Military Wearables Market

Military Wearables Market Size, Share & Trends Analysis Report by Type (Military Apparel, Communication, and Navigation Instruments, Imaging Instruments, and Others), by End-User (Land Forces, Airborne Forces, and Naval Forces), Forecast 2019-2025 Update Available - Forecast 2025-2035

The military wearables market is growing significantly at a CAGR of 6.5% during the forecast period. The market growth is attributed to increasing demand for lightweight and small wearable equipment in the defense sector. During training and combat situation, a soldier has to carry at least 45 kgs whereas a marine soldier has to carry at least 68 kgs which can further increase as per circumstances. Hence, militaries are opting lightweight and small wearable equipment. Earlier, a solider used to carry weapons, food and their personal belonging mainly, however, with technological advancement various instruments have been adding up to it including advance googles, communication and navigation systems, batteries, exoskeleton and other.

The major factor rising the growth of the military wearable market is increasing the development of lightweight military wearables to reduce overall carried weight by the soldiers. Modernization of military and special task force owing to continuous terrorist attacks are also expected to augment the market. A major restraint to the market growth is declining defense budget of major economies globally. A major part of the defense budget gets used for salaries and routine activities and hence delay in the approvals for modern equipment. As an instance, the defense budget of the US is going to be reduced to $700 billion in 2020 from $716 billion and $779 billion in 2019 and 2018 respectively. However, the introduction of nanotechnology and smart clothing will be some key opportunities during the forecast period.

Segmental Outlook

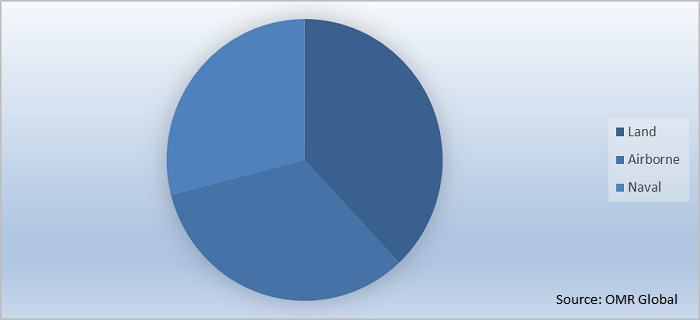

The market is segmented by type and end-user. By type, the market is segmented into military apparel and accessories, communication & navigation instruments, imaging instruments, and Other. Military apparel and accessories segment include bulletproof armor, helmet, footwear & smart textile. Military apparel and accessories segment is expected to have a major market share during the forecast period. It is due to continuous up-gradation of the military by various country and the introduction of lightweight material. Communication & navigation instruments and imaging instruments are expected to have a significant growth rate. By end-user, the market is segmented into land forces, airborne forces and Naval forces. It is expected that the land forces will have a major share.

Global Military Wearables Market Share by End-User, 2018 (%)

Regional Outlook

Based on geography the global military wearables market is divided on the basis of North America, Europe, Asia-Pacific and Rest of the World (RoW). During the forecast period, it is expected that North America will have a major share in the market in 2018. It is due to the high defense budget, and significant adoption of new advanced equipment. Deployment of the military of the US in various other countries is also one of the major factors for a significant share of the region. Europe is also expected to have a considerable share. Major economies contributing to the market are the UK, France, Russia, and Italy.

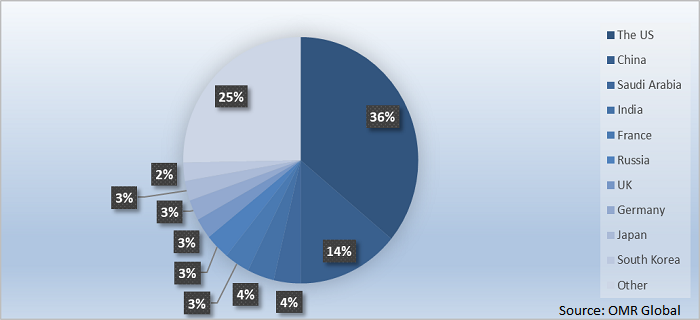

Global Military Expenditure Share, 2018 (%)

The Asia-Pacific region will grow with the highest rate

Asia-Pacific is expected to have the fastest growth rate during the forecast period. It is due to significant growth into the modernization of military of countries including India and China. China has the 3rd largest military expenditure globally with about 14% of the global share. India and Japan also have a significant global share of 3.7% and 2.6% respectively and the budget is growing continuously. These countries are investing significantly for military modernization. As an instance, in April 2018, the Indian government ordered to procure 1.86 bulletproof jackets worth around $90 million. It will be built manufactured by SMPP Pvt Ltd. The jackets will also cover the throat and groin. Weight of each jacket is around 10 kgs and offer level III+ protection. Rest of the World is also expected to show a considerable market. Countries such as Saudi Arabia, Brazil, and Turkey are contributing significantly to the market growth.

