities for the Air Force's modernization, including infrastructure upgrades, improved pilot training with better aircraft and simulators, and an overall increase in operational sustainability. These advancements directly translate to a demonstrably improved pilot training experience, fostering a more highly skilled and prepared air force capable of effectively addressing the demands of modern warfare. This confluence of rising defense budgets and the imperative for a well-equipped air force creates a compelling incentive for sustained investment in the military trainer aircraft market.

Fleet Modernization: A Key Driver of Growth in the Military Trainer Aircraft Market

One significant driver of growth in the global military trainer aircraft market is the ongoing process of fleet modernization. Military forces around the world grapple with aging trainer aircraft that are becoming increasingly expensive to maintain and operate. These legacy platforms often struggle to meet the demands of modern pilot training regimens, which emphasize advanced technologies and combat scenarios. For instance, in a recent article in the Air & Space Forces Association magazine over 900 aspiring Air Force pilots wait for training due to a lack of operational aircraft. The aging T-38 fleet, in service since 1972, suffers from engine problems and limitations. This hinders the Air Force's goal of training 1,500 pilots a year. A new T-7 Red Hawk trainer is delayed, and the outdated T-38 requires training for irrelevant skills. The pilot shortage of 2,000 impacts not only combat readiness but also future leadership development. Consequently, there is a growing need to invest in next-generation trainer aircraft. These new platforms offer improved fuel efficiency, lower maintenance requirements, and advanced avionics systems that better prepare pilots for the realities of contemporary warfare. As nations prioritize military modernization efforts, the trainer aircraft market is expected to see continued growth fueled by the need to replace outdated fleets with these advanced training solutions.

Market Segmentation

Our in-depth analysis of the global military training aircraft includes the following segments by type and by application:

- Based on the training types, the market is sub-segmented into combat training, basic and intermediate pilot training, and advanced pilot training.

- Based on type, the market is bifurcated into Fixed-Wing and Rotary-Wing.

- Based on application, the market is bifurcated into armed and unarmed.

Basic & Intermediate Pilot Training Dominates the Military Trainer Market

There are a couple of key reasons why basic and intermediate pilot training is the biggest segment in the military training aircraft market. Firstly, it's the foundation for all military aviation careers. Every pilot, regardless of their eventual specialization, needs to start with the fundamentals of flight control, navigation, and basic maneuvers. This initial training phase requires a significant number of flight hours, which translates to a high demand for reliable and cost-effective training aircraft. Secondly, there's a constant influx of new pilots into air forces globally. As pilots retire or move on to other roles, there's a continuous need to recruit and train replacements. This ongoing process ensures a steady demand for basic and intermediate training aircraft.

Unarmed Military Trainer Aircraft Holds a Considerable Market Share

The unarmed segment of the Military Training Aircraft market is poised for significant growth. This dominance stems from its role in foundational pilot training. Basic and intermediate phases, crucial for all military aviators, require extensive flight hours. Unarmed trainers offer a cost-effective solution compared to armed variants. Additionally, the rising global demand for new pilots, due to factors like pilot retirements and air force expansion, fuels the need for training aircraft. Finally, the adaptability of unarmed platforms allows trainees to be introduced to various aircraft types, streamlining their qualification process. These factors collectively position the unarmed segment as a major growth driver within the Military Training Aircraft market.

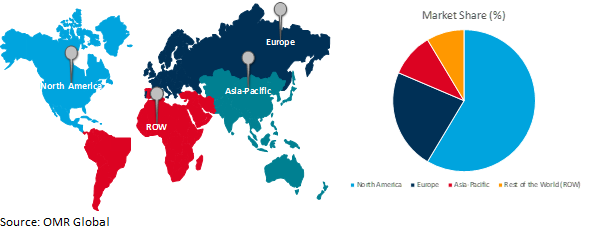

Regional Outlook

The global military training aircraft is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America: A Leader in the Military Training Aircraft

- Large and Modernizing Military Force: The United States, the dominant military power in North America, boasts the world's largest military aircraft fleet. According to World Directory of Modern Military Warships (WDMMA) aerial fighting capabilities of the United States Air Force (2024) is currently counts 5,189 total units in its active aircraft inventory which includes 1,541 units trainer aircrafts. This vast fleet necessitates ongoing pilot training and replacement of aging trainer aircraft. North American air forces prioritize maintaining a technologically advanced training infrastructure, leading to consistent demand for new trainers.

- High Defense Spending: North American countries, particularly the US, allocate significant portions of their budgets to defense spending. For instance, The Department of the Air Force FY 2023 budget request is approximately $194.0B, a $20.2Bincrease from the FY 2022 request. The Air Force budget of $169.5B is a $13.2B increase over the ’22 request and the Space force budget of $24.5B is a $7.1B increase; $3B of that is for inter-service transfers, the remaining $4.1B is programmatic growth. This translates to a steady flow of funds for military equipment acquisition, including advanced training aircraft. This financial commitment ensures North America remains a major buyer in the global Military Training Aircraft market.

Global Military Training Aircraft Growth by Region 2024-2031

Asia-Pacific: Rising Defense Budgets and Geopolitical Tensions Fuel Military Trainer Aircraft Market

The Asia-Pacific region has emerged as the fastest-growing market for military trainer aircraft, fueled by two key drivers: growing defense budgets and heightened geopolitical concerns. On the economic front, significant economic growth in countries like China, India, and Japan has translated to increased defense spending. For instance, Taiwan declared that it would raise defense spending to a record $19.1 billion (2.6% of GDP, in total. The actual increase over the$ 18.83billion budget from the previous year is 3.5%. A portion of these budgets is allocated towards modernizing air forces, with a particular focus on replacing aging trainer fleets. For instance, in November 2023, Taiwan is replacing its outdated AT-3 and F-5 training aircraft with the modern trainer Brave Eagle, which is being developed locally. By the end of 2023, the F-5 fighter jets would no longer be used in combat, according to a military source first published by Taiwan News. This focus on modernization creates a strong demand for new and advanced trainer aircraft within the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Military Training Aircraft includeAirbus SE, BAE Systems PLC, Lockheed Martin Corporation, Northrop Grumman Corporation, and The Boeing Companyamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2023, Boeing delivered the US Air Force with its first Red Hawk T-7A jet trainer. In order to modernize the Air Force's jet fighter training program and replace the aging T-38 Talon trainer jet, which entered service in 1961, Boeing and Saab designed the Red Hawk. According to Boeing, this allowed for the faster, more affordable, and sustainable integration of new technological concepts and capabilities through virtual testing.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global military training aircraft based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Airbus SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BAE Systems PLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Lockheed Martin Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Northrop Grumman Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Boeing Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Military Training Aircraftby Training Types

4.1.1. Combat Training

4.1.2. Basic and Intermediate Pilot Training

4.1.3. Advanced Pilot Training

4.2. Global Military Training Aircraft by Types

4.2.1. Fixed-Wing

4.2.2. Rotary-Wing

4.3. Global Military Training Aircraft by Application

4.3.1. Armed

4.3.2. Unarmed

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Calidus LLC

6.2. Diamond Aircraft Industries GmbH

6.3. Hindustan, Aeronautics Ltd

6.4. Korea Aerospace Industries, Ltd.

6.5. Leonardo SpA

6.6. Northrop Grumman Corporation

6.7. Pilatus Aircraft Ltd

6.8. Rostec

6.9. Saab AB

6.10. Textron Inc

1. GLOBAL MILITARY TRAINING AIRCRAFT BY TRAINING TYPES, 2023-2031 ($ MILLION)

2. GLOBAL COMBAT TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BASIC AND INTERMEDIATE PILOT TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ADVANCED PILOT TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MILITARY TRAINING AIRCRAFT BY TYPE, 2023-2031 ($ MILLION)

6. GLOBAL FIXED-WINGMILITARY TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ROTARY-WINGMILITARY TRAINING AIRCRAFTMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MILITARY TRAINING AIRCRAFT BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBALARMEDMILITARY TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL UNARMEDMILITARY TRAINING AIRCRAFTMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBALMILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BYTRAINING TYPES 2023-2031 ($ MILLION)

14. NORTH AMERICAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY TYPES, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. EUROPEAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BYTRAINING TYPE 2023-2031 ($ MILLION)

18. EUROPEAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA- PACIFIC MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BYTRAINING TYPE, 2023-2031 ($ MILLION)

22. ASIA- PACIFIC MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY TYPES, 2023-2031 ($ MILLION)

23. ASIA- PACIFIC MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. REST OF THE WORLD MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BYTRAINING TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY TYPES, 2023-2031 ($ MILLION)

27. REST OF THE WORLD MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY TRAINING TYPE, 2023 VS 2031 (%)

2. GLOBALCOMBAT TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL BASIC AND INTERMEDIATE PILOT TRAININGAIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL ADVANCED PILOT TRAININGMILITARY TRAINING AIRCRAFTMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY TYPES, 2023 VS 2031 (%)

6. GLOBALFIXED-WINGMILITARY TRAINING AIRCRAFTRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBALROTARY-WINGMILITARY TRAINING AIRCRAFTRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL ARMEDMILITARY TRAINING AIRCRAFTMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL UNARMEDMILITARY TRAINING AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL MILITARY TRAINING AIRCRAFT RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. US MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

13. CANADA MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

14. UK MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

15. FRANCE MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

16. GERMANY MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

17. ITALY MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

18. SPAIN MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

20. INDIA MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

21. CHINA MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

22. JAPAN MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC MILITARY TRAINING AIRCRAFT SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA MILITARY TRAINING AIRCRAFT S031 ($ 2031 ($ MILLION)

26. THE MIDDLE EAST & AFRICA MILITARY TRAINING AIRCRAFT S031 ($ 2031 ($ MILLION