Mobile Cranes Market

Global Mobile Cranes Market Size, Share & Trends Analysis Report, By Product Type (Truck Mounted Crane, Crawler Crane, and Trailer Mounted Crane), By Application (Construction, Industrial, and Utility) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global mobile cranes market is estimated to grow at a CAGR of 5.9% during the forecast period. The market was valued at nearly $14.7 billion in 2019, which is estimated to teach nearly $22.0 billion in 2026. Some crucial factors encouraging market growth include the rising investment in infrastructure projects and significant growth in the mining sector. As per the USA Facts, in 2019, the US Federal government invested $29 billion in infrastructure and transferred an additional $67 billion in infrastructure expenditure to the US states. Half of the federal transportation investment witnessed for highways, with rail and air is the next major classes. Growth in infrastructure spending has also witnessed in emerging nations such as China and India, owing to the rising investment in port infrastructure and growth in the tourism sector in these countries.

This is resulting in an increasing demand for tower crane models that find application in the office building, shopping center, apartment, and business center. Additionally, 10 tons and 12 tons of tower cranes are used in airports, big office buildings, steel plants, and power station projects. Mobile cranes offer a range of benefits than fixed cranes. These cranes require little setup and can deal with a range of terrain and particular site concerns as well as they are easy to get to the job site. One of the major advantages of mobile cranes is the level of movability and flexibility, primarily in situations with several obstacles. These cranes can be used to access narrow sections and places with limited space, which makes it an appropriate solution for several job sites.

They can also be set up easily and quickly, which signifies that the required task can be finished much faster, which in turn, saves money in the long run. Additionally, mobile crane comprises hydraulic power and heavy-duty axles, which has the power required to lift heavy materials to needed heights in the most efficient safest way possible. To rent a mobile crane can be a cost-effective solution for a big project, as it can support to complete the operation quickly and reduce downtime on the job site. As they require little setup time, the little cost is involved in the job rather than setting up larger scale cranes.

Market Segmentation

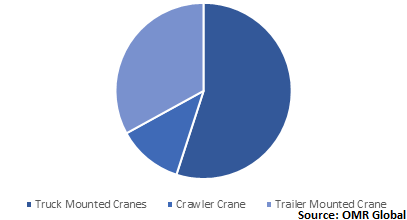

The market is segmented based on product type and application. Based on product type, the market is classified into the truck mounted crane, crawler crane, and trailer mounted crane. Based on application, the market is segmented into construction, industrial, and utility.

Truck Mounted Cranes to Witness Largest Share in the Market

Truck-mounted cranes amount for a number of all cranes that are available for service. These cranes are suitable for a comprehensive range of jobs and are extensively used in a range of construction projects. Industrial sensors can be used to survive the heavy shock, temperature, vibration, and weather conditions while installed on truck-mounted cranes. The lifting capacity can range from 5-2,000 tons 35-100 is often used. Since this kind of crane has a short site preparation time and transportable, they are normally utilized for short hire periods. The adoption of truck-mounted cranes has been gaining significance owing to the increasing railways and metro projects, road construction, expansion of refineries, and waterways. Innovations in truck-mounted cranes for considerable performance, higher maneuverability with the adaption of advanced engines, four-wheel drive, and simplified electronics are some key initiatives being conducted by manufacturers.

Global Mobile Cranes Market Share by Product Type, 2019 (%)

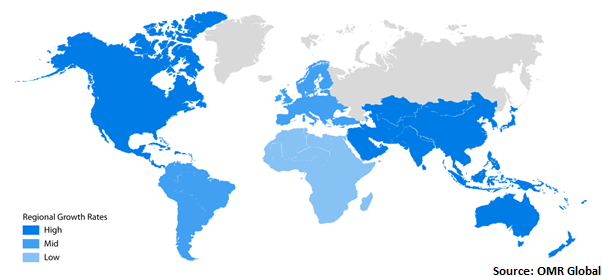

Regional Outlook

Geographically, in 2019, Asia-Pacific is estimated to witness a significant share in the market owing to the rising infrastructure projects in the region. As per the India Brand Equity Foundation (IBEF), India is expected to become the third-largest construction market across the globe by 2022. Certain cohesive initiatives such as Smart City Mission and housing for all will likely accelerate the market growth. In 2019, the infrastructure sector fetched $14.7 billion across 74 deals, represented 40.0% of the total private equity/venture capital investment. This results in increasing demand for mobile cranes that are extensively utilized in all construction, engineering, and infrastructure industry. Mobile cranes are used for moving, shifting, loading, unloading, and erecting material.

Global Mobile Cranes Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Liebherr-International AG, Tadano Ltd., Sany Heavy Industry Co., Ltd., Zoomlion Heavy Industry Science & Technology Co., Ltd., and The Manitowoc Co., Inc. The market players are using some key strategies to increase their market share. For instance, in October 2020, Liebherr revealed a 150-ton mobile crane with a 66-meter telescopic boom. After manufacturing nearly 1500 units, the company unveiled the successor to its successful LTM 1130-5.1 - the LTM 1150-5.3. With a larger lifting capacity of 150 tons and a 66-meter telescopic boom, this new crane is a potential addition to Liebherr's crane range below the 180-ton LTM 1160-5.2. It offers excellent lifting capacities while completely raised and at large radii. It can finish lots of jobs without any need for further ballast transport vehicles. This, in turn, saves money and time and makes it more valuable to crane contractors.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mobile cranes market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Liebherr-International AG

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Tadano, Ltd.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Sany Heavy Industry Co., Ltd.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Zoomlion Heavy Industry Science & Technology Co., Ltd.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. The Manitowoc Co., Inc.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Mobile Cranes Market by Product Type

5.1.1. Truck Mounted Crane

5.1.2. Crawler Crane

5.1.3. Trailer Mounted Crane

5.2. Global Mobile Cranes Market by Application

5.2.1. Construction

5.2.2. Industrial

5.2.3. Utility

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Altec, Inc.

7.2. Bauer AG

7.3. Cargotec Corp.

7.4. Galmon (S) Pte, Ltd.

7.5. JLG Industries, Inc.

7.6. Kato Works Co., Ltd.

7.7. Kobelco Construction Machinery Co., Ltd.

7.8. Konecranes Oyj

7.9. Liugong Machinery Co., Ltd.

7.10. Manitex, Inc.

7.11. Muhibbah Engineering (M) Bhd

7.12. Palfinger AG

7.13. Sarens Bestuur N.V.

7.14. Sumitomo Heavy Industries, Ltd.

7.15. Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

1. GLOBAL MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL TRUCK MOUNTED CRANE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CRAWLER CRANE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL TRAILER MOUNTED CRANE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL MOBILE CRANES IN CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MOBILE CRANES IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL MOBILE CRANES IN UTILITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. EUROPEAN MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. REST OF THE WORLD MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MOBILE CRANES MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL MOBILE CRANES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

3. GLOBAL MOBILE CRANES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD MOBILE CRANES MARKET SIZE, 2019-2026 ($ MILLION)