Mining Equipment Market

Global Mining Equipment Market Size, Share & Trends Analysis Report, By Type (Surface Mining Equipment, Mineral Processing Equipment, Underground Mining Equipment), By Application (Coal Mining, Metal Mining, and Non-Metal Mining) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global mining equipment market is estimated to grow at a CAGR of 4.6% during the forecast period. Some pivotal factors encouraging market growth include the rising adoption of electric machinery in underground mining and growth in the mining industry. As per the US Geological Survey (USGS), in 2019, the US mines produced nearly $86.3 billion in minerals in 2019, which is more than $2 billion higher compared to revised 2018 production totals. The materials that can be extracted from the seabed comprise mineral sands (ilmenite, rutile, zircon), gold, tin (cassiterite), aluminum (bauxite+ e), diamond deposits, and rocks salts.

This leads to the increasing demand for mining equipment that occupies a major position in the process of mining and evaluates the performance of extraction and processing operations of minerals. Mining equipment has experienced remarkable advances in performance, design, and reliability. Electrification of underground mining equipment has been witnessed owing to the emerging focus in underground mining for the reduction of carbon emissions and increase workers’ safety. To fulfill the emerging emissions, energy efficiency, and safety concerns of the underground mining industry, increasing development of electric-powered machinery has been witnessed over the years.

The mining equipment manufacturers have also been witnessing an increasing demand for electric mining equipment. For instance, in September 2019, Epiroc declared that after the introduction of its new generation battery electric mining equipment in November 2018, it has won orders for these machines from several countries which include Canada, Finland, and Australia. In the third quarter of 2019, Agnico Eagle Mines Limited (Finland) ordered the Boltec E Battery rig for application at the Kittilä gold mine. Additionally, several orders from other firms have been booked for battery Boltec rock bolting electric versions of the rig, Scooptram loader, and Minetruck hauler, Boomer face drilling rig. As part of the Sustainable Intelligent Mining Systems (SIMS) project, Agnico Eagle Mines has been testing several Epiroc battery-powered machines at Kittilä.

Scope of the Report

The global mining equipment market covers high productivity equipment for both surface and underground mining operations and mineral processing equipment. These equipment are mainly used to extract and haul copper, iron ore, coal, oil sands, aggregates, gold, and other minerals and ores. The market revenue of comprehensive mining equipment solutions providers such as Caterpillar, Inc., Komatsu Ltd., The Liebherr Group., Hitachi, Ltd., and Atlas Copco, among others are taken under consideration. The construction equipment market generated by these players is omitted to get comprehensive market figures for the global mining equipment market in different economies.

Market Segmentation

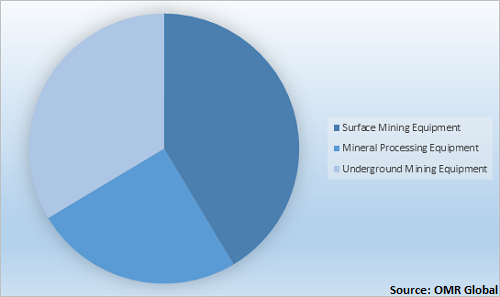

The global mining equipment market is segmented based on type and application. Based on type, the market is classified into surface mining equipment, mineral processing equipment, and underground mining equipment. Based on application, the market is classified into coal mining, metal mining, and non-metal mining.

Surface Mining Equipment to Witness Significant Share in the Market

Surface mining methods witnessed a potential share in the global minerals production. Nearly all non-metallic minerals, most metallic minerals, and a large fraction of coal are mined by surface techniques. There is a comprehensive range of surface mining methods. The operations of loading and hauling, drilling, and blasting, are common to most methods. Technological advances have led to the application of surface techniques to deeper and leaner deposits. Caterpillar Inc. is one of the major providers of surface mining equipment. Its Cat equipment is intended to reduce cost per ton by offering productive and reliable performance. Surface mines have relied on rotary drills to faster drill consistent blast patterns. Rotary drills are used in all applications, including high altitudes, extreme temperatures, and soft and hard rock. Drilling and blasting lead to broken materials that can be moved by shovels, draglines, excavators, and other loading equipment.

Global Mining Equipment Market Share by Type, 2019 (%)

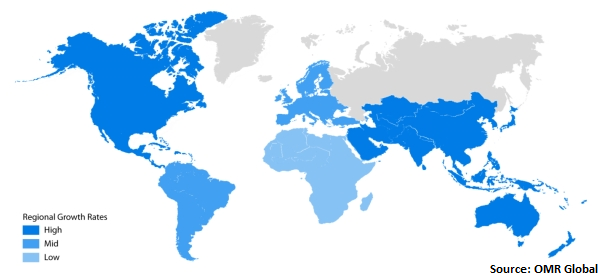

Regional Outlook

Asia-Pacific is estimated to witness potential growth during the forecast period owing to the significant growth in mining operations coupled with the rising coal production in the region. As per the Government of India, Ministry of Coal, the overall production of coal in India during 2019-20 were 729.10 million tons (Provisional) with positive growth was 0.05%. Additionally, the Chinese government has drawn a plan that intends to make its coal industry more efficient by constantly decreasing "outdated" manufacturing capacity, while rising capacity in key producing regions simultaneously. This, in turn, is accelerating the demand for specialized underground mining equipment including trucks, diggers, and loaders that are employed to excavate raw materials.

Global Mining Equipment Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Caterpillar Inc., Atlas Copco AB, Liebherr Group, Komatsu, Ltd., and Doosan Corp. The market players are using some key strategies to increase their market share. For instance, in December 2020, Doosan Infracore North America increased its excavator series with its largest model yet. This named Doosan DX800LC-7 excavator augments the footprint of the company in the aggregate mining industry. The excavator size of the crawler makes it suitable for pit and quarry customers. In addition, it is also suitable as a large machine for heavy infrastructure and construction activities. It can efficiently load large amounts of material and eliminate overburden into trucks at quarries.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mining equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Caterpillar, Inc.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Atlas Copco AB

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Liebherr Group

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Komatsu, Ltd.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Sandvik AB

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Mining Equipment Market by Type

5.1.1. Surface Mining Equipment

5.1.2. Mineral Processing Equipment

5.1.3. Underground Mining Equipment

5.2. Global Mining Equipment Market by Application

5.2.1. Coal Mining

5.2.2. Metal Mining

5.2.3. Non-Metal Mining

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AB Volvo

7.2. Astec Industries, Inc.

7.3. Bell Equipment, Ltd.

7.4. Boart Longyear, Ltd.

7.5. China Coal Energy Co., Ltd.

7.6. CNH Industrial N.V.

7.7. Corum Group

7.8. Epiroc AB

7.9. Famur SA

7.10. FLSmidth A/S

7.11. Furukawa Co. Ltd.

7.12. Hitachi Constructioxn Machinery Co., Ltd.

7.13. Hyundai Heavy Industries Holdings Co., Ltd.

7.14. JCB Sales, Ltd.

7.15. John Deere

7.16. Metso Outotec Corp.

7.17. Northern Heavy Industries Group Co., Ltd.

7.18. RCR Tomlinson, Ltd.

7.19. Sandvik AB

7.20. Sany Group

7.21. Thyssenkrupp AG

7.22. Zhengzhou Coal Mine Machinery Group Ltd. (ZMJ Group)

1. GLOBAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL SURFACE MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL MINERAL PROCESSING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL UNDERGROUND MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL COAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL METAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL NON-METAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. EUROPEAN MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. REST OF THE WORLD MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MINING EQUIPMENT MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL MINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

3. GLOBAL MINING EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

6. UK MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD MINING EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)