Market Players Outlook

The major players that contribute to the growth of the global military wearables market include BAE Systems PLC, Microsoft Corp., Rockwell Collins Inc., Saab AB, Lockheed Martin Corp., Elbit Systems Ltd., Honeywell International Inc., L3Harris Technologies, Inc., and Thales S.A. These players are significantly contributing to the market growth. These companies are adopting various strategies such as new product launch, collaborations with the government, better services, facilities of transfer of technology, and various others to stay competitive in the market.

Major Activities

- In October 2018, Harris Corporation and L3 Technologies Inc., announced for the merger. In April 2019, their merger got approved from the stakeholder and new company is created named L3 Technologies, Inc., After the merger, the company can also disinvest some businesses to other companies.

- In November 2018, Microsoft Corp. had got $480 million contracts to develop an AR system named Integrated Visual Augmentation System (IVAS), for the use in combat and military training in the US Army. The company is working to develop a google with a 3D display, digital cameras, ballistic laser, and hearing protection, which has not to be mounted on a helmet. The system will be able to provide remote viewing, integrate both thermal and night vision cameras and can track soldier vitals as the heart and breathing rates, and detect concussions. At the initial stage, the company has plans to make 2,550 prototypes and have a target to manufacture 100,000 such systems.

- In November 2018, Rockwell Collins Inc. launched Griffin-2, a next-generation visual system for military fast-jet simulated training.

- In September 2017, BAE System PLC demonstrated the AR glass at the DSEI defense and security trade show in London, UK. It is using advanced display, tracking and sensing technologies to develop AR wearable for soldiers, commercial pilots, and emergency responders.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global military wearables market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BAE Systems PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. L3Harris Technologies, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Rockwell Collins, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Saab AB

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Lockheed Martin Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Military Wearables Market by Type

5.1.1. Military Apparel and Accessories

5.1.1.1. Bulletproof Armor

5.1.1.2. Helmet

5.1.1.3. Footwear

5.1.1.4. Smart Textiles

5.1.1.5. Other

5.1.2. Communication and Navigation Instruments

5.1.3. Imaging Instruments

5.1.4. Other (Exoskeleton, Smart Keychains)

5.2. Global Military Wearables Market by End-User

5.2.1. Land Forces

5.2.2. Airborne Forces

5.2.3. Naval Forces

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aselsan A.S.

7.2. BAE Systems PLC

7.3. Bionic Power, Inc.

7.4. BlackBox Biometrics, Inc.

7.5. Elbit Systems Ltd.

7.6. FLIR Systems, Inc.

7.7. General Dynamics Corp.

7.8. Harris Corp.

7.9. Honeywell International, Inc.

7.10. Interactive Wear AG

7.11. KDH Defense Systems, Inc.

7.12. L3Harris Technologies, Inc.

7.13. Leonardo S.p.A.

7.14. Lockheed Martin Corp.

7.15. Mars, Inc.

7.16. Microsoft Corp.

7.17. Northrop Grumman Corp.

7.18. Rockwell Collins, Inc.

7.19. Saab AB

7.20. Safran S.A.

7.21. Singapore Technologies Engineering, Ltd.

7.22. TE Connectivity, Ltd.

7.23. Thales S.A.

7.24. Ultra-Electronics, Ltd.

1. GLOBAL MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL MILITARY APPAREL AND ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COMMUNICATION AND NAVIGATION INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL IMAGING INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHER (EXOSKELETON, SMART KEYCHAINS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

7. GLOBAL LAND FORCES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL AIRBORNE FORCES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL NAVAL FORCES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. NORTH AMERICAN MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. EUROPEAN MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. ASIA PACIFIC MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. REST OF THE WORLD MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD MILITARY WEARABLES MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL MILITARY WEARABLES MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL MILITARY WEARABLES MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL MILITARY WEARABLES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD MILITARY WEARABLES MARKET SIZE, 2018-2025 ($ MILLION)