Modular UPS Market

Modular UPS Market Size, Share & Trends Analysis Report by Power Capacities (50 kVA, 100 kVA, 300 kVA, and 301 & above kVA), and by End User (Data Centres, Industrial, Telecommunication, Commercial, BFSI, and Government) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Modular UPS market is anticipated to grow at a significant CAGR of around 10.5% during the forecast period. The growing need for zero power outages from various industries would propel the market forward. The digital revolution has impacted business in every industry. As a result, electronic devices are being used to collect and retrieve data for business activities. This enhances the need for a consistent and reliable power source. Enterprises can't perform operational processes if they don't have access to electricity. There must be an assured and stable power source in the event of a power outage or loss of the main power source. When the main power goes out, the UPS maintains continuity and resilience, allowing ongoing work to be stored and hardware to be safeguarded. Although UPS systems are in high demand in the IT industry, many industrial processes have recently embraced PC-based systems and microprocessors that are vulnerable to power outages. Moreover, continuous product innovation and launches by market players will take forward the market growth. For instance, in August 2020, Socomec launched two editions of the Modulys XS MC, with six and nine slots for power as well as plug-in battery modules, respectively, that are ideal for IT and non-IT applications. The electronic-free cabinet offers fully autonomous power modules and a multilingual 7-inch retractable touchscreen display.

Impact of COVID-19 Pandemic on the Global Modular UPS Market

The COVID-19 pandemic had disrupted the operations of various industries across the globe, which drastically reduced the demand for modular UPS. Due to a lack of staff and the fact that the bulk of the world's population was staying at home due to rigorous laws and containment precautions during the pandemic, production plants were closed or were operating at lesser capacity, limiting output. Therefore, the demand for modular UPS was adversely affected by the COVID-19 pandemic. As the COVID-19 situation normalizes, the modular UPS market started to recover as industrial operations were normalized after the recovery.

Segmental Outlook

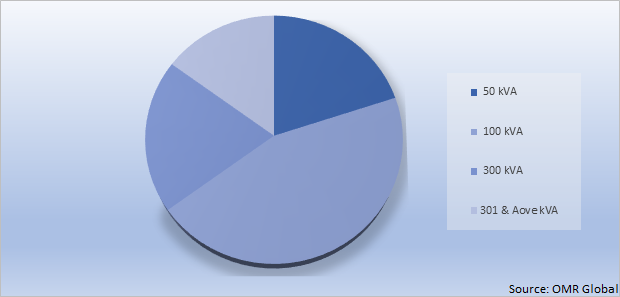

The global modular UPS market is segmented based on power capacities and end users. Based on the power capacities, the market is segmented into 50 kva, 100 kva, 300 kva, and 301 & above kva. Based on the end user, the market is sub-segmented into data centres, industrial, telecommunication, commercial, BFSI, and government.

Global Modular UPS Market Share by Power Capacities, 2021 (%)

The 100 kVA Segment Holds the Major Share in the Global Modular UPS Market

It is projected that the 100 kVA segment will hold the largest share of the market during the forecast period. The modular UPS solutions of this range are extensively used by BFSI service providers, small or medium data centres, cloud service providers, as well as telecommunication operators. This range of modular UPS solutions provides several advantages, including better usability, simple installation with expansion, hassle-free servicing, and on-demand capacity growth, all while enhancing business productivity. These solutions are provided by major companies such as Huawei, Emerson, and Schneider Electric.

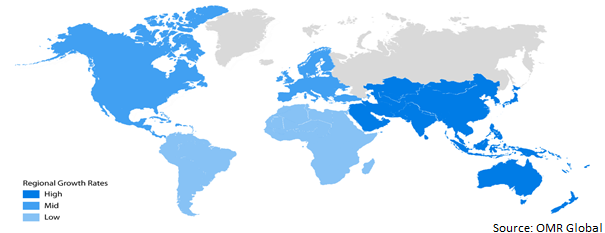

Regional Outlooks

The global Modular UPS market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). It is expected that the North American region will dominate the market and the Asia-Pacific will register the fastest growth in the market.

Global Modular UPS Market Growth, by Region 2022-2028

The North America Region Holds the Major Share of the Global Modular UPS Market

It is anticipated that the North American region will have a prominent contribution to the growth of the modular UPS market. The wide presence of data centres and collocation facilities in technologically advanced countries including the US and Canada will accelerate the market growth in the region.

Market Players Outlook

The major companies serving the global modular UPS market include ABB Ltd., Delta Electronics, LEGRAND, Schneider Electric, Vertiv, AEG Power Solutions B.V., Eaton Corp. Plc, Gamatronic Electronic Industries Ltd., Hewlett Packard Enterprises Co., Toshiba Corp., Xtreme Power, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Huawei launched its new UPS power module with 100 kW high power densities. Huawei's Fusion Power 2.0 data centre power supply solution is based on the 100 kW modules and delivers the "1MW, 1 Rack” (1 normal rack can handle 1MW power principles with such a footprint that is more than half, allowing for enhanced data centre utilization and revenue).

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global modular UPS market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Modular UPS Market

• Recovery Scenario of Global Modular UPS Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. ABB Ltd.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Delta Electronics

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. LEGRAND

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schneider Electric

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Vertiv

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Modular UPS Market by Power Capacities

4.1.1. 50 kVA

4.1.2. 100 kVA

4.1.3. 300 kVA

4.1.4. 301 and above kVA

4.2. Global Modular UPS Market by End User

4.2.1. Data centers

4.2.2. Industrial

4.2.3. Telecommunication

4.2.4. Commercial

4.2.5. BFSI

4.2.6. Goverment

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AEG Power Solutions B.V.

6.2. Borri

6.3. CENTIEL

6.4. Cyber Power Systems, Inc.

6.5. Costa Industries Pvt. Ltd.

6.6. Eaton Corp. Plc

6.7. Gamatronic Electronic Industries Ltd.

6.8. Hawlett Packard Enterprises Co.

6.9. Panduit Corp.

6.10. RPS S.p.A.

6.11. Rittal GmbH

6.12. SOCOMEC Group

6.13. Tripp-Lite

6.14. Toshiba Corp.

6.15. Xtreme Power

1. GLOBAL MODULAR UPS MARKET RESEARCH AND ANALYSIS BY POWER CAPACITIES, 2021-2028 ($ MILLION)

2. GLOBAL 50 kVA MODULAR UPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL 100 kVA MODULAR UPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL 300 kVA MODULAR UPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL 300 AND ABOVE kVA MODULAR UPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL MODULAR UPS MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

7. GLOBAL MODULAR UPS IN DATA CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL MODULAR UPS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL MODULAR UPS IN TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL MODULAR UPS IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL MODULAR UPS IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL MODULAR UPS IN GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL MODULAR UPS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN MODULAR UPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN MODULAR UPS MARKET RESEARCH AND ANALYSIS BY POWER CAPACITIES, 2021-2028 ($ MILLION)

16. NORTH AMERICAN MODULAR UPS MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

17. EUROPEAN MODULAR UPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN MODULAR UPS MARKET RESEARCH AND ANALYSIS BY POWER CAPACITIES, 2021-2028 ($ MILLION)

19. EUROPEAN MODULAR UPS MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC MODULAR UPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC MODULAR UPS MARKET RESEARCH AND ANALYSIS BY POWER CAPACITIES, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC MODULAR UPS MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

23. REST OF THE WORLD MODULAR UPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. REST OF THE WORLD MODULAR UPS MARKET RESEARCH AND ANALYSIS BY POWER CAPACITIES, 2021-2028 ($ MILLION)

25. REST OF THE WORLD MODULAR UPS MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MODULAR UPS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MODULAR UPS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL MODULAR UPS MARKET, 2021-2027 (%)

4. GLOBAL MODULAR UPS MARKET SHARE BY POWER CAPACITIES, 2021 VS 2028 (%)

5. GLOBAL 50 kVA MODULAR UPS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL 100 kVA MODULAR UPS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL 300 kVA MODULAR UPS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL 301 AND ABOVE kVA MODULAR UPS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL MODULAR UPS MARKET SHARE BY END USER, 2021 VS 2028 (%)

10. GLOBAL MODULAR UPS IN DATA CENTRES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL MODULAR UPS IN INDUSTRIAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL MODULAR UPS IN TELECOMMUNICATION MARKET MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL MODULAR UPS IN COMMERCIAL MARKET MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL MODULAR UPS IN BFSI MARKET MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL MODULAR UPS IN GOVERNMENT MARKET MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL MODULAR UPS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

19. UK MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD MODULAR UPS MARKET SIZE, 2021-2028 ($ MILLION